No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Titan FX and FXCL ?

In the table below, you can compare the features of Titan FX , FXCL side by side to determine the best fit for your needs.

EURUSD:-0.1

EURUSD:1.6

EURUSD:22.24

XAUUSD:28.02

EURUSD: -6.99 ~ 1.68

XAUUSD: -34.14 ~ 11.75

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of titan-fx, fxcl lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Titan FX Review Summary | |

| Registered in | Vanuatu |

| Founded | 2014 |

| Registered | Vanuatu |

| Regulated | FSA/VFSC (Offshore), FSC (Suspicious clone) |

| Trading Instruments | 250+, Forex, cryptocurrencies, commodities, index CFDs, stock CFDs |

| Demo Account | Available |

| Max. Leverage | 1000:1 on Micro |

| 500:1 on Blade/Standard | |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4, MT5, Webtrader, mobile trading, and Titan FX social |

| Social Trading | Available |

| Minimum Deposit | $0 on Micro |

| $200 on Blade/Standard | |

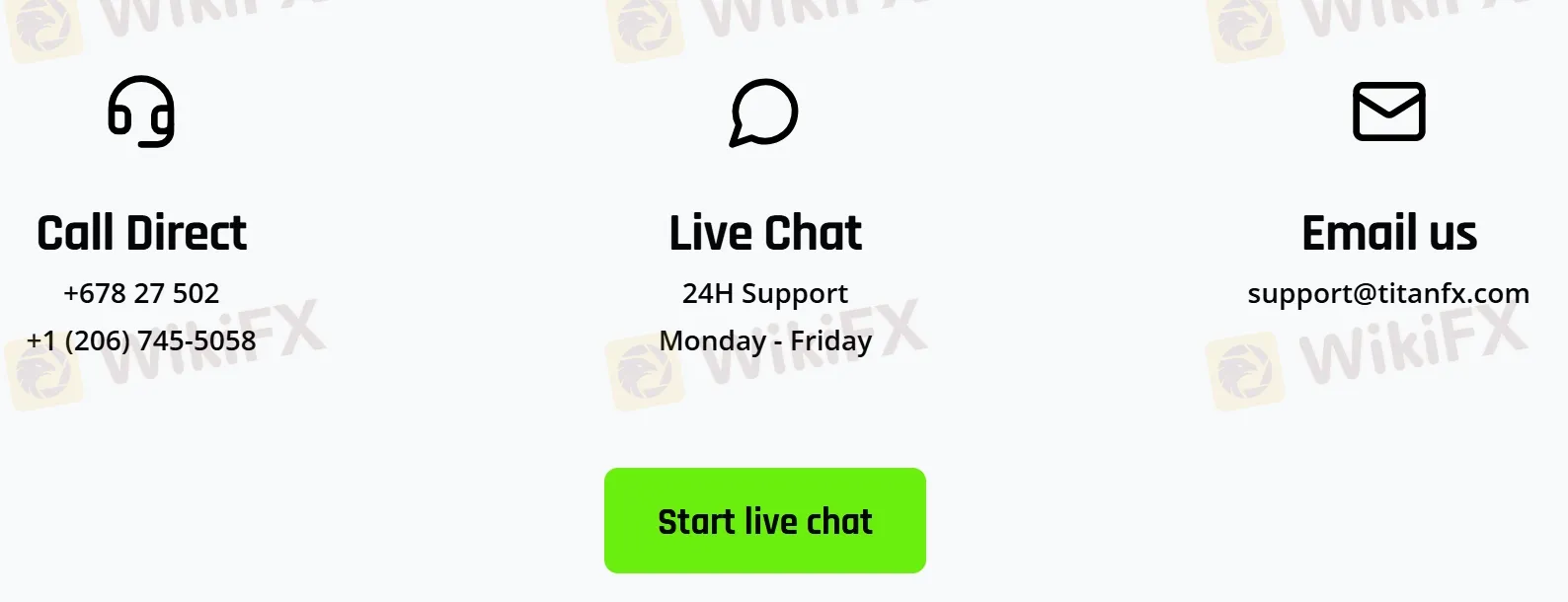

| Customer Service | 24/5 live chat, contact form |

| Phone: +678 27 502, +1 (206) 745-5058 | |

| Email: support@titanfx.com | |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Titan FX is an offshore regulated ECN forex broker broker that was established in 2014. The company offers a range of trading instruments, including orex, cryptocurrencies, commodities, index CFDs, and stock CFDs, as well as several account types with different features such as variable or ECN spreads, and high leverage. Titan FX operates on the MetaTrader 4 and 5 platforms, and offers multiple deposit and withdrawal options with no fees. The broker also provides educational resources such as market analysis and technical analysis, and has a customer support team available 24/5 through multiple channels.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Wide range of trading instruments including forex, commodities, and cryptocurrencies.

