简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TTCM Traders-Some Important Points about the Broker

Ikhtisar:Traders-Trust was launched in 2009 by a financial services provider known as TTCM Traders Trust Capital Markets Ltd. Based in Cyprus, it is licensed and regulated by CySEC (registration number .107/09).

| Aspect | Information |

| Company Name | Traders Trust |

| Registered Country/Area | Seychelles |

| Founded year | 2015 |

| Regulation | Suspicious clone by CySEC and FSA |

| Market Instruments | Forex, Stocks, Indices, Metals, Cryptocurrencies, Oil |

| Account Types | Classic, Pro, VIP |

| Minimum Deposit | Classic: $50, Pro: $500, VIP: $5,000 |

| Maximum Leverage | Up to 1:3000 |

| Spreads | Classic: 1.5 pips, Pro: 0 pips, VIP: 0 pips |

| Trading Platforms | MetaTrader 4, cTrader |

| Customer Support | Email at support@ttcm.com or calling +44 203 1295899. |

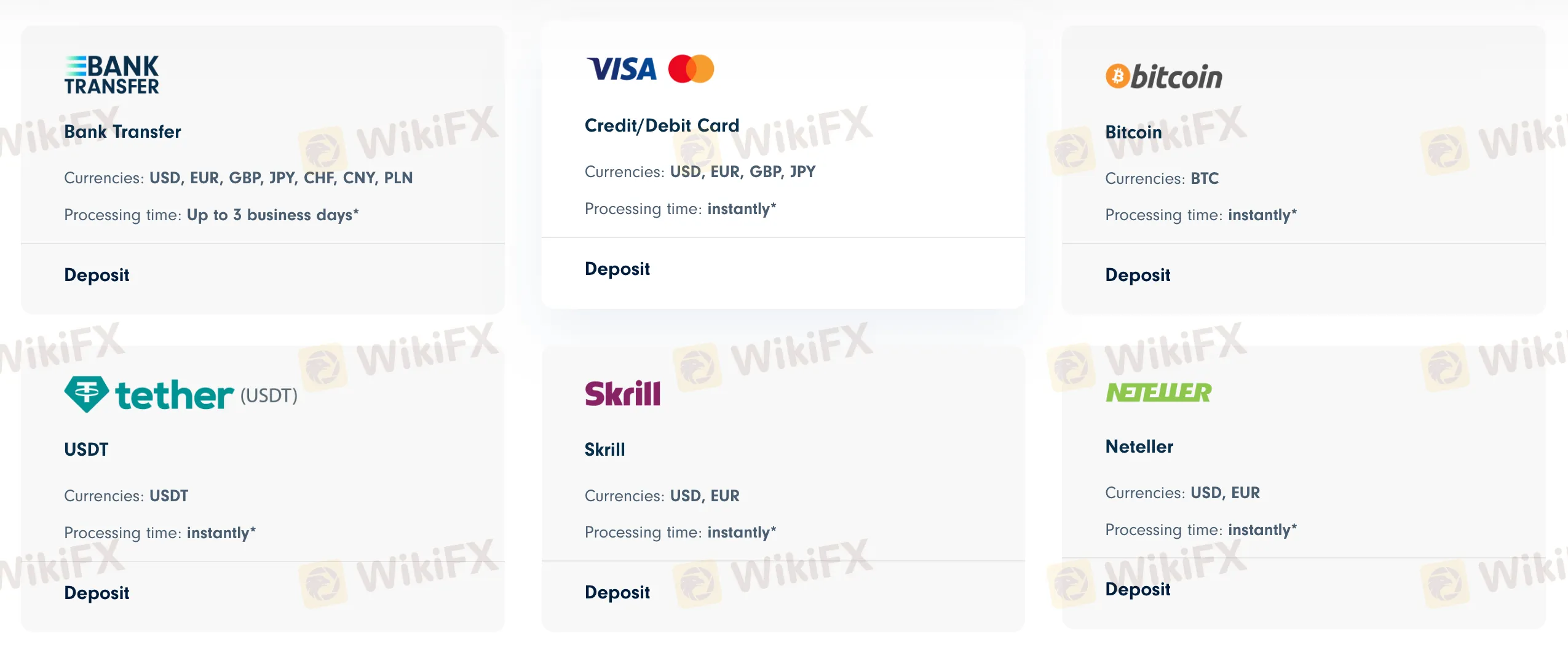

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Card, Bitcoin, USDT, Skrill, Neteller |

