简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Gold Prices Soar to $2473 per Ounce Amidst Fed Policy Expectations and Global Economic Uncertainty!

Sommario:In general, investors need to closely monitor the Fed's policy statements, the release of economic data, and the development of global political and economic events in the coming period. In particular, if the Fed adjusts its monetary policy stance at the upcoming meetings, or conveys new policy signals at the Jackson Hole Central Bank Annual Meeting, this may have a significant impact on the market. At the same time, investors should also consider diversifying their investment portfolios, includ

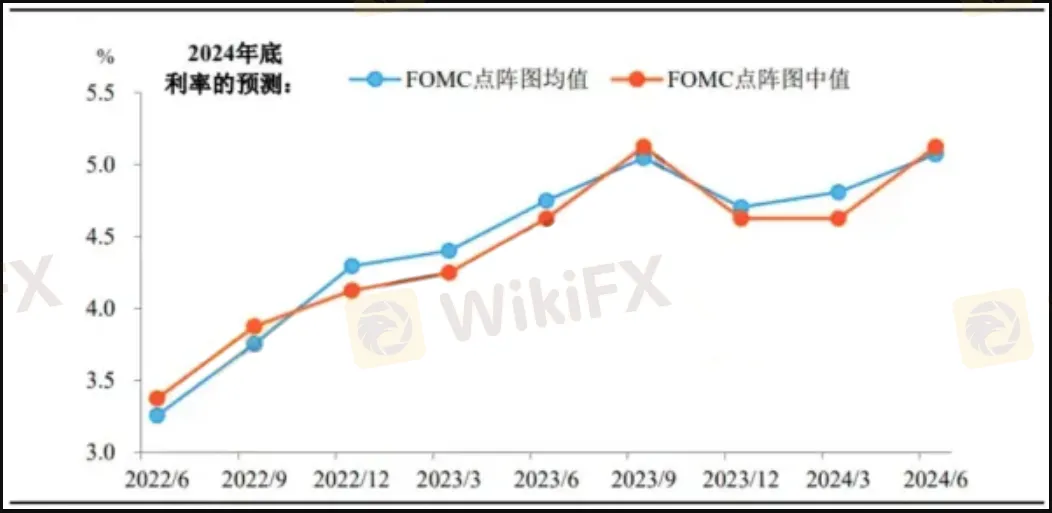

In the fluctuating financial markets, the policy direction of the Federal Reserve has always been a focal point for investors. Recently, the market's expectation of a rate cut by the Fed in September has sharply increased, which is clearly reflected in the Fed Watch tool of the Chicago Mercantile Exchange. Traders generally believe that the Fed will at least cut rates by 25 basis points, reducing the federal funds rate from 5.25%-5.5% to 5%-5.25%, and some traders even expect a rate cut of 50 basis points.