Advanced trading platforms such as MT4 and MT5 with social trading capabilities.

No deposit or withdrawal fees.

Multiple deposit options including credit/debit cards, bitwallet, and local bank transfers.

Excellent customer support through live chat, email, and social media platforms.

Educational resources available on the website, including market analysis, news, and forex basics.

Relatively high leverage for cryptocurrencies

Lack of good regulation, which may raise concerns for some traders.

4% withdrawal fee is applied if no trades are made on the account.

Titan FX operates under offshore regulation by the Seychelles Financial Services Authority (FSA, No. SD138) and the Vanuatu Financial Services Commission (VFSC, No. 40313), which may not offer the same level of oversight as more stringent regulatory bodies like the FCA or SEC.

Additionally, the presence of a suspicious clone British Virgin Islands Financial Services Commission (FSC, No. SIBA/L/23/1124) license raises concerns about potential risks associated with authenticity and security.

However, Titan FX does implement some risk management measures such as offering negative balance protection and maintaining segregated accounts to protect clients' funds. These features help mitigate some risks but do not fully compensate for the lack of robust regulatory oversight. Prospective clients should exercise caution and conduct thorough due diligence when considering trading with Titan FX, weighing the benefits of its trading offerings against the potential regulatory risks.

Titan FX offers a diverse range of over 250 trading instruments, including forex, cryptocurrencies, commodities, index CFDs, and stock CFDs. With such a wide variety of instruments, traders have a greater opportunity to diversify their portfolios and access different markets. Forex pairs available for trading include majors, minors, and exotics, while commodity trading covers energies, softs, and metals. The indices offered by Titan FX include major global indices such as the S&P 500, FTSE 100, and Nikkei 225. The company also offers trading in popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, along with popular stocks such as Apple, Amazon, and Tesla.

Titan FX offers a range of trading account types that cater to different trading needs and styles. The Standard Account is a commission-free forex trading account suitable for discretionary traders and low-volume traders. The Blade Account is suitable for high-volume traders, EA traders, and scalpers. The Micro Account is an account for traders that want to start with zero commission fees, a smaller initial deposit, and better risk control.

The accounts can be opened with a low initial investment of just $200 or even $0, and a free demo account is also available. Base currencies include US dollar, Euro, Japanese yen, Singapore dollar. One of the great things about Titan FX's account types is that there are no account opening or maintenance fees.

Titan FX offers leverage options of up to 1:500 for the Standard and Blade accounts and 1:1000 for the Micro account. The leverage option for cryptocurrencies is up to 1:100.

| Account Type | Leverage |

| Standard | 500:1 |

| Blade | |

| Micro | 1000:1 |

High leverage enables traders to amplify their positions and potentially increase their profits, even with a smaller capital investment. However, it is important to note that high leverage also increases the risk of significant losses if the market moves against a trader's position. Therefore, it is crucial for traders to manage their risk effectively and use leverage wisely. While high leverage can be advantageous for experienced traders, novice traders should exercise caution and start with lower leverage ratios until they gain sufficient knowledge and experience.

Titan FX offers competitive spreads on all trading accounts, with some of the tightest spreads available in the forex market.

| Account Type | Spread | Commission |

| Standard | Institutional grade STP spreads | $0 per trade |

| Blade | Raw ECN spreads from 0.0 pips | $3.5 per 100k traded |

| Micro | Institutional grade STP spreads | $0 per trade |

Titan FX offers a range of spread and commission structures tailored to different types of traders, providing competitive conditions across its account offerings. For those using the Standard and Micro accounts, the broker provides institutional grade STP (Straight Through Processing) spreads, allowing for transparent pricing without any commission charges. This setup is ideal for traders who prefer a simpler cost structure and are perhaps newer to the forex market.

On the other hand, more experienced traders might opt for the Blade account, which features Raw ECN (Electronic Communication Network) spreads starting from as low as 0.0 pips. This account does carry a commission of $3.5 per 100k traded, reflecting the direct access to underlying market prices and the minimal spread markup.

Titan FX offers a range of trading platforms to suit different trading styles and preferences. Traders can choose from the popular MetaTrader 4 and 5 platforms, which offer advanced charting tools, a wide range of technical indicators, and support for automated trading through expert advisors (EAs) and custom indicators. Titan FX also offers its proprietary social trading platform, which allows traders to follow and copy the trades of successful traders in real-time. This platform is user-friendly and requires no installation or additional software.

