No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Swissquote and FinMarket ?

In the table below, you can compare the features of Swissquote , FinMarket side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of swissquote, finmarket lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Swissquote | Basic Information |

| Founded in | 1996 |

| Headquarters | Gland, Switzerland |

| Regulation | FCA, MFSA, FINMA, DFSA |

| Tradable Instruments | Stocks, currency pairs, precious metals, stock indices, commodities, bonds |

| Demo Account | ✅ |

| Leverage | Up to 1:30 (retail)/1:100 (professional) |

| Spread | From 0.6 pips (Prime account) |

| Trading Platform | Mobile App, MT4, MT5, Money Managers |

| Minimum Deposit | 1,000 EUR/USD/GBP/CHF |

| Customer Support | Phone, Email, Live Chat |

| Regional Restrictions | USA |

Swissquote is a leading online forex and financial trading broker headquartered in Switzerland. It was established in 1996 and has since grown to become a popular choice among traders worldwide. The broker offers a wide range of financial instruments to trade, including forex, stocks, indices, commodities, bonds, and cryptocurrencies. Swissquote provides its clients with access to several trading platforms, including Mobile App, MT4, MT5, and Money Managers.

Swissquote is areputable and regulated broker, offering an array of financial instruments and account types for traders to choose from. As with any broker, there are advantages and disadvantages to consider. In the following table, we present a summary of the key pros and cons of trading with Swissquote.

Swissquote undoubtedly offers a comprehensive range of trading instruments and state-of-the-art trading platforms. However, despite its many strengths, it falls short in terms of customer support, as it does not provide round-the-clock assistance, which can be a major drawback for traders who require immediate assistance during off-hours or in emergency situations.

| Pros | Cons |

| Regulated by reputable authorities | Limited education and research resources |

| Wide range of trading instruments | Inactivity fee charged after 24 months of inactivity |

| Competitive spreads | No 24/7 customer support |

| Demo accounts available | High minimum deposit requirement |

| Various account types with different features | Limited customer support options outside of business hours |

| Availability of advanced trading platforms - MT4, MT5 | No US clients accepted |

| Efficient and reliable customer support during business hours |

Yes, Swissquote is a legitimate broker with four entities under respective jurisdictions:

Swissquote Bank Ltd, which is based in Switzerland, is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Swissquote Ltd, which is based in the United Kingdom, is regulated by the Financial Conduct Authority (FCA).

Swissquote MEA Ltd, which is based in Dubai, is regulated by the Dubai Financial Services Authority (DFSA).

SWISSQUOTE FINANCIAL SERVICES (MALTA) LTD, is regulated by the Malta Financial Services Authority (MFSA).

These regulatory authorities ensure that Swissquote adheres to strict standards in terms of financial stability, transparency, and investor protection.

Swissquote offers a wide range of market instruments for trading, including 400+ forex and CFD instruments, commodities, stock indices, shares, bonds, and cryptocurrencies. As a well-established Swiss broker, Swissquote is able to offer trading on several Swiss-specific instruments, such as the Swiss Market Index (SMI) and the Swissquote Group Holding Ltd. (SQN) stock, as well as access to other global exchanges such as the NYSE, NASDAQ, and LSE.

Swissquote offers a range of account types to cater to the varying needs and preferences of its clients. The primary account types available are the Premium Account, Prime Account, Elite Account and Professional Account. Each account type comes with distinct features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads. The Premium Account requires a minimum deposit of 1,000 CHF or equivalent, while the Prime Accounts require a higher minimum deposit of 5,000 CHF or equivalent. The Elite and Professional accounts ask for the highest minimum deposit of 10,0000 CHF or equivalent.

The Standard Account provides clients with access to a wide range of financial instruments, including forex, CFDs, stocks, options, futures, and bonds. The Premium Account, on the other hand, is designed for high-volume traders and offers lower spreads and commissions, as well as personalized service. The Prime Account is designed for institutional clients and provides them with a dedicated account manager, as well as access to exclusive liquidity and pricing.

Moreover, Swissquote also offers an Islamic Account, which is compliant with Sharia law and is available to clients who follow the Islamic faith.

Swissquote offers a free demo account for clients to practice trading strategies and test out the broker's trading platforms without risking any real funds. The demo account provides users with virtual funds to trade on the same live markets as the actual trading accounts. The account comes with real-time pricing and charting tools, allowing traders to simulate trading conditions as closely as possible. This is an excellent opportunity for traders to get familiar with the broker's platforms and trading environment before committing any real money. Moreover, the demo account is ideal for both novice and experienced traders who want to try new trading strategies or test their current trading strategies without incurring any financial risk.

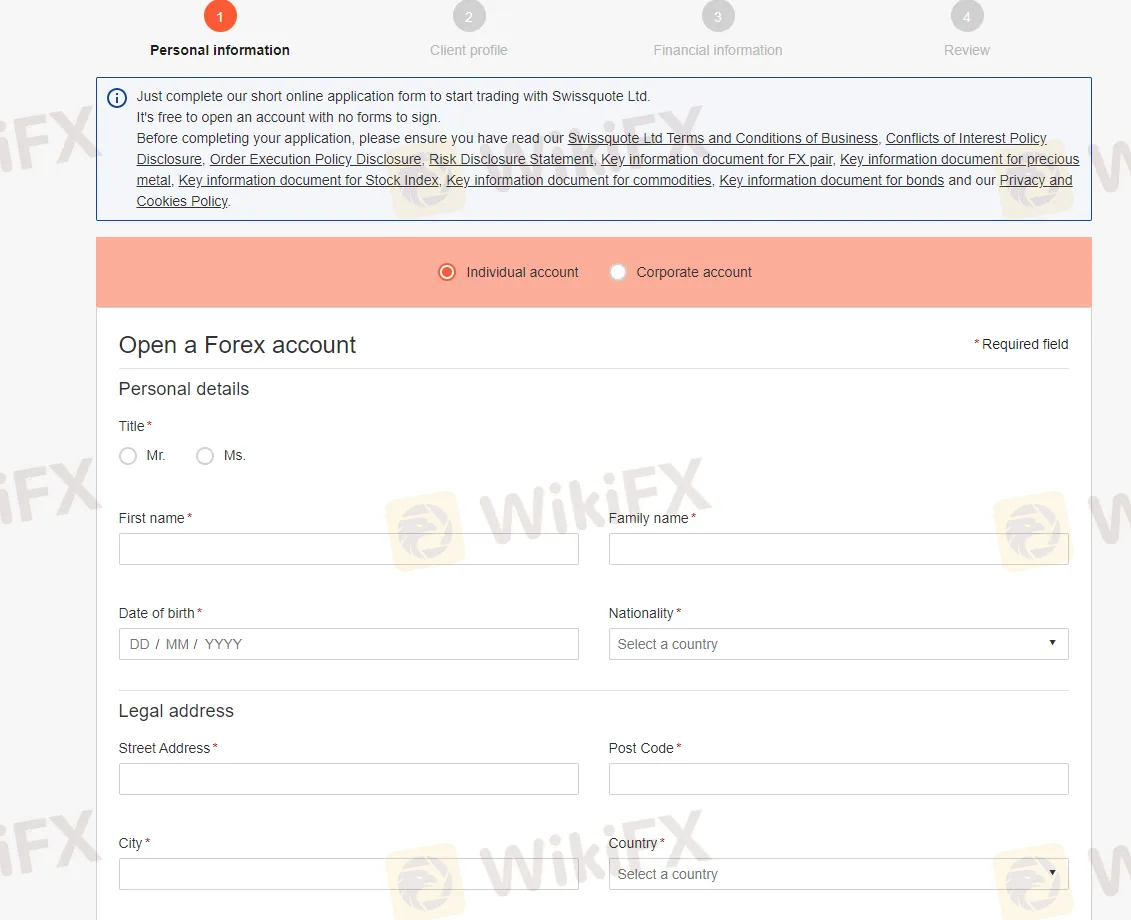

Step 1: Visit the Swissquote website and click on the “Open your account” button.

Step 2: Provide personal information, such as name, email, and phone number, along with a valid identification document, such as a passport or driver's license.

Step 3: After the account is created and verified, the next step is to select the desired account type and deposit funds, such as Premium, Prime or Elite accounts.

Step 4: Agree to the terms and conditions and submit your application.

Step 5: Swissquote offers several convenient deposit methods, including debit card (Visa, MasterCard) and bank wire transfer.

Step 6: Once the account is funded, traders can access the trading platforms, begin analyzing the markets, and placing trades on a variety of financial instruments.

