简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SBI SECURITIES 、ACY SECURITIES 交易商比较(前端未翻译)

Do you want to know which is the better broker between SBI SECURITIES and ACY SECURITIES ?

在下表中,您可以并排比较 SBI SECURITIES 、 ACY SECURITIES 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost (USD/Lot)

- Average Rollover Cost (USD/Lot)

--

--

--

--

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of sbi-securities, acy-securities lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

sbi-securities

| SBI Securities Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Japan |

| Regulation | FSA |

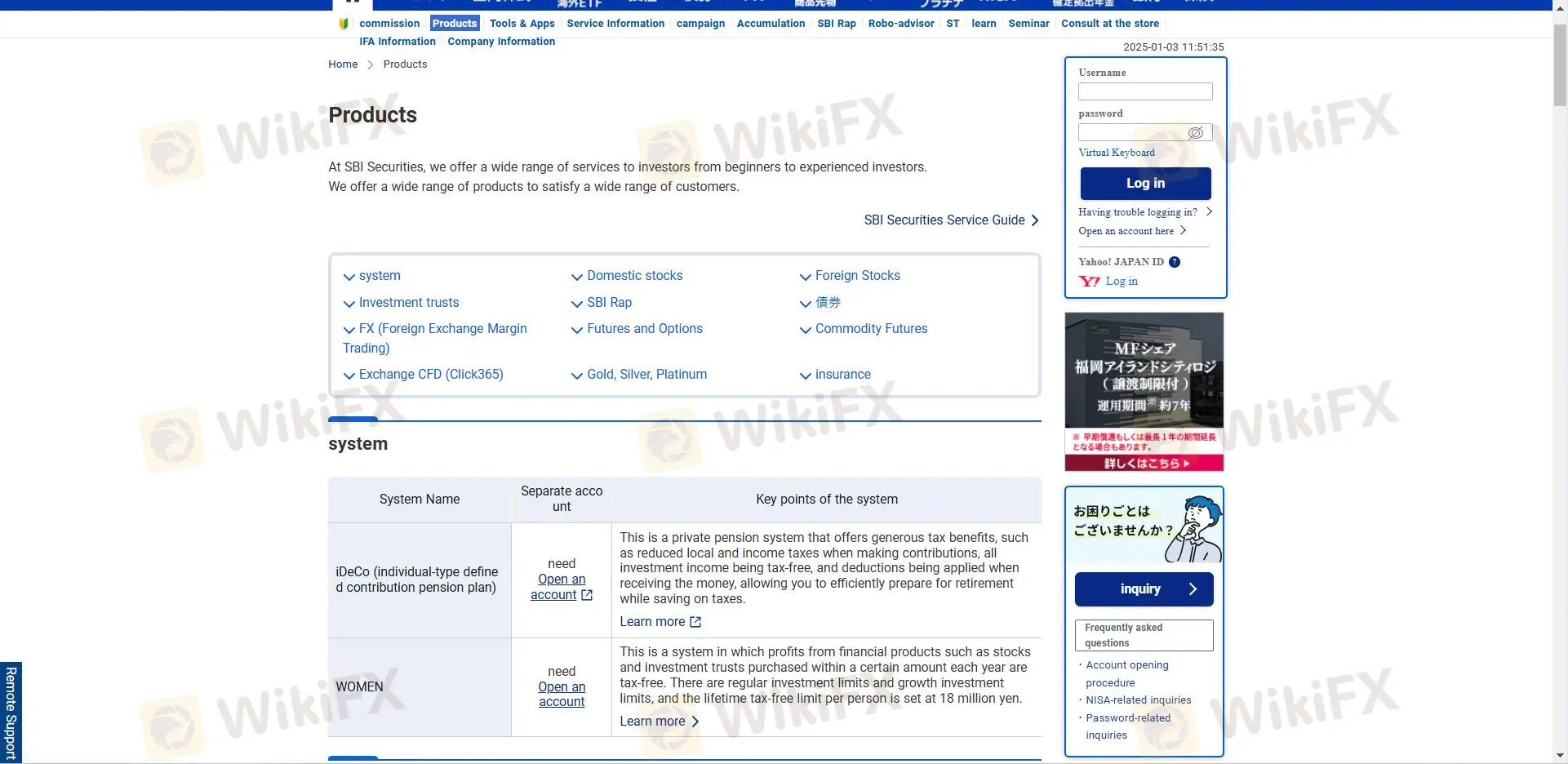

| Market Instruments | Forex, Stocks, Bonds, ETFs, Mutual Funds, CFDs, Gold/Platinum, NISA, iDeCo |

