No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Vault Markets and ActivTrades ?

In the table below, you can compare the features of Vault Markets , ActivTrades side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of vault-markets, activtrades lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Note: Vault Markets official site - https://www.vault-markets.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| Vault Markets Review Summary in 10 Points | |

| Founded | 2021 |

| Headquarters | South Africa |

| Regulation | No license |

| Market Instruments | Forex, Shares, Indices, and Cryptocurrencies |

| Demo Account | N/A |

| Leverage | 1:500 |

| EUR/USD Spread | From 1 pip |

| Trading Platforms | MT4 |

| Minimum deposit | $5 |

| Customer Support | Phone, email |

Vault Markets is an unregulated multi-asset broker founded in 2021 and registered in South Africa that claims to provide its clients with various tradable financial instruments with leverage up to 1:500 and floating spreads from 1 pip on the MT4 trading platform via 6 different live account types.

Vault Markets' advantages include its competitive spreads, low minimum deposit requirement, multiple account types, and user-friendly trading platform. However, its disadvantages include the lack of regulatory licenses and unavailable website.

| Pros | Cons |

| • Offers a wide range of trading instruments | • Unregulated by any financial authority |

| • Low minimum deposit requirement | • Website is unavailable |

| • Provides competitive spreads and leverage | |

| • Allows trading on MetaTrader4 | |

| • Offers multiple account types |

There are many alternative brokers to Vault Markets in the market that offer similar services, such as IC Markets, Pepperstone, XM, and Tickmill.

IC Markets: IC Markets is a well-established broker with a strong reputation, offering a wide range of trading instruments, competitive pricing, and advanced trading platforms.

XM: XM is a reputable broker with a wide range of trading instruments, low minimum deposit, competitive pricing, and a user-friendly platform.

Tickmill: Tickmill is a reliable broker offering competitive pricing, a wide range of trading instruments, and a user-friendly platform, with a focus on transparency and security.

It is important to conduct thorough research on any broker you are considering to ensure that they are reputable and suitable for your trading needs. Factors to consider may include regulations, fees, trading platforms, customer service, and trading instruments offered.

Vault Markets does not seem to be a regulated broker by any major financial authority. The lack of regulation raises concerns about the safety of client funds and the overall legitimacy of the company. It is important for traders to do their own research and due diligence before deciding to trade with an unregulated broker.

Vault Markets offers a range of tradable financial instruments that include Forex, Shares, Indices, and Cryptocurrencies. Forex traders can enjoy competitive spreads and leverage, while share traders can access a wide range of global markets. Additionally, the platform offers various indices, such as NASDAQ and S&P500, for those looking to trade a diversified portfolio. Lastly, Vault Markets has recently expanded its trading offerings to include cryptocurrencies like Bitcoin, Litecoin, and Ethereum, providing traders with a new asset class to diversify their portfolios.

Vault Markets offers 6 trading accounts in total, namely Vault100, Vault200, Swap Free, Vault Zero, Vault No Bonus, and Vault Cent. The minimum opening balance for Vault100, Vault200, Vault No Bonus, and Vault Cent accounts is as low as $5, while $100 for Swap Free and Vault Zero accounts. Although this requirement sounds encouraging, traders are not advised to register real trading accounts here given the fact that Vault Markets is unregulated.

The maximum trading leverage offered by Vault Markets is as high as 1:500. Leverage can amplify gains as well as losses, traders are not advised to use too high leverage.

The spreads on major currency pairs start from 1 pip, which could be considered a competitive pricing model compared to other brokers in the market. Unfortunately, there is no available information about Vault Markets' commission fees. Traders may need to contact the broker's customer support team for further details on pricing and fees.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Vault Markets | 1 pip | N/A |

| IC Markets | 0.0 pips | $7 round turn |

| XM | 0.1 pips | Zero |

| Tickmill | 0.0 pips | $4 round trip |

Note: Spreads can vary depending on market conditions and volatility.

The only platform provided for trading is the popular MetaTrader4 (MT4) trading platform developed by the Russian software company MetaQuotes. Vault Markets provides the MT4 platform as a downloadable windows desktop application and also as Mobile APPs. MAC OSX users are advised to contact the support team for assistance on how to install MT4 on their systems. Other brokers provide MT4 for MAC.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Vault Markets | MT4 |

| IC Markets | MT4, MT5, cTrader, WebTrader |

| XM | MT4, MT5, WebTrader |

| Tickmill | MT4, MT5, WebTrader |

Note: Some brokers may offer additional platforms or have different versions of the above platforms with varying features.

Bank Card (minimum deposit of $3),

Bitcoin (minimum deposit of $10),

Internet Banking (minimum deposit of $10),

Internal Transfer (minimum deposit of $1),

Neteller (minimum deposit of $10),

Perfect Money (minimum deposit of $50),

Skrill (minimum deposit of $10).

| Vault Markets | Most other | |

| Minimum Deposit | $5 | $100 |

Vault Markets offers multiple contact channels, including phone (27(0) 10 449 6045), email (info@vaultmarkets.trade), Skype, WhatsApp and social networks like Twitter, Instagram and YouTube.