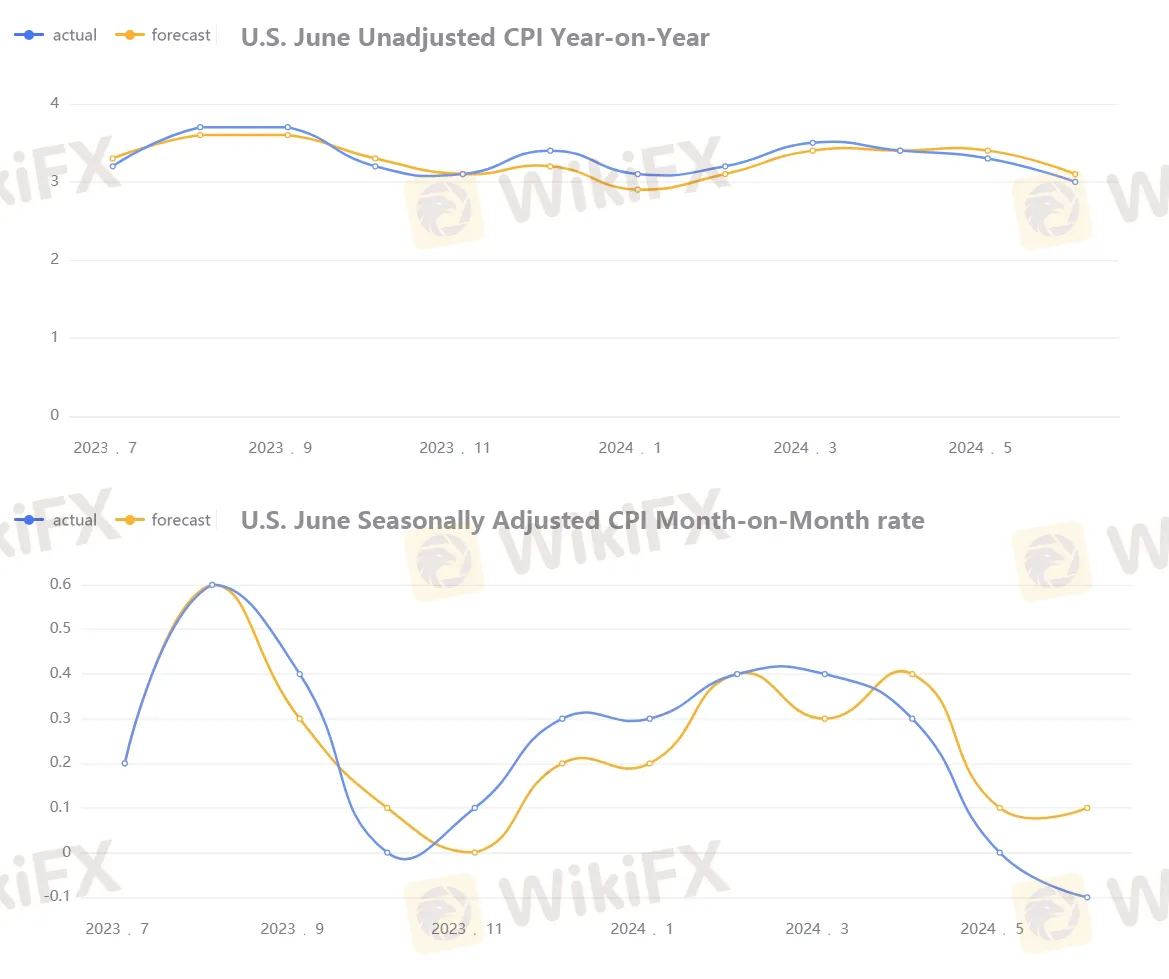

This surge in expectations is attributed to the decline in the Consumer Price Index (CPI) in June. Data shows that the CPI decreased by 0.1% month-on-month in June, with the year-on-year growth rate falling to 3%, the lowest in three years. This change contrasts sharply with a month ago when the market's expectation of a rate cut in September was only 70%. The remarks of Federal Reserve Chairman Powell have also added momentum to market expectations. In his speech, he hinted that the Fed will not wait for inflation to fall completely to 2% before cutting rates, as there is a lag effect in tightening policies.

However, despite strong market expectations, there are still different views within the Fed on the timing and magnitude of the rate cut. Some economists and analysts believe that after raising interest rates to the highest level in twenty years, the Fed may have waited too long to cut rates. They point out that the inflation data in the past three months is not ideal, with the slowdown of economic growth in the United States and the rise in unemployment rate, all of which point to the urgency of a rate cut. Jan Hatzius, Chief Economist at Goldman Sachs, and others have called for the Fed to start cutting rates at the end of July, considering that the impact of interest rate adjustments on the economy has a time lag, and policymakers need to take a preemptive strategy.

Against this backdrop, the rise in gold prices has become another major focus in the market. The spot gold price continued to hit a historical high on Wednesday, reaching a peak of $2473 per ounce. This increase is partly due to the market's bet on a rate cut in the United States in September, as well as concerns about an increase in global geopolitical risks, which has boosted interest in safe-haven assets. Data from UBS Group shows that in the first half of 2024, the amount of gold purchased by central banks worldwide reached the highest level since the late 1960s, reflecting the attractiveness of gold as a safe-haven asset in the context of increasing global economic uncertainty.

Market participants are closely monitoring every move of the Fed, especially in the upcoming policy meetings. If the Fed adjusts its statement at the July meeting, emphasizing the improvement of inflation data, this may be seen as a prelude to a rate cut in September. At the same time, Powell may use his speech at the Jackson Hole Central Bank Annual Meeting in Wyoming at the end of August to convey further policy signals. In this critical period, gold, as a traditional safe-haven asset, its price increase reflects the market's concern about uncertainty and expectations of policy changes by the Fed.

The strong performance of gold prices is also attributed to the market's bet on Trump potentially returning to the White House for a second term, as well as signs of a slowdown in U.S. inflation, which further intensifies speculation that the Fed will start cutting rates soon. Traders expect the Fed to cut rates twice this year, each by 25 basis points, which is generally good news for the precious metals market. In addition, the increase in gold ETF holdings has also driven up gold prices.

Robert Minter, Director of Investment Strategy at Abrdn, pointed out in an interview that the market's expectation of a rate cut is the key factor driving gold prices to new highs. He emphasized that Powell's testimony in Congress was a long-awaited turning point for the market, in which the Fed Chairman stated that the risks facing the economy are now balanced, and high inflation is not the only problem. This statement seems to have injected confidence into the market, allowing gold prices to hold the key support level of $2400 and set new highs continuously this week.

Minter also pointed out that under high interest rates, the rising consumer debt poses a significant risk to the economy. Higher interest rates increase the pressure on auto loans and credit card interest, meaning that the economic cushion is decreasing. However, Minter believes that the Fed still has the possibility to avoid a recession, which is also the reason why gold has great potential. He expects that the Fed will eventually take faster and larger rate cuts to catch up, which is a strong basis for the expectation of a rate cut in September.

In addition, Minter is also optimistic about the prospects of silver and copper, pointing out that to meet the growing energy demand, the world will need more copper, and the price of silver is expected to surpass gold in the context of the strengthening momentum of the precious metals market. He explained that looking back at the past three interest rate cycles, in 2000, gold rose by 57%, but silver rose by 65%; in 2006, gold rose by 235%, but silver rose by 318%; at the end of 2018, gold rose by 69%, but silver rose by 101%.

The rise in gold prices is the result of the combined effects of the Fed's rate cut expectations, geopolitical tensions, economic data performance, and the market's bet on Trump's possible return to the White House. As these factors continue to ferment, gold and its related assets may continue to be the focus of investors. The policy direction of the Fed, changes in market expectations, and global economic uncertainty will continue to affect the trend of gold prices.

In general, investors need to closely monitor the Fed's policy statements, the release of economic data, and the development of global political and economic events in the coming period. In particular, if the Fed adjusts its monetary policy stance at the upcoming meetings, or conveys new policy signals at the Jackson Hole Central Bank Annual Meeting, this may have a significant impact on the market. At the same time, investors should also consider diversifying their investment portfolios, including but not limited to gold, silver, and copper, to cope with potential market fluctuations.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Vantage

OANDA

Pepperstone

Tickmill

FBS

IQ Option

Vantage

OANDA

Pepperstone

Tickmill

FBS

IQ Option

WikiFX Trader

Vantage

OANDA

Pepperstone

Tickmill

FBS

IQ Option

Vantage

OANDA

Pepperstone

Tickmill

FBS

IQ Option

Rate Calc