WikiFX, as an independent third-party information service platform, is dedicated to providing users with comprehensive and objective broker regulatory information services. WikiFX does not directly engage in any forex trading activities, nor does it offer any form of trading channel recommendations or investment advice. The ratings and evaluations of brokers by WikiFX are based on publicly available objective information and take into account the regulatory policy differences of various countries and regions. Broker ratings and evaluations are the core products of WikiFX, and we firmly oppose any commercial practices that may compromise their objectivity and fairness. We welcome supervision and suggestions from users worldwide. To report any concerns, please contact us: report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

Broker Search

English

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gamma Squeezer

0123456789

0123456789

0123456789

0123456789

KOL

ID: 2111991648

Hong Kong

Within 1 year

Follow

Life is long gamma

Gamma Squeezer

Market Wrap(11.13)

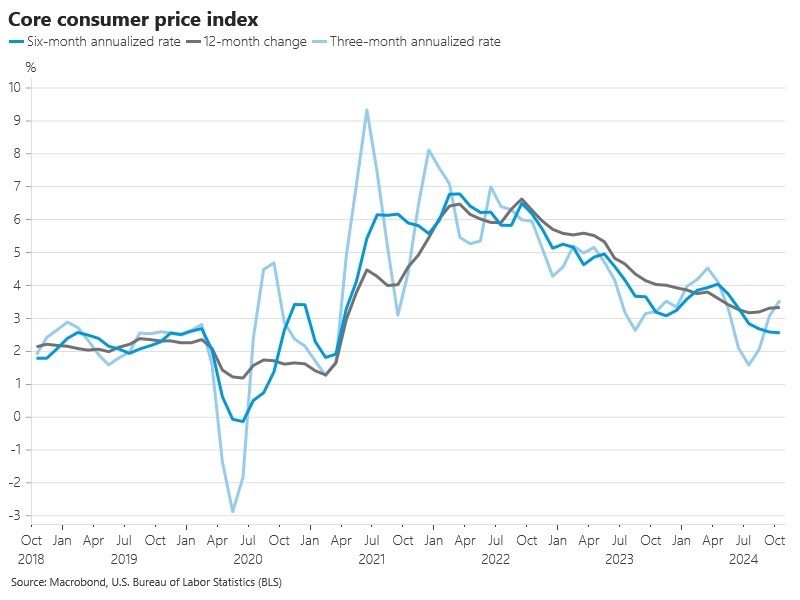

US CPI data impacts markets:

Oct inflation: 2.6%, core 3.3% (as expected)

US stock futures cut losses

Dollar retreats, Treasury yields drop

Gold extends rally

MSCI world index -0.17%, European shares dip

Market reactions:

US futures turn positive

2-yr Treasury yield falls to 4.256%

Dec rate cut probability: 69% vs 62% earlier

Euro up 0.1% at $1.0630

Yen at 154.615/USD

Expert view (Pavlik, Dakota Wealth):

"In-line inflation allows market to focus on positives: less regulation, potential business increase. We're on glide path to another rate cut."

Trump effect lingers:

Bond yields surged post-election

Expectations: lower taxes, higher tariffs

Potential GOP House majority adds uncertainty

Analyst: "Still repricing the Trump trade"

Commodities recover:

Gold +0.6% to $2,610/oz

Silver +0.8% to $30.93/oz

Brent crude +0.4% to $72.15/barrel

WTI +0.37% to $68.36/barrel

#US CPI #Fed #MarketReaction #TrumpEffect

2024-11-13 23:01

Gamma Squeezer

Oil Near $72 as Market Weighs Demand and Supply

Brent crude holds around $72/barrel, trading in narrow range:

Little changed for second day, near month's low

Earlier support from pause in USD rally

Trading band of ~$5 for nearly a month

Market factors:

OPEC cuts demand growth forecast (4th consecutive month)

Awaiting US and IEA outlooks this week

Traders assessing 2025 consumption outlook

Concerns about potential oversupply next year

Expert view (Harry Tchilinguirian, Onyx Capital Group):

"The market is looking for a catalyst to break out. OPEC+ cuts afford somewhat of price support while macro economic realities put in place a cap."

