Como plataforma independiente de servicios de información de terceros, WikiFX se compromete a brindar a los usuarios servicios integrales y objetivos de consulta de información regulatoria de distribuidores. WikiFX no participa directamente en ninguna actividad de comercio de divisas, ni proporciona ningún tipo de recomendación de canales de comercio o asesoramiento de inversión. La calificación de los comerciantes de WikiFX se basa en información objetiva de canales públicos y tiene plenamente en cuenta las diferencias en las políticas regulatorias en diferentes países y regiones. Las calificaciones de los comerciantes son el producto principal de WikiFX. Nos oponemos firmemente a cualquier práctica comercial que pueda dañar su objetividad e imparcialidad, y agradecemos la supervisión y sugerencias de los usuarios de todo el mundo. Línea directa de denuncia: report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

Búsqueda de brokers

Español

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Benny44

0123456789

0123456789

0123456789

0123456789

Inversor

ID: 3765117124

Hong Kong

6-10 años

Seguir

Benny44

Understanding the Concept of Forex Trading

What is Forex Trading?*

Forex trading involves buying and selling currencies on the foreign exchange market.

Why Trade Forex?*

- Liquidity: Forex market is highly liquid

- Accessibility: Trade from anywhere with an internet connection

- Market hours: Forex market is open 24/5

- Leverage: Use borrowed capital to increase potential gains

Basic Forex Concepts*

- Currency pairs: EUR/USD, USD/JPY, etc.

- Exchange rates: Price of one currency in terms of another

- Bid/Ask prices: Buy/Sell prices

- Pips: Smallest price change (0.0001)

- Leverage: Borrowed capital to increase trade size

2024-11-17 22:02

Benny44

Forex Trading: Currency Exchange

1. Currency pairs: Forex trading involves trading currency pairs, such as EUR/USD (Euro vs. US Dollar) or USD/JPY (US Dollar vs. Japanese Yen).

2. Major currencies: The most widely traded currencies are the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Swiss Franc (CHF), Canadian Dollar (CAD), Australian Dollar (AUD), and New Zealand Dollar (NZD).

3. Currency symbols: Each currency has a unique symbol, such as $ for the US Dollar, € for the Euro, and £ for the British Pound.

4. Exchange rates: Exchange rates determine how much of one currency can be exchanged for another.

5. Currency strength: Currencies can strengthen (appreciate) or weaken (depreciate) relative to other currencies.

6. Currency correlation: Certain currency pairs tend to move together, such as the EUR/USD and GBP/USD.

7. Currency intervention: Central banks can intervene in the Forex market to influence exchange rates.

8. Currency risks: Forex traders face risks such as exchange rate fluctuations, political instability, and economic changes.

9. Currency converter: A currency converter tool helps traders convert between currencies.

10. Currency quotes: Forex brokers provide currency quotes, which include the bid (buy) and ask (sell) prices.

Remember, understanding currencies and their interactions is crucial for successful Forex trading!

2024-11-17 21:55

Benny44

Concepts on Forex trading: Brokers

Forex brokers are intermediary firms that facilitate Forex trading between individuals and institutions. They provide traders with access to the Forex market, enabling them to buy and sell currencies

Choosing a Forex Broker:

1. Reputation: Research the broker's history and reviews.

2. Regulation: Ensure the broker is properly licensed and regulated.

3. Trading Conditions: Compare spreads, leverage, and execution quality.

4. Customer Support: Evaluate the broker's support and education resources.

5. Security: Verify the broker's security measures and fund segregation.

2024-11-17 21:50

Benny44

Forex Trading Brokers

Forex brokers are intermediary firms that facilitate Forex trading between individuals and institutions. They provide traders with access to the Forex market, enabling them to buy and sell currencies.

Types of Forex Brokers:

1. Market Makers: Set bid/ask prices, provide liquidity, and profit from spreads.

2. Electronic Communication Network (ECN) Brokers: Connect traders directly to the market, charging commissions.

3. Straight-Through Processing (STP) Brokers: Route trades directly to liquidity providers, earning commissions

Regulation and Security:

1. Licensing: Brokers must obtain licenses from regulatory bodies, such as the Commodity Futures Trading Commission (CFTC).

2. Segregation of Funds: Brokers must separate client funds from their own.

3. Negative Balance Protection: Ensures traders cannot lose more than their account balance.

Forex brokers play a crucial role in the Forex market, providing traders with access to the market and essential services. When choosing a Forex broker, it is essential to consider reputation, regulation, trading conditions, customer support, and security. By selecting a reliable and suitable broker, traders can ensure a successful and secure Forex trading experience.

