简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 2 August: Japanese Yen Rallies as BoJ Surprises with Hawkish Moves, Eyes Set on USD/JPY Support Levels

Sommario:The Japanese Yen strengthened against the US Dollar after the Bank of Japan's hawkish policy move, raising rates by 15 basis points and reducing bond purchases. Japan's Ministry of Finance also spent ¥5.53 trillion ($36.8 billion) in July to stabilize the Yen. Meanwhile, the US Dollar weakened as the Federal Reserve maintained interest rates. Traders now await US economic data, including the ISM Manufacturing PMI and Initial Jobless Claims, for further guidance.

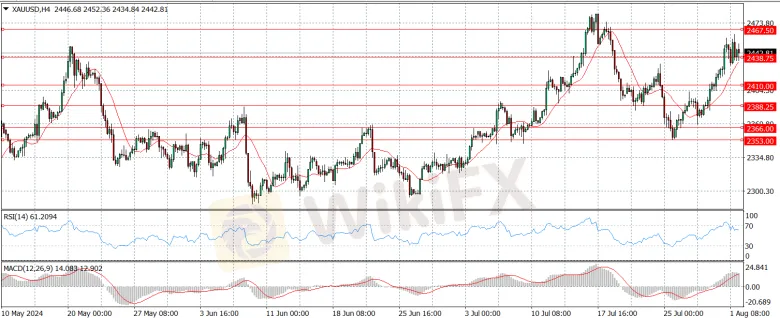

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold prices edged lower during the North American session, hitting a daily low of $2,430 and high of $2,462, as the US Dollar strengthened on weak economic data. The manufacturing sector contracted, and jobs data pointed to a weak labour market, driving risk aversion and volatility in financial markets.

Asian shares suffered, with the Nikkei losing over 2%, amid speculation the Bank of Japan will continue hiking rates. European markets also traded lower on softer-than-expected data, while the Bank of England's rate hike was seen as hawkish. Dismal US data, including a drop in the ISM Manufacturing PMI, fueled concerns over the American economy, boosting the US Dollar and pushing gold into a consolidative phase.

Technical Analysis:

The XAU/USD pair remains comfortably above the 23.6% Fibonacci retracement of the June/July rally at $2,438.75, with buyers stepping in around the 61.8% retracement. The daily chart shows the pair developing above all its moving averages, with the 20 SMA providing near-term support around $2,410. Technical indicators lack strong directional cues but remain in positive territory, aligning with the bulls' dominance.

In the short term, the 4-hour chart suggests a pause in the bullish momentum, but bulls maintain control. A bullish 20 SMA is crossing above the 100 SMA at around $2,410.80, and the 38.2% Fibonacci retracement. Technical indicators have lost some momentum but remain near overbought levels, indicating a potential continuation of the uptrend.

Product: EUR/USD

Prediction: Decrease

Fundamental Analysis:

The EUR/USD pair lost ground, slipping below the 1.0800 level, after a miss in US Purchasing Managers Index figures sparked fears of a worsening US economic outlook and a potential hard landing scenario. The US Dollar regained strength, with the DXY index rising to 104.40, as risk aversion prevailed in the markets.

The rebound in the Dollar was fueled by the Federal Reserve's decision to keep interest rates unchanged and its reiteration that inflation remains “somewhat” excessive. The policy divergence between the Fed and the ECB is expected to persist, with both central banks potentially cutting rates soon.

However, weak US economic data and a loss of momentum in the Eurozone's recovery point to further retracements in EUR/USD and a stronger US Dollar.

Technical Analysis:

The EUR/USD pair's next downside target is the weekly low of 1.0777, followed by the June low of 1.0666 and the May bottom of 1.0649. On the upside, the immediate resistance is at the July top of 1.0948, followed by the March peak of 1.0981 and the crucial 1.1000 level.

Fundamentally, the pair's bearish bias is expected to remain in place as long as it stays below the 200-day SMA at 1.0823. Technically, the four-hour chart indicates fresh weakness, with initial support at 1.0777 and 1.0709. The upside is capped by the 200-SMA at 1.0806, the 55-SMA at 1.0842, and 1.0849, while the RSI has returned to around 39.

