简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Santander 、A3TRADING 交易商比较(前端未翻译)

Do you want to know which is the better broker between Santander and A3TRADING ?

在下表中,您可以并排比较 Santander 、 A3TRADING 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost (USD/Lot)

- Average Rollover Cost (USD/Lot)

--

--

--

--

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of santander, a3trading lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

santander

| Santander Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Exceeded |

| Products and Services | Mortgages, Credit Cards, Savings and ISAs, Investments, Insurance, Personal Loans, Current Accounts |

| Trading Platform | Online Banking, Mobile Banking app |

| Min Deposit | Not mentioned |

| Customer Support | 24/7 Live chat |

Santander Information

Santander, founded in 2003 and registered in the UK, is an online trading platform that offers many financial services accessible through online and mobile banking. While the Investment Advisory License is now exceeded, this platform provides diverse products including mortgages, credit cards, savings, ISAs, investments, insurance, and personal loans, alongside various current account options.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Santander Legit?

Santander once had an Investment Advisory License regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 106054, but now it is exceeded. The WHOIS search shows the domain santander.co.uk was registered on August 14, 2003.

Products and Services

- Mortgages: Santander offers mortgage services for first-time buyers, home movers, and remortgagers, including options for switching lenders, borrowing more, and managing existing mortgages.

- Credit Cards: Santander offers credit cards to suit different needs, including the All in One, Long Term Balance Transfer, Everyday No Balance Transfer Fee, and Santander World Elite™ Mastercard®.

- Savings and ISAs: Santander provides various savings and ISA options for different financial goals, such as the Easy Access Saver, Regular Saver, Santander Edge Saver, Easy Access ISA, Fixed Rate ISAs, Fixed Term Bonds, Junior ISA, and Inheritance ISA.

- Investments: Santander offers investment options with cashback, an online Investment Hub for advice and fund selection, and readily available investment advice and resources.

- Insurance: Santander offers a comprehensive range of insurance products, including home, life (with critical illness), health, mortgage life, family/lifestyle, over 50s life, car (including EV), travel, business, and landlord insurance.

