简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Simple at Epektibong Diskarte sa Forex (Bahagi 3)

abstrak:Alamin natin ang ilang Pangunahing Kaalaman sa Forex !

Ikalawang Bahagi : https://cutt.ly/MkWNGnW

Winning Trading Strategy - Trend

The capability to understand market trends is fundamental for any financial trader. Fortunately, the following trend strategy is one of the simpler Forex trading strategies. The markets move in the same direction for an extended period of time, but the challenge is the speed and certainty with which a trader can identify a trend, and therefore, be one of the first to jump on the bandwagon.

Step 1 - Setting up the beginner trading strategy

In this trading strategy, a 200 exponential moving average is applied to the hourly chart to help traders differentiate range periods from trending periods. If the candles close near the exponential moving average, the market consolidates; If the price closes relatively far, we will be in the trend where we can open positions.

Step 2 - Entering positions

To go into more details about entry points, we use Bollinger Bands, which are a dynamic standard deviation indicator. In this trading strategy, Bollinger Bands confirm if the market is expanding and help traders identify impulses - the perfect place to enter into a trend.

When the market is in the uptrend, you will see the Bollinger Bands above the 200 exponential moving average, then you can take a buy signal following the contact between the price and the lower Bollinger Band, marking a rejection.

On the contrary, a sell signal is produced when the market is in a downtrend and when the bands are below the exponential moving average. However, the price must also hit the upper band - also indicating a rejection.

Step 3 - Exiting positions

An exit signal for both long and short positions is produced when price hits the opposite Bollinger Band - the upper band for an uptrend and the low band for a downtrend. This allows a trader to exploit trend movements without wasting time on retracements.

This is a good example of a simple Forex trading strategy. However, as with all trading methodologies, it is not rid of weaknesses. Similar to the breakout strategy, this one performs well in a directional market, but conducts losses in a range and consolidate market. Unlike the previous trading strategy, this one is a bit more dynamic when it is for hourly charts.

(To be continued ...)

Matuto nang higit pa sa pangunahing kaalaman sa Forex upang simulan ang iyong karera sa pangangalakal, i-download ang WikiFX APP ngayon:

- Android: t.ly/4stP

- iOS: t.ly/cr7F

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

Mga Sesyon ng Forex Trading

Ngayong alam mo na kung ano ang forex, bakit mo ito dapat i-trade, at kung sino ang bumubuo sa forex market, oras na para malaman mo kung kailan ka makakapag-trade.

Kailan Maaari kang Mag-trade ng Forex?

Dahil lamang na ang forex market ay bukas 24 na oras sa isang araw ay hindi nangangahulugan na ito ay palaging aktibo! Tingnan kung paano nahahati ang forex market sa apat na pangunahing sesyon ng pangangalakal at kung alin ang nagbibigay ng pinakamaraming pagkakataon.

Demo Trade Iyong Daan sa Tagumpay

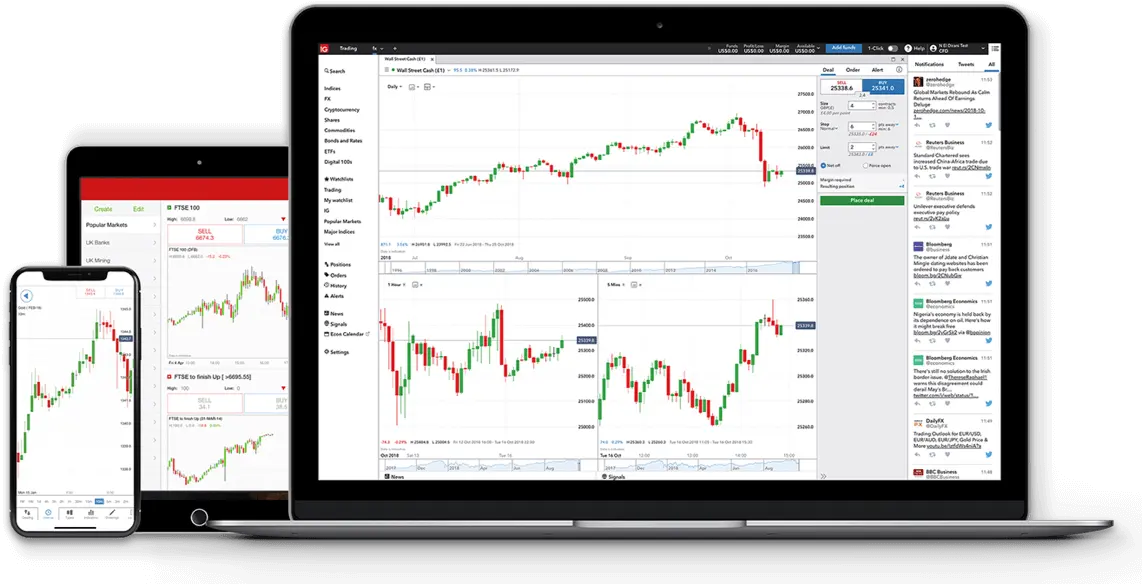

Maaari kang magbukas ng demo trade account nang LIBRE sa karamihan ng mga forex broker. Ang mga "pagpapanggap" na account na ito ay may karamihan sa mga kakayahan ng isang "tunay" na account.

Ano ang Spread sa Forex Trading?

Ang spread na ito ay ang bayad para sa pagbibigay ng agarang transaksyon. Ito ang dahilan kung bakit ang mga terminong "gastos sa transaksyon" at "bid-ask spread" ay ginagamit nang magkapalit.

Broker ng WikiFX

Pinakabagong Balita

Challenge Yourself: Transform from Novice to Expert

Exchange Rate