Product:USD/JPY

Prediction: Decrease

Fundamental Analysis:

The Japanese Yen is gaining ground against the US Dollar following the Bank of Japan's (BoJ) unexpected hawkish policy announcements. The BoJ increased the short-term rate target by 15 basis points and outlined a plan to reduce its purchases of Japanese government bonds. Japan's Ministry of Finance also confirmed that it spent ¥5.53 trillion ($36.8 billion) in July to stabilise the Yen, which had fallen to a 38-year low.

The US Dollar struggled after the Federal Reserve maintained interest rates at 5.25%-5.50% during its July meeting. Traders will be watching upcoming US economic data, such as the ISM Manufacturing PMI and weekly Initial Jobless Claims, for further guidance on the Dollar's direction.

Technical Analysis:

The USD/JPY pair is trading around 149.30 on Thursday. The daily chart analysis shows the pair has broken below a descending wedge pattern, suggesting the bearish trend is continuing. The 14-day Relative Strength Index is below 30, indicating an oversold condition and potential for a short-term rebound.

The pair may test support around the four-month low of 146.48 seen in March. On the upside, resistance is at 151.60, the lower boundary of the descending wedge. If the pair returns to this wedge, it could weaken the bearish trend and set the stage for a possible bullish reversal, potentially testing resistance at 154.27 and 154.50.

Product: GBP/USD

Prediction: Decrease

Fundamental Analysis:

The broader risk-off sentiment in the foreign exchange market is weighing on the British pound and its peers, pushing GBP/USD back towards four-week lows near 1.2750.

After a brief bounce on Wednesday, GBP/USD came under renewed selling pressure, falling to a three-week low below 1.2800 on Thursday morning. The US dollar struggled to gain traction in the previous session, helping GBP/USD edge higher, as the Federal Reserve left its policy unchanged and hinted at a potential rate cut in September.

The upcoming Bank of England meeting is a key focus, with a 25 basis point cut priced in. An unchanged rate could provide a boost to the pound, while a cut could lead to further GBP/USD weakness, despite being the market expectation.

Technical Analysis:

GBP/USD is currently trading below 1.2750 where the 200-period Simple Moving Average on the 4-hour chart is acting as resistance. If this level holds, the pair could face further declines towards the 1.2710-1.2700 area, corresponding to the 61.8% Fibonacci retracement of the latest uptrend and a psychological support level.

On the upside, the first resistance is at 1.2830, which coincides with the 50% Fibonacci retracement and a descending trend line. Further above, 1.2880 (38.2% Fibonacci retracement) and 1.2900 (100-period SMA) are the next key resistance levels to watch.

Market Analysis Disclaimer:

The market analysis provided by KVB Prime Limited is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any financial instrument. Trading forex and other financial markets involves significant risk, and past performance is not indicative of future results.

KVB Prime Limited does not guarantee the accuracy, completeness, or timeliness of the information provided in the market analysis. The content is subject to change without notice and may not always reflect the most current market developments or conditions.

Clients and readers are solely responsible for their own investment decisions and should seek independent financial advice from qualified professionals before making any trading or investment decisions. KVB Prime Limited shall not be liable for any losses, damages, or other liabilities arising from the use of or reliance on the market analysis provided.

By accessing or using the market analysis provided by KVB Prime Limited, clients and readers acknowledge and agree to the terms of this disclaimer.

RISK WARNING IN TRADING

Transactions via margin involve products that use leverage mechanisms, carry high risks, and are certainly not suitable for all investors. THERE IS NO GUARANTEE OF PROFIT on your investment, so be wary of those who guarantee profits in trading. You are advised not to use funds if you are not prepared to incur losses. Before deciding to trade, ensure that you understand the risks involved and also consider your experience.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

XM

FOREX.com

GO MARKETS

STARTRADER

IC Markets Global

FP Markets

XM

FOREX.com

GO MARKETS

STARTRADER

IC Markets Global

FP Markets

WikiFX Trader

XM

FOREX.com

GO MARKETS

STARTRADER

IC Markets Global

FP Markets

XM

FOREX.com

GO MARKETS

STARTRADER

IC Markets Global

FP Markets

Rate Calc