No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Swissquote and Central Tanshi ?

In the table below, you can compare the features of Swissquote , Central Tanshi side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of swissquote, central-tanshi-fx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Swissquote | Basic Information |

| Founded in | 1996 |

| Headquarters | Gland, Switzerland |

| Regulation | FCA, MFSA, FINMA, DFSA |

| Tradable Instruments | Stocks, currency pairs, precious metals, stock indices, commodities, bonds |

| Demo Account | ✅ |

| Leverage | Up to 1:30 (retail)/1:100 (professional) |

| Spread | From 0.6 pips (Prime account) |

| Trading Platform | Mobile App, MT4, MT5, Money Managers |

| Minimum Deposit | 1,000 EUR/USD/GBP/CHF |

| Customer Support | Phone, Email, Live Chat |

| Regional Restrictions | USA |

Swissquote is a leading online forex and financial trading broker headquartered in Switzerland. It was established in 1996 and has since grown to become a popular choice among traders worldwide. The broker offers a wide range of financial instruments to trade, including forex, stocks, indices, commodities, bonds, and cryptocurrencies. Swissquote provides its clients with access to several trading platforms, including Mobile App, MT4, MT5, and Money Managers.

Swissquote is areputable and regulated broker, offering an array of financial instruments and account types for traders to choose from. As with any broker, there are advantages and disadvantages to consider. In the following table, we present a summary of the key pros and cons of trading with Swissquote.

Swissquote undoubtedly offers a comprehensive range of trading instruments and state-of-the-art trading platforms. However, despite its many strengths, it falls short in terms of customer support, as it does not provide round-the-clock assistance, which can be a major drawback for traders who require immediate assistance during off-hours or in emergency situations.

| Pros | Cons |

| Regulated by reputable authorities | Limited education and research resources |

| Wide range of trading instruments | Inactivity fee charged after 24 months of inactivity |

| Competitive spreads | No 24/7 customer support |

| Demo accounts available | High minimum deposit requirement |

| Various account types with different features | Limited customer support options outside of business hours |

| Availability of advanced trading platforms - MT4, MT5 | No US clients accepted |

| Efficient and reliable customer support during business hours |

Yes, Swissquote is a legitimate broker with four entities under respective jurisdictions:

Swissquote Bank Ltd, which is based in Switzerland, is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Swissquote Ltd, which is based in the United Kingdom, is regulated by the Financial Conduct Authority (FCA).

Swissquote MEA Ltd, which is based in Dubai, is regulated by the Dubai Financial Services Authority (DFSA).

SWISSQUOTE FINANCIAL SERVICES (MALTA) LTD, is regulated by the Malta Financial Services Authority (MFSA).

These regulatory authorities ensure that Swissquote adheres to strict standards in terms of financial stability, transparency, and investor protection.

Swissquote offers a wide range of market instruments for trading, including 400+ forex and CFD instruments, commodities, stock indices, shares, bonds, and cryptocurrencies. As a well-established Swiss broker, Swissquote is able to offer trading on several Swiss-specific instruments, such as the Swiss Market Index (SMI) and the Swissquote Group Holding Ltd. (SQN) stock, as well as access to other global exchanges such as the NYSE, NASDAQ, and LSE.

Swissquote offers a range of account types to cater to the varying needs and preferences of its clients. The primary account types available are the Premium Account, Prime Account, Elite Account and Professional Account. Each account type comes with distinct features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads. The Premium Account requires a minimum deposit of 1,000 CHF or equivalent, while the Prime Accounts require a higher minimum deposit of 5,000 CHF or equivalent. The Elite and Professional accounts ask for the highest minimum deposit of 10,0000 CHF or equivalent.

The Standard Account provides clients with access to a wide range of financial instruments, including forex, CFDs, stocks, options, futures, and bonds. The Premium Account, on the other hand, is designed for high-volume traders and offers lower spreads and commissions, as well as personalized service. The Prime Account is designed for institutional clients and provides them with a dedicated account manager, as well as access to exclusive liquidity and pricing.

Moreover, Swissquote also offers an Islamic Account, which is compliant with Sharia law and is available to clients who follow the Islamic faith.

Swissquote offers a free demo account for clients to practice trading strategies and test out the broker's trading platforms without risking any real funds. The demo account provides users with virtual funds to trade on the same live markets as the actual trading accounts. The account comes with real-time pricing and charting tools, allowing traders to simulate trading conditions as closely as possible. This is an excellent opportunity for traders to get familiar with the broker's platforms and trading environment before committing any real money. Moreover, the demo account is ideal for both novice and experienced traders who want to try new trading strategies or test their current trading strategies without incurring any financial risk.