Titan FX offers multiple options for deposits and withdrawals, including credit/debit card (Visa, MasterCard), bitwallet, Sticpay, Skrill, Neteller, Bank transfer, cryptocurrencies, and Perfect Money (only for withdrawal). There are no deposit or withdrawal fees, and some methods allow for instant clearing of funds to the trading account. The ability to transact in multiple currencies, including USD, EUR, JPY, and SGD, provides flexibility for traders. However, a withdrawal fee of 4% will be applied if no trades are made on the account, and receipt of funds into the account can depend on the withdrawal method used and payment provider. Local Japanese bank transfer only accepts JPY, and cryptocurrency deposit processing time may depend on blockchain.

| Payment Method | Minimum Deposit | Deposit/Withdrawal Fee | Withdrawal Processing Time |

| Credit card (Visa, MasterCard) | / | Free | Instant |

| Sticpay | 30 USD or equivalent | Free | Instant |

| Skrill | 10 USD or equivalent | Free | Within 1 business day |

| Neteller | 10 USD or equivalent | Free | Instant |

| Perfect Money (only withdrawal) | / | Free | Instant |

| bitwallet | / | Free | Instant |

| Local Japanese bank transfer | 5,000 JPY | Free | Within 2-3 business days |

| cryptocurrencies | / | Free | Instant |

Educational resources are an important aspect of any trading platform, and Titan FX provides a range of resources for its clients. These resources include market analysis, news, forex basics, and technical analysis. The platform offers daily market analysis, which includes an economic calendar, market news, and technical analysis reports. This helps traders stay informed about market trends and events that may impact their trading strategies. Additionally, Titan FX provides forex basics resources, such as trading guides and glossaries, which can be particularly useful for novice traders. Technical analysis resources are also available, including charting tools, indicators, and expert advisors (EAs), which can help traders make informed trading decisions.

Titan FX offers several channels for customer care, including live chat, contact form, phone, email, and social media. Customer support is available 24/5 in multiple languages.

Titan FX is committed to providing exceptional customer service, offering a variety of channels to ensure clients can reach out for support conveniently. The broker offers 24/5 live chat, ensuring quick responses to any inquiries during trading hours. Additionally, customers can contact Titan FX through dedicated phone:+678 27 502, +1 (206) 745-5058, or via email: support@titanfx.comfor more detailed queries. For those preferring written communication, a contact form is also available on their website.

Titan FX's head office is located in Poteau 564/100, Rue De Paris, Pot 5641, Centre Ville, Port Vila, Republic of Vanuatu. They maintain a strong social media presence on platforms like Facebook and LinkedIn, providing updates and engaging with clients.

Furthermore, Titan FX has an extensive FAQ section that covers a wide range of topics from basic company information to specific trading conditions and VPS services.

Titan FX offers a range of enticing promotions designed to enhance the trading experience for its clients. One notable offer is the Free VPS promotion, which is ideal for traders who use Expert Advisors (EAs). To qualify, traders need to trade at least 5 lots and maintain a balance of over $5,000, allowing them to subscribe to Beeks VPS for free, ensuring faster and more reliable automated trading.

Additionally, Titan FX has a Refer a Friend program that benefits both the referrer and the referee; each can earn $50 when the referred friend registers and verifies an account, with the bonus being fully withdrawable.

Furthermore, Titan FX hosts exciting trading competitions such as the June Tournament where participants trade with virtual funds but compete for real cash prizes totaling $3,500. This competition is open to everyone and adds a competitive edge to trading with substantial rewards.

In conclusion, Titan FX offers traders a wide range of trading instruments and platforms to choose from, along with a range of account types to cater to different trading styles and preferences. With low spreads, competitive commissions, and high leverage options, traders can take advantage of market opportunities to potentially maximize profits. The company also offers a range of deposit and withdrawal options with no fees attached, making it easy and convenient for traders to manage their accounts. Additionally, the educational resources and customer support provided by Titan FX ensure that traders have access to the knowledge and assistance they need to make informed trading decisions.

However, the company's lack of good regulation may pose a risk to traders. Overall, Titan FX offers a reliable and competitive option for traders looking to enter the global financial markets.

Is Titan FX regulated?

Yes, Titan FX is offshore regulated by FSA and VFSC.

What are the trading platforms offered by Titan FX?

MT4, MT5, Webtrader, mobile trading, and Titan FX social.

Does Titan FX charge any fees for deposits or withdrawals?

No. Titan FX does not charge any deposit or withdrawal fees, but some payment providers may charge fees for transactions.

What is the maximum leverage offered by Titan FX?