Swissquote offers variable leverage levels depending on the financial instrument and the account type. For forex trading, the maximum leverage available is typically 1:30 for retail clients and up to 1:100 for professional clients who meet certain criteria. For CFD trading on indices, commodities, and cryptocurrencies, the maximum leverage ranges from 1:10 to 1:5, depending on the underlying asset.

Always keep in mind that high leverage can significantly increase the potential gains, but it can also magnify the losses, so it's important to use it with caution and always keep in mind the risks involved.

Swissquote offers competitive spreads and commissions to its clients. The exact costs depend on the type of account and the trading instrument being traded. The Premium Account has variable spreads, with the EUR/USD spread starting from 1.3 pips, while the Prime Account offers spreads starting from 0.6 pips. The Elite Account offers spreads as low as 0.0 pips, but it requires a higher minimum deposit and trading volume. The professional accounts provide spreads from 0.0 pips too.

In terms of commissions, the Premium Account and Prime Account charge zero commission. The Elite Account and the Professional Account charge a commission of EUR2.5 per side per lot traded. Overall, Swissquote is often seen as competitive in terms of spreads and commissions when compared to other major brokers.

Non-trading fees are fees that Swissquote charges its clients for services that are not directly related to trading activities. Swissquote has a relatively low level of non-trading fees compared to other brokers. Swissquote does not charge deposit and withdrawal fees, which depend on the method used. Swissquote also charges an inactivity fee of CHF 50 per quarter if no trades have been made during the last 6 months. This fee is lower than the industry average, which is around $15 per month.

Besides, Swissquote also charges overnight swap fees, also known as rollover fees or financing fees, on positions that are held overnight. The amount of the fee depends on the currency pair, the size of the position, and the prevailing interest rates in the respective countries.

Swissquote offers Mobile App, MT4, MT5, and Money Managers.

MT4: Swissquote offers the popular MetaTrader 4 (MT4) trading platform to its clients, which is widely recognized in the industry for its reliability, speed, and advanced charting tools. MT4 is available for download on desktop, web, and mobile devices, allowing traders to access their accounts and manage their trades from anywhere at any time. Swissquote also offers a range of customized tools and indicators, allowing traders to personalize their trading experience on the platform. Additionally, Swissquote provides free access to Autochartist, a popular technical analysis tool that helps traders identify potential trading opportunities.

MT5: Swissquote also offers the MetaTrader 5 (MT5) platform to its clients, which is the successor to the popular MT4 platform. MT5 has several advanced features such as improved charting capabilities, additional order types, and an economic calendar. Clients can also use MT5's algorithmic trading capabilities through the use of Expert Advisors (EAs) to automate their trading strategies. Swissquote's MT5 platform is available for desktop, web, and mobile devices, making it easily accessible for traders on the go.

Swissquote offers two primary deposit methods: debit card (Visa, MasterCard), bank wire transfer. With wire transfer, clients can make deposits in various currencies, but the process may take longer, typically taking 1 to 2 business days to reflect on their account. On the other hand, debit card deposits are processed faster, typically within a few minutes, and they are available in CHF, EUR, GBP, EUR, AUD, JPY, PLN, CZK, HUF and USD.

For withdrawals, Swissquote typically processes requests within 1 to 2 business days. Clients can withdraw funds using the same methods they used to deposit funds. However, it's important to note that some withdrawal methods may incur fees, so it's essential to check with the broker first before initiating a withdrawal request.

Swissquote offers a plethora of educational resources to help traders of all levels enhance their knowledge and skills. The broker provides various learning materials, including webinars, seminars, online courses, and e-books. Additionally, Swissquote offers market analysis and news to keep clients informed about the latest developments in the financial markets.

In conclusion, Swissquote is a well-established and highly regulated forex broker offering a wide range of trading instruments, advanced trading platforms, and competitive trading conditions. The broker has earned a strong reputation for its commitment to security, transparency, and innovation, which has made it a preferred choice for traders looking for a reliable and trustworthy trading partner. While the broker's high minimum deposit requirement may be a challenge for some traders, its educational resources and excellent customer support help to offset this disadvantage.

Is Swissquote a regulated broker?

Yes, Swissquote is regulated by several financial authorities, including FCA, MFSA, FINMA, and DFSA.

What trading platforms are offered by Swissquote?

Swissquote offers several trading platforms, including the MetaTrader 4 and 5 platforms, Mobile App, and Money Managers.

What is the minimum deposit required to open an account with Swissquote?

The minimum deposit required to open an account with Swissquote is 1,000 EUR/USD/GBP/CHF.

Does Swissquote offer demo accounts?

Yes, Swissquote offers a free demo account with virtual funds for traders to practice trading strategies.

How can I deposit and withdraw funds from my Swissquote account?

You can deposit and withdraw funds from your Swissquote account using bank wire transfer or debit card (Visa, MasterCard),.

| Aspect | Information |

| Registered Country/Area | Cyprus |

| Founded Year | 2015 |

| Company Name | FinMarket |

| Regulation | Unregulated (Suspicious Clone) |

| Minimum Deposit | $250 (Mini Account) |

| Maximum Leverage | Up to 1:500 |

| Spreads | High spreads on Mini accounts |

| Trading Platforms | MetaTrader 4 (MT4), WebTrader, In-House Mobile Platform |

| Tradable Assets | Forex currency pairs, major indices, commodities, individual stocks, cryptocurrencies |

| Account Types | Mini Account, Standard Account, VIP Account, Premium Account |

| Demo Account | Available |

| Islamic Account | Available |

| Customer Support | Limited availability and slow response times |

| Payment Methods | Credit transfer, wire transfer, Ecommpay |

| Educational Tools | Information not provided |

FinMarket is an unregulated Forex and CFD broker based in Cyprus, established in 2015. Despite claiming to be regulated by CySEC, the lack of proper regulation raises concerns about the safety of traders' funds and the transparency of their operations. Unfortunately, the website is currently down, which adds further doubts about the broker's legitimacy. The high spreads and commissions, along with the relatively high minimum initial deposit of $1000, make it an unattractive option for traders, especially beginners. Moreover, the limited account manager availability and the absence of an FAQ section demonstrate a lack of commitment to customer support. Overall, due to the unregulated status and the website's unavailability, FinMarket should be approached with extreme caution.

Suspicious Clone.

A “Suspicious Clone” in the context of financial services refers to an entity that mimics or imitates the appearance and branding of a legitimate and regulated company, often with the intent to deceive and defraud unsuspecting individuals. These clones use similar names, websites, and other identifying features to create the illusion of being a reputable and regulated entity, while in reality, they are operating without proper authorization and oversight.

In the case of FinMarket being labeled as a “Suspicious Clone,” it suggests that the broker claims to be regulated by CySEC but lacks the necessary authorization and compliance. Such suspicious clones can pose significant risks to investors and traders, as they may engage in fraudulent activities, mismanage funds, and potentially disappear without a trace. Traders should exercise extreme caution when dealing with suspicious clones and always conduct thorough research and due diligence before entrusting their funds to any financial service provider.

FinMarket offers a diverse array of market instruments, catering to traders' interests and allowing them to diversify their portfolios across different asset classes. The following table summarizes the market instruments along with some examples:

| Market Instrument | Number of Assets | Examples |

| Forex Currency Pairs | 30+ | EUR/USD, EUR/GBP, AUD/JPY, etc. |

| Major Indices | Various | FTSE, S&P 500, NASDAQ, etc. |

| Commodities | Various | Silver, Crude Oil, Gold, Coffee, etc. |

| Individual Stocks | 160+ | Amazon, Netflix, Apple, etc. |

| Cryptocurrencies | Various | Bitcoin, Ethereum, etc. |

Forex Currency Pairs:

FinMarket provides access to more than 30 forex currency pairs, including major pairs like EUR/USD, EUR/GBP, and AUD/JPY. These major pairs offer high liquidity and are widely traded in the global forex market.

Major Indices:

Traders can participate in the performance of major stock market indices, such as FTSE, S&P 500, and NASDAQ. These indices represent the overall performance of specific stock markets and sectors.

Commodities:

FinMarket offers various commodities for trading, including precious metals like Silver and Gold, energy resources like Crude Oil, and agricultural products like Coffee. Commodity trading allows traders to diversify their investment strategies.

Individual Stocks:

With over 160 individual stocks available as CFDs, traders can speculate on the price movements of well-known market holders like Amazon, Netflix, and Apple. This allows investors to gain exposure to individual companies without owning the underlying shares.

Cryptocurrencies:

For those interested in the cryptocurrency market, FinMarket offers access to various digital assets like Bitcoin, Ethereum, and more. Cryptocurrency trading allows traders to capitalize on the price movements of these digital currencies.

Despite offering a diverse array of market instruments, FinMarket's lack of proper regulation raises concerns about the safety and legitimacy of its offerings. Traders should exercise extreme caution when considering this broker due to the absence of regulatory oversight, which may expose investors to potential risks and fraudulent activities. Additionally, the website being down further adds to the suspicion surrounding the broker. While the range of assets offered, including forex currency pairs, major indices, commodities, individual stocks, and cryptocurrencies, might seem attractive, the overall lack of regulation casts doubt on the broker's credibility and reliability. It is essential for traders to conduct thorough research and choose regulated brokers to safeguard their investments and trading experience.

FinMarket offers a range of trading accounts, but be warned, their account types may not be as attractive as they seem. Let's take a closer look at each account with a critical eye:

Mini Account:

Minimum Deposit: $250

Features: This account type may seem affordable, but don't be fooled. The demo account for practicing strategies is nothing special, and the 40% margin is quite restrictive. With only 24 Forex currency pairs and 10 commodities and indices for trading, you won't have a wide range of options. The leverage up to 1:500 might sound impressive, but it could lead to significant losses for inexperienced traders.

Standard Account:

Minimum Deposit: $1,000

Features: The demo account is available, but the 26 Forex currency pairs and 10 commodities and indices offered for trading are nothing extraordinary. The daily market news and SMS alerts may sound appealing, but they hardly compensate for the lack of variety in trading options. The dedicated account manager might not be as dedicated as you expect, and the Islamic account option is just a small gesture to attract a specific group of traders.

VIP Account:

Minimum Deposit: $10,000

Features: The high minimum deposit might make you think you're getting premium treatment, but don't be fooled. The additional features offered, such as 28 Forex currency pairs and a full range of commodities and indices, may not justify the steep price. Direct access to a trading manager might not be as beneficial as they claim, and the 30% margin is quite restrictive for experienced traders.

Premium Account:

Minimum Deposit: $100,000

Features: The hefty minimum deposit requirement might make you believe you're entering an exclusive club, but the reality might disappoint you. The in-depth analyst tips they promise are just a way to add some fluff to the account. The 25% margin is not as competitive as you'd expect, and the so-called deep liquidity might not be as deep as you hope.

| Account Type | Minimum Deposit | Features |

| Mini Account | $250 | - Demo account for practicing strategies<br> - 40% margin<br> - Trading options include 24 Forex currency pairs and 10 commodities and indices<br> - Leverage up to 1:500 |

| Standard Account | $1,000 | - Demo account available<br> - Trading options include 26 Forex currency pairs and 10 commodities and indices<br> - Daily market news and SMS alerts<br> - Dedicated account manager<br> - Islamic account option |

| VIP Account | $10,000 | - 28 Forex currency pairs and a full range of commodities and indices for trading<br> - Direct access to a trading manager<br> - 30% margin |

| Premium Account | $100,000 | - In-depth analyst tips<br> - 25% margin<br> - Claims of deep liquidity |

In summary, FinMarket's account types might appear enticing at first glance, but upon closer inspection, they fail to deliver on their promises. The high minimum deposits, limited trading options, and questionable additional features make these accounts less appealing than they initially seem.

FinMarket boasts about offering “up to 1:500” leverage on their trading accounts. However, before you get too excited, let's take a closer look at the reality behind this high leverage claim.

While a leverage of 1:500 might seem like an attractive prospect, it comes with significant risks and drawbacks. High leverage can amplify both your potential profits and your potential losses. This means that even a small adverse price movement could wipe out a significant portion of your trading capital.

Inexperienced traders often get lured in by the promise of high leverage, thinking they can make huge profits with a small initial deposit. However, they fail to realize that it also exposes them to substantial risks.

Moreover, it's worth noting that regulatory authorities, like CySEC, which oversees FinMarket, have been tightening their rules regarding leverage. High leverage has been associated with increased client losses and is considered risky for retail traders. Many regulatory bodies now impose leverage caps to protect traders from excessive risk-taking.

So, while FinMarket might advertise high leverage as a way to attract traders, it's crucial to approach it with caution. Trading with such high leverage can be a recipe for disaster, especially for inexperienced traders who might not fully comprehend the risks involved.

In conclusion, the maximum trading leverage offered by FinMarket might sound appealing, but it's essential to remember that high leverage comes with substantial risks. It's crucial for traders to exercise caution and employ proper risk management strategies to protect their capital when trading with such high leverage.

