简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】Non-farm Employment Data Falls Short of Expectations! Goldman Sachs Raises Economic Recession Forecast Amid Intensified Market Turmoil!

Sommario:The release of the U.S. employment report in July has intensified market concerns about the economic outlook. Although institutions such as Goldman Sachs have raised their economic recession risk forecasts, they still believe that the possibility of a recession is limited. Faced with the slowdown in employment growth and the rise in unemployment rate, the Federal Reserve is expected to adopt a more cautious monetary policy to stabilize the market. Investors and policymakers need to closely monit

The U.S. Department of Labor released employment data on August 2nd, showing that the job growth in the United States for July was lower than expected, with the unemployment rate climbing to 4.3%, the highest point in nearly three years, exceeding the market's estimated 4.1%. Following the release of this unexpected and disappointing data, Wall Street experienced the most severe sell-off this year, with significant declines in U.S. stock markets, the U.S. dollar exchange rate, and Treasury bond yields. Analysts are concerned that this could intensify concerns about the deterioration of the U.S. labor market and the risk of economic recession, while the market is uneasy about the Federal Reserve's policy response.

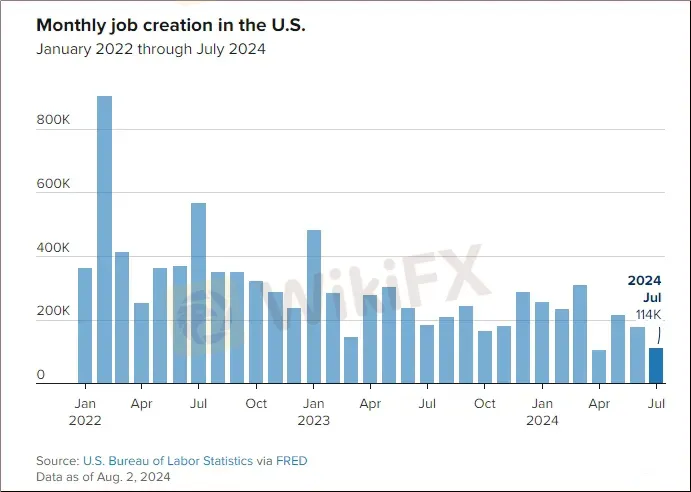

In July, the U.S. non-farm employment population increased by 114,000 people, a figure that is not only lower than the expected 175,000 but also one of the weakest since the outbreak of the pandemic. The healthcare industry led with the addition of 55,000 jobs, and there were significant increases in the construction industry, government, and transportation and warehousing sectors. The unemployment rate's rise for the fourth consecutive month, along with the average hourly wage growth of only 0.2% in July, which was lower than expected, further increased doubts about the sustainability of economic expansion.

The new employment report has intensified recent uncertainties about the economic outlook, with financial markets feeling nervous about the Federal Reserve's policy response, leading to a severe sell-off on Wall Street. After the data was released, U.S. major stock index futures and Treasury bond yields both fell. In addition, the U.S. dollar index also fell by more than 1.1%. Although the latest situation in the labor market is consistent with an economic slowdown, some scholars emphasize that it does not necessarily mean a recession, but only indicates that the U.S. economy may become even weaker. Some analysts have suggested that hurricanes may have affected job growth in Texas and Louisiana. At the same time, analysts have begun to question the pace of the Federal Reserve's interest rate cuts, even discussing the possibility of a 50 basis point cut. The market is worried that if the Federal Reserve does not cut interest rates quickly enough, it may lead to further declines in the job market.

The U.S. non-farm employment report for July unexpectedly showed a significant slowdown in job growth, triggering market concerns about potential problems in the labor market. The day before, the further decline in the U.S. ISM manufacturing activity index and the new high in the number of initial unemployment claims had already caused market panic, with market sentiment becoming sensitive to any negative news. The market now fully expects more than four 25 basis point rate cuts this year. After the release of the employment report, U.S. Treasury bond yields fell sharply, especially in short-term bonds, with the 2-year Treasury bond yield falling by 29 basis points, breaking through the 4% threshold.