Up to 1:500 for zero standard and zero blade accounts, 1:1000 for zero micro accounts, and 1:100 for cryptocurrencies.

| FXCLReview Summary | |

| Founded | 2006 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | VFSC |

| Market Instruments | Forex, indices, cryptocurrencies, metals |

| Demo Account | ✔ |

| Leverage | Up to 1:2000 |

| Spread | Low |

| Trading Platform | MT4 Margin WebTrader |

| Min Deposit | $1 |

| Customer Support | Email: support@fxclearing.com |

| Registered office: Plot 54368 Western Commercial Road, The Hub, Itowers, Cbd, Gaborone, Botswana. | |

FXCL, founded in 2006, is a forex brokerage registered in Saint Vincent and the Grenadines. It is regulated by VFSC. Its current status is revoked. It charges no fees or commissions. Its leverage is up to 1:2000.

| Pros | Cons |

| VFSC regulated | Limited customer support options |

| Wide range of currency pairs and trading instruments | Fixed spreads |

| Low minimum deposit of $1 | No Islamic trading account |

| Eight types of trading accounts to choose from | No MT5 supported |

| Generous leverage up to 1:2000 | No phone number information offered |

| Competitive spreads and low trading fees | |

| MT4 trading platform and webtrader supported | |

| Copy trading available | |

| Demo account available |

FXCL is regulated by VFSC in Vanuatu. Its current status is revoked.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Vanuatu | VFSC | FXCL Markets Ltd | Retail Forex License | 14610 | Revoked |

FXCL offers traders forex, indices, cryptocurrencies, metals to trade.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ✔ |

| Commodities | ❌ |

| Stocks | ❌ |

| Futures | ❌ |

| Options | ❌ |

FXCL offers 4 different types of accounts to traders - Start Account, Cent Account, Standard Account, Interbank Cent Account, Interbank Standard Account, ECN Pro Account, Live Contest Account, Volume Cash Account. It also provides demo accounts.

| Account Type | Start Account | Cent Account | Standard Account | Interbank Cent Account | Interbank Standard Account | ECN Pro Account | Live Contest Account | Volume Cash Account |

| Leverage | 1:2000 | 1:1000 | 1:500 | 1:500 | 1:500 | 1:300 | 1:1000 | 1:1000 |

| Spreads | Floating for full spread list | Fixed for fufor full spread list | Fixed for fufor full spread list | Floating starting from 1.1 pip with a 5-digit price feed for full spread list | Floating,starting from 1.1 pip with a 5-digit price feed for full spread list | Floating, starting from 0.1 pip with a 5-digit price feed | Floating for full spread list | Floating for full spread list |

| Position Size | 0.01-1.00 (standard lot) | 0.01-200 (micro lot) | 0.01-2.00 (standard lot) | 0.01-500 (micro lot) | 0.01-5.00 (standard lot) | 0.01-50.00 (standard lot) | 0.01-3.00 (standard lot) | 0.01-3.00 (standard lot) |

| Execution | Market | Instant | Instant/Market | Market | Market | Market | Automatic Market Execution | Automatic Market Execution |

FXCL's spreads are as low as 0 pips. FXCL charges low commissions. It charges $3 per lot for forex, metals, indices 0.15% per lot of Crypto when transaction happens in ECN Account and $1.5 per lot for forex, metals when transaction happens in Live Contest Account and Volume Cash Account. The min deposit is $1.

FXCL's trading platform is MT4 Margin WebTrader, which supports traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 Margin WebTrader | ✔ | Web, Mobile | Beginner |

| MT5 | ❌ |

FXCL offers a lot of deposit and withdrawal methods.

| Method | Processing Time | Fees |

| Online bank (Asiabank) | Instant | N/A |

| Crypto (Alphacoins) | Instant | N/A |

| PerfectMoney | Instant | Low fees |

| Local Deposit | Up to 1 business day | Low fees |

| FasaPay | Quick | FXCL provides full fee coverage for all Fasapay deposits |

| Dragonpay | Instant | N/A |

| Method | Processing Time | Fees |

| Online bank (Asiabank) | Instant | N/A |

| Crypto (Alphacoins) | Instant | N/A |

| PerfectMoney | Instant | Low fees |

| Local Deposit | Up to 1 business day | Low fees |

| FasaPay | Quick | Low fees |

| Dragonpay | Instant | N/A |

FXCL's copytrading offers an opportunity to automatically follow good traders and monitor the markets.

Any FXCL client may open an ECN Copy Pro account as a Follower (hereinafter, Follower‘s Account).In order to open an ECN Copy Pro account as a Signal Provider (hereinafter, Provider’s Account), the client should verify the Traders Cabinet first and provide a link to his/her previous trading results on Myfxbook, MQL5 or FX Blue resource or upload an MT4 statement from his/her previous trading account (any account type from any broker is allowed).

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive titan-fx and fxcl are, we first considered common fees for standard accounts. On titan-fx, the average spread for the EUR/USD currency pair is -- pips, while on fxcl the spread is from 0.1.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

titan-fx is regulated by FSC,FSA,VFSC. fxcl is regulated by VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

titan-fx provides trading platform including Micro,Standard,Blade and trading variety including 30+ currency pairs, precious metals. fxcl provides trading platform including ECN Pro account,Volume Cash account,Live Contest account,Interbank Cent account,Interbank Standard account,Start account,Standard account,Cent account and trading variety including --.