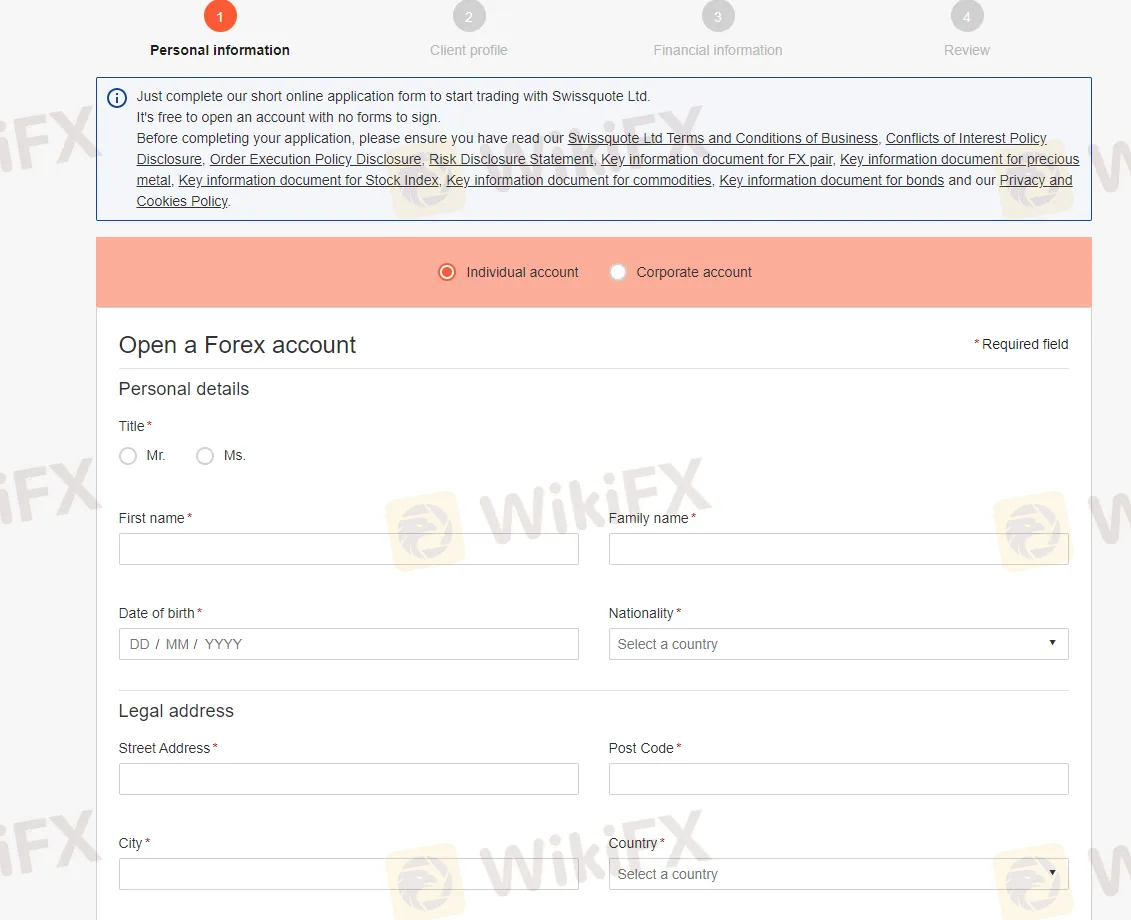

Step 1: Visit the Swissquote website and click on the “Open your account” button.

Step 2: Provide personal information, such as name, email, and phone number, along with a valid identification document, such as a passport or driver's license.

Step 3: After the account is created and verified, the next step is to select the desired account type and deposit funds, such as Premium, Prime or Elite accounts.

Step 4: Agree to the terms and conditions and submit your application.

Step 5: Swissquote offers several convenient deposit methods, including debit card (Visa, MasterCard) and bank wire transfer.

Step 6: Once the account is funded, traders can access the trading platforms, begin analyzing the markets, and placing trades on a variety of financial instruments.

Swissquote offers variable leverage levels depending on the financial instrument and the account type. For forex trading, the maximum leverage available is typically 1:30 for retail clients and up to 1:100 for professional clients who meet certain criteria. For CFD trading on indices, commodities, and cryptocurrencies, the maximum leverage ranges from 1:10 to 1:5, depending on the underlying asset.

Always keep in mind that high leverage can significantly increase the potential gains, but it can also magnify the losses, so it's important to use it with caution and always keep in mind the risks involved.

Swissquote offers competitive spreads and commissions to its clients. The exact costs depend on the type of account and the trading instrument being traded. The Premium Account has variable spreads, with the EUR/USD spread starting from 1.3 pips, while the Prime Account offers spreads starting from 0.6 pips. The Elite Account offers spreads as low as 0.0 pips, but it requires a higher minimum deposit and trading volume. The professional accounts provide spreads from 0.0 pips too.

In terms of commissions, the Premium Account and Prime Account charge zero commission. The Elite Account and the Professional Account charge a commission of EUR2.5 per side per lot traded. Overall, Swissquote is often seen as competitive in terms of spreads and commissions when compared to other major brokers.

Non-trading fees are fees that Swissquote charges its clients for services that are not directly related to trading activities. Swissquote has a relatively low level of non-trading fees compared to other brokers. Swissquote does not charge deposit and withdrawal fees, which depend on the method used. Swissquote also charges an inactivity fee of CHF 50 per quarter if no trades have been made during the last 6 months. This fee is lower than the industry average, which is around $15 per month.

Besides, Swissquote also charges overnight swap fees, also known as rollover fees or financing fees, on positions that are held overnight. The amount of the fee depends on the currency pair, the size of the position, and the prevailing interest rates in the respective countries.

Swissquote offers Mobile App, MT4, MT5, and Money Managers.

MT4: Swissquote offers the popular MetaTrader 4 (MT4) trading platform to its clients, which is widely recognized in the industry for its reliability, speed, and advanced charting tools. MT4 is available for download on desktop, web, and mobile devices, allowing traders to access their accounts and manage their trades from anywhere at any time. Swissquote also offers a range of customized tools and indicators, allowing traders to personalize their trading experience on the platform. Additionally, Swissquote provides free access to Autochartist, a popular technical analysis tool that helps traders identify potential trading opportunities.

MT5: Swissquote also offers the MetaTrader 5 (MT5) platform to its clients, which is the successor to the popular MT4 platform. MT5 has several advanced features such as improved charting capabilities, additional order types, and an economic calendar. Clients can also use MT5's algorithmic trading capabilities through the use of Expert Advisors (EAs) to automate their trading strategies. Swissquote's MT5 platform is available for desktop, web, and mobile devices, making it easily accessible for traders on the go.

Swissquote offers two primary deposit methods: debit card (Visa, MasterCard), bank wire transfer. With wire transfer, clients can make deposits in various currencies, but the process may take longer, typically taking 1 to 2 business days to reflect on their account. On the other hand, debit card deposits are processed faster, typically within a few minutes, and they are available in CHF, EUR, GBP, EUR, AUD, JPY, PLN, CZK, HUF and USD.

For withdrawals, Swissquote typically processes requests within 1 to 2 business days. Clients can withdraw funds using the same methods they used to deposit funds. However, it's important to note that some withdrawal methods may incur fees, so it's essential to check with the broker first before initiating a withdrawal request.

Swissquote offers a plethora of educational resources to help traders of all levels enhance their knowledge and skills. The broker provides various learning materials, including webinars, seminars, online courses, and e-books. Additionally, Swissquote offers market analysis and news to keep clients informed about the latest developments in the financial markets.

In conclusion, Swissquote is a well-established and highly regulated forex broker offering a wide range of trading instruments, advanced trading platforms, and competitive trading conditions. The broker has earned a strong reputation for its commitment to security, transparency, and innovation, which has made it a preferred choice for traders looking for a reliable and trustworthy trading partner. While the broker's high minimum deposit requirement may be a challenge for some traders, its educational resources and excellent customer support help to offset this disadvantage.

Is Swissquote a regulated broker?

Yes, Swissquote is regulated by several financial authorities, including FCA, MFSA, FINMA, and DFSA.

What trading platforms are offered by Swissquote?

Swissquote offers several trading platforms, including the MetaTrader 4 and 5 platforms, Mobile App, and Money Managers.

What is the minimum deposit required to open an account with Swissquote?

The minimum deposit required to open an account with Swissquote is 1,000 EUR/USD/GBP/CHF.

Does Swissquote offer demo accounts?

Yes, Swissquote offers a free demo account with virtual funds for traders to practice trading strategies.

How can I deposit and withdraw funds from my Swissquote account?