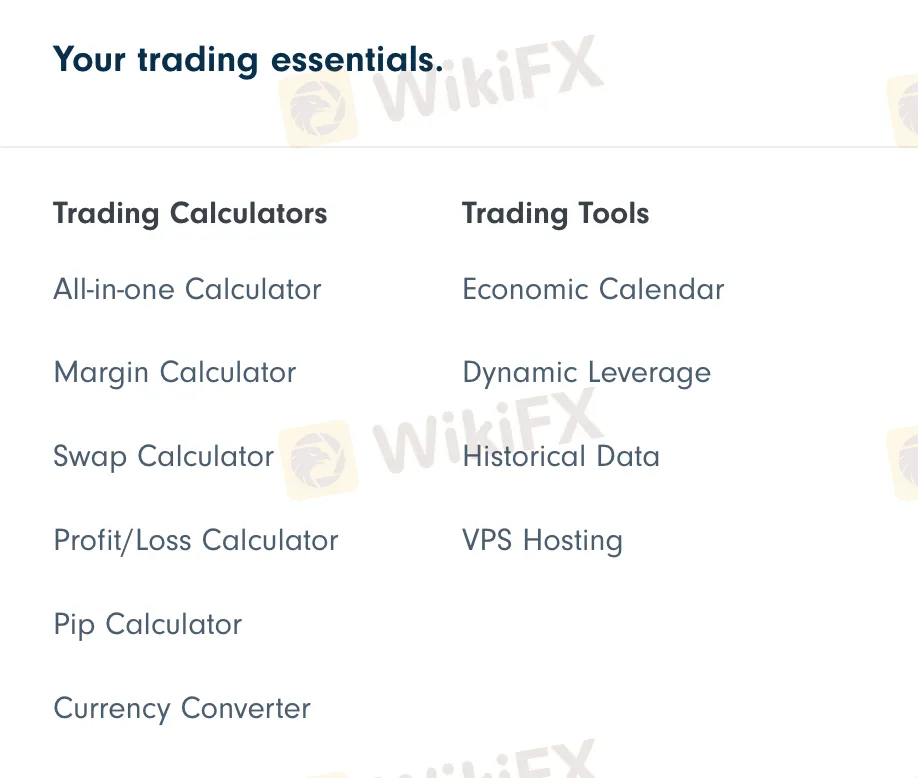

| Educational Resources | Trading Calculators, Trading Tools |

Overview of Traders Trust

Established in Seychelles in 2015, Traders Trust offers a wide range of trading assets spanning forex, stocks, indices, metals, cryptocurrencies, and oil. With competitive leverage up to 1:3000, the platform provides traders with opportunities to amplify profits.

However, it's essential to note potential disadvantages, including its designation as a “suspicious clone” by regulatory authorities like CySEC and FSA, which raises questions regarding regulatory compliance and trustworthiness. Despite these issues, Traders Trust boasts a variety of payment methods and comprehensive trading tools, serving traders' various needs and preferences in the global financial markets.

Is Traders Trust legit or a scam?

Traders Trust falls under the regulatory purview of the Cyprus Securities and Exchange Commission (CySEC), holding license number 107/09. Governed by CySEC, the platform operates with a Straight Through Processing (STP) license.

However, Traders Trust's classification as a “suspicious clone” by CySEC raises red flags, potentially undermining traders' confidence in the platform's regulatory compliance and overall trustworthiness.

