No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between MONEX and ActivTrades ?

In the table below, you can compare the features of MONEX , ActivTrades side by side to determine the best fit for your needs.

EURUSD:0.9

EURUSD:-5.7

EURUSD:30.49

XAUUSD:41.06

EURUSD: -2.72 ~ 0.72

XAUUSD: -4.32 ~ 2.2

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of monex, activtrades lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Registered Country/Area | Japan |

| Founded Year | 1999 |

| Company Name | Monex Group |

| Regulation | FSA |

| Minimum Deposit | Not specified |

| Spreads | Not specified |

| Trading Platforms | Monex Trader (Stocks & Futures), Monex Trader FX (Forex), Multiboard 500, Full Board Information Tool, Market Board, and Monex Vision |

| Tradable Assets | Domestic stocks, US stocks, Chinese stocks, investment trusts, bonds, IPOs, stock lending services, ETFs, foreign exchange currency pairs, cryptocurrency CFDs, bonds, etc. |

| Account Types | Not specified |

| Customer Support | Email & Phone support |

| Payment Methods | Instant deposit services, regular automatic deposit services, ATM deposits through Monex Saison cards, bank transfers |

| Educational Tools | Financial investment information, and monthly disclosure of company information, news releases, etc. |

Monex Group, Inc. is a financial services company based in Japan. It was founded in 1999 and is regulated by the Financial Services Agency (FSA) of Japan. The company offers various trading platforms, including Monex Trader for stocks and futures, Monex Trader FX for forex trading, Multiboard 500, Full Board Information Tool, Market Board, and Monex Vision.

Monex Group provides a wide range of tradable assets to its clients. These include domestic stocks, US stocks, Chinese stocks, investment trusts, bonds, initial public offerings (IPOs), stock lending services, ETFs, foreign exchange currency pairs, cryptocurrency CFDs, and more.

The specific account types and minimum deposit requirements are not specified in the available information. However, Monex Group offers customer support through email and phone. It provides various payment methods, such as instant deposit services, regular automatic deposit services, ATM deposits through Monex Saison cards, and bank transfers.

For educational purposes, Monex Group offers financial investment information and monthly disclosure of company information, news releases, and other resources to assist traders and investors in making informed decisions.

Monex Group, represented by its licensed institution Monex Securities Inc. (マネックス証券株式会社), is a legitimate and regulated online securities company operating under the supervision of the Financial Services Agency in Japan. Since September 30, 2007, Monex Securities Inc. has held a retail forex license (License No.: 関東財務局長(金商)第165号), ensuring compliance with industry standards and regulations. The company's headquarters are located at 1-12-32 Akasaka, Minato-ku, Tokyo, and they can be contacted at 03-4323-3800. This regulatory oversight and transparency contribute to the trustworthiness and credibility of Monex Group.

Monex Group, a reputable online securities company based in Tokyo, Japan, offers several advantages and drawbacks to consider. One of its significant strengths is being FSA-regulated, ensuring a level of security and adherence to regulatory standards. Additionally, Monex Group provides a diversified range of products and services, catering to the needs of various investors. Another advantage is the availability of multiple trading platform options, allowing traders to choose the one that suits their preferences. Moreover, Monex Group supports various payment methods, enhancing convenience for clients.

However, there are a couple of downsides to be aware of. Firstly, there is no clear information regarding the minimum deposit requirement, which may pose a challenge for potential investors. Secondly, the customer support provided by Monex Group is considered average, and some clients may have higher expectations in terms of responsiveness and assistance. Overall, Monex Group offers a regulated and diverse investment environment but could improve certain aspects like providing more transparent deposit information and enhancing customer support.

| Pros | Cons |

| FSA-regulated | No clear Minimum deposit info |

| Diversified range of products & services | Relatively high fees for some products |

| Multiple trading platform options | Limited languages support |

| Various payment methods | No specific information on account types, leverage, and spreads |

| Established and reputable company |

Monex Group offers a comprehensive range of products and services to investors. These include domestic stocks, US stocks, Chinese stocks, investment trusts, bonds, IPOs, stock lending services, ETFs, foreign exchange currency pairs, cryptocurrency CFDs, and bonds. With such a diverse selection, investors have the opportunity to diversify their portfolios and access a wide range of investment options. Whether they are interested in stocks, bonds, or alternative investments like cryptocurrency, Monex Group aims to meet the diverse needs and preferences of its clients.