Morgan Stanley outlook:

Cut oil price forecast

Predicts potential glut in 2025

Reduced consumption expectations for 2024 and 2025

Second Trump presidency could significantly impact prices, direction unclear

Key factors influencing oil market:

Geopolitical risk premiums

OPEC+ production cuts

Global economic conditions

#OilMarkets #CrudeOil #OPEC #WTI

2024-11-13 22:25

Gamma Squeezer

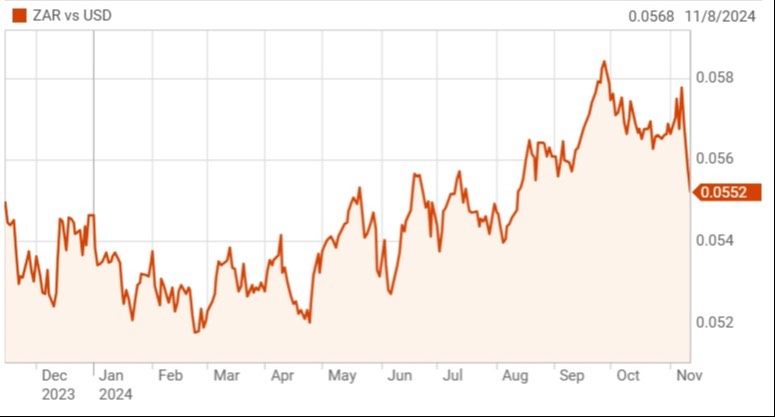

South African Rand Gains After 3-Day Slump

ZAR strengthens 0.4% to 18.05/USD in early trading, following three days of heavy losses. Key factors:

Markets anxious about Trump's trade policies

Rand lost ~4% vs USD since Nov 5 US election

High volatility in currency markets

Market dynamics:

Rising US Treasury yields

USD strength on expectations of Trump's pro-growth policies

Short-term speculative positioning pressuring ZAR

SA's terms of trade remain relatively robust

Market outlook:

Rand likely to follow global cues due to light domestic calendar

Johannesburg Top-40 index down 0.3% in early trade

SA 2030 govt bond yield up 2 bps to 9.25%

Expert view (Andre Cilliers, TreasuryONE):

"The currency has struggled amid rising U.S. Treasury yields and dollar strength driven by expectations of pro-growth policies under Trump."

#SouthAfricanRand #ForexMarkets

2024-11-13 16:12

Gamma Squeezer

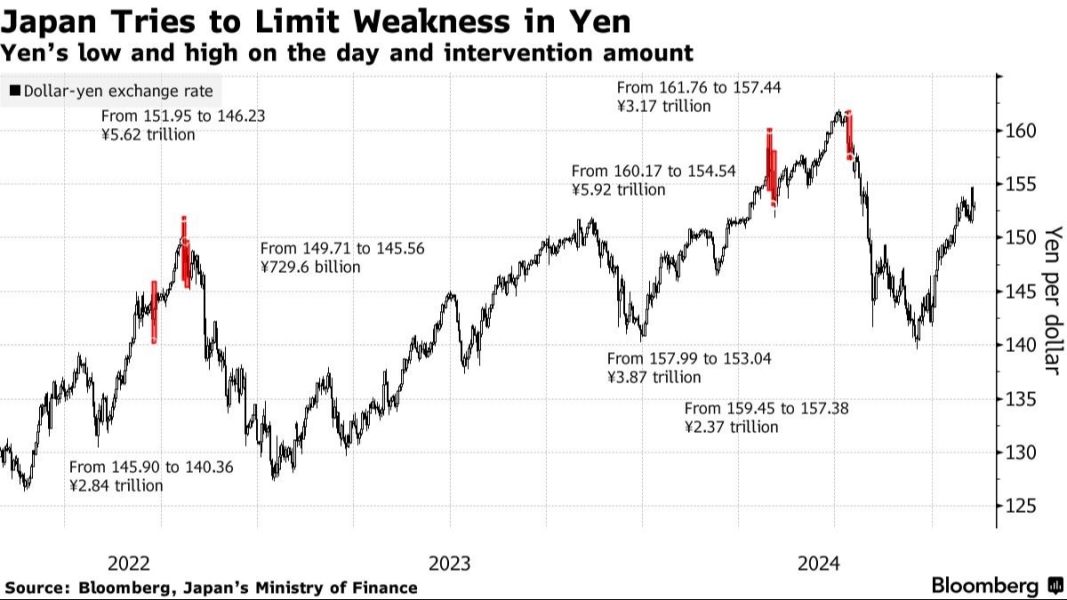

Yen Breaks 155 Per$, Raising Intervention Risk

JPY weakens past 155/USD for first time since July, increasing Japan's market intervention risk. Key factors:

Yen slides 0.3% to 155.04 vs USD

Losses extend after Trump's re-election as US president

Surging Treasury yields weigh on yen, 2-yr yield at highest since July

Market focus:

Yen near levels of last Japanese intervention

Japan's top FX official warns of one-sided, sudden moves

Bloomberg economist survey: median intervention trigger at 160 yen/USD

Trump policy potential impacts:

Expansionary, inflationary economic policies may reduce Fed rate cut willingness

Could further widen US-Japan interest rate gap, weakening yen

Market questions pace of narrowing interest rate differential

Japan govt & BOJ stance:

Record interventions this year in two rounds

¥9.8T ($63B) spent late Apr-early May

Additional ¥5.5T in early July

BOJ Gov Ueda acknowledges FX impact on Japan's price trends

Persistent yen weakness may prompt earlier rate hike consideration

#BOJ #JPY

2024-11-13 15:05

Gamma Squeezer

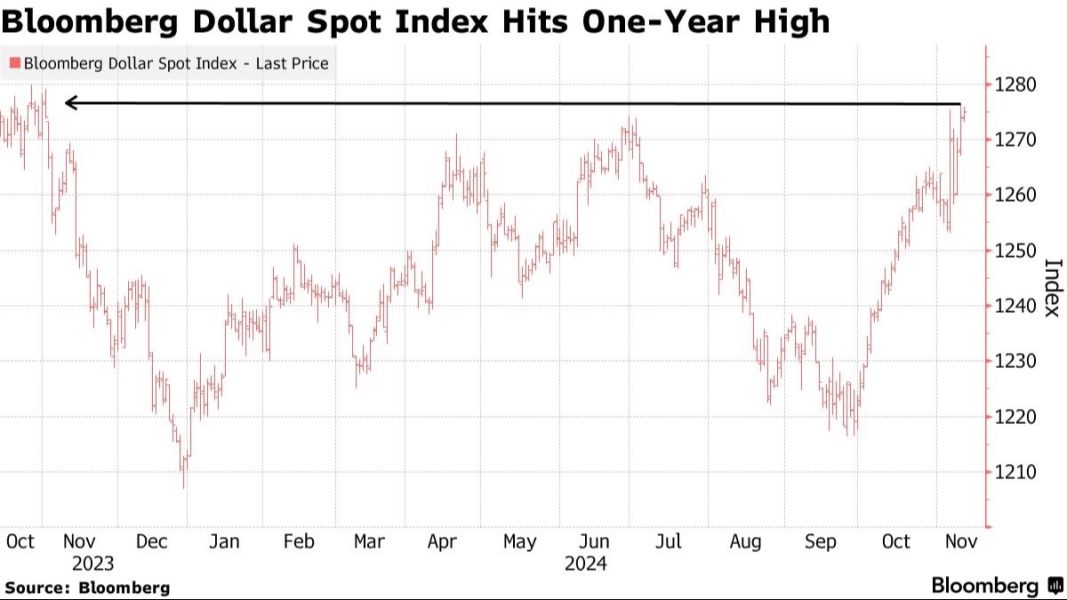

Market Wrap(11.12)

USD rises to 4-month peak vs major peers.