2024-11-17 21:47

Benny44

Forex Trading:Specialization

1. Currency pair specialization: Focus on specific pairs, such as EUR/USD or USD/JPY.

2. Trading strategy specialization: Expertise in specific strategies, like day trading or swing trading.

3. Market analysis specialization: Focus on technical analysis, fundamental analysis, or sentiment analysis.

4. Time frame specialization: Focus on specific time frames, such as scalping or long-term trading.

Benefits of specialization:

1. Improved expertise: In-depth knowledge of a specific area.

2. Increased efficiency: Focus on a specific area allows for more effective use of time and resources.

3. Better risk management: Specialization helps traders understand and manage risks more effectively.

4. Enhanced performance: Specialization leads to more accurate predictions and profitable trades.

2024-11-17 21:43

Benny44

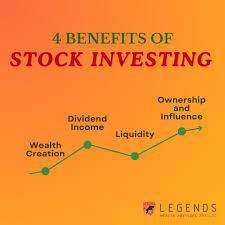

Stock Market Rewards

Benefits of Stock Market:

- Wealth Creation: Share price appreciation and dividends generate wealth for investors.

- Economic Growth: Companies use raised capital for growth, driving economic expansion.

- Ownership: Shareholders have a stake in companies, promoting accountability and transparency.

2024-11-17 21:35

Benny44

Stock Market Limitations

Key Players:

- Investors: Individuals, institutions, and organizations that buy and sell shares.

- Listed Companies: Companies whose shares are traded on the stock exchange.

- Stock Exchanges: Platforms where buying and selling occur, such as the NYSE and NASDAQ.

- Brokers: Intermediaries who facilitate transactions between investors and the exchange.

Challenges and Risks:

- Volatility: Share prices fluctuate rapidly, posing risks for investors.

- Risk of Loss: Investors may lose some or all of their investment.

- Market Manipulation: Unethical practices, such as insider trading, can distort the market.

- Regulatory Challenges: Evolving regulatory frameworks can impact market dynamics

2024-11-17 21:32

Benny44

Global stock market

The stock market, also known as the equity market, is a platform where companies raise capital by issuing shares of stock to the public, and investors buy and sell those shares in hopes of earning a profit. It plays a vital role in the global economy by enabling companies to raise capital, facilitating wealth creation, and providing a platform for investment.

History of Stock Market:

The modern stock market originated in Amsterdam in the 17th century, with the establishment of the Dutch East India Company. The London Stock Exchange was founded in 1698, followed by the New York Stock Exchange (NYSE) in 1792.

- Raising Capital: Companies issue shares to raise funds for expansion, research, and development.

- Investment Avenue: Investors buy shares to earn dividends and capital appreciation.

- Liquidity: Investors can easily buy and sell shares.

- Price Discovery: Market forces determine share prices, reflecting a company's performance and prospects.

- Risk Management: Investors can diversify portfolios to minimize risk.

l

2024-11-17 21:28

Benny44

Forex trading Analysis

- Decentralized: Forex is a global network of banks, brokers, and individual traders, with no central exchange.

- Global: Forex is traded worldwide, with markets open 24/5 (Sunday evening to Friday evening).

- $6 trillion daily volume: The Forex market is the largest financial market, with a massive daily trading volume.

- Currency pairs: Currencies are traded in pairs (e.g., EUR/USD, USD/JPY).

- Exchange rates: Rates fluctuate based on supply and demand.

- Traders buy and sell: Traders profit from exchange rate fluctuations.

- Liquidity: Easy entry and exit, with markets open 24/5.

- Accessibility: Trade online from anywhere.

- Leverage: Control large positions with a small amount of capital.

- Volatility: Profit from changes in currency values.

2024-11-17 21:23

Benny44

Risk management: Forex trading

- Risks:

- Market risk: Rapid changes in currency values.

- Leverage risk: Amplifies losses and gains.

- Liquidity risk: Difficulty entering or exiting trades.

-

- Risk management:

- Position sizing (manage trade size).

- Stop-loss orders (limit losses).

- Take-profit orders (secure profits).

- Diversification (spread risk).

2024-11-17 21:12

haz click para cargar más

Personas que pueden estar interesadas

cambiar

MarquezNavarro

Seguir

FX1693557505

Seguir

Melon1952

Seguir

FX2713451314

Seguir

PeterParker10

Seguir