Score

CMG

Australia|5-10 years|

Australia|5-10 years| http://www.cmgau.com

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:CMG AUSTRALIA PTY LTD

License No.:001256635

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Australia

AustraliaFailure to Find CMG’s office in Australia

The investigators, based on the result of this field survey, confirmed that CMG’s real address failed to match with the one in its regulatory information. Besides, the broker’s Australian Financial Services Representative license (license number: 001256635) issued by Australia Securities & Investment Commission has been revoked.Investors can take the broker into consideration.

Australia

AustraliaFailure to Find CMG’s office in Australia

The investigators, based on the result of this field survey, confirmed that CMG’s real address failed to match with the one in its regulatory information. Besides, the broker’s Australian Financial Services Representative license (license number: 001256635) issued by Australia Securities & Investment Commission has been revoked.Investors can take the broker into consideration.

Australia

AustraliaUsers who viewed CMG also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

cmgau.com

Server Location

Hong Kong

Website Domain Name

cmgau.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

0001-01-01

Server IP

119.9.117.119

Company Summary

| CMG Markets Review Summary | |

| Founded | 2019 |

| Registered Country/Region | St. Vincent and the Grenadines |

| Regulation | ASIC (Unsubscribed) |

| Market Instruments | Forex, Indices, Commodities, Oil, Precious Metal, CFDs |

| Demo Account | Available |

| Leverage | 1:400 (Maximum) |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4 |

| Minimum Deposit | $250 |

| Customer Support | 24/5 Customer Service: Phone: +61 2 4036 3165; Email: support@cmgau.com |

What is CMG Markets?

CMG is a brand name of AxiTrader Limited, which is incorporated in St Vincent and the Grenadines, number 25417 BC 2019 by the Registrar of International Business Companies. It offers a variety of trading options including forex, indices, commodities, oil, precious metals, and CFDs. It uses the well-known MT4 trading platform and provides a demo account for practice and familiarisation with the platform.

With a highly competitive EUR/USD spread of only 0.2 pips and a minimum deposit of $250, this platform can be appealing to both novices and experienced traders. Although CMG Markets offers substantial leverage of up to 1:400, potential users should be aware of the associated high-risk factors. The platform can be contacted for customer support via phone and email. However, its lack of regulation warrants careful scrutiny before engagement.

Pros and Cons

| Pros | Cons |

| Diverse Range of Trading Instruments | Unregulated |

| Multiple Account Types | High Minimum Deposit |

| Competitive Spreads | |

| Competitive Leverage |

Pros:

Diverse range of trading instruments: CMG Markets offers a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. This gives traders a lot of flexibility in choosing what to trade.

Multiple account types: CMG Markets offers a variety of account types to suit different needs and experience levels. This makes it a good choice for both beginner and experienced traders.

Competitive spreads: CMG Markets offers competitive spreads on its trading instruments. This means that traders can keep more of their profits.

Competitive leverage: CMG Markets offers competitive leverage on its trading instruments. This allows traders to control larger positions with less capital, but it also increases their risk of loss.

Cons:

Unregulated: CMG Markets is not regulated by any major financial authority. This means that there is less protection for traders in the event of something going wrong.

High minimum deposit: The minimum deposit required to open an account with CMG Markets is relatively high. This may be a barrier to entry for some traders.

Is CMG Markets Safe or Scam?

CMG Markets is regulated by the Australian Securities and Investments Commission (ASIC). This means that CMG Markets is subject to ASIC's rules and regulations, which are designed to protect consumers and ensure the integrity of the financial markets. ASIC is a highly respected financial regulator, and its regulation of CMG Markets provides some assurance to clients that the company is operating in a fair and transparent manner.

CMG offers encryption technology to protect its clients' data and funds. Where required by law or regulation, client funds are paid into a trust account maintained by AxiCorp on behalf of AxiTrader Ltd. This means that client funds are held in a separate account from CMG's own funds and are protected from CMG's creditors in the event of bankruptcy or insolvency.

Market Instruments

CMG Markets' diverse range of trading instruments provides users with opportunities to diversify their portfolios and engage in different types of trading strategies. Traders can choose from these asset classes based on their risk tolerance, market knowledge, and investment goals.

Forex (Foreign Exchange): CMG Markets provides access to the Forex market, allowing users to trade currency pairs. Forex trading involves the exchange of one currency for another and is one of the largest and most liquid financial markets globally. Traders can speculate on the price movements of currency pairs, such as EUR/USD, USD/JPY, and GBP/USD.

Indices: CMG Markets offers trading in various stock market indices. Stock indices represent the performance of a group of stocks from a particular region or sector. Popular indices include the S&P 500, Dow Jones Industrial Average, and NASDAQ, among others. Traders can take positions on whether the index will rise or fall.

Commodities: CMG Markets allows users to trade commodities, which can include both agricultural and non-agricultural commodities. Examples of tradable commodities may include gold, silver, oil, natural gas, wheat, and coffee. Commodity trading allows investors to speculate on the future price movements of these physical goods.