The U.S. stock market continued to decline, with the S&P 500 index falling by more than 2%, and the NASDAQ 100 index falling by more than 3%, falling more than 10% from last month's high, reaching the standard for market correction. The VIX panic index rose to 25 for the first time since March 2023. In addition, the quarterly performance of some large companies was disappointing, including Amazon and Intel, with the latter's stock price falling by 26% on the day of the report release, setting the largest single-day drop since at least 1982. Alphabet and Tesla, among other large companies, also failed to meet expectations in their performance released earlier in this earnings season.

The Asia-Pacific stock market also performed poorly, with the Nikkei 225 index and the Japan Stock Exchange index falling by 5.8% and 6.14% respectively, setting the largest decline since 2016. European stock markets also fell across the board, with technology stocks leading the decline, the European Stoxx Technology index fell by 6.6%, the largest drop since 2020. In the foreign exchange market, the U.S. dollar index fell by 1%, and the U.S. dollar against the yen broke through 147, for the first time since March 12, with a daily drop of 1.58%. The euro and the British pound against the U.S. dollar both appreciated, and the offshore renminbi against the U.S. dollar also rose sharply, recovering the key point of 7.16.

In the commodity market, the price of gold once rose nearly 1% due to the softening of the U.S. dollar, but then reversed, giving up all the gains. Spot silver also experienced a similar sharp decline. Nicky Shiels, head of metal strategy at MKS PAMP SA, pointed out that although short-term panic selling in the stock market may put pressure on gold prices, if the cooling of the job market becomes a trend, it may prompt the Federal Reserve to cut interest rates several times this year, paving the way for further gold price increases.

The crude oil market accelerated its decline due to uncertain demand prospects, falling for the fourth consecutive week. The two major crude oil benchmark prices fell by about 10% in the past four weeks. Analyst Ashley Kelty of Panmure Liberum said that although tensions in the Middle East may affect supply, the slowdown in economic growth in major economies may suppress oil demand. Weak manufacturing activity around the world has increased concerns about the lack of global economic recovery and pressure on oil consumption. Data from LSEG shows that crude oil imports in Asia in July fell to the lowest level in two years. OPEC+ decided to maintain its oil production policy unchanged at the recent meeting, including gradually exiting the voluntary production cut plan starting in October. At the same time, conflicts in the Middle East have also attracted the attention of oil investors, who are worried that it may interrupt crude oil supply.