On another front, Traders Trust is also subject to regulation by the Seychelles Financial Services Authority (FSA). Operating under a Retail Forex License with license number SD141, the platform is monitored by the FSA in Seychelles. While this regulatory framework imposes certain obligations and guidelines, Traders Trust's designation as a “suspicious clone” by the FSA amplifies risks regarding its legitimacy and adherence to regulatory standards.

Pros and Cons

| Pros | Cons |

| Various Trading Assets Including Forex, Stocks, Indices, Metals, Cryptocurrencies, and Oil. | Suspicious clone by CySEC and FSA |

| Multiple Trading Platforms | Risks associated with high leverage |

| Variety of Payment Methods | |

| Competitive Leverage up to 1:3000 | |

| Comprehensive Trading Tools |

Pros

Various Trading Assets: Traders Trust offers a wide range of trading assets, including forex, stocks, indices, metals, cryptocurrencies, and oil.

Multiple Trading Platforms: Traders Trust provides access to multiple trading platforms such as MetaTrader 4 (MT4) and cTrader. This variety allows traders to choose a platform that best suits their preferences, trading style, and technical requirements, ensuring a friendly and personalized trading experience.

Competitive Leverage up to 1:3000: Traders Trust offers competitive leverage ratios of up to 1:3000.

Variety of Payment Methods: Traders Trust offers a variety of payment methods for deposits and withdrawals, including bank transfers, credit/debit cards, cryptocurrencies (such as Bitcoin and USDT), and e-wallets (such as Skrill and Neteller).

Comprehensive Trading Tools: Traders Trust provides traders with a range of comprehensive trading tools, including trading calculators (such as margin calculator, profit/loss calculator, and pip calculator), currency converter, economic calendar, dynamic leverage, historical data, and VPS hosting.

Cons

Suspicious clone by CySEC and FSA: Traders Trust has been flagged as a “suspicious clone” by both the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA).

Risks associated with high leverage: While Traders Trust offers competitive leverage ratios of up to 1:3000, high leverage comes with inherent risks.

Market Instruments

Traders Trust offers a wide range of trading assets, providing opportunities to engage in various markets and instruments.

Forex trading allows users to trade major, minor, and exotic currency pairs, including symbols such as the dollar, euro, and yen.

Investors can also access the Stocks market, enabling them to trade shares of well-known global companies.

Additionally, the platform offers trading in Indices, providing instant exposure to bundles of global shares, and Metals, allowing traders to diversify their portfolios with commodities like gold and silver.

For those interested in the rapidly evolving world of cryptocurrencies, Traders Trust facilitates trading in Crypto, enabling users to engage with popular digital currencies.

Moreover, traders can participate in the energy market through trading Oil, with options to trade WTI and Brent, among the most actively traded commodities globally.