2nd floor, Nelson Mandela Square, Maude Street, Sandton;

9th Floor, SKYCITY MALL, University Road Dar es Salaam, Dar es Salam, Tanzania;

Unit 3b, South Port, Hosea Kutako Drive, Windhoek, Namibia.

Overall,Vault Markets' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • Multiple contact channels including phone, email, Skype, and social networks | • No 24/7 customer support availability |

| • No live chat option |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Vault Markets' customer service.

Overall, Vault Markets seems to be a relatively new forex broker that offers competitive trading conditions such as tight spreads, high leverage, and a variety of trading instruments. It also provides multiple contact channels for customer support. However, it is important to note that Vault Markets does not appear to be regulated, which may raise concerns for some traders about the safety and security of their funds.

| Q 1: | Is Vault Markets regulated? |

| A 1: | No. It has been verified that Vault Markets currently has no valid regulation. |

| Q 2: | Does Vault Markets offer the industry-standard MT4 & MT5? |

| A 2: | Yes. Vault Markets supports MT4. |

| Q 3: | What is the minimum deposit for Vault Markets? |

| A 3: | The minimum initial deposit at Vault Markets to open an account is just $5. |

| Q 4: | Is Vault Markets a good broker for beginners? |

| A 4: | No. Vault Markets is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, SCB (Offshore) |

| Market Instruments | Currencies, Commodities, Indices, Shares, Bonds and ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated byFCA (UK) and SCB (Offshore, Bahamas) and offers a range of trading instruments, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • High minimum deposit requirement |

| • Wide range of trading products | • Fees charged for Credit/Debit card deposits |

| • Demo and Islamic accounts offered | |

| • Variety of trading platforms including MetaTrader4/5 and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

ActivTrades is regulated by both the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of the Bahamas (SCB).

The FCA regulation ensures strict adherence to financial standards and integrity within the UK as a Market Maker. Additionally, SCB regulation allows ActivTrades to hold a Retail Forex License in the Bahamas, providing broader international service under reliable oversight.

At ActivTrades, you can trade over 1,000 different CFD instruments across 6 asset classes, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