Oil: In addition to commodities, CMG Markets specifically offers trading in oil. This typically involves trading oil futures contracts, which track the price of crude oil. Traders can take positions on whether the price of oil will increase or decrease, which can be influenced by various geopolitical and economic factors.

Precious Metals: CMG Markets provides the opportunity to trade precious metals like gold and silver. These metals are considered safe-haven assets and are often used as a store of value. Traders can speculate on the price movements of these precious metals in response to economic events and market conditions.

CFDs (Contracts for Difference): CMG Markets offers Contracts for Difference, which are derivative financial instruments. CFDs allow traders to speculate on the price movements of various underlying assets, including stocks, indices, commodities, and cryptocurrencies, without owning the actual asset. CFD trading offers leverage, enabling traders to potentially amplify their gains or losses.

Account Types

CMG Markets offers four types of real trading accounts: Individual, Joint, Company, and Sole Trader.

Individual account: This account type is for individual traders.

Joint account: This account type is for two individuals who want to trade together.

Company account: This account type is for companies that want to trade.

Sole trader account: This account type is for self-employed individuals who want to trade.

The minimum initial deposit for all four account types is $250.

Leverage

The maximum leverage ratio provided by CMG Markets is much higher than most brokers, up to 400:1, available to professional clients, while for retail clients leverage is 30:1. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high power.

Spreads & Commissions

CMG Markets claims to offer its clients spreads as low as 0.2 pips. And it will charge some commissions depending on the type of account traders are holding. However, the broker did not directly disclose any more detailed information about commissions on its official website in the absence of opening an account.

Trading Platform Available

When it comes to trading platforms available, CMG Markets gives traders the industry-standard MetaTrader4 on PC, Mac, iPhone, and Android, as well as MT4 WebTrader. MT4 is known as one of the most successful, efficient, and competent forex trading software, simple to use and full of functions like charts, price alerts, custom indicators, and analysis tools. With the MT4 Mobile app, trading can be done from anywhere and at any time through the right mobile terminals.

Trading Tools

MT4 VPS Hosting: To ensure uninterrupted trading, CMG Markets offers MT4 Forex VPS hosting services. A Virtual Private Server (VPS) allows traders to host their trading platform on a remote server, ensuring 24/7 connectivity and minimal downtime. This is particularly valuable for traders who rely on automated trading strategies and need a stable connection.

Signal Providers: CMG Markets provides a feature that allows traders to automate and simplify their trading by copying the strategies of experienced traders from around the world directly into their MT4 platform. This feature can be especially beneficial for those who want to learn from established traders or diversify their trading portfolio.

Deposit & Withdrawal

CMG Markets accepts a wide selection of payment methods, which include Bank Wire Transfer, Credit/Debit Cards (Visa, MasterCard), Neteller, Skrill, C-Link Solution, Union Pay and B2B Transfer. The minimum deposit requirement is $250. As for the processing time of deposit and withdrawal requests, deposit via B2B Transfer will be processed in 2-3 working days, while deposit via other methods is instant. The broker says all withdrawal requests will be processed in 1-2 working days, but it cannot guarantee same-day receipt of funds. For example, withdrawal with International Transfers may take 2-5 days.

Fees

You won't be required to pay any fees when you first sign up and create your CMG Markets trading account. This eliminates a barrier to entry and allows you to start exploring the financial markets without incurring any costs from the outset.

Customer Support

CMG Markets customer support can be reached by telephone: +61240363165, email: support@cmgau.com or fill in the Contact Form to get in touch. Company address: Suite 305, Griffith Corporate Centre 1510, Beachmont, Kingstown St. Vincent and the Grenadines.

Frequently Asked Questions (FAQs)

Q: Is CMG Markets regulated?

A: No. It has been verified that this broker currently has no valid regulation.

Q: At CMG Markets, are there any regional restrictions for traders?

A: Yes, CMG Markets doesn't provide service for US traders.

Q: Does CMG Markets offer demo accounts?

A: Yes.

Q: Does CMG Markets offer the industry-leading MT4 & MT5?

A: Yes, and CMG markets allows you to trade on MT4.

Q: What is the minimum deposit for CMG Markets?

A: The minimum deposit for CMG Markets is 250$.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Australia Appointed Representative(AR) Revoked