Account Types

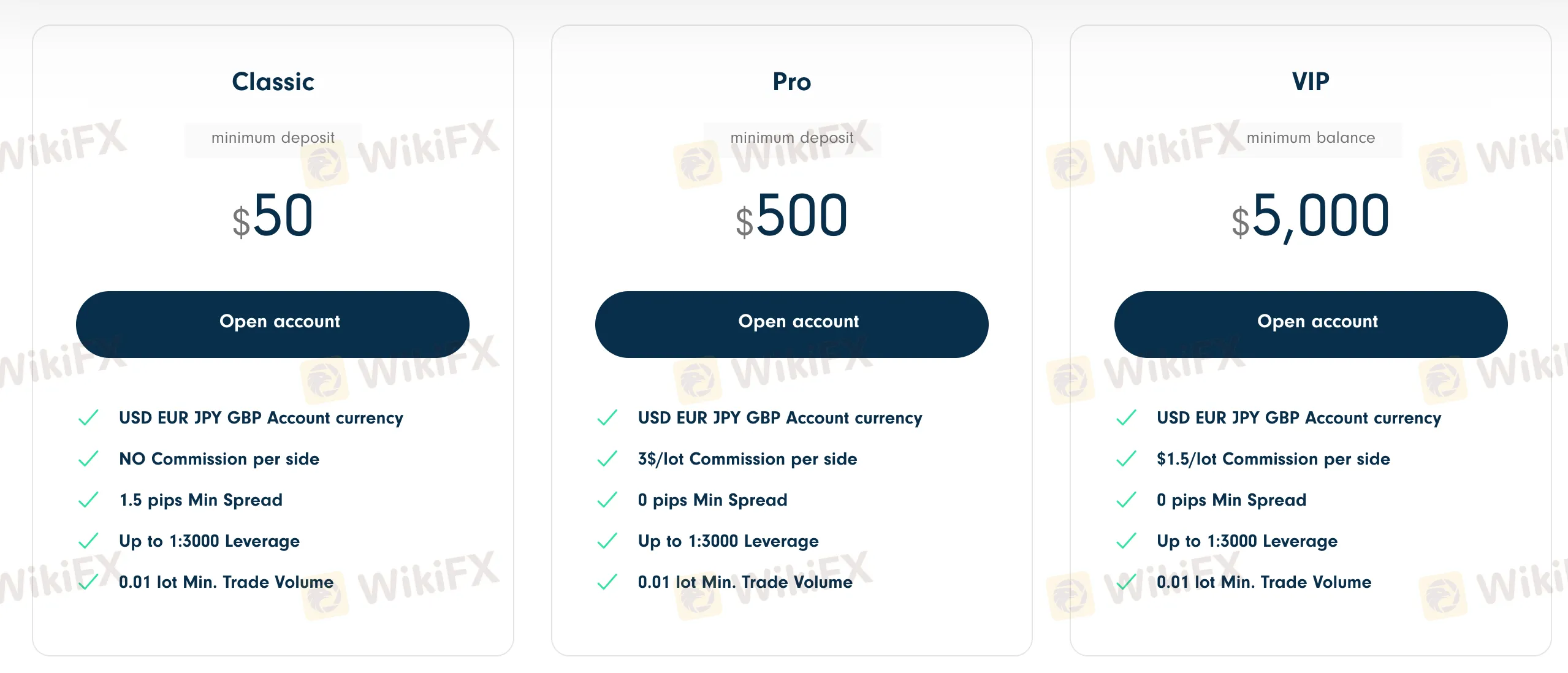

Traders Trust offers three distinct account types to accommodate a range of trading preferences and investment levels.

The Classic account requires a minimum deposit of $50 and does not entail any commission per side. With a minimum spread of 1.5 pips and leverage of up to 1:3000, this account type appeals to beginner traders or those with limited initial capital. Its accessibility and relatively low entry requirements make it suitable for individuals seeking to explore the trading platform without committing significant funds upfront.

The Pro account, on the other hand, necessitates a higher minimum deposit of $500 but offers competitive features such as commission-free trading and tighter spreads starting from 0 pips.

With the same leverage of up to 1:3000 and a minimum trade volume of 0.01 lot, the Pro account accommodates more experienced traders who prioritize cost-efficient trading and have a larger capital base at their disposal. This account type attracts traders seeking enhanced trading conditions and willing to meet a higher deposit threshold for premium services.