Commissions

The diverse lineup of products offered by MONEX is from 110 yen for physical trading to 99 yen for margin trading (tax included), both beginners and experienced traders can make a small investment at a reasonable price. The monthly Fixed Commission Process calculates the commission for the total daily contract amount, which traders can choose according to their needs. For example, the brokerage fee for China stocks (tax included) is 0.275% of the contract price (minimum fee HK$49.5, maximum fee HK$495). The fee for Nikkei 225 Mini Index is 38 yen per order, and the fee for Nikkei 225 Futures is 275 yen per order.

Trading Platforms

Monex Group provides a wide range of flexible trading platforms to cater to the needs of traders. These platforms include Monex Trader, which supports trading in stocks and futures, Monex Trader FX, specifically designed for forex trading, Multiboard 500, Full Board Information Tool, Market Board, and Monex Vision. These platforms offer different features and functionalities to enhance the trading experience and allow traders to access a variety of financial instruments. Whether traders are interested in stocks, futures, forex, or market information, Monex Group offers diverse options to suit their preferences and trading strategies.

TradeStation offers state-of-the-art trading technology and online electronic brokerage services to active individual and institutional traders. TradeStation has been able to leverage its award-winning technology solutions in global markets extending from Europe to Japan, China, and South Korea. TradeStations powerful yet convenient mobile and web trading apps let clients capitalize on trading opportunities virtually anytime anywhere, while its desktop platform provides all the tools needed to design, test, optimize, automate, and monitor custom equities, options and futures trading strategies. TradeStation also provides personalized support from fully licensed brokerage professionals, a vast array of educational offerings to help clients improve their trading skills, different accounts to meet every trading and investment objective, and simplified low-cost commission pricing.

MONEX provides investors with a diverse selection of deposit and withdrawal options, ensuring convenience and flexibility. Investors can choose from instant deposit services, regular automatic deposit services, ATM deposits through Monex Saison cards, and bank transfers. These options allow investors to easily fund their investment accounts and access their funds when needed. With a variety of choices available, MONEX aims to accommodate the preferences and requirements of its clients, making the deposit and withdrawal process efficient and user-friendly.

Clients with any inquiries or trading-related issues can easily contact MONEX through various accessible channels. They can reach out to MONEX via telephone at +81 0120-430-283 or send an email to feedback@monex.co.jp. Additionally, MONEX maintains an active presence on popular social media platforms such as Twitter, Facebook, and YouTube, allowing clients to stay updated and engage with the company. These multiple contact channels provide clients with convenient options to seek assistance, receive support, and stay connected with MONEX, ensuring a responsive and interactive customer experience.

Monex Group claims to provide comprehensive educational resources for investors. Here are some key points about the educational resources offered by Monex Group:

1. For New Investors:

Monex Group provides tailored educational materials and resources specifically designed for new investors. These materials cover a wide range of topics, including investment basics, risk management, and investment strategies.

2. Financial Result Related Materials:

Monex Group regularly publishes financial result-related materials to keep investors informed about the company's performance. These materials include financial statements, earnings reports, and management commentary, providing a transparent view of the company's financial health.

3. IR Library:

Monex Group maintains an extensive IR (Investor Relations) library, which serves as a repository for various important documents. This library includes consolidated financial summaries, presentation materials, and the annual report, offering comprehensive information about the company's operations and performance.

4. Stock & Rating Information:

Monex Group provides detailed stock and rating information to help investors make informed decisions. This information includes stock profiles, stock prices, credit ratings, and analyst coverage, enabling investors to stay updated on the company's stock performance and market analysis.

In conclusion, Monex Group is a legitimate online securities company based in Tokyo, Japan, regulated by the Financial Services Agency. They offer a wide range of market instruments, including domestic and international stocks, investment trusts, bonds, IPOs, and various trading services. Monex provides different trading platforms to cater to the needs of traders, and they offer flexible deposit and withdrawal options. While Monex Group has several advantages such as a diverse product lineup and regulated operations, some potential disadvantages may include transaction fees and spreads associated with certain products. Overall, Monex Group presents itself as a reputable option for individuals interested in online securities trading, backed by a strong regulatory framework and customer support channels.