Key factors:

Investors betting on Trump administration policies

Euro at 7-month low, yuan at 3-month low

Potential Trump tariffs targeting Europe and China

Trump's crypto stance:

Vows to make US "crypto capital of the planet"

Analyst Gautam Chhugani: "regulatory tailwind zone"

Expectations of crypto-friendly SEC under Trump

Dollar index up 0.38% to 105.83 (highest since July). Drivers:

US equities, interest rates, and dollar pushing higher

Reports of hawkish China policy team (Rubio, Waltz)

Republican control of Congress

Currency movements:

Onshore yuan at 7.2378 (lowest since Aug 1)

AUD down 0.45% to $0.6545

EUR at $1.0611 (lowest since late April)

GBP down 0.36% to $1.2824

JPY at 154.04 per dollar

Market expectations:

Reduced likelihood of Dec Fed rate cut (69% vs 80% week ago)

Inflationary tariffs and immigration policies

German political uncertainty (Feb 23 elections)

UK wage growth slowing, unemployment rising

#ForexMarkets #TrumpEffect #BitcoinRally #DollarStrength #GlobalEconomics

2024-11-12 22:03

Gamma Squeezer

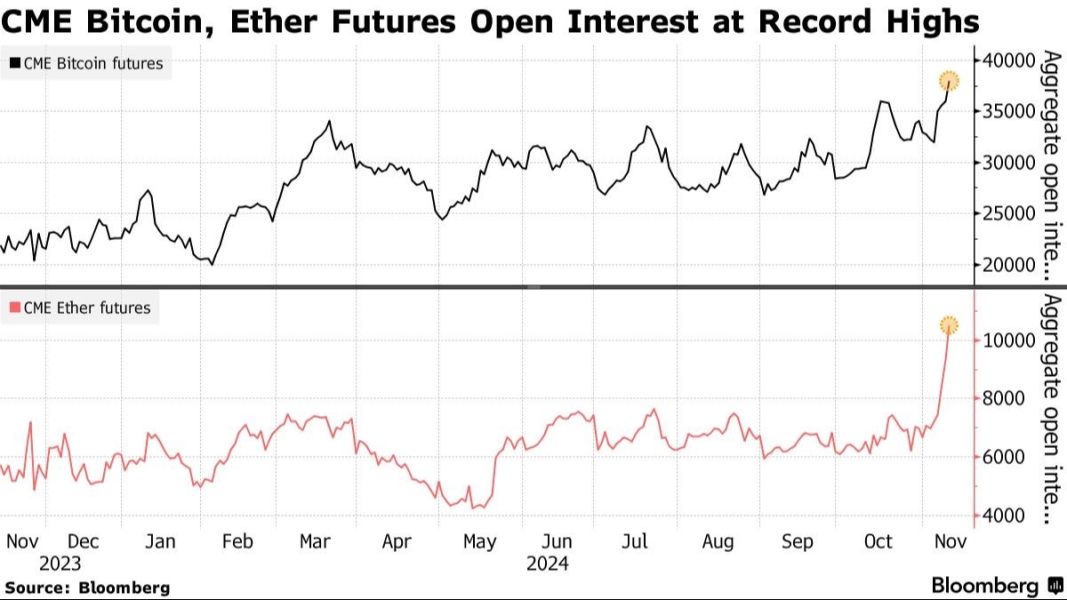

Bitcoin Nears $90K as Trump Win Fuels Crypto Rally

Bitcoin's record-breaking rally approaches $90,000, pushing overall crypto market value above pandemic-era peak. BTC hit all-time high of $89,599, up 32% since US election. Current price: $87,063 as of 7:02 a.m. New York time.

Trump's pro-crypto stance driving surge:

Promises friendlier regulations

Plans for strategic Bitcoin stockpile

Aims to boost domestic mining

Goal: Make US the global crypto capital

Sharp contrast to SEC crackdown under Biden administration.

Market dynamics:

Total crypto market cap reaches $3.1 trillion

Bitcoin options traders betting on $100K by year-end

CME futures for BTC and ETH hit record open interest

MicroStrategy purchased 27,200 BTC ($2B) in early November

2024 performance:

Bitcoin up 110% YTD

Outperforming global stocks and gold

BlackRock's iShares Bitcoin Trust sees record turnover

Analysts warn of potential "digestion" period after steep rise

Political landscape:

Crypto companies heavily invested in pro-industry candidates

Trump's crypto support marks significant policy shift

Bitcoin joins other "Trump trades" (US stocks, USD)