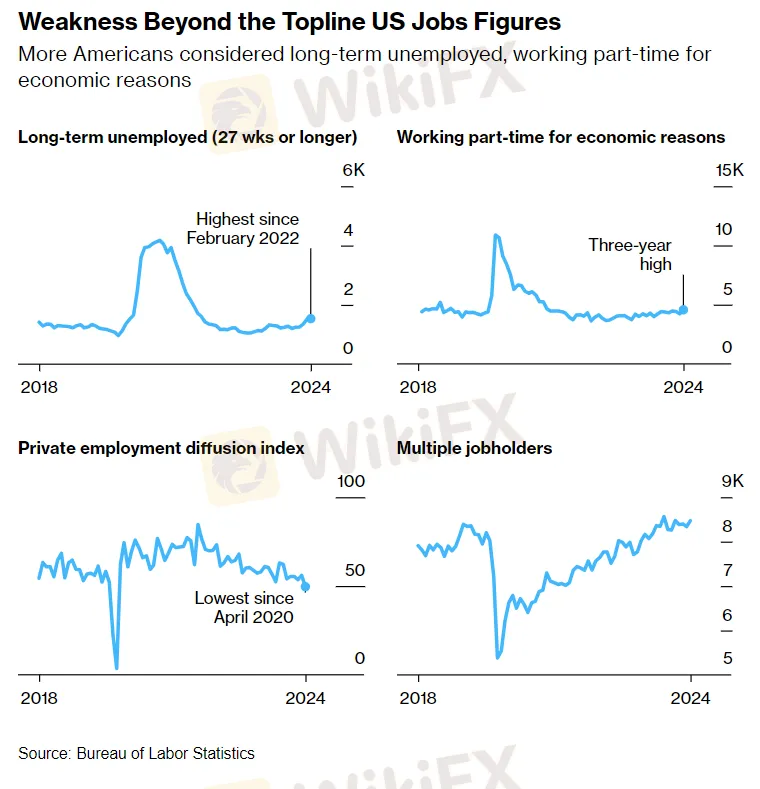

Goldman Sachs economists have raised their forecast for the probability of the United States encountering an economic recession next year from 15% to 25%. Nevertheless, they still believe that the risk of economic recession is limited, and even if the unemployment rate rises, there is no need to worry too much. Goldman Sachs' Chief Economist, Hatzius, emphasized in a customer report that the overall condition of the U.S. economy is still good, there are no significant financial imbalances, and the Federal Reserve has enough room to cut interest rates and can take action quickly if necessary.The recently released U.S. employment data shows that the growth rate of non-farm employment positions in July has slowed down significantly, and the unemployment rate has risen to the highest point in nearly three years, causing the market to worry about economic slowdown and doubts about the Federal Reserve's slow action on interest rate cuts. In addition to non-farm employment data, other labor market indicators also show signs of weakness.

After the non-farm employment data was released, Wall Street investment banks quickly adjusted their predictions for the Federal Reserve's interest rate cuts. Goldman Sachs expects the Federal Reserve to cut the benchmark interest rate by 25 basis points in September, November, and December, while Morgan Chase and Citigroup's predictions are more aggressive, expecting the Federal Reserve to cut interest rates by 50 basis points in September. Morgan Chase expects the Federal Reserve to cut interest rates by 50 basis points in September and November, and then by 25 basis points at each meeting. Citigroup's forecast is even more active, expecting the Federal Reserve to cut interest rates by 50 basis points at the meetings in September and November, and by 25 basis points at the December meeting.

Bank of America, after analyzing the ISM manufacturing report and other weak data, believes that the non-farm employment report for July was not as expected, which may prompt the Federal Reserve to cut interest rates by 25 basis points at the September meeting. TD Securities expects the Federal Reserve to cut interest rates by a total of 75 basis points in 2024, that is, by 25 basis points at the meetings in September, November, and December. Goldman Sachs economists also said that their forecast is based on the premise that employment growth will recover in August, and believe that a 25 basis point rate cut is enough to deal with any downside risks. If the non-farm employment report for August is as weak as in July, the Federal Reserve may cut interest rates by 50 basis points in September. In addition, analysts are also skeptical about whether there is a risk of rapid deterioration in the job market.

The release of the U.S. employment report in July has intensified market concerns about the economic outlook. Although institutions such as Goldman Sachs have raised their economic recession risk forecasts, they still believe that the possibility of a recession is limited. Faced with the slowdown in employment growth and the rise in unemployment rate, the Federal Reserve is expected to adopt a more cautious monetary policy to stabilize the market. Investors and policymakers need to closely monitor future economic data and policy trends to make wise decisions. In this volatile economic environment, governments and central banks need to take effective measures to alleviate economic downward pressure and be prepared to deal with any unexpected situations to maintain robust economic development and market confidence.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

GO MARKETS

HFM

IQ Option

Octa

Tickmill

IC Markets Global

GO MARKETS

HFM

IQ Option

Octa

Tickmill

IC Markets Global

WikiFX Trader

GO MARKETS

HFM

IQ Option

Octa

Tickmill

IC Markets Global

GO MARKETS

HFM

IQ Option

Octa

Tickmill

IC Markets Global

Rate Calc