| Demo Account | Available |

| Leverage | Up to 1:25 (for FX) |

| Spread | From 1 pip (FX pairs),0.5 pips(CFDs) |

| Trading Platform | Proprietary web and mobile platforms, HYPER SBI |

| Min Deposit | ¥10,000 |

| Customer Support | Phone: 0120-104-214 |

| Email: contact@sbisec.co.jp | |

| 24/7 Online Chat: No | |

| Physical Address: Japan | |

SBI Securities Information

Established in 1999 with a headquarters in Japan, SBI Securities is under FSA control. Forex, equities, bonds, ETFs, mutual funds, and more are among the several market tools it provides with leverage up to 1:25 for FX trading. The platform offers proprietary web and mobile trading systems including HYPER SBI and enables a minimum deposit of ¥10,000.

Pros and Cons

| Pros | Cons |

| Over 150+ financial products and services | Limited leverage for FX (max 1:25) |

| Provide NISA and iDeCo accounts for tax advantages | No 24/7 customer support |

| Regulated by FSA |

Is SBI Securities Legit?

| Current Status | Regulated |

| License Type | Retail Forex License |

| Regulated By | Japan |

| License No. | 関東財務局長(金商)第44号 |

| Licensed Institution | 株式会社SBI証券 |

What Can I Trade on SBI Securities?

SBI Securities offers a 150+ stocks, 30+ currency pairs, and various ETFs, mutual funds, and bonds.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks(Overseas and Japan stock) | ✔ |

| ETFs(Overseas) | ✔ |

| Mutual Funds | ✔ |

| Bonds | ✔ |

| Commodities | ✔ |

| Options | ✔ |

| Cryptocurrencies | ❌ |

Leverage

SBI Securities only provides 1:25 leverage for FX pairs.

Account Types

SBI Securities offers multiple account types: regular investment accounts, NISA accounts, and iDeCo pension accounts.

Demo accounts are also available.

| Account Type | Minimum Deposit | Features |

| Regular Account | ¥10,000 | Access to all products and services |

| NISA Account | ¥0 | Tax-advantaged investing |

| iDeCo Account | Variable | Pension-specific tax benefits |

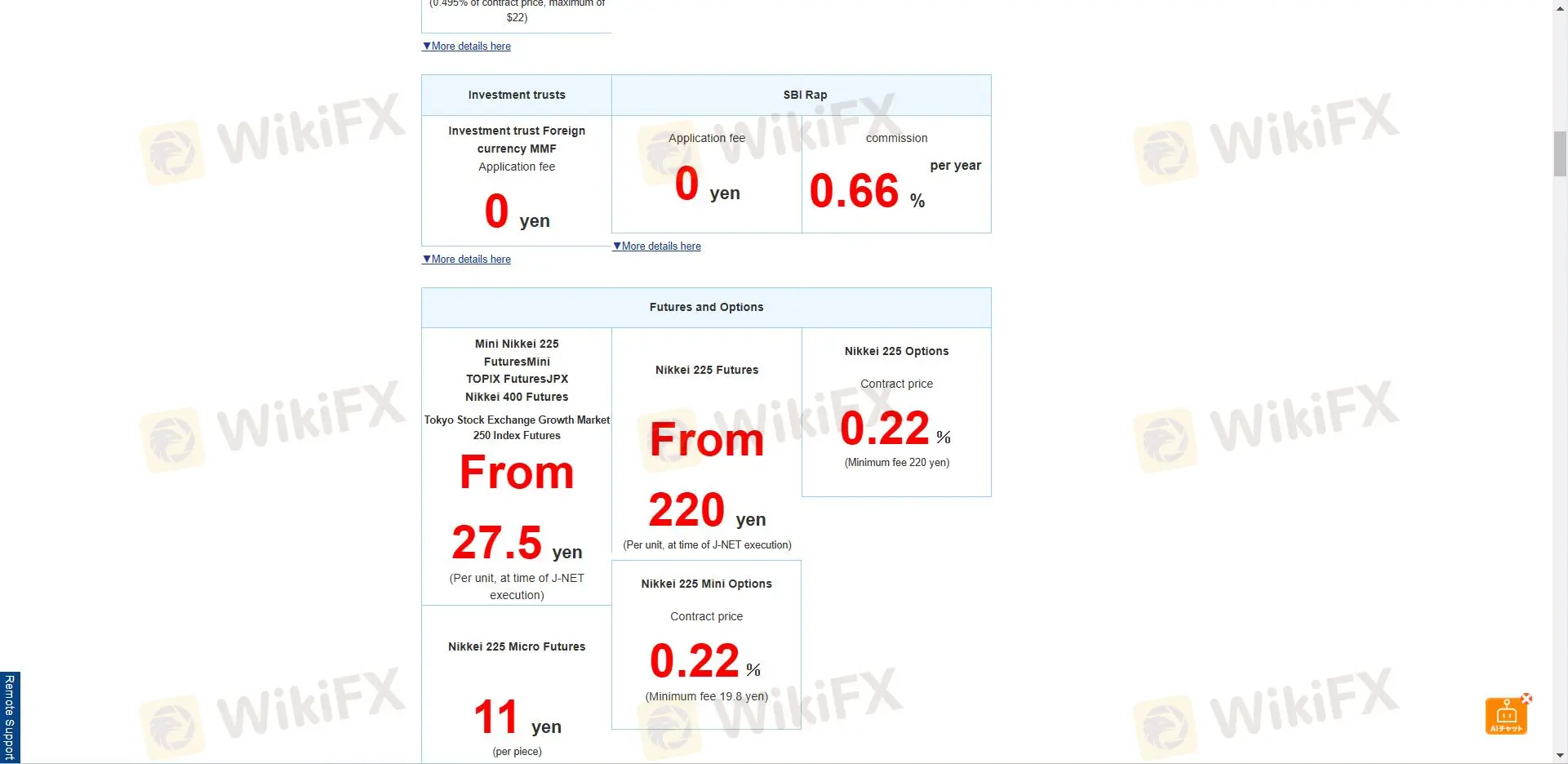

SBI Securities Fees

With specified fees for domestic stock transfers under different names and ¥3,300 for investment trust transfers, SBI Securities offers free account administration, deposits, withdrawals, and most transfers.

Trading Fees

| Service | Fee |

| Domestic Stocks | Starting from ¥99 per trade |

| Investment Trusts | Varies by fund (management fees apply) |

| FX (Foreign Exchange) | From 1 pip (spread only) |

| ETF/ETN | Varies by issuer |

| REITs | Varies by issuer |

| Bonds | Depends on bond type |

| CFDs | From 0.5 pips (spread only) |

Non-Trading Fees

| Service | Fee |

| Account Opening and Management | Free |

| Bank Transfer Deposits | Customer-borne transfer fees |

| Instant Deposits/Real-Time Deposits | Free |

| Withdrawals | Free |

| Domestic Stock Transfers | Free (same-name) |

| Domestic Stock Transfers (different names) | ¥2,200 per brand (tax incl.) |

| Investment Trust Transfers | Free (same-name) / ¥3,300 per brand (tax incl.) |

| Foreign Stock Transfers | Free (same-name) / ¥2,200 per brand (tax incl.) |

Paid Services (Optional)

| Service | Fee |

| Premium News | ¥37,125/month (tax incl.) |

| Real-Time US Stock Prices | ¥550/month (tax incl.) |

| BroadNewsStreet | ¥330/month (tax incl.) |

Trading Platform

SBI provides different App for different products.

| Trading Platform | Supported | Available Devices | Suitable for |

| HYPER SBI | ✔ | Windows, macOS | Stock traders |

| SBI Mobile App | ✔ | iOS, Android | On-the-go trading |

| Unique App for different products(SBI stock App, Domestic socks smartphone site.etc) | ✔ | Web | General and retail traders |

Deposit and Withdrawal

SBI Securities does not charge withdrawals or deposits fees. Account type determines the minimum deposit; it ranges from ¥10000 in standard account.

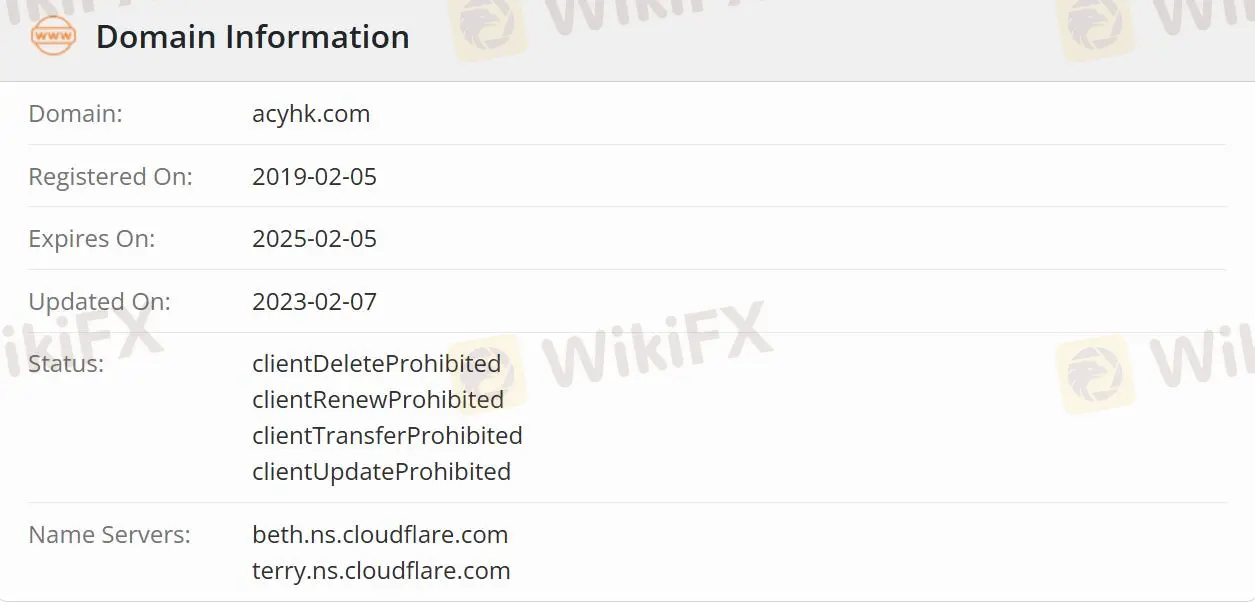

acy-securities

| ACY SecuritiesReview Summary | |

| Founded | 2019-02-05 |

| Registered Country/Region | Australia |

| Regulation | Regulated (ASIC) |

| Market Instruments | Forex, Commodities, Indices, Cryptocurrencies, ETFs, Shares, Precious Metals, Futures |

| Demo Account | ✅ |

| Leverage | Up to 1:5000 |

| Spread | From 0.0 pips |

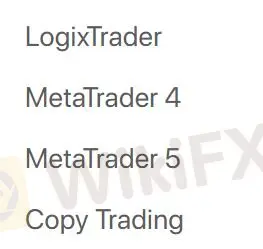

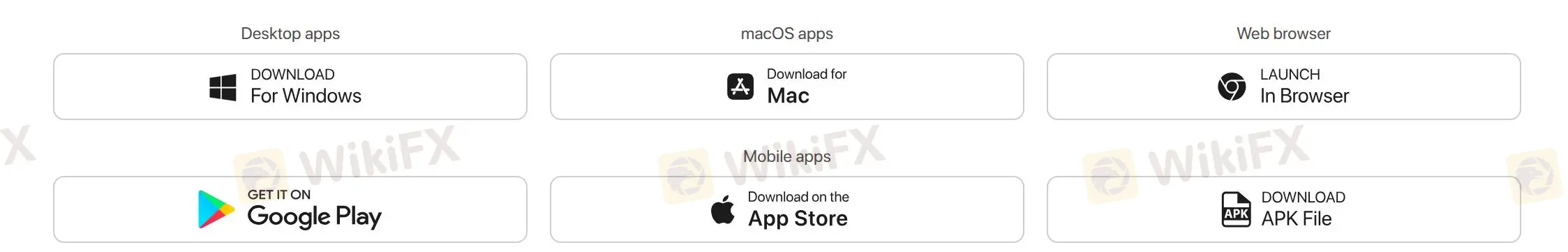

| Trading Platform | LogixTrader(Web-based), MT4/MT5(Desktop, macOS, Web, Mobile) |

| Min Deposit | $50 |

| Customer Support | Phone: 1300 729 171(Australia), +612 9188 2999(International) |

| Email: support@acy.com | |

| Facebook, YouTube, Twitter, Instagram, LinkadIn, TikTok | |

| Live Chat | |

ACY Securities Information

ACY Securities is a broker that provides traders access to various opportunities across global financial markets, including forex, commodities, indices, cryptocurrencies, ETFs, shares, precious metals, and futures. The broker also offers up to 5000x leverage and different accounts. The minimum spread is from 0.0 pips, and the minimum deposit is $50. Traders can also access the popular MT4 and MT5 trading platforms through ACY Securities.

Pros and Cons

| Pros | Cons |

| Regulated (AUS) | No 24/7 customer support |

| MT4/MT5 available | Some negative voices: scams |

| Demo account available | |

| 2200+ instruments |

Is ACY Securities Legit?

ACY Securities is authorized and regulated by the Commonwealth of Australia Regulatory Authority(AUS), with License No. 000403863 and 000474738 and the License Type Market Making(MM) and Straight Through Processing(STP), making it safer than unregulated.

What Can I Trade on ACY Securities?

ACY Securities offers 2,200+ instruments, including 60 FX pairs, 20 Indices, 12 Metals, 9 Cryptos, 6 Commodities, 2 Oil, over 1600 share CFDs, and more.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ✔ |

| Shares | ✔ |

| Precious Metals | ✔ |

| Futures | ✔ |

Account Type

ACY Securities has 3 account types: Standard, ProZero, and Bespoke. Traders who want low spreads and deposits can choose a ProZero account, while those with a sufficient budget can open a Bespoke account.

In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only. Swap-Free Account, or Islamic Account, tailored for traders adhering to Islamic principles against interest.

| Account Type | Standard | ProZero | Bespoke |

| Initial Minimum Deposit | $50 | $200 | $1000 |

| Minimum Trading Volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

| Spreads From | Variable | 0.0 Pips | 0.0 Pips |

| Commission starts from | Zero | $3/Lot Per Side | $2.5/Lot Per Side |

| Leverage up to | 1:5000 (via LogixTrader) | 1:5000 (via LogixTrader) | 1:500 |

| Swap Free Account | Yes | No | No |

ACY Securities Fees

The spread starts from 0.0 pips and the commission starts from zero. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:5000 meaning that profits and losses are magnified 5000 times.

Trading Platform

ACY Securities offers a Web-based LogixTrader. Traders can also access MT4 and MT5 compatible Desktop, macOS, Web, and Mobile versions through ACY Securities.

Copy trading is also available, a way for inexperienced traders or followers who dont have the time to do extensive research or want to diversify their portfolio to copy the trades of experienced traders (also known as money managers or copy trading gurus).

| Trading Platform | Supported | Available Devices | Suitable for |

| LogixTrader | ✔ | Web-based | All |

| MT4 | ✔ | Desktop, macOS, Web, Mobile | Junior traders |

| MT5 | ✔ | Desktop, macOS, Web, Mobile | Experienced traders |

Deposit and Withdrawal

The initial Minimum Deposit must be $50 or above. ACY Securities accepts MasterCard, VISA, NETELLER, UnionPay, Skrill, and more for deposit and withdrawal. Traders get three free withdrawals per month. After their third withdrawal in the calendar month, traders will be charged $25 in your base currency per withdrawal. Withdrawal processing time within 24 hours.

Are the transaction costs and expenses of sbi-securities, acy-securities lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive sbi-securities and acy-securities are, we first considered common fees for standard accounts. On sbi-securities, the average spread for the EUR/USD currency pair is -- pips, while on acy-securities the spread is From 0.0.

Which broker between sbi-securities, acy-securities is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

sbi-securities is regulated by FSA. acy-securities is regulated by ASIC,FSCA.

Which broker between sbi-securities, acy-securities provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

sbi-securities provides trading platform including -- and trading variety including --. acy-securities provides trading platform including ProZero,Standard,Basic and trading variety including --.