Focus on economic growth, tax cuts, and protectionist policies

#Bitcoin #TrumpEffect #CryptoMarkets #BTC

2024-11-12 22:02

Gamma Squeezer

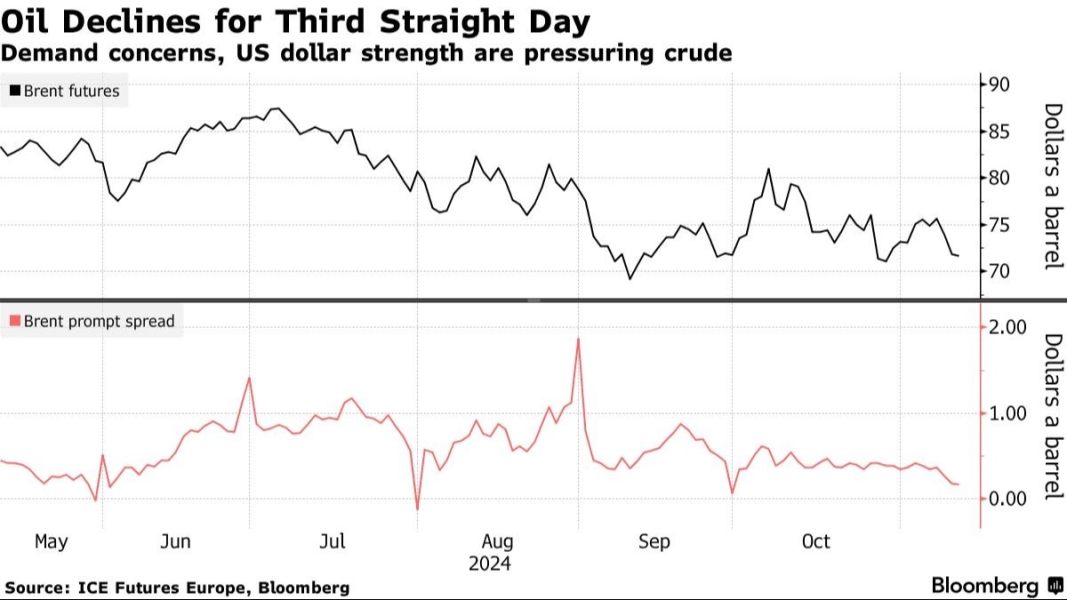

Oil Dips on Demand Worries, Strong Dollar

Oil prices fall for third day, with Brent below $72 and WTI above $67. Key factors:

Soft demand outlook in China

Stronger US dollar post-Trump win

Potential market oversupply concerns

China's economic measures fall short of direct stimulus, inflation remains weak.

Market dynamics:

Crude trading in narrow range since mid-October

Influenced by Middle East tensions, US election, OPEC+ decisions

Global supply expected to outpace demand in 2025

OPEC monthly report due Tuesday, to provide market balance insights

Technical indicators:

Brent's front-month spread at 17 cents backwardation, down from 44 cents a month ago

Most gauges still in backwardation, but spreads narrowing

Analyst view (Warren Patterson, ING):

"Sentiment largely bearish"

USD strength, demand concerns, loosening oil balance pressure prices

OPEC+ delay in production increase or effective US sanctions on Iran could change 2025 outlook

Upcoming reports: US short-term outlook (Wednesday), IEA view (Thursday)

#Oil #WTI #OPEC #CrudeOutlook

2024-11-12 16:02

Gamma Squeezer

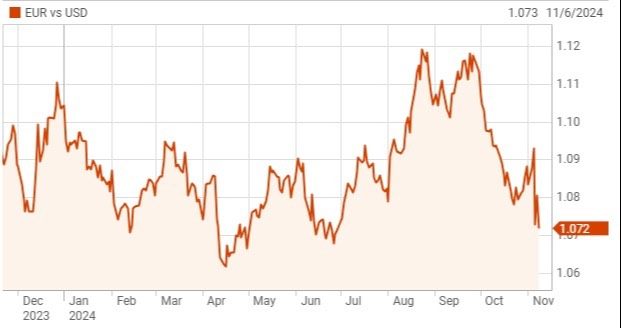

Traders See CNH, Euro as Biggest Losers

Currency traders place new bets on stronger USD post-Trump win, focusing on EUR and CNH. Options data shows increased interest in dollar calls against these currencies. USD/CNH call options outnumber puts 3:2 for $100M+ trades.

