简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

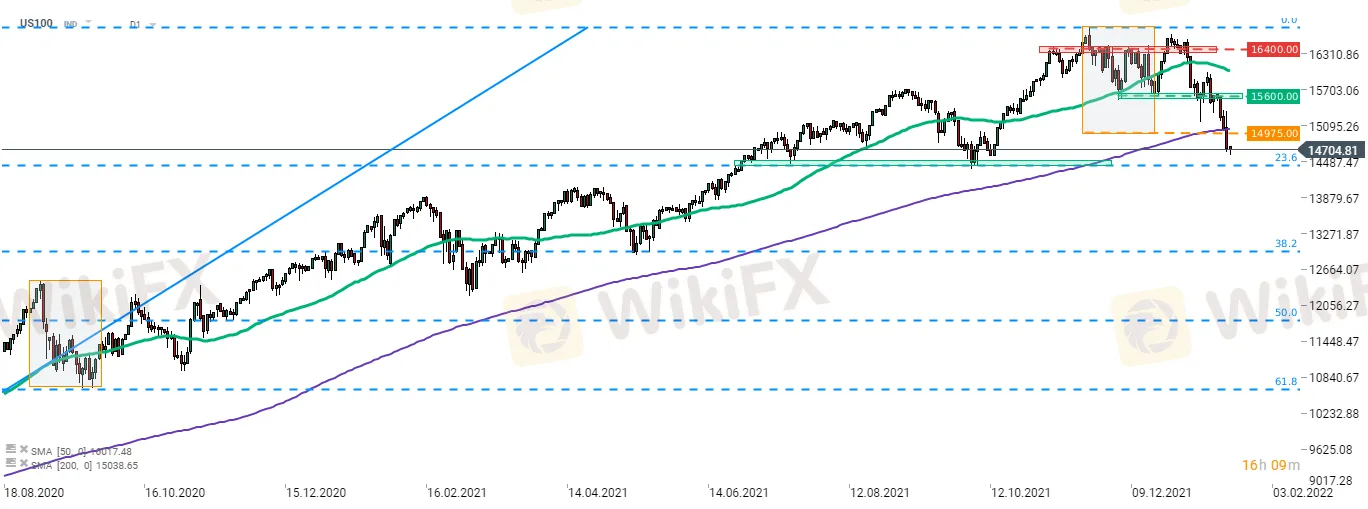

US100 Crashed Below 15,000 Points

abstrak:What seemed just like the starting of a restoration rally, quickly grew to become out to be some other useless cat bounce. Despite US indices gaining barely at the start of yesterday's Wall Street consultation, moods quickly deteriorated and US shares took some other hit.

What seemed just like the starting of a restoration rally, quickly grew to become out to be some other useless cat bounce. Despite US indices gaining barely at the start of yesterday's Wall Street consultation, moods quickly deteriorated and US shares took some other hit. There are some motives that have contributed to the drop in fairness markets

Continued pick-up in the US yields and developing chance of Fed doing away with extra liquidity

Netflix (NFLX.US) plunged 20% in after-hours buying and selling as Q4 2021 subscriber figures upset and forecast for Q1 2022 turned into visible as unambitious

Cryptocurrencies joined tech sell-off with Bitcoin losing under $40,000

A big wide variety of unmarried inventory choice contracts expires these days which might also additionally have compelled sellers to hedge positions and in flip amplify the latest movements withinside the markets

Taking a have a take a observe the Nasdaq-100 (US100) chart, we will see that the index plunged under the mental 15,000 pts region and keeps to transport decrease. The index broke under the decrease restriction of the Overbalance shape at 14,975 pts and 200-consultation shifting average (red line), signaling that an extra weak spot can be ahead. The subsequent guide region to observe may be determined on the 23.6% retracement of the post-pandemic restoration flow withinside the 14,420 pts region.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate