No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Super Forex and Moneta Markets ?

In the table below, you can compare the features of Super Forex , Moneta Markets side by side to determine the best fit for your needs.

EURUSD:0.3

EURUSD:3

EURUSD:14

XAUUSD:30.8

EURUSD: -11.5 ~ 4.5

EURUSD:-0.2

EURUSD:-0.1

EURUSD:12.01

XAUUSD:27.74

EURUSD: -5.7 ~ 2.27

XAUUSD: -30.8 ~ 22

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of super-forex, moneta-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Belize |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 5-10 years |

| Trading instruments | Cryptocurrencies, precious metals, stock, oil, forex pairs, indices |

| Minimum Initial Deposit | $1 |

| Maximum Leverage | 1:3000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4 |

| Deposit and withdrawal method | Bank Wire Transfers, Credit/Debit Cards, E-Payments, Cryptocurrencies, Local Payments and superforex money |

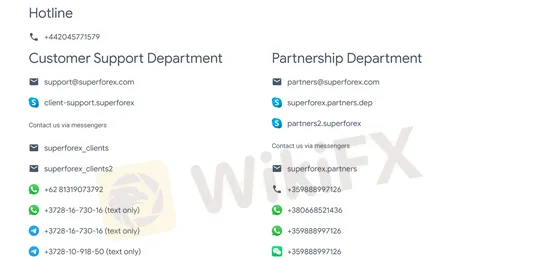

| Customer Service | Email, phone number, WhatsApp, WeChat, telegramInstagram, YouTube, Facebook, twitter, LinkedInFAQ, Callback |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Wide range of trading products and account types to choose from

High leverage of up to 1:3000

No additional fees on transactions with your account

Extensive educational resources available, including videos and seminars

Multiple channels of customer support, including social media platforms and callback option

Fast processing time for deposits

Cons:

Limited regulatory oversight and licensing

Limited information on the company's history and ownership

Some account types have high minimum deposits, such as the Profi STP and ECN accounts

The spreads on some trading products can be higher compared to other brokers

Withdrawals may take longer to process compared to deposits

Limited options for trading platforms, only offering the MT4 platform.

| Advantages | Disadvantages |

| Super Forex offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, Super Forex has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

Super Forex is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Super Forex acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that Super Forex has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with Super Forex or any other MM broker.

SuperForex is a global forex broker established in 2013 with a mission to provide its clients with top-quality financial services and a wide range of trading instruments. The company is headquartered in Belize. With its client-centric approach, SuperForex offers various account types, flexible trading conditions, a range of trading platforms, a variety of payment options, and a comprehensive set of educational resources to cater to the needs of both novice and experienced traders.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Super Forex offers a wide range of trading instruments, including cryptocurrencies, precious metals, stocks, oil, forex pairs, and indices. The availability of multiple asset classes provides traders with diversification opportunities, access to global markets, and the potential for high returns. With access to popular asset classes such as forex pairs and indices, traders can also benefit from high liquidity, which means they can quickly enter and exit positions at the desired price. However, trading multiple asset classes can be complex, may require extensive knowledge and expertise, and may come with higher margin requirements, increasing trading costs. Additionally, as the research and analysis on each asset class may not be as detailed or comprehensive as traders would prefer, traders should conduct their own research and analysis to make informed trading decisions.

| Advantages | Disadvantages |

| Competitive spreads | Unregulated broker |

| Detailed fee table | Potential hidden fees |

| Zero commissions | High leverage up to 1:3000 |

| No deposit or withdrawal fees | Lack of negative balance protection |

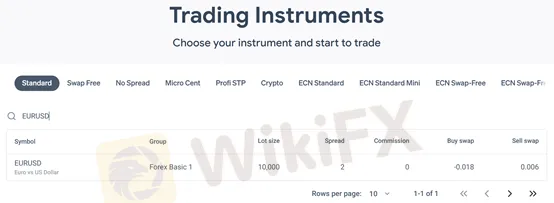

Super Forex offers competitive spreads and provides a detailed fee table that outlines spreads, commissions, SWAPs and lot sizes for various accounts and products. The absence of commissions and deposit/withdrawal fees makes trading cost-effective. However, as an unregulated broker, Super Forex carries a risk of potential hidden fees. Also, the high leverage of up to 1:3000 can be both beneficial and risky, as it can magnify profits and losses. Moreover, the lack of negative balance protection is a disadvantage that can expose traders to significant losses.

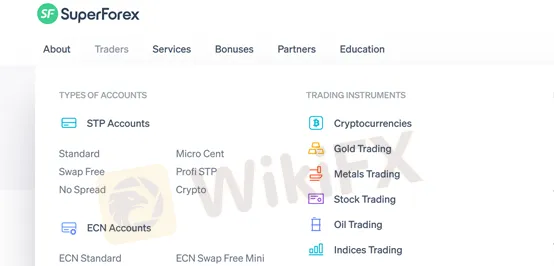

STP accounts:

| Account type | Standard | Swap-Free | No Spread | Micro Cent | Profi STP | Crypto |

| Minimum deposit | 5 USD | 5 USD | 50 USD | 1 USD | 500 USD | 50 USD |

| Maximum leverag | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:3000 | 1:10 |

| Swaps | Yes | No | No | Yes | No | No |

| Spreads | Fixed | Fixed | 0 | Fixed | from 0.01 pips | Fixed |

ECN accounts:

| Account type | ECN Standard | ECN Standard-Mini | ECN Swap-Free | ECN Swap-Free Mini | ECN Crypto |

| Minimum deposit | 100 USD | 5 USD | 100 USD | 5 USD | 50 USD |

| Maximum leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:10 |

| Swaps | Yes | Yes | No | No | No |

| Spreads | Floating | Floating | Floating | Floating | Floating |

Super Forex offers a variety of account types, ranging from Standard and Micro Cent accounts to more specialized accounts like No Spread and Crypto. The broker also offers ECN accounts with floating spreads for traders looking for a more transparent pricing model. Each account type has its own minimum deposit requirement and maximum leverage, giving traders the flexibility to choose an account that best fits their needs. Additionally, the Swap-Free account option is available for those who require it, and the Profi STP account is specifically designed for professional traders. However, it should be noted that some account types have limited leverage and some have higher spreads compared to others.

| Advantages | Disadvantages |

| User-friendly and intuitive interface | Outdated and not as advanced as newer platforms |

| Flexible and customizable | Limited charting tools compared to other platforms |

| Large community support with abundant resources | No two-factor authentication for added security |

| Ability to use expert advisors (EAs) | Limited access to market data and news |

| Multiple language support | Limited integration with third-party plugins and tools |

Super Forex offers its clients the popular MetaTrader 4 (MT4) platform for trading, which has been in use for over a decade and is known for its user-friendly interface and flexible customization options. With MT4, traders have access to advanced charting tools, automated trading through expert advisors (EAs), and a large community of support with abundant resources. However, MT4 has limitations in terms of access to market data and news compared to newer platforms, and it does not offer two-factor authentication for added security. Additionally, while the platform is flexible and customizable, it does have limitations in terms of charting tools compared to other platforms.

| Advantages | Disadvantages |

| Potential for higher profits with smaller initial investments | Increased risk of substantial losses |

| Increased market exposure and flexibility in trading strategies | High leverage can lead to rapid depletion of funds in case of unfavorable market movements |

| Can provide access to larger positions and more trades | Requires a higher level of experience and risk management skills |

| Can amplify both profits and losses | Limited availability in certain jurisdictions due to regulatory restrictions |

Super Forex offers a very high maximum leverage of up to 1:3000, which can be advantageous for experienced traders looking to amplify their profits and gain greater market exposure with smaller initial investments. However, high leverage also carries a significant amount of risk, as it can lead to substantial losses in a short period of time. This requires traders to possess advanced risk management skills and strategies to mitigate the risks. Additionally, high leverage is not available in all jurisdictions due to regulatory restrictions.

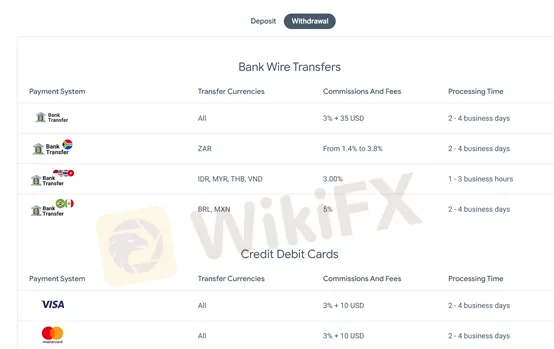

| Advantages | Disadvantages |

| Multiple deposit and withdrawal options | No information on fees charged by payment systems or banks |

| No additional fees charged by SuperForex on transactions | Processing time for withdrawals may take up to 4 business days |

| Instant processing time for deposits | Lack of information on withdrawal limits |

| Availability of local payment options | Limited cryptocurrency options compared to some competitors |

SuperForex offers a variety of deposit and withdrawal options to cater to clients' different preferences. One advantage is that the company does not charge any additional fees on transactions with your account. However, there is no information available on the fees charged by payment systems or banks, which may lead to unexpected charges for clients. Processing time for withdrawals may also take up to four business days, which may be longer than some competitors. On the other hand, deposits are processed instantly. SuperForex also offers local payment options, which can be convenient for clients in certain regions. However, the cryptocurrency options are limited compared to some competitors. It would be helpful for SuperForex to provide more information on withdrawal limits to assist clients in planning their transactions.

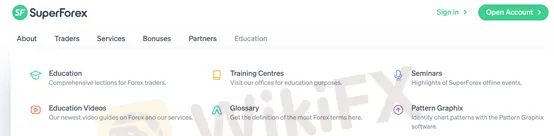

| Advantages | Disadvantages |

| Comprehensive educational resources available | Limited personal guidance |

| Variety of resources such as lections, glossary, seminars, and videos | No formal certification |

| Official YouTube channel available for additional resources | Self-directed learning may not suit all learners |

| Free of charge for Super Forex clients | No interactive learning tools |

| Accessible to clients worldwide | Some resources may be more basic than others |

Super Forex offers a variety of educational resources for its clients. The company provides comprehensive lections, a glossary, seminars, training centers, educational videos, and other resources to help traders learn more about forex trading. Additionally, Super Forex has an official YouTube channel where clients can access even more videos to supplement their learning. These resources are available free of charge to Super Forex clients, and they are accessible to traders worldwide. However, there are some disadvantages to Super Forex's educational resources. While they are comprehensive, they do not offer personalized guidance, and there is no formal certification process. Additionally, the resources are self-directed, which may not be suitable for all learners, and some of the materials may be more basic than others.

You may also visit their official YouTube channel to watch more videos. Here is a recent video about technical analysis.

| Advantages | Disadvantages |

| 24/5 customer support available via various channels | No 24/7 customer support |

| Several social media channels for customer support and engagement | No live chat available on website |

| FAQ section available on the website for quick self-help | No phone support for some countries |

| Callback feature available for personalized assistance | No physical office or location available for in-person assistance |

Super Forex offers a variety of customer care options for their clients. The company provides 24/5 customer support through various channels, including email, phone, WhatsApp, WeChat, Telegram, and social media platforms such as Instagram, YouTube, Facebook, Twitter, and LinkedIn. The FAQ section on their website is another helpful resource for clients who prefer self-help. Additionally, the callback feature is available for personalized assistance. However, Super Forex does not offer 24/7 customer support and live chat is not available on their website. Furthermore, phone support may not be available for some countries and there is no physical office or location available for in-person assistance.

In conclusion, Super Forex is a reputable and reliable forex broker that offers a wide range of trading instruments and account types to its clients. Its multiple deposit and withdrawal options, as well as its educational resources and customer support channels, make it an attractive option for traders of all levels of experience. The company also stands out with its high leverage of up to 1:3000, which can potentially lead to significant profits. However, traders must be aware of the risks involved in high leverage trading and exercise caution when trading with such high ratios. Overall, Super Forex provides a solid trading environment for traders looking to participate in the forex market.

Question: What is Super Forex?

Answer: Super Forex is a global forex broker that provides online currency trading services for both retail and institutional clients worldwide.

Question: Is Super Forex regulated?

Answer: No, Super Forex is not regulated.

Question: What trading platforms does Super Forex offer?

Answer: Super Forex offers the popular MetaTrader 4 (MT4) trading platform, which is available for both desktop and mobile devices.

Question: What is the minimum deposit required to open an account with Super Forex?

Answer: The minimum deposit required to open a Standard account with Super Forex is 5 USD.

Question: What types of accounts does Super Forex offer?

Answer: Super Forex offers various types of accounts, including Standard, Swap-Free, No Spread, Micro Cent, Profi STP, Crypto, ECN Standard, ECN Standard-Mini, ECN Swap-Free, ECN Swap-Free Mini, and ECN Crypto accounts.

Question: What is the maximum leverage offered by Super Forex?

Answer: Super Forex offers a maximum leverage of up to 1:3000.

Question: What educational resources are available on the Super Forex website?

Answer: Super Forex provides a variety of educational resources, including comprehensive lessons, a glossary, seminars, training centers, and educational videos, which are all designed to help traders improve their knowledge and skills in the forex market.

| Moneta Markets Review Summary in 10 Points | |

| Founded | 2020 |

| Registered Country/Region | Australia |

| Regulation | FSA (offshore regulated) / FSCA (general registration) / ASIC (regulated) |

| Market Instruments | Forex, Commodities, Indices, Share CFDs, ETFs, Bonds |

| Demo Account | Available |

| Leverage | 1000:1 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platforms | MT4, PRO Trader |

| Minimum deposit | $50 |

| Customer Support | 24/5 live chat, phone, email |

Founded in 2020, Moneta Markets is an Australian Forex and CFD broker, giving its clients access to a bulk of trading assets, including forex, commodities, indices and more through both MT4 and PRO Trader platforms, flexible leverage up to 1:1000, initial deposit as low as $50.

Concerning regulation, Moneta Markets is the trading name of Moneta Markets South Africa (Pty) Ltd, regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa.

Besides, Moneta Markets is also a trading name of Moneta Markets Pty Ltd, authorized by the ASIC in Australia, holding an Appointed Representative (AR) license, with License No.: 001298177.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Moneta Markets appears to be a competitive broker with a wide range of trading instruments and account types, as well as multiple funding options and trading platforms. The broker's negative balance protection and segregation of client funds provide an added layer of security for traders. However, the limited educational resources and offshore regulated by FSA may be potential drawbacks for some traders.

| Pros | Cons |

| • Regulated by ASIC | • Limited educational resources |

| • Wide range of trading instruments | • Clients from Canada, the United States are not accepted |

| • Demo accounts and Islamic (swap-free) accounts are available | • No cryptocurrency trading |

| • High leverage available on certain assets | • Offshore regulation (FSA) |

| • Competitive spreads and commission rates | |

| • Multiple funding methods with no deposit or withdrawal fees | |

| • Negative balance protection and segregated client accounts |

Please note that this is not an exhaustive list and there may be additional pros and cons depending on individual preferences and circumstances.

Moneta Markets holds three regulatory licenses. The Seychelles Financial Services Authority (FSA) license is offshore regulated, Financial Sector Conduct Authority (FSCA) license is general registration, Australia Securities & Investment Commission (ASIC) license is regulated.

Moneta Markets also has registered with the FSCA in South Africa, with a Financial Service Corporate License. Yet, this license is beyond its business scope.

Moneta Markets appears to have proper regulatory licenses and measures in place to ensure the safety of client funds. Client funds are held in a segregated account with AA-Rated Global Bank and trading accounts have negative balance protection. They are also subject to regular audits and have comprehensive insurance. However, it's important to conduct thorough research and due diligence before investing in any financial product or service, as the market carries inherent risks.

Moneta Markets offers a diverse range of over 1000 CFDs to trade, including Forex currency pairs, commodities, indices, share CFDs, ETFs, and bonds. This provides traders with ample opportunities to diversify their portfolios and take advantage of various market conditions.

Apart from demo accounts, Moneta Markets offers three live accounts to cater to traders with different needs, Direct STP, Prime ECN, and Ultra ECN. The minimum deposit requirement is $50, $200 and $50,000 respectively. Moneta Markets also offers Islamic accounts for Direct STP and Prime ECN accounts, which are swap-free and designed for traders who want to adhere to Sharia law.

Moneta Markets offers leverage options that vary depending on the asset class, with the highest leverage of up to 1000:1 available for forex, indices and precious metals. Energy instruments have a maximum leverage of 500:1, while soft commodities have a maximum leverage of 50:1, and share CFDs have a maximum leverage of 33:1. It is important to note that high leverage can lead to increased risk and potential losses, so traders should use caution and ensure they understand the risks involved before using leverage.

Moneta Markets offers different spreads and commissions depending on the account type. Direct STP accounts have spreads starting from 1.2 pips and no commission fees. Prime ECN accounts have spreads starting from 0.0 pips with a commission fee of $3 per lot per side. Ultra ECN accounts have spreads starting from 0.0 pips with a commission fee of $1 per lot per side. The commission fees are relatively low compared to other brokers, and the tight spreads can be attractive for traders who want to minimize trading costs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | Spread | Commission |

| Moneta Markets | 1.2 pips | Free |

| Rakuten Securities | 0.3 pips | Free |

| GMI | 0.2 pips | Free |

| DBG Markets | 0.0 pips | $7/lot |

Note that spreads and commissions can vary depending on market conditions and account type.

Moneta Markets offers multiple trading platforms to its clients, including the PRO Trader, MetaTrader 4 (MT4), MetaTrader 5 (MT5) mobile apps, and MT4 WebTrader. The PRO Trader platform is the broker's proprietary platform that is designed for traders who prefer a customizable and user-friendly interface. MT4 and MT5 are popular trading platforms that provide advanced charting tools, technical indicators, and algorithmic trading capabilities. The MT4 WebTrader is a browser-based platform that allows clients to trade from any device with internet access, without the need to download any software. The mobile apps provide the convenience of trading on-the-go for iOS and Android devices.

Overall, Moneta Markets' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

See the trading platform comparison table below:

| Broker | Trading Platform(s) |

| Moneta Markets | PRO Trader, MT4, MT4 and MT5 mobile apps, and MT4 WebTrader |

| Rakuten Securities | Rakuten FX, Rakuten Securities Option Station, MetaTrader 4 |

| GMI | MT4, GMI Edge |

| DBG Markets | MT4, WebTrader |

Note: These may not be the only trading platforms offered by these brokers, and some platforms may only be available to certain account types.

Moneta Markets provides a range of trading tools to help traders make informed decisions. The Premium Economic Calendar is a comprehensive tool that provides detailed information about upcoming economic events and their expected impact on the market. Technical Views provides a variety of technical analysis tools to help traders analyze market trends and patterns. Alpha EA is an automated trading tool that uses advanced algorithms to identify profitable trading opportunities. AI Market Buzz uses artificial intelligence to analyze market sentiment and identify potential trading opportunities. Forex Signals provides real-time trading signals to help traders make informed trading decisions. Finally, Market Masters Tutorials is a collection of educational resources that cover a wide range of trading topics and provide traders with valuable insights into the market.

Moneta Markets offers a variety of funding methods to accommodate traders globally, including International EFT, credit/debit cards (Visa, MasterCard), Fasapay, JCB Bank, and Sticpay, with a relatively low minimum deposit requirement of $50.

To make a deposit into your Moneta Markets account, you need to follow these steps:

Step 1: Log in to your Moneta Markets Client Portal;

Step 2: Click “Funds - Withdraw Funds” on the left side menu;

Step 3: Choose your preferred payment option to fund your account.

USD: United States dollar ($)

EUR: Euro (€)

GBP: British pound sterling (£)

NZD: New Zealand dollar (NZ$)

SGD: Singapore dollar (S$)

JPY: Japanese yen (¥)

CAD: Canadian dollar (C$)

HKD: Hong Kong dollar (HK$)

BRL: Brazilian real (R$)

| Moneta Markets | Most other | |

| Minimum Deposit | $50 | $100 |

The broker also does not charge deposit and withdrawal fees, except for possible handling fees charged by the financial institution. The majority of deposits are processed instantly, while withdrawals are usually processed within 1-3 business days. However, International EFT withdrawals may take longer, up to 5 business days. It's worth noting that International bank wire transfers may incur additional fees charged by both the trader's and broker's financial institutions.

To withdraw funds from your Moneta Markets account, you need to follow these steps:

Step 1: Log in to your Moneta Markets Client Portal;

Step 2: Click “Funds - Withdraw Funds” in the left side menu;

Step 3: Complete the form and your withdrawal will be processed shortly.

Moneta Markets charges fees in the form of spreads and commissions for trading that we have mentioned before, but there are no deposit or withdrawal fees. Additionally, there is an inactivity fee of $10 per month for accounts that have been inactive for after 180 days of inactivity.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| Moneta Markets | None | None | $10/month after 180 days of inactivity |

| Rakuten Securities | None | None | None |

| GMI | None | None | None |

| DBG Markets | None | $30 for international wire transfer | None |

Note: Fees may vary depending on the account type and payment method used. It is recommended to check with each broker for the most up-to-date information on their fees.

Moneta Markets seems to provide professional and dedicated customer support. Firstly, Moneta Markets relies on its FAQ section to give clients some general and basic answers concerning their trading process.

Secondly, clients with any inquiries can also get in touch with Moneta Markets through multiple contact channels. Here are some contact details:

Phone: UK - 44 (113) 3204819, International - 61283301233

Email: support@monetamarkets.com

24/5 Online Chat

Or you can also follow this broker on some social media platforms, such as Facebook, Instagram, Twitter, LinkedIn and YouTube.

Overall, Moneta Markets' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 customer support available | No 24/7 customer support |

| • Multilingual customer support | |

| • Quick response time | |

| • Personalized customer service experience |

Note: These pros and cons are based on available information and may not be exhaustive.

Moneta Markets is a regulated online broker that offers a range of trading instruments, multiple account types, and trading platforms. They provide access to various trading tools, including a premium economic calendar, forex signals, and technical views. The broker offers competitive spreads and commissions, and they have various funding methods with no deposit and withdrawal fees. However, they have limited educational resources. Overall, Moneta Markets is a good option for traders looking for a reliable and comprehensive online trading experience.

Is Moneta Markets legit?

Yes. It is regulated by ASIC, offshore regulated by FSA and has a general registration of FSCA license.

At Moneta Markets, are there any regional restrictions for traders?

Yes. Moneta Markets does not accept residents of Canada, the United States, or used by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Does Moneta Markets offer demo accounts?

Yes. Each Moneta Markets demo account lasts for 30 days before your login will expire.

Does Moneta Markets offer Islamic (swap-free) accounts?

Yes. Islamic (swap-free) accounts are available for Direct STP and Prime ECN accounts.

Is Moneta Markets a good broker for beginners?

Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive super-forex and moneta-markets are, we first considered common fees for standard accounts. On super-forex, the average spread for the EUR/USD currency pair is -- pips, while on moneta-markets the spread is from 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

super-forex is regulated by FSC. moneta-markets is regulated by FSA,FSCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

super-forex provides trading platform including Profi STP,Crypto,Standard,Swap Free,Micro Cent,No Spread and trading variety including USD, EUR, GBP, ZAR. moneta-markets provides trading platform including STP/ECN and trading variety including Forex, Indices, Commodities, Stock CFDs, Cryptocurrencies, ETFs.