You can deposit and withdraw funds from your Swissquote account using bank wire transfer or debit card (Visa, MasterCard),.

| Central Tanshi Review Summary | |

| Founded | 2002 |

| Registered Country/Region | Japan |

| Regulation | Regulated by FSA (Japan) |

| Market Instruments | Forex |

| Demo Account | ❌ |

| Leverage | 1:25 for individual customer |

| EUR/USD Spread | From 0.1 pips |

| Trading Platform | Mobile app, PC and Web platforms |

| Min Deposit | 0 |

| Customer Support | Contact form |

| YouTube: https://www.youtube.com/channel/UCGDu9m4guwZcPAIPXyyx7KQ | |

| Twitter: https://twitter.com/CTFX | |

Central Tanshi is a legally regulated forex pairs provider that was registered in Japan in 2002. It offers a variety of forex pairs through versatile trading platforms, with no minimum deposit required. In addition, it provides a leverage of 1:25 for individual customers and spreads starting from 0.1 pips.

However, it does not accept inquiries by phone number. Instead, you can only submit a contact form with your questions, and they will respond to your inquiries.

| Pros | Cons |

| Long history of operation | Limited leverage |

| Regulated by Japan's FSA | No MT4/5 |

| Various forex pairs choices | Limited customer support channels |

| Commission-free | |

| Multiple trading platforms available | |

| No minimum deposit requirement |

Yes, Central Tanshi is a legitimate provider of forex pairs. It holds a retail forex license issued by the Japan Financial Services Agency (FSA), bearing the license number Kanto Finance Director (Financial Business) No. 278.

In addition, it is a member of the Securities and Exchange Surveillance Commission of Japan.

In conclusion, Central Tanshi is reliable, and you can consider trading forex on its platforms.

| Regulated Country | Current Status | Regulated Authority | Regulated Entity | License Type | License Number |

| Regulated | Japan Financial Services Agency (FCA) | セントラル FX Co., Ltd. | Retail Forex License | Kanto Finance Director (Financial Business) No. 278 |

Central Tanshi focuses on forex pairs trading. It offers many common forex pairs, and you can also find exotic forex pairs on its platform. The forex pairs it provides include USD/JPY, EUR/JPY, GBP/JPY, AUD/JPY, ZAR/JPY, GBP/USD, AUD/USD...

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

You need to follow eight steps to register an account with Central Tanshi. All of these steps are quite easy, and detailed explanations for each are provided in its website.

The leverage offered by Central Tanshi differs between individual and corporate customers.

For individual customers, it is set at a fixed ratio of 1:25, which is considered conservative and safe, enabling you to trade securely based on your requirements.

On the other hand, for corporate customers, the leverage varies weekly based on market fluctuations, and it also differs for each type of currency pair.

The spreads offered by Central Tanshi also vary depending on the type of currency pair.

During certain trading hours, the spread for MXN/JPY can be as low as 0.1 pips, while during other periods, the spread for GBP/JPY can reach as high as 16.0 pips.

Central Tanshi does not charge any account maintenance fees or transaction fees.

However, if you need to send an issuing report by mail, there is a charge of 1,100 yen per report.

Additionally, for delivery services, there is a fee of 500 yen for every 10,000 units.

Central Tanshi offers a proprietary platform available on mobile (smartphone and iPad), PC and Web.

The PC version comes with three additional options, including fast chart, Trade Plus, and a network trading system.

| Trading Platform | Supported | Available Devices | Suitable for |

| Proprietary platform | ✔ | Web, PC and Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Payment Methods

Central Tanshi offers two types of deposit methods: click deposit and bank transfer deposit.

Click deposit utilizes your financial institution's online banking service for near-instant deposits. You must have an online banking agreement with one of the following financial institutions to use this method.

Bank transfer deposit allows you to fund your account through various methods such as bank counters, ATMs, and online banking. The transfer fees will be borne by you. Supported banks include Sumitomo Mitsui Banking Corporation (Nihonbashi Branch), Mizuho Bank (Kofunecho Branch), and Mitsubishi UFJ Bank.

Fees

Deposit: For click deposits, it is free. For transfer deposits, certain fees may be charged.

Withdrawal: Withdrawal in Japanese Yen is free, whereas withdrawals in other foreign currencies will incur some fees.

Additionally, withdrawal fees differ based on the banking institution.

Specifically, withdrawals through Sumitomo Mitsui Banking Corporation, Mizuho Bank, and the Main Branch of Mitsubishi UFJ Bank are free.

For other branches of Mitsubishi UFJ Bank, a fee of 1,000 yen will be charged, and for other financial institutions, a fee of 1,500 yen will be imposed.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive swissquote and central-tanshi-fx are, we first considered common fees for standard accounts. On swissquote, the average spread for the EUR/USD currency pair is -- pips, while on central-tanshi-fx the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

swissquote is regulated by FCA,MFSA,FINMA,DFSA. central-tanshi-fx is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

swissquote provides trading platform including professional ,standard,prime,premium and trading variety including custom. central-tanshi-fx provides trading platform including -- and trading variety including --.