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

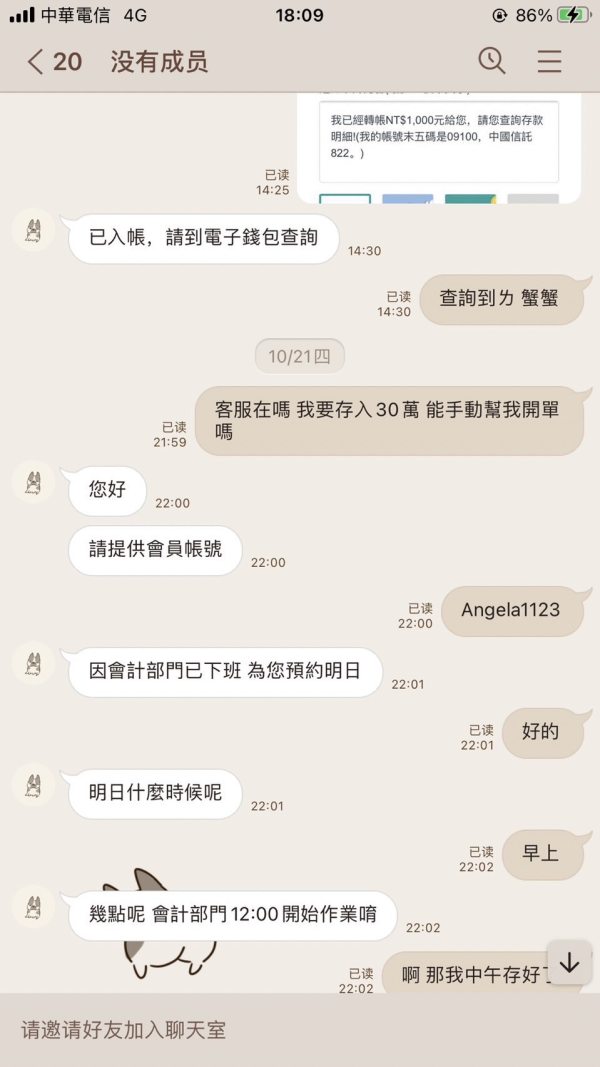

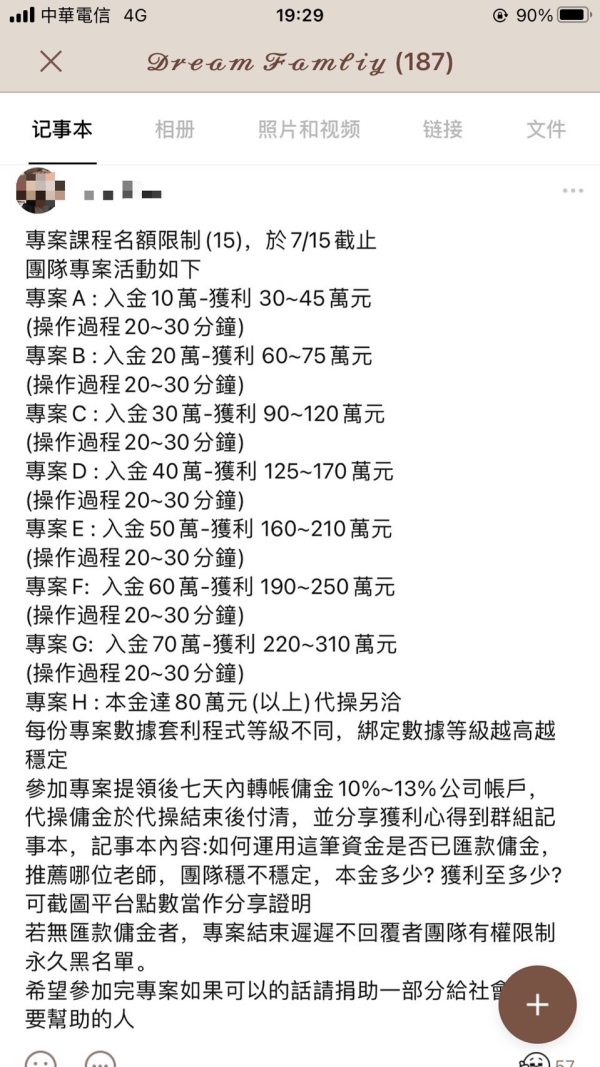

helun

Taiwan

I encountered a scam on a dating app. He pretended to be dating at the beginning and later taught me how to invest. He also took the initiative to help me deposit a sum of money into the platform. After I saw the profit, I also deposited money. Who knew that this was the beginning of the scam? Then various fake activities appeared. It has gone too far!

Exposure

03-24

...72321

Hong Kong

Don’t trade in this scam platform. I will be the first to tell that, when I deposited $1200, the platform would made my account liquidated by expanding 1000 pips.

Exposure

2020-03-27

天道酬勤6337

Mexico

Although I thought that the trading conditions offered by this CMG company were excellent, I decided not to trade with him because he had no reliable supervision. Security is the most important thing to me when choosing a forex company because I don't want to be one of the many victims of scams.

Neutral

2022-11-28

best miner

South Africa

High leverage, low spreads & 0% commissions, as well as mt4 trading platform and a variety of trading instruments to choose from. The only downside is that the minimum deposit amount of $250 is too high for me, but the broker also provides free demo accounts.

Neutral

2022-11-27

虫妈

Australia

The platform is not ideal, but it is possible to get things done using it. The conditions are functioning normally, with a sufficient supply of assets for traders. The broker may be young, but I believe in his potential so long as he sticks to an ethical policy.

Positive

2022-11-26