For traders with a substantial investment capacity and a preference for personalized support and premium features, Traders Trust offers the VIP account. Requiring a minimum balance of $5,000, this account type provides commission rates as low as $1.5 per lot and maintains spreads starting from 0 pips. With leverage options of up to 1:3000 and a minimum trade volume of 0.01 lot, the VIP account is tailored to sophisticated traders or institutional investors looking for exclusive benefits, prioritized assistance, and optimal trading conditions.

| Account Type | Classic | Pro | VIP |

| Minimum Deposit | $50 | $500 | $5,000 |

| Open Account | USD EUR JPY GBP Account currency | USD EUR JPY GBP Account currency | USD EUR JPY GBP Account currency |

| Commission per side | NO | $3/lot | $1.5/lot |

| Min Spread | 1.5 pips | 0 pips | 0 pips |

| Leverage | Up to 1:3000 | Up to 1:3000 | Up to 1:3000 |

| Min. Trade Volume | 0.01 lot | 0.01 lot | 0.01 lot |

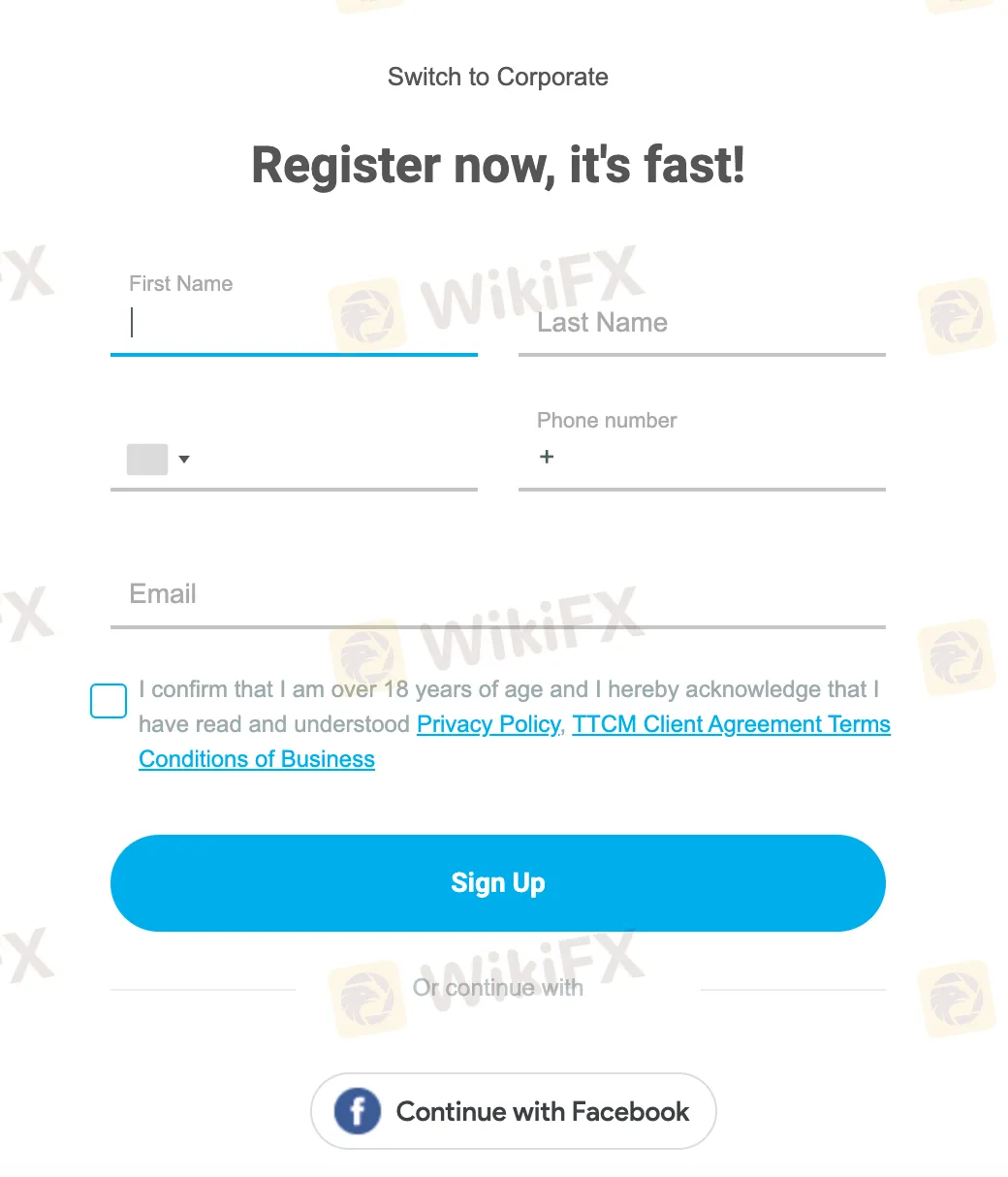

How to Open an Account?

