简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

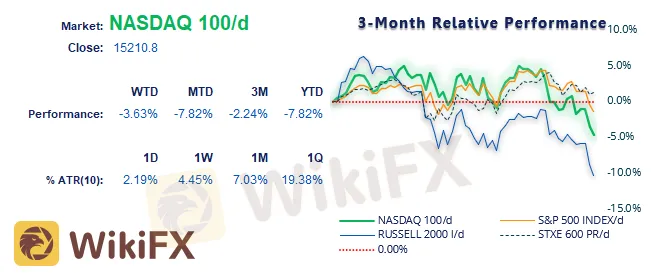

Nasdaq Correction: Here's How to Handle It

abstrak:There is a saying in the stock markets: "Highs are a process, lows are an event". And this fits with the trend that market tops can be a slow and tiring experience, while market bottoms can be quick.

There is a saying in the stock markets: “Highs are a process, lows are an event”. And this fits with the trend that market tops can be a slow and tiring experience, while market bottoms can be quick. That's not always the case, but you seem to be seeing that in the US markets right now. Compare the March 2020 “V-bottom” low to the price action from the Nasdaq 100 all-time high and you'll see what we mean.

Price action has been mixed over the past few months, although bearish momentum is building as yields rise ahead of expected Fed rate hikes. Can prices accelerate down from here? It's very possible. But markets rarely move in a straight line and are down. Deep markets/corrections are notorious for swinging against the trend.

With that in mind, the Nasdaq 100 is down more than 10% from its all-time high, confirming this as a correction versus a pullback. It's a well-publicized event judging by the headlines and that alone puts the index at risk of a corrective bounce. We also have the 200-day EMA and the 15,000 level just below yesterday's close, increasing the likelihood that it will not turn down immediately, coupled with the fact that US yields on the VIX (NDX) ticked lower yesterday. Despite the lower index.

Viewing the daily chart, the bearish momentum on the Nasdaq 100 is now accelerating down. However, three clear areas of support stand out.

15,000 as it is a round number and right near the 200-day EMA

14,800 – 14,900: gap not closed, 138.2% Fibonacci projection

14,834 – 14,566: October low, 100 / 161, 8% Fibonacci projection, long-term 23.8% Fibonacci Ratio

Therefore the suspect moves lower could be capped at the short-term and prices could rally to 14,900 from the 14,800 support zone if prices break above 15,000 October lows. However, a direct move back above 15,500 will invalidate our bearish bias.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

I-claim ang Iyong 50% Welcome Bonus hanggang $5000!

Bukas sa Parehong Bago at Existing na Customer!

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

IMF cuts global growth outlook, warns high inflation threatens recession

The International Monetary Fund cut global growth forecasts again on Tuesday, warning that downside risks from high inflation and the Ukraine war were materializing and could push the world economy to the brink of recession if left unchecked.

Starting Forex Trading: Creating A Profit Plan

A key factor in building a successful and profitable trading career is making your own plans. Your transaction plan will provide a good framework for guiding ever-changing currency prices to profit.

Broker ng WikiFX

Exchange Rate