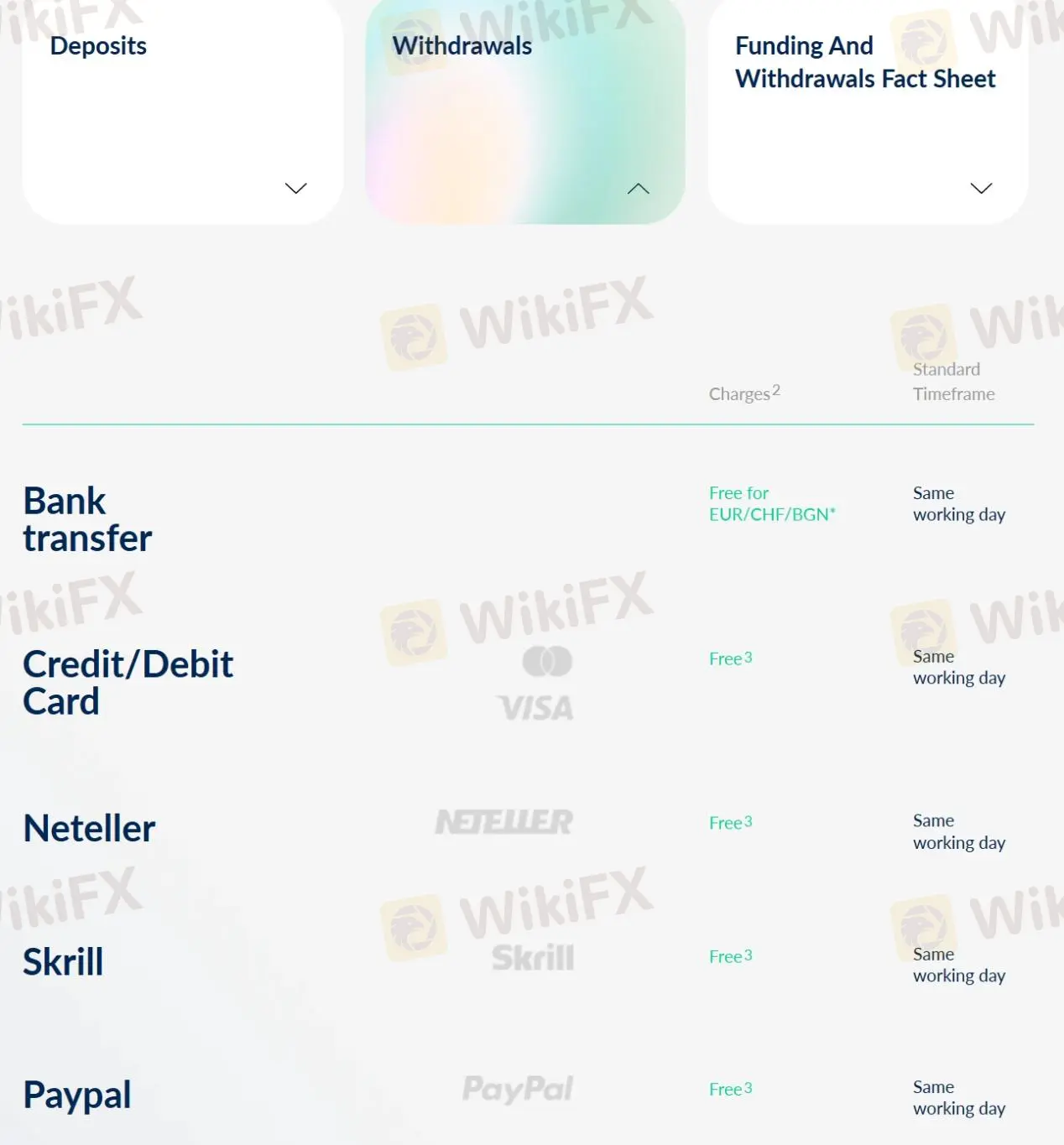

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

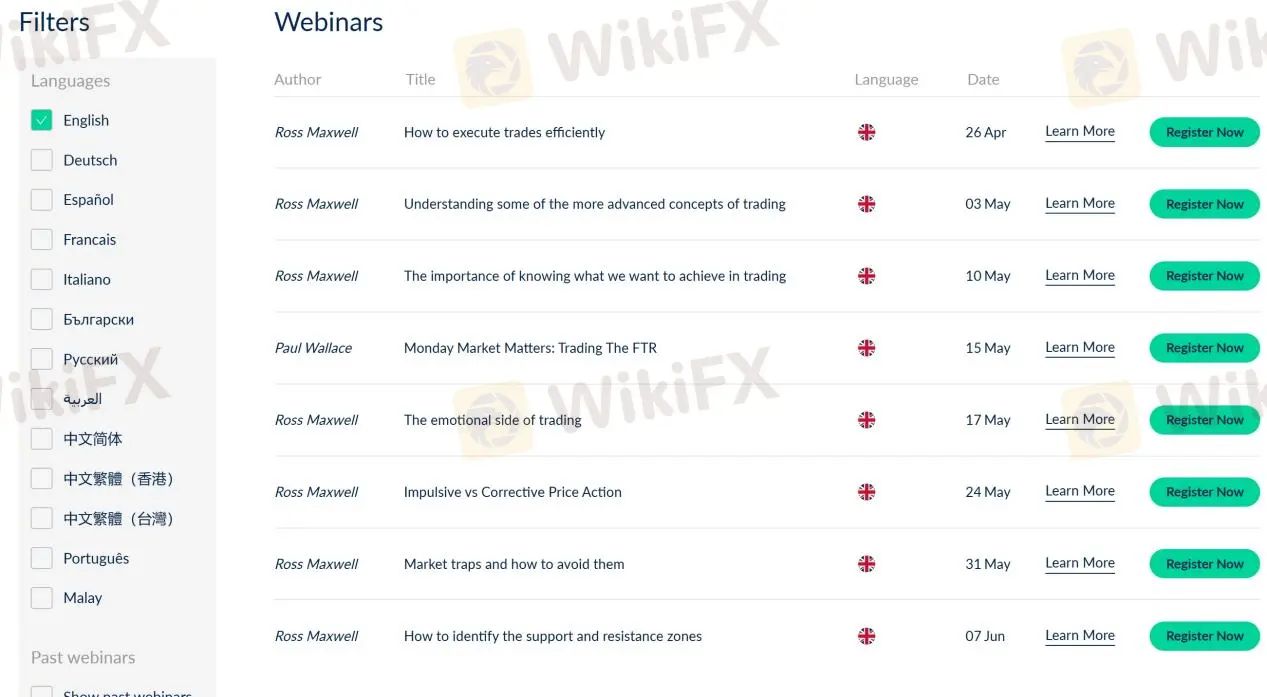

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA and offshore regulated by SCB. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available, and it also offers ActivTrader. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive vault-markets and activtrades are, we first considered common fees for standard accounts. On vault-markets, the average spread for the EUR/USD currency pair is 1 pips, while on activtrades the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

vault-markets is regulated by --. activtrades is regulated by FCA,SCB,DFSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

vault-markets provides trading platform including Vault Cent,Vault No Bonus,Vault Zero,Vault Swop Free,Vault200,Vault100 and trading variety including 4. activtrades provides trading platform including -- and trading variety including --.