No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Super Forex and SBI FXTRADE ?

In the table below, you can compare the features of Super Forex , SBI FXTRADE side by side to determine the best fit for your needs.

EURUSD:0.3

EURUSD:3

EURUSD:14

XAUUSD:109.21

EURUSD: -11.5 ~ 4.5

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of super-forex, sbi-fxtrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Belize |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 5-10 years |

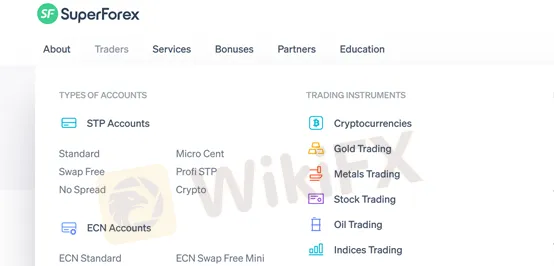

| Trading instruments | Cryptocurrencies, precious metals, stock, oil, forex pairs, indices |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:3000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4 |

| Deposit and withdrawal method | Bank Wire Transfers, Credit/Debit Cards, E-Payments, Cryptocurrencies, Local Payments and superforex money |

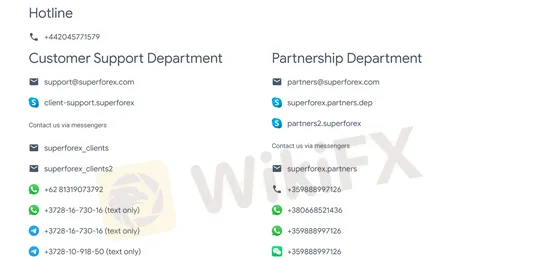

| Customer Service | Email, phone number, WhatsApp, WeChat, telegramInstagram, YouTube, Facebook, twitter, LinkedInFAQ, Callback |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide range of trading products and account types to choose from

High leverage of up to 1:3000

No additional fees on transactions with your account

Extensive educational resources available, including videos and seminars

Multiple channels of customer support, including social media platforms and callback option

Fast processing time for deposits

Cons:

Limited regulatory oversight and licensing

Limited information on the company's history and ownership

Some account types have high minimum deposits, such as the Profi STP and ECN accounts

The spreads on some trading products can be higher compared to other brokers

Withdrawals may take longer to process compared to deposits

Limited options for trading platforms, only offering the MT4 platform.

| Advantages | Disadvantages |

| Super Forex offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, Super Forex has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

Super Forex is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Super Forex acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Super Forex has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Super Forex or any other MM broker.

SuperForex is a global forex broker established in 2013 with a mission to provide its clients with top-quality financial services and a wide range of trading instruments. The company is headquartered in Belize. With its client-centric approach, SuperForex offers various account types, flexible trading conditions, a range of trading platforms, a variety of payment options, and a comprehensive set of educational resources to cater to the needs of both novice and experienced traders.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Super Forex offers a wide range of trading instruments, including cryptocurrencies, precious metals, stocks, oil, forex pairs, and indices. The availability of multiple asset classes provides traders with diversification opportunities, access to global markets, and the potential for high returns. With access to popular asset classes such as forex pairs and indices, traders can also benefit from high liquidity, which means they can quickly enter and exit positions at the desired price. However, trading multiple asset classes can be complex, may require extensive knowledge and expertise, and may come with higher margin requirements, increasing trading costs. Additionally, as the research and analysis on each asset class may not be as detailed or comprehensive as traders would prefer, traders should conduct their own research and analysis to make informed trading decisions.

| Advantages | Disadvantages |

| Competitive spreads | Unregulated broker |

| Detailed fee table | Potential hidden fees |

| Zero commissions | High leverage up to 1:3000 |

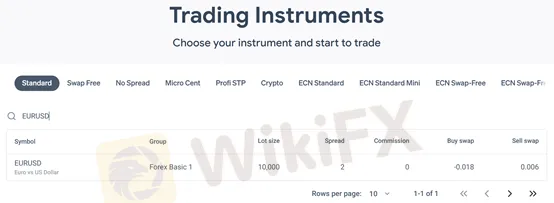

| No deposit or withdrawal fees | Lack of negative balance protection |

Super Forex offers competitive spreads and provides a detailed fee table that outlines spreads, commissions, SWAPs and lot sizes for various accounts and products. The absence of commissions and deposit/withdrawal fees makes trading cost-effective. However, as an unregulated broker, Super Forex carries a risk of potential hidden fees. Also, the high leverage of up to 1:3000 can be both beneficial and risky, as it can magnify profits and losses. Moreover, the lack of negative balance protection is a disadvantage that can expose traders to significant losses.

STP accounts:

| Account type | Standard | Swap-Free | No Spread | Micro Cent | Profi STP | Crypto |

| Minimum deposit | 5 USD | 5 USD | 50 USD | 1 USD | 500 USD | 50 USD |

| Maximum leverag | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:3000 | 1:10 |

| Swaps | Yes | No | No | Yes | No | No |

| Spreads | Fixed | Fixed | 0 | Fixed | from 0.01 pips | Fixed |

ECN accounts:

| Account type | ECN Standard | ECN Standard-Mini | ECN Swap-Free | ECN Swap-Free Mini | ECN Crypto |

| Minimum deposit | 100 USD | 5 USD | 100 USD | 5 USD | 50 USD |

| Maximum leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:10 |

| Swaps | Yes | Yes | No | No | No |

| Spreads | Floating | Floating | Floating | Floating | Floating |

Super Forex offers a variety of account types, ranging from Standard and Micro Cent accounts to more specialized accounts like No Spread and Crypto. The broker also offers ECN accounts with floating spreads for traders looking for a more transparent pricing model. Each account type has its own minimum deposit requirement and maximum leverage, giving traders the flexibility to choose an account that best fits their needs. Additionally, the Swap-Free account option is available for those who require it, and the Profi STP account is specifically designed for professional traders. However, it should be noted that some account types have limited leverage and some have higher spreads compared to others.

| Advantages | Disadvantages |

| User-friendly and intuitive interface | Outdated and not as advanced as newer platforms |

| Flexible and customizable | Limited charting tools compared to other platforms |

| Large community support with abundant resources | No two-factor authentication for added security |

| Ability to use expert advisors (EAs) | Limited access to market data and news |

| Multiple language support | Limited integration with third-party plugins and tools |

Super Forex offers its clients the popular MetaTrader 4 (MT4) platform for trading, which has been in use for over a decade and is known for its user-friendly interface and flexible customization options. With MT4, traders have access to advanced charting tools, automated trading through expert advisors (EAs), and a large community of support with abundant resources. However, MT4 has limitations in terms of access to market data and news compared to newer platforms, and it does not offer two-factor authentication for added security. Additionally, while the platform is flexible and customizable, it does have limitations in terms of charting tools compared to other platforms.

| Advantages | Disadvantages |

| Potential for higher profits with smaller initial investments | Increased risk of substantial losses |

| Increased market exposure and flexibility in trading strategies | High leverage can lead to rapid depletion of funds in case of unfavorable market movements |

| Can provide access to larger positions and more trades | Requires a higher level of experience and risk management skills |

| Can amplify both profits and losses | Limited availability in certain jurisdictions due to regulatory restrictions |

Super Forex offers a very high maximum leverage of up to 1:3000, which can be advantageous for experienced traders looking to amplify their profits and gain greater market exposure with smaller initial investments. However, high leverage also carries a significant amount of risk, as it can lead to substantial losses in a short period of time. This requires traders to possess advanced risk management skills and strategies to mitigate the risks. Additionally, high leverage is not available in all jurisdictions due to regulatory restrictions.

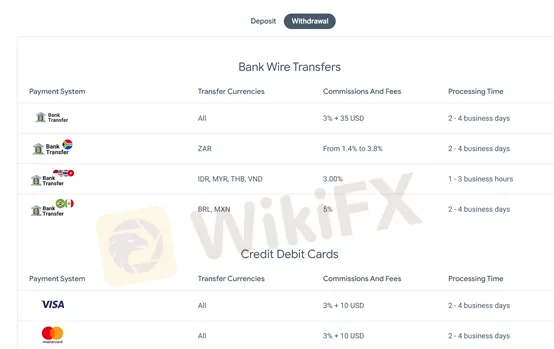

| Advantages | Disadvantages |

| Multiple deposit and withdrawal options | No information on fees charged by payment systems or banks |

| No additional fees charged by SuperForex on transactions | Processing time for withdrawals may take up to 4 business days |

| Instant processing time for deposits | Lack of information on withdrawal limits |

| Availability of local payment options | Limited cryptocurrency options compared to some competitors |

SuperForex offers a variety of deposit and withdrawal options to cater to clients' different preferences. One advantage is that the company does not charge any additional fees on transactions with your account. However, there is no information available on the fees charged by payment systems or banks, which may lead to unexpected charges for clients. Processing time for withdrawals may also take up to four business days, which may be longer than some competitors. On the other hand, deposits are processed instantly. SuperForex also offers local payment options, which can be convenient for clients in certain regions. However, the cryptocurrency options are limited compared to some competitors. It would be helpful for SuperForex to provide more information on withdrawal limits to assist clients in planning their transactions.

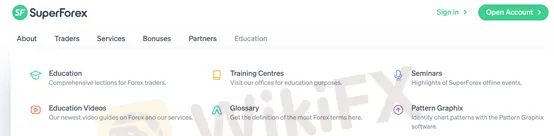

| Advantages | Disadvantages |

| Comprehensive educational resources available | Limited personal guidance |

| Variety of resources such as lections, glossary, seminars, and videos | No formal certification |

| Official YouTube channel available for additional resources | Self-directed learning may not suit all learners |

| Free of charge for Super Forex clients | No interactive learning tools |

| Accessible to clients worldwide | Some resources may be more basic than others |

Super Forex offers a variety of educational resources for its clients. The company provides comprehensive lections, a glossary, seminars, training centers, educational videos, and other resources to help traders learn more about forex trading. Additionally, Super Forex has an official YouTube channel where clients can access even more videos to supplement their learning. These resources are available free of charge to Super Forex clients, and they are accessible to traders worldwide. However, there are some disadvantages to Super Forex's educational resources. While they are comprehensive, they do not offer personalized guidance, and there is no formal certification process. Additionally, the resources are self-directed, which may not be suitable for all learners, and some of the materials may be more basic than others.

You may also visit their official YouTube channel to watch more videos. Here is a recent video about technical analysis.

| Advantages | Disadvantages |

| 24/5 customer support available via various channels | No 24/7 customer support |

| Several social media channels for customer support and engagement | No live chat available on website |

| FAQ section available on the website for quick self-help | No phone support for some countries |

| Callback feature available for personalized assistance | No physical office or location available for in-person assistance |

Super Forex offers a variety of customer care options for their clients. The company provides 24/5 customer support through various channels, including email, phone, WhatsApp, WeChat, Telegram, and social media platforms such as Instagram, YouTube, Facebook, Twitter, and LinkedIn. The FAQ section on their website is another helpful resource for clients who prefer self-help. Additionally, the callback feature is available for personalized assistance. However, Super Forex does not offer 24/7 customer support and live chat is not available on their website. Furthermore, phone support may not be available for some countries and there is no physical office or location available for in-person assistance.

In conclusion, Super Forex is a reputable and reliable forex broker that offers a wide range of trading instruments and account types to its clients. Its multiple deposit and withdrawal options, as well as its educational resources and customer support channels, make it an attractive option for traders of all levels of experience. The company also stands out with its high leverage of up to 1:3000, which can potentially lead to significant profits. However, traders must be aware of the risks involved in high leverage trading and exercise caution when trading with such high ratios. Overall, Super Forex provides a solid trading environment for traders looking to participate in the forex market.

Question: What is Super Forex?

Answer: Super Forex is a global forex broker that provides online currency trading services for both retail and institutional clients worldwide.

Question: Is Super Forex regulated?

Answer: No, Super Forex is not regulated.

Question: What trading platforms does Super Forex offer?

Answer: Super Forex offers the popular MetaTrader 4 (MT4) trading platform, which is available for both desktop and mobile devices.

Question: What is the minimum deposit required to open an account with Super Forex?

Answer: The minimum deposit required to open a Standard account with Super Forex is 5 USD.

Question: What types of accounts does Super Forex offer?

Answer: Super Forex offers various types of accounts, including Standard, Swap-Free, No Spread, Micro Cent, Profi STP, Crypto, ECN Standard, ECN Standard-Mini, ECN Swap-Free, ECN Swap-Free Mini, and ECN Crypto accounts.

Question: What is the maximum leverage offered by Super Forex?

Answer: Super Forex offers a maximum leverage of up to 1:3000.

Question: What educational resources are available on the Super Forex website?

Answer: Super Forex provides a variety of educational resources, including comprehensive lessons, a glossary, seminars, training centers, and educational videos, which are all designed to help traders improve their knowledge and skills in the forex market.

| Information | Details |

| Company Name | SBI FXTRADE |

| Registered Country/Area | Japan |

| Regulation | Financial Services Agency, Japan |

| Minimum Deposit | 1,000 yen for Quick Deposits |

| Spreads | Narrow Spreads |

| Trading Platforms | Desktop and Mobile |

| Tradable Assets | Forex (34 currency pairs) |

| Demo Account | Available |

| Deposit & Withdrawal | Quick Deposits, Normal Deposits, Deposits to SBI Shinsei Bank |

| Educational Resources | Official YouTube channel |

SBI FXTRADE is a Forex broker and a part of the SBI Group, a leading online financial services company in Japan. Its service allows users to engage in foreign exchange (FX) margin trading. The platform offers real-time market information and various analysis tools, which can assist both novices and experienced traders in their decision-making process.

The SBI FXTRADE platform boasts of features such as narrow spreads and 24-hour trading. It also offers a demo account option for practice. Additionally, there is a user-friendly interface which simplifies the process of FX trading and a mobile application for trading on the go. It is essential to remember that just like any other type of trading and investment, forex trading involves certain risks which should be thoroughly understood before participating.

SBI FXTRADE is a regulated broker under the jurisdiction of Japan. The platform is licensed as a Retail Forex License holder and is overseen by the Financial Services Agency of Japan. The license number is 関東財務局長(金商)第2635号 and the official licensed institution is SBI FX トレード株式会社. The license was effectively granted on 13th April 2012. However, there is no shared email address of the licensed institution. It's crucial to trade with a regulated broker as it provides a certain level of security and oversight.

Pros:

1. Wide Range of Trading Instruments: SBI FXTRADE offers an extensive range of 34 currency pairs for trading, making it an attractive platform for those who wish to diversify their trading portfolio.

2. Quick Deposits: The platform provides a quick deposit feature that starts from 1,000 yen with no associated fees.

3. Regulation: SBI FXTRADE is regulated by the Financial Services Agency of Japan, adding a higher level of security and trustworthiness.

5. User-Friendly Interface: The platform has a user-friendly interface that simplifies the process of FX trading, making it easier for beginner traders to navigate.

6. Demo Account: SBI FXTRADE provides a demo account which allows users to practice trading strategies before investing real money.

7. 24-Hour Service: The platform facilitates 24-hour trading, enabling traders to take advantage of global forex market hours.

8. Mobile Trading: SBI FXTRADE offers mobile trading platforms for users to trade on the go.

Cons:

1. Deposit Fees: While quick deposits are free, other deposit methods such as the “normal deposit” method have associated transfer fees that will be borne by the customer.

2. Delay in Reflection of Deposits: Certain deposit methods may not immediately reflect the deposited amount in the trading account. If any error occurs, the reflection of deposit will have to wait till the confirmation of payment receipt.

3. Fees on Some Services: For certain services, such as normal deposits, transfer fees will be borne by the customer.

SBI FXTRADE provides its users with the opportunity to trade in a total of 34 currency pairs. This offering is considered to be one of the highest in the industry, giving traders a wide range of options when it comes to choosing their trading instruments.

It signifies that traders have the opportunity to capitalize on the movements of various currencies ranging from major currency pairs to minor and exotic ones. However, it's always important for traders to understand the risks associated with each trading instrument before investing.

SBI FXTRADE offers two different methods of depositing funds: quick deposits and normal deposits.

Quick deposits start from 1,000 yen, with no associated fees. It's important to note that applications cannot be accepted during maintenance times performed by the broker or financial institutions.

SBI FXTRADE provides several methods for depositing and withdrawing funds.

For making deposits, there are three methods available:

The following provides more details on deposit confirmation and conditions:

SBI FXTRADE offers an array of contact channels enabling seamless and efficient communication:

SBI FXTRADE provides several educational resources for its traders:

Please note that Forex trading and trading in general can be risky, so it's essential to fully understand these risk factors and strategies before investing. Educational resources are a starting point, but should not be the only source of knowledge or strategy formulation. Real-time experience, trading practice, and individual research are also critical components of trading education.

SBI FXTRADE, a premium trading firm, offers multiple features tailored towards assisting traders succeed. Key offerings include diverse deposit methods (featuring Quick Deposits), a wide array of trading instruments, a user-friendly platform, and well-developed educational resources. However, potential users should be aware of potential deposit fees and delays, and inherent trading risks.

Q: What are some educational resources that SBI FXTRADE provides for traders?

A: SBI FXTRADE offers a variety of educational resources, including a YouTube channel filled with market news, trading strategies, and other trading-related insights, a feature for recent market news, programs providing insights into alternative currencies to USD/JPY.

Q: How can users contact SBI FXTRADE?

A: SBI FXTRADE can be reached through their phone number (+81 0120-982-417), their official website, or their social media accounts on Twitter, Facebook, and YouTube.

Q: What are the unique features of SBI FXTRADE?

A: SBI FXTRADE offers quick deposits without any fees starting from 1,000 yen and is regulated by the Financial Services Agency of Japan for enhanced security.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive super-forex and sbi-fxtrade are, we first considered common fees for standard accounts. On super-forex, the average spread for the EUR/USD currency pair is -- pips, while on sbi-fxtrade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

super-forex is regulated by FSC. sbi-fxtrade is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

super-forex provides trading platform including Profi STP,Crypto,Standard,Swap Free,Micro Cent,No Spread and trading variety including USD, EUR, GBP, ZAR. sbi-fxtrade provides trading platform including -- and trading variety including --.