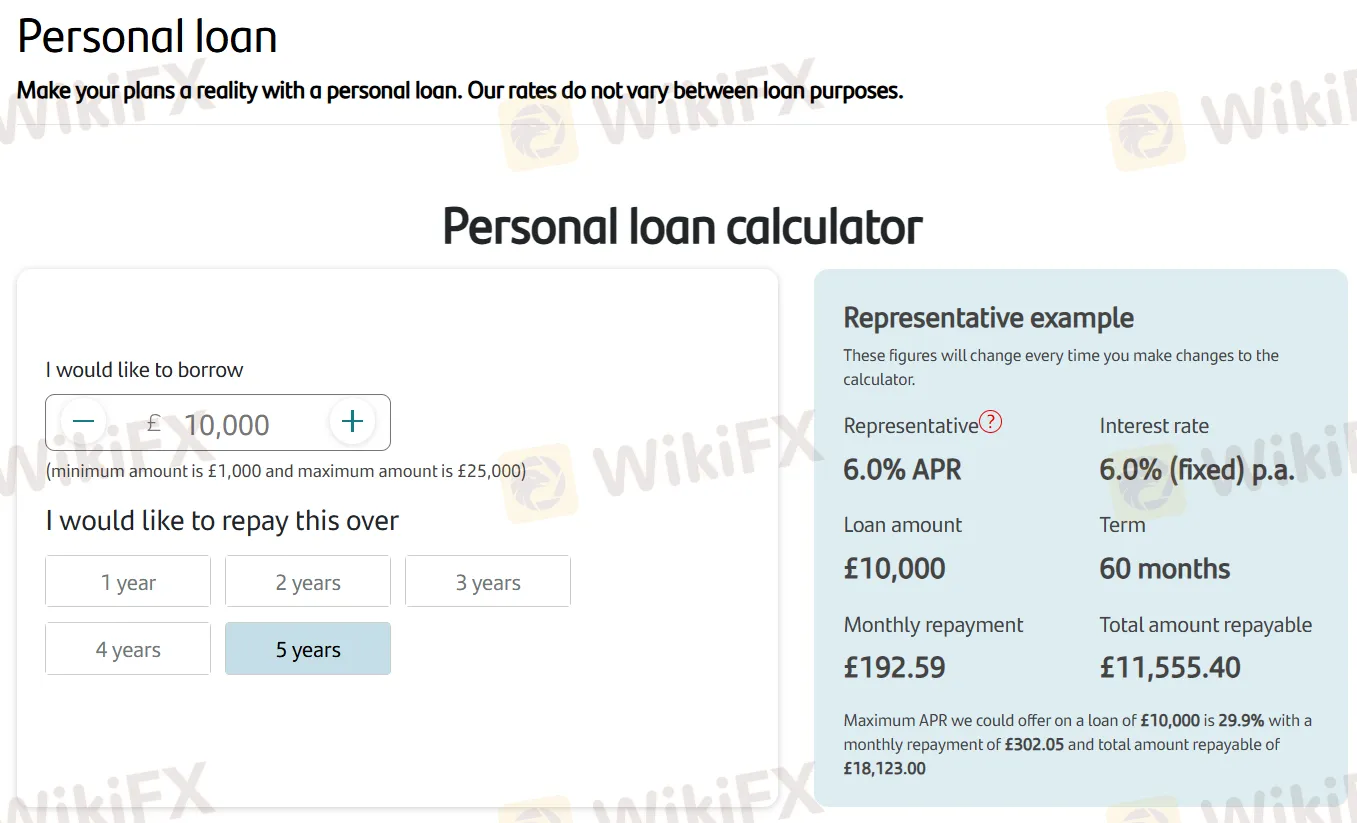

- Personal loan: Santander offers personal loans with fixed interest rates, ranging from £1,000 to £25,000, with flexible repayment terms, subject to eligibility.

Current Accounts

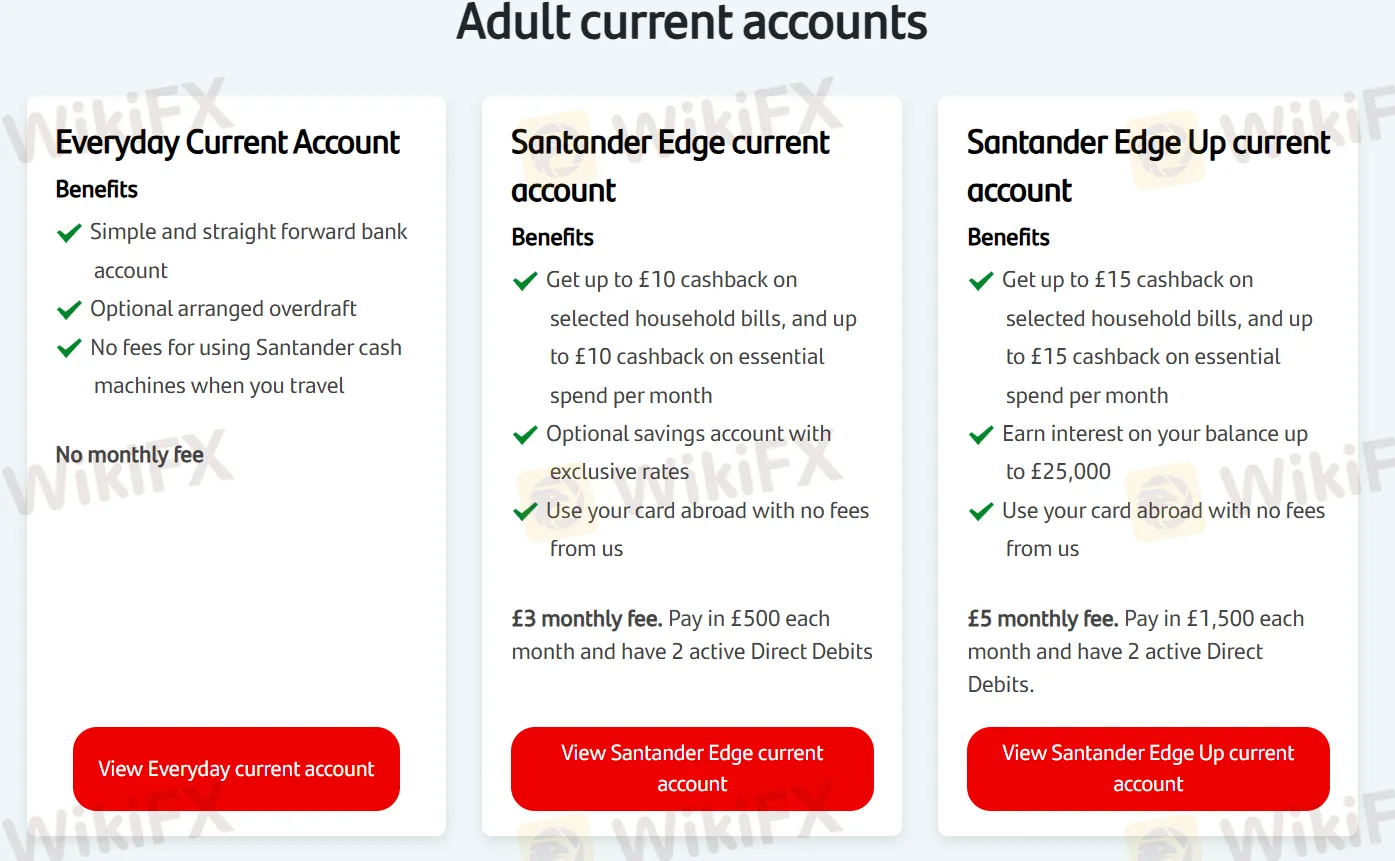

Adult current accounts:

Account Name Benefits Monthly Fee Key Requirements Everyday Current Account Simple bank account, optional overdraft, no fees at Santander ATMs abroad. No fee None explicitly stated. Santander Edge current account Up to £10 cashback on bills & essential spend, optional savings account with exclusive rates, no card usage fees abroad from Santander. £3 Pay in £500/month and have 2 active Direct Debits. Santander Edge Up current account Up to £15 cashback on bills & essential spend, earn interest on balances up to £25,000, no card usage fees abroad from Santander. £5 Pay in £1,500/month and have 2 active Direct Debits.

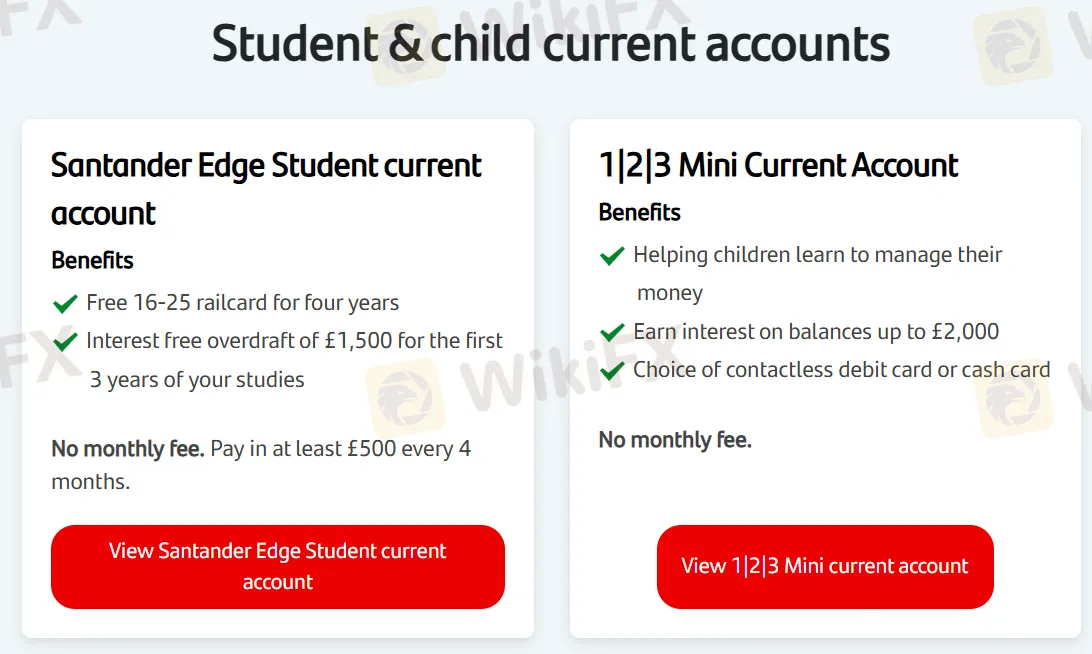

Student & child current accounts

Other current accounts

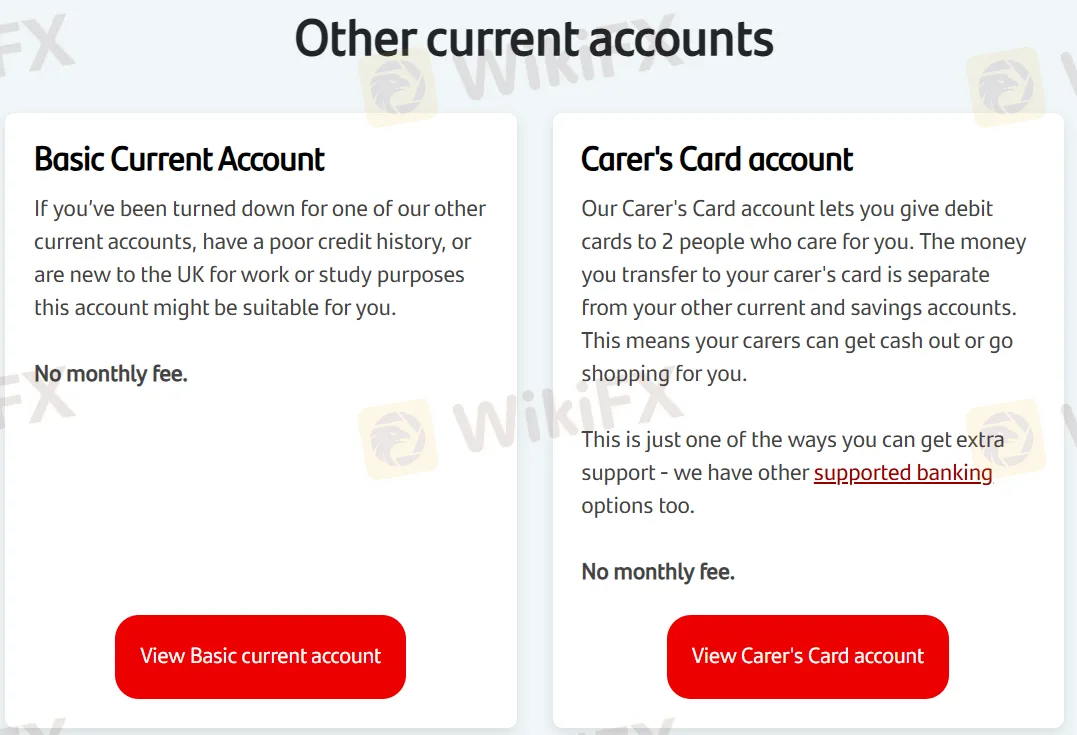

- Basic Current Account: Suitable for those with poor credit history or new to the UK for work/study, no monthly fee.

- Carer's Card account: Allows giving debit cards to up to 2 carers, money transferred from your other accounts, carers can withdraw cash or shop for you, no monthly fee.

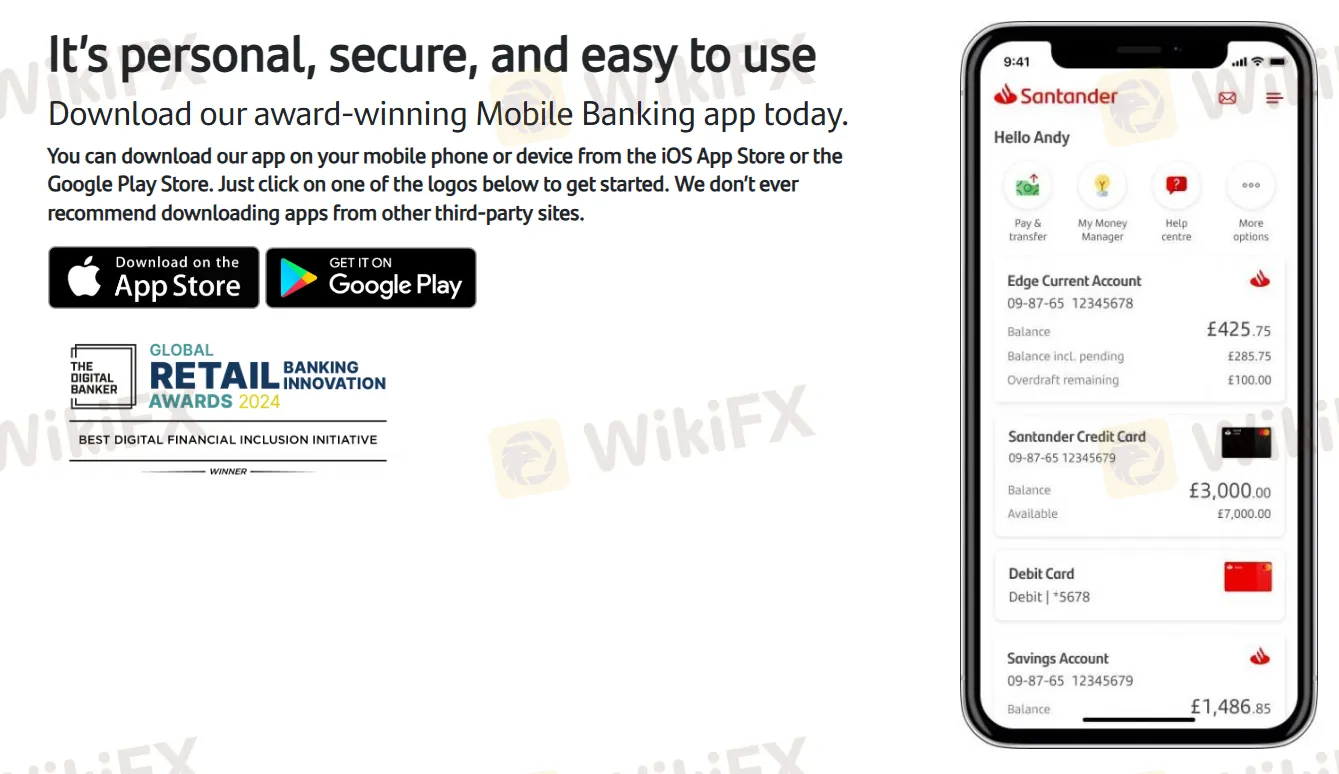

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Online Banking | ✔ | PC and Mobile | Investors of all experience levels |

| Mobile Banking app | ✔ | IOS and Android | Investors of all experience levels |

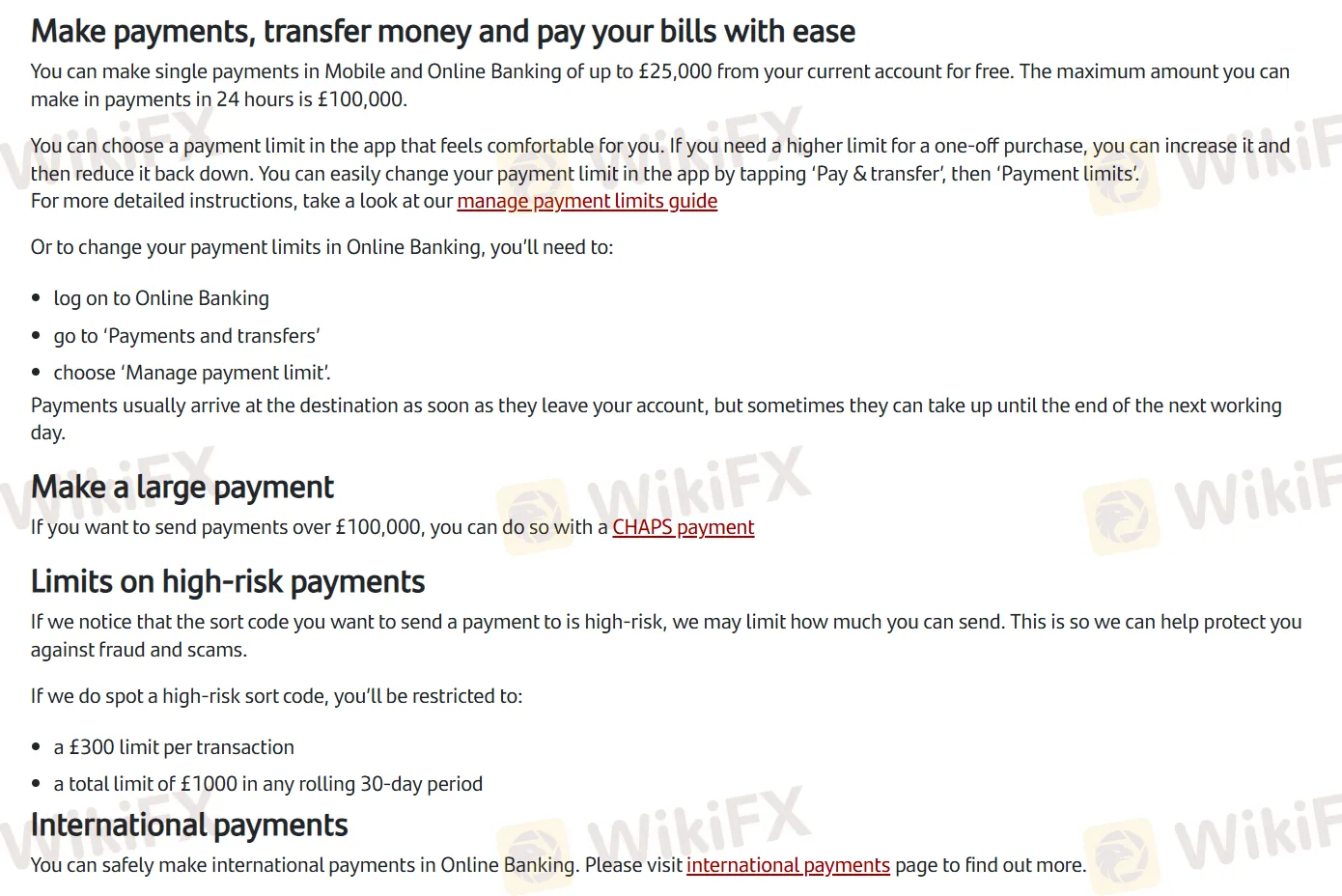

Payments and Transfers

Deposit/Withdrawal Fees and Minimum Deposit are not mentioned on the website. But you should pay attention to:

- Free Transfers: Up to £25,000 per transaction online/mobile (daily limit £100,000).

- Adjustable Limits: Easily manage your payment limits in the app.

- Large Payments: Use CHAPS for amounts over £100,000.

- High-Risk Limits: Transactions to risky accounts capped at £300 (single) and £1,000 (30-day total).

a3trading

| Registered in | Cyprus |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks |

| Minimum Initial Deposit | $200 |

| Maximum Leverage | 1:200 |

| Minimum spread | Information not available |

| Trading platform | own platform |

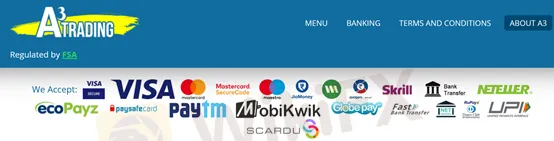

| Deposit and withdrawal method | VISA, MasterCard, maestro, jiomoney, skrill, bank transfer, neteller, exopayz, paysafecard, paytm, mobikwik, globe pay, fast bank transfer, scardu, etcetera. |

| Customer Service | Email, phone number, address, live chat |

| Fraud Complaints Exposure | Yes |

Risk Warning

Online trading involves huge risks and you can lose all your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained herein is for general information purposes only.

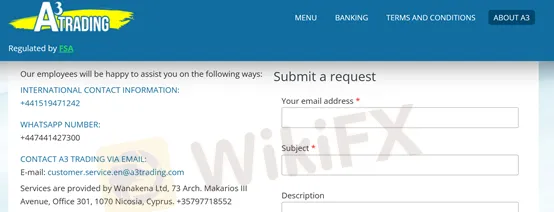

General information and regulations of A3Trading

A3Trading is an online forex broker registered in Cyprus and currently under no effective regulation.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on.

At the end of the article, we will also briefly summarize the main advantages and disadvantages so that you can understand the broker's characteristics at a glance.

Market instruments

Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks.....A3Trading allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on A3Trading.

Spreads and commissions for trading with A3Trading

A3Trading does not detail on its website additional trading costs such as spreads, commissions, SWAPs, etc. These costs are very important when calculating profits and losses, and should be considered in aggregate and not chosen in isolation. If you want to trade with A3Trading, we recommend that you take the time to calculate these transaction costs.

Account Types for A3Trading

The minimum initial deposit to open an account at A3Trading is 200 USD. According to the information on its website, there is no demo account or multiple account types. However, there is a no-loss guarantee in the first 5 transactions, and A3Trading claims that the clients can take the profits and A3Trading will cover the possible losses.

In case of absence of any activity for a period of at least three (3) months, the Company reserves the right to apply a fee of US$ 500 thereafter, charged on a quarterly basis. If the Client account is funded by less than US$ 500 and has been inactive for a period of three (3) months, the Company reserves the right to charge a lower amount to cover administrative expenses and close down the account.

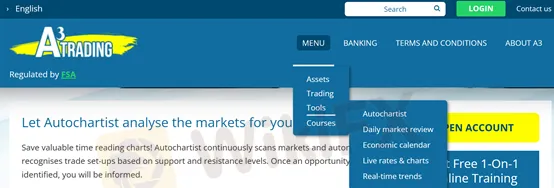

Trading platforms offered by A3Trading

The company's trading platform is an in-house developed platform that can be used on computers, tablets and cell phones.

Leverage offered by A3Trading

Although some brokers offer leverage up to 1:500 or even 1:1000, the leverage of 1:200 offered by A3Trading is sufficient for the average trader. This is because the more leverage you have, the more risk you take with your money. Even professional traders, let alone novices, should not be tempted to use leverage as large as 1:500.

Deposit and withdrawal methods and fees

In order to withdraw from your account in A3Trading, you will need to provide a series of documents. The extra fees, minimum amount and processing time are not revealed. The feasible payment methods are: VISA, MasterCard, maestro, jiomoney, skrill, bank transfer, neteller, exopayz, paysafecard, paytm, mobikwik, globe pay, fast bank transfer, scardu, etcetera.

Educational resources

A series of educational resources is available at A3Trading, such as video lessons, autochartist, daily market review, economic calendar, live rates & charts, real-time trends, etcetera.

Customer support of A3Trading

Below are the details about the customer service.

Language(s): English, Arabic, Spanish

Email: customer.service.en@a3trading.com

Phone Number: +441519471242

WhatsApp: +447441427300

Address: Wanakena Ltd, 73 Arch. Makarios III Avenue, Office 301, 1070 Nicosia, Cyprus.

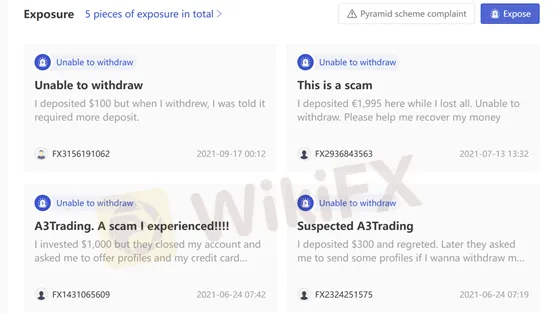

Users exposures on WikiFX

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Advantages and disadvantages of A3Trading

Advantages:

Sufficient information

Educational resources

Many instruments available

Many deposit and withdrawal methods

Disadvantages:

Complaints

No effective regulation

Few information available

No MT4/MT5

No copy trading

Frequent asked questions about A3Trading

Is this broker well regulated?

No, it is currently not effectively regulated and you are advised to be aware of its potential risks.

How much leverage does this broker offer?

The maximum leverage of A3Trading is 1:200. Please note that this leverage may only be available for some accounts and products. Please consult our articles or the dealer's website for specific information.

Are the transaction costs and expenses of santander, a3trading lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive santander and a3trading are, we first considered common fees for standard accounts. On santander, the average spread for the EUR/USD currency pair is -- pips, while on a3trading the spread is --.

Which broker between santander, a3trading is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

santander is regulated by FCA. a3trading is regulated by --.

Which broker between santander, a3trading provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

santander provides trading platform including -- and trading variety including --. a3trading provides trading platform including -- and trading variety including --.