Spreads and commissions at FinMarket vary depending on the type of trading account. However, upon closer examination, it becomes evident that the broker's offerings are less competitive than they claim to be.

Spreads:

FinMarket advertises “tight spreads” on their website, but in reality, the spreads they offer are quite high, especially on their Mini accounts. For the benchmark EUR/USD currency pair, the average spread exceeds 3.7 pips on Mini accounts. Such high spreads can significantly impact a trader's potential profits, making it challenging to trade cost-effectively.

Commissions:

In addition to spreads, FinMarket charges commissions on trades, further increasing the overall cost of trading. The commission rates vary depending on the type of account. For Mini accounts, the commission fee is $15.00 per trade.

Comparison to Competitors:

Compared to other reputable brokers in the market, FinMarket's trading costs are less favorable. Many competitors offer much lower spreads, often within the range of 1.0 to 1.5 pips for the EUR/USD pair, without charging additional commission fees.

Impact on Traders:

The high spreads and commission fees at FinMarket can hinder a trader's ability to profit consistently, particularly for those with smaller trading accounts. These unfavorable trading conditions may lead to significant losses and can discourage traders from achieving their financial goals.

In conclusion, despite claiming to provide tight spreads and varying commissions, FinMarket's trading conditions fall short compared to many other brokers in the industry. Traders seeking cost-effective and competitive trading experiences may find better options with brokers offering lower spreads and commission fees.

Deposit and withdrawal processes at FinMarket seem to be relatively straightforward, offering various methods for funding accounts and accessing funds. However, there are some considerations to keep in mind.

Deposit Options:

FinMarket provides several options for depositing funds into trading accounts. Traders can choose to deposit through credit transfer, wire transfer, or the electronic payment method Ecommpay. These options offer flexibility, allowing clients to select the most suitable method based on their preferences and location.

Minimum Deposit Requirements:

The broker does not impose any specific minimum deposit requirements. However, it's important to note that individual payment channels may have their own minimum deposit limits. Traders should verify the minimum deposit amount with their chosen payment method before initiating the transaction.

Withdrawal Process:

FinMarket generally processes withdrawals through the same method used for depositing funds. This is a standard practice among many brokers and helps ensure the security of transactions. Traders should be aware that withdrawal requests may take some time to process, depending on the payment method and the broker's internal procedures.

Fund Security:

FinMarket emphasizes the security of customer funds. The broker operates under the regulation of the Cyprus Securities Exchange Commission (CySEC), which requires adherence to strict guidelines for the protection of client funds. Furthermore, the use of SSL encryption ensures the safe transmission of personal and financial information during transactions.

Additional Considerations:

While the deposit and withdrawal processes themselves appear to be straightforward, traders should also consider the overall cost associated with funding their accounts and accessing their funds. This includes any fees charged by payment providers and potential currency conversion charges, especially for international clients.

In conclusion, FinMarket offers various deposit options and follows standard practices for processing withdrawals. However, traders should be aware of any minimum deposit requirements imposed by payment channels and carefully consider any associated costs to make informed decisions about funding their trading accounts and accessing their funds.

FinMarket provides its clients with multiple trading platforms, ensuring a diverse range of options to suit individual preferences and trading styles. The broker offers the following trading platforms:

MetaTrader 4 (MT4) Platform:

MetaTrader 4 is one of the most popular and widely used trading platforms in the industry. It offers a user-friendly interface and a comprehensive set of tools and features, making it suitable for both beginner and experienced traders. Traders can access advanced charting capabilities, a wide array of technical indicators, and various timeframes for market analysis. MT4 also supports automated trading through Expert Advisors (EAs), allowing traders to execute trades automatically based on predefined strategies. The platform is available for desktop (Windows, Linux, and MacOS), as well as mobile devices (iOS and Android), providing convenience and flexibility for traders who prefer to trade on the go.

In-House Web Trading Platform (WebTrader):

FinMarket has developed its own web-based trading platform known as WebTrader. This platform is accessible through any web browser without the need for downloading or installing additional software. WebTrader offers a user-friendly interface with one-click trading functionality, real-time market charts to monitor market trends, and social trading features. The platform caters to traders who prefer a hassle-free trading experience and wish to access their accounts from any internet-connected device.

In-House Mobile Trading Platform:

For traders who are constantly on the move, FinMarket offers a mobile trading platform compatible with both Android and iOS devices. This mobile app provides full access to trading accounts, enabling traders to execute trades, monitor positions, and access real-time market data from the palm of their hands. The mobile trading platform ensures that traders can stay updated and respond to market movements promptly, regardless of their location.

In summary, FinMarket provides a diverse selection of trading platforms to cater to the needs of different traders. The MetaTrader 4 platform offers advanced tools and analysis for experienced traders, while the in-house WebTrader platform appeals to those seeking simplicity and convenience. Additionally, the mobile trading platform ensures traders can stay connected to the markets at all times, making it a comprehensive offering for a range of trading preferences.

FinMarket's customer support has been a source of frustration for many traders, as it often fails to meet their expectations. The broker claims to provide reliable assistance, but in reality, reaching their customer support team can be a tedious and time-consuming process.

Phone Support: While FinMarket offers a phone support option, getting through to a support representative can be a daunting task. Traders often find themselves waiting on hold for extended periods, only to be met with unhelpful responses or transferred to different departments without any resolution.

Email Support: Traders who opt for email support are often left disappointed with the slow response times. It can take several days to receive a reply, and even then, the answers provided are often generic and fail to address the specific concerns raised by traders.

Live Chat: The live chat feature on FinMarket's website is advertised as a quick way to get assistance, but in reality, it is far from efficient. Traders report experiencing long wait times before connecting with a support agent, and when they do, the responses are often vague and unhelpful.

Web Contact Form: Submitting inquiries through the web contact form is no better, as traders rarely receive timely or satisfactory responses. It seems like the broker pays little attention to these contact forms, leaving traders feeling ignored and frustrated.

Overall, FinMarket's customer support is lackluster and inadequate. Traders have expressed their dissatisfaction with the slow response times, unhelpful answers, and overall lack of professionalism displayed by the support team. As a result, many traders feel let down by the broker's supposed commitment to providing reliable assistance.

FinMarket is an unregulated Forex and CFD broker based in Cyprus, established in 2015. While it offers a diverse range of market instruments, including forex currency pairs, major indices, commodities, individual stocks, and cryptocurrencies, the lack of proper regulation raises concerns about the safety of traders' funds and the legitimacy of its operations. The high spreads, varying commissions, and relatively high minimum initial deposit of $1000 make it unattractive, especially for beginners. The website's unavailability adds further doubts about the broker's credibility. The customer support is inadequate, with slow response times and unhelpful assistance.

Pros:

Offers a diverse array of market instruments.

Provides multiple trading platforms, including MetaTrader 4 (MT4).

Supports mobile trading for on-the-go access.

Cons:

Unregulated status raises concerns about fund safety and transparency.

High spreads and commissions impact profitability.

High minimum deposit requirements.

Inadequate customer support with slow response times and unhelpful answers.

Website unavailability adds to doubts about legitimacy.

Overall, due to the lack of regulation, high costs, and unsatisfactory customer support, FinMarket is not recommended for traders. It is essential to consider alternative, regulated brokers with better trading conditions and customer service for a more secure and reliable trading experience.

Q1: Is FinMarket a regulated broker?

A1: No, FinMarket is an unregulated broker, which raises concerns about the safety of traders' funds and the transparency of their operations.

Q2: What is the minimum initial deposit required to open an account with FinMarket?

A2: The minimum initial deposit for a Mini account is $250, while the VIP account requires a minimum deposit of $10,000.

Q3: Does FinMarket offer a demo account for practice?

A3: Yes, FinMarket provides a demo account for traders to practice their strategies before trading with real money.

Q4: What trading platforms does FinMarket offer?

A4: FinMarket offers MetaTrader 4 (MT4), a web-based platform (WebTrader), and a mobile trading platform for Android and iOS devices.

Q5: Is customer support readily available at FinMarket?

A5: FinMarket's customer support has been reported as inadequate, with slow response times and unhelpful assistance, making it a source of frustration for traders.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive swissquote and finmarket are, we first considered common fees for standard accounts. On swissquote, the average spread for the EUR/USD currency pair is -- pips, while on finmarket the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

swissquote is regulated by FCA,MFSA,FINMA,DFSA. finmarket is regulated by CYSEC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

swissquote provides trading platform including professional ,standard,prime,premium and trading variety including custom. finmarket provides trading platform including Silver Member,Gold Member,Platium Member,Diamond Member,Elite Member and trading variety including Forex Commodities Indices World Shares CryptoCurrencies.