Opening an account with Traders Trust involves a straightforward process, broken down into six clear steps:

Visit the Traders Trust Website: Begin by accessing the official Traders Trust website using a web browser.

Navigate to the Account Opening Section: Once on the website's homepage, locate and click on the “Join now” button. This action typically directs users to the account registration page.

Complete the Registration Form: Fill out the required information accurately in the provided registration form. This typically includes personal details such as name, email address, country of residence, and contact information. Additionally, users need to create a username and password for their account.

Submit Identification Documents: After completing the registration form, users are usually required to upload identification documents to verify their identity. Commonly accepted documents include a valid passport, driver's license, or national identification card.

Agree to Terms and Conditions: Review the platform's terms and conditions, privacy policy, and any other relevant agreements. Users must agree to these terms before proceeding with the account opening process.

Verify and Activate Account: Once all required information and documents have been submitted, users need to undergo a verification process.

Leverage

Traders Trust provides users with access to maximum leverage of up to 1:3000. This leverage ratio allows traders to amplify their trading positions, potentially increasing both profits and losses.

Spreads & Commissions

Traders Trust offers a tiered fee structure comprising spreads and commissions across its different account types.

For the Classic account, traders encounter spreads starting from 1.5 pips with no commissions per side.

Moving up to the Pro account, traders experience tighter spreads, commencing from 0 pips, but are subject to a commission of $3 per lot traded.

Conversely, the VIP account presents the most favorable fee arrangement, with spreads starting from 0 pips and a reduced commission rate of $1.5 per lot.

For budget-conscious traders seeking the lowest commissions, the Classic account stands out as the ideal choice.

Trading Platform

Traders Trust offers a variety of trading platforms to accommodate the preferences and needs of its users.

One of the primary platforms available is MetaTrader 4 (MT4), a widely recognized and popular choice among traders globally. MT4 is accessible on multiple operating systems, including Windows, Mac, iOS, and Android devices, ensuring flexibility and convenience for traders who prefer different devices. Additionally, Traders Trust provides Webtrader, allowing users to access their accounts and trade directly from a web browser without needing to download or install any software.

For traders seeking an alternative to MT4, Traders Trust also offers cTrader, another robust trading platform known for its user-friendly interface and advanced features. cTrader is available on desktop and mobile devices, including Windows, Mac, iOS, and Android, offering access to the markets regardless of the preferred device.

Furthermore, cTrader Web provides traders with the option to trade directly from a web browser, providing flexibility and convenience.

Deposit & Withdrawal

Traders Trust offers a variety of payment methods to facilitate deposits, each with its own set of currencies, processing times.

Bank Transfer is one such method, allowing deposits in currencies including USD, EUR, GBP, JPY, CHF, CNY, and PLN. While bank transfers typically take up to 3 business days to process, they offer a reliable and secure way for users to deposit funds into their trading accounts.

Credit/Debit Card payments provide instant deposit processing, supporting currencies such as USD, EUR, GBP, and JPY. This method offers convenience and accessibility, allowing users to fund their accounts swiftly using their preferred credit or debit cards.

For those utilizing cryptocurrency, Traders Trust accepts Bitcoin deposits, with processing times instantaneously. This option is suitable for users seeking fast and secure transactions within the Bitcoin network, allowing for easy funding of trading accounts with BTC.