Drivers for USD strength:

Trump's proposed tax cuts

Potential tariff increases

Expected inflation boost

Republican control of government

Traders eye yuan as Trump threatens 60% fee on Chinese goods + 10% universal import tariff.

Political risks affect EUR:

German Chancellor open to early confidence vote

Possible February elections

ECB's Holzmann hints at potential December rate cut

Investors using options to express views on higher USD vs EUR, JPY, and CNH.

Currency volatility rising:

6-month USD/CNH implied vol above pre-election levels

EUR/USD 6-month implied vol at highest since June

Traders target USD/CNH at 7.35-7.40, EUR/USD moving towards parity. European digital options popular with 3-month to 1-year expiries.

#Forex #TrumpEffect #DXY #CurrencyOptions

2024-11-12 14:58

Gamma Squeezer

Euro Hits 6-Month Low Amid U.S. Tariff Fears

Euro just hit a 6.5-month low against the dollar as fears of U.S. tariffs mount. Investors are spooked by potential moves from President-elect Trump, who might tap trade hawk Robert Lighthizer for his team. The euro is down 0.6%, trading at $1.0657 – the lowest since May. Dollar bulls are charging ahead.

German politics also added fuel to the fire. Olaf Scholz paving the way for snap elections means more uncertainty around Germany's fiscal future. Meanwhile, mixed views about the Fed's next move are keeping traders on their toes. ING is bullish, betting that tariffs and easing Fed policy will support the greenback, while others aren't so sure.

Bottom line: A clean U.S. election result has strengthened the dollar, but global uncertainty is on the rise. The market's now waiting for clarity on U.S. trade policy and Fed direction. Buckle up, this ride isn't over yet.

2024-11-11 21:38

Gamma Squeezer

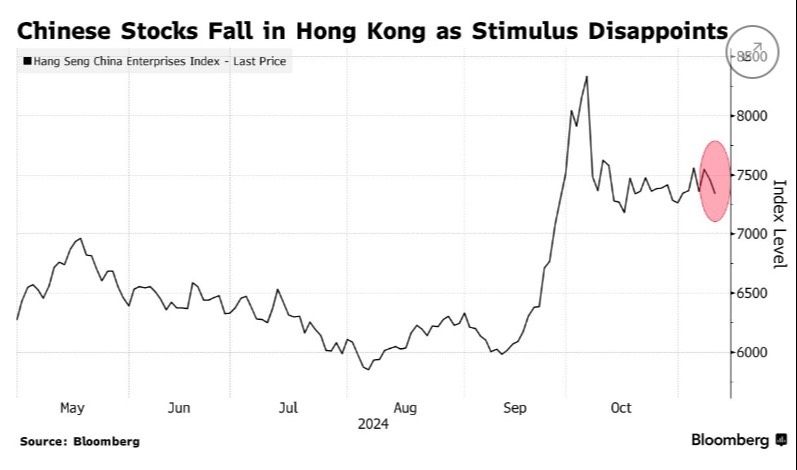

MarketWrap(11.11)

European shares poised for gains, following Wall Street's Friday rally. Euro Stoxx 50 futures up 0.5%. Hong Kong's Chinese stock index down 1.7%, CSI 300 recovers to close with slight gains.

Bitcoin surges past $81,000, boosted by Trump's pro-crypto stance and supportive lawmakers. Dollar and euro steady, yen slips as BOJ hints at caution on rate hikes. Japan PM Ishiba leads in party vote despite election setback.

Fed's Kashkari suggests less easing than expected, citing strong US economy. Key data ahead: AU jobs, CN retail/industrial, US/EU inflation, UK/JP growth. Multiple Fed speakers to provide post-election policy insights.

2024-11-11 16:40

Load More

People you may like

Change

AXI顶级外汇=代理

Follow

ACCOUNT MANAGEMNT4/5

Follow

StevePhillips

Follow

Srgi

Follow

ForexTrader1

Follow