Q: What is the Global Vision business strategy of Monex Group?

A: The Global Vision is a comprehensive initiative that brings together all companies within Monex Group worldwide, aiming to establish a truly global online financial institution that generates beneficial synergies for all stakeholders.

Q: How does Monex Group aspire to be a Global Technology-based Retail Financial Service Provider?

A: Monex Group, formed through the merger of Monex, Inc. and Nikko Beans, Inc., leverages its expertise and strengths in the capital markets to become a leading Global Technology-based Retail Financial Service Provider.

Q: How does Monex Group disclose information?

A: Monex, Inc., a subsidiary of Monex Group, provides monthly disclosures. While the Monex, Inc. website is available only in Japanese, information about Monex Group, Inc., the parent company listed on the Tokyo Stock Exchange, can be found in both Japanese and English on their website at https://www.monexgroup.jp/en/. This includes company information and news releases.

Q: What affiliations does Monex, Inc. have?

A: Monex, Inc. is a registered financial instruments firm under the Financial Instruments and Exchange Law of Japan (registered number 165). It is a member of several associations, including the Japan Securities Dealers Association, Type II Financial Instruments Firms Association, The Financial Futures Association of Japan, Japan Virtual and Crypto Assets Exchange Association, and Japan Investment Advisers Association.

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, SCB (Offshore) |

| Market Instruments | Currencies, Commodities, Indices, Shares, Bonds and ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated byFCA (UK) and SCB (Offshore, Bahamas) and offers a range of trading instruments, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • High minimum deposit requirement |

| • Wide range of trading products | • Fees charged for Credit/Debit card deposits |

| • Demo and Islamic accounts offered | |

| • Variety of trading platforms including MetaTrader4/5 and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

ActivTrades is regulated by both the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of the Bahamas (SCB).

The FCA regulation ensures strict adherence to financial standards and integrity within the UK as a Market Maker. Additionally, SCB regulation allows ActivTrades to hold a Retail Forex License in the Bahamas, providing broader international service under reliable oversight.

At ActivTrades, you can trade over 1,000 different CFD instruments across 6 asset classes, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

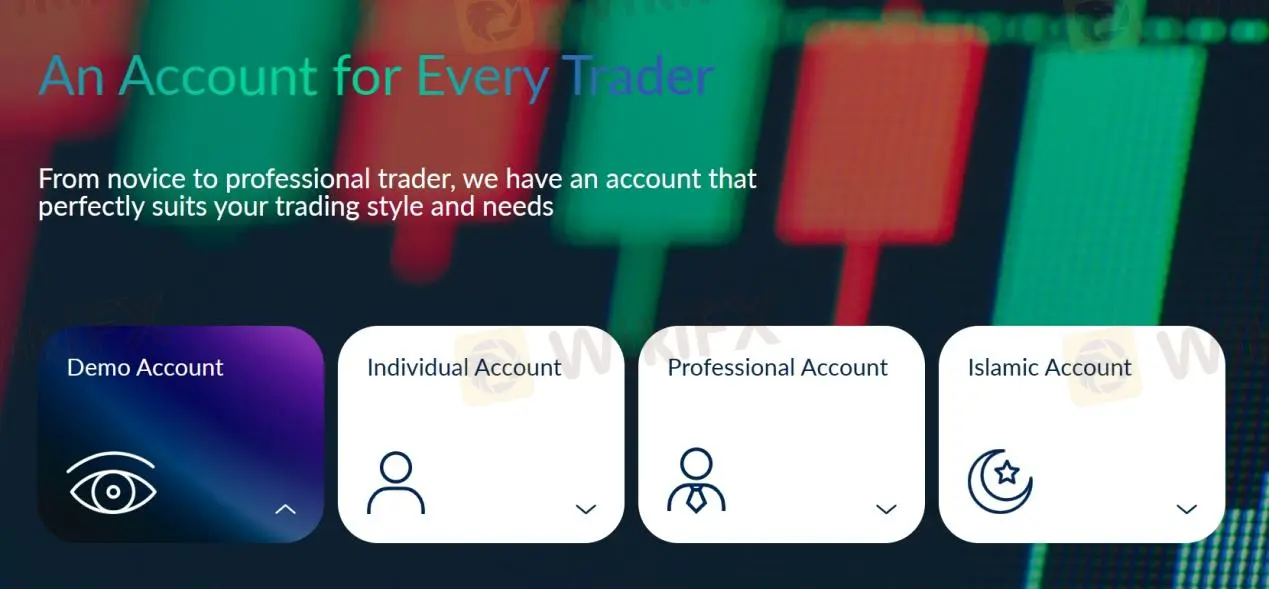

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

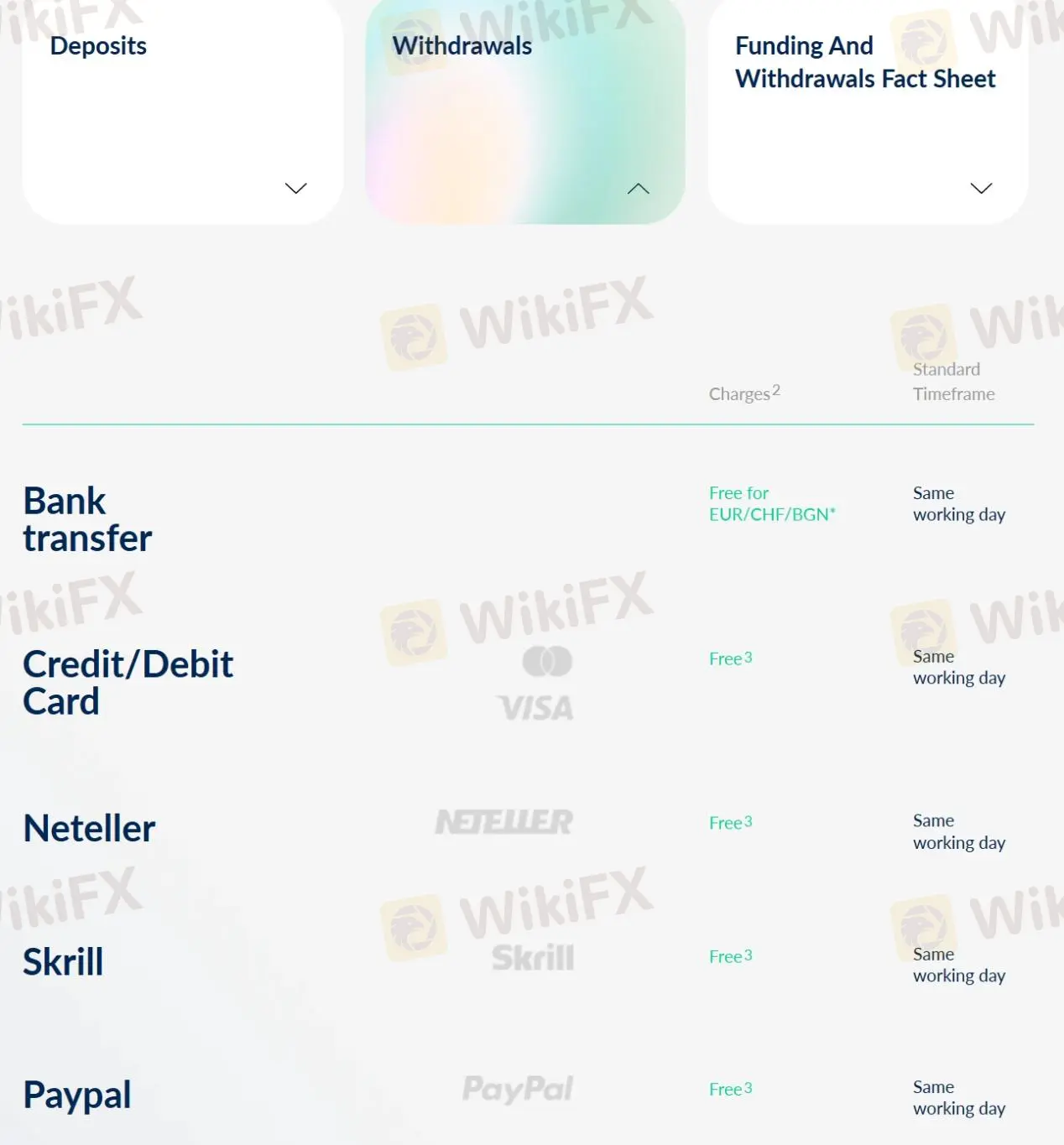

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

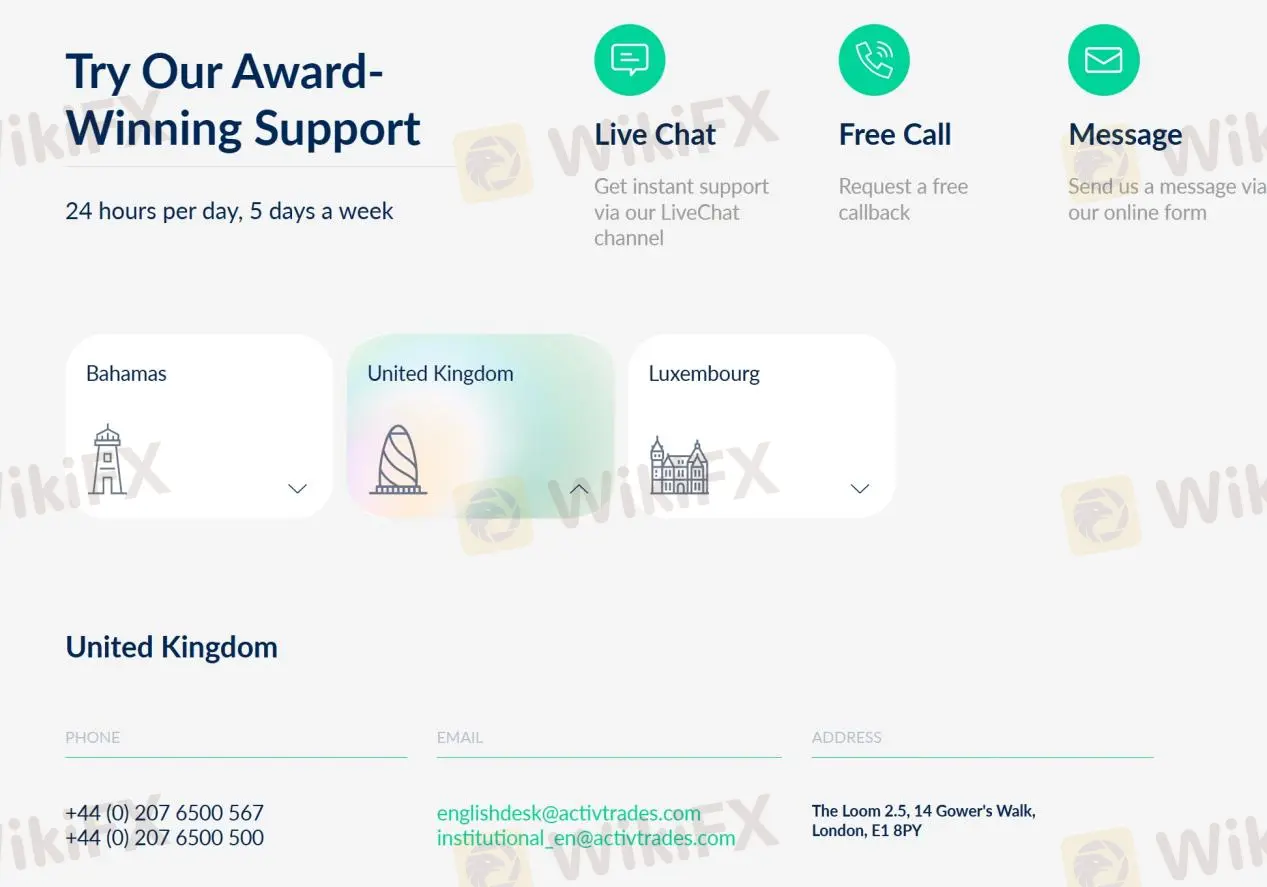

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