Similarly, deposits made via USDT, a stablecoin pegged to the US dollar, offer instant processing times, providing users with an efficient means of transferring funds to their trading accounts. This option appeals to traders looking for stability and quick transaction speeds within the cryptocurrency realm.

Moreover, e-wallets such as Skrill and Neteller are available for instant deposits in USD and EUR. These payment methods offer users additional flexibility and convenience, allowing for swift funding of trading accounts without the need for traditional banking channels.

Customer Support

Traders Trust provides customer support through multiple channels, including email and phone.

Users can reach out to the support team via email at support@ttcm.com or by calling +44 203 1295899. Additionally, the platform's physical address is located at 5th Floor, Andrews Place, 51 Church Street, Hamilton HM 12 Bermuda.

Through these communication channels, Traders Trust assists users with any inquiries, technical issues, or account-related matters they may encounter, offering prompt and responsive support to ensure a friendly trading experience for its clientele.

Educational Resources

Traders Trust offers a comprehensive suite of educational resources and trading tools to empower traders in their journey.

The platform provides various trading calculators, including an All-in-one Calculator, Margin Calculator, Swap Calculator, Profit/Loss Calculator, and Pip Calculator, aiding traders in making informed decisions. Additionally, a Currency Converter assists in understanding exchange rates. Traders can utilize essential trading tools like the Economic Calendar to stay updated on market events, Dynamic Leverage for risk management, and Historical Data for analysis.

Moreover, Traders Trust offers VPS Hosting, ensuring friendly trading experiences. These resources equip traders with valuable insights and tools to enhance their trading strategies and performance.

Conclusion

In summary, Traders Trust presents traders with a broad range of trading assets and competitive leverage options, fostering opportunities to explore diverse markets and potentially enhance profits.

However, the platform's regulatory status, marked as a “suspicious clone” by CySEC and FSA, deter traders seeking assurance in regulatory compliance and platform reliability.

Despite this regulatory scrutiny, Traders Trust offers a robust selection of payment methods and comprehensive trading tools, catering to traders' diverse needs and preferences in the global financial markets. While the platform carries inherent risks associated with its regulatory designation, it also presents avenues for traders to engage in accessible and comprehensive trading services.

FAQs

Q: What trading assets can I access on Traders Trust?

A: Traders Trust offers a wide range of assets including forex, stocks, indices, metals, cryptocurrencies, and oil.

Q: How do I deposit funds into my Traders Trust account?

A: You can deposit funds via bank transfer, credit/debit card, Bitcoin, USDT, Skrill, or Neteller.

Q: What are the minimum deposit requirements for Traders Trust accounts?

A: Minimum deposits vary by account type: Classic requires $50, Pro requires $500, and VIP requires $5,000.

Q: What leverage is available on Traders Trust?

A: Traders Trust offers competitive leverage up to 1:3000, allowing traders to control larger positions with a smaller amount of capital.

Q: Which trading platforms are supported by Traders Trust?

A: Traders Trust supports MetaTrader 4 (MT4) and cTrader, providing traders with a choice of platforms to suit their preferences.

Q: How can I contact customer support at Traders Trust?

A: You can reach Traders Trust customer support via email or phone for assistance with any inquiries or issues.

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

Broker yang bersangkutan

WikiFX Broker

Tickmill

EC Markets

Vantage

FxPro

GO MARKETS

VT Markets

Tickmill

EC Markets

Vantage

FxPro

GO MARKETS

VT Markets

WikiFX Broker

Tickmill

EC Markets

Vantage

FxPro

GO MARKETS

VT Markets

Tickmill

EC Markets

Vantage

FxPro

GO MARKETS

VT Markets

Berita Terhangat

Catatan Kelam Broker Forex! Broker dan Exchanger Ini DISERANG Hacker BERBAHAYA!

Daftar Nama Top 6 Broker Forex Penipu Di Indonesia Per Oktober 2024

WNI Dibikin Gak Bisa WD Oleh Broker Z Forex Capital Market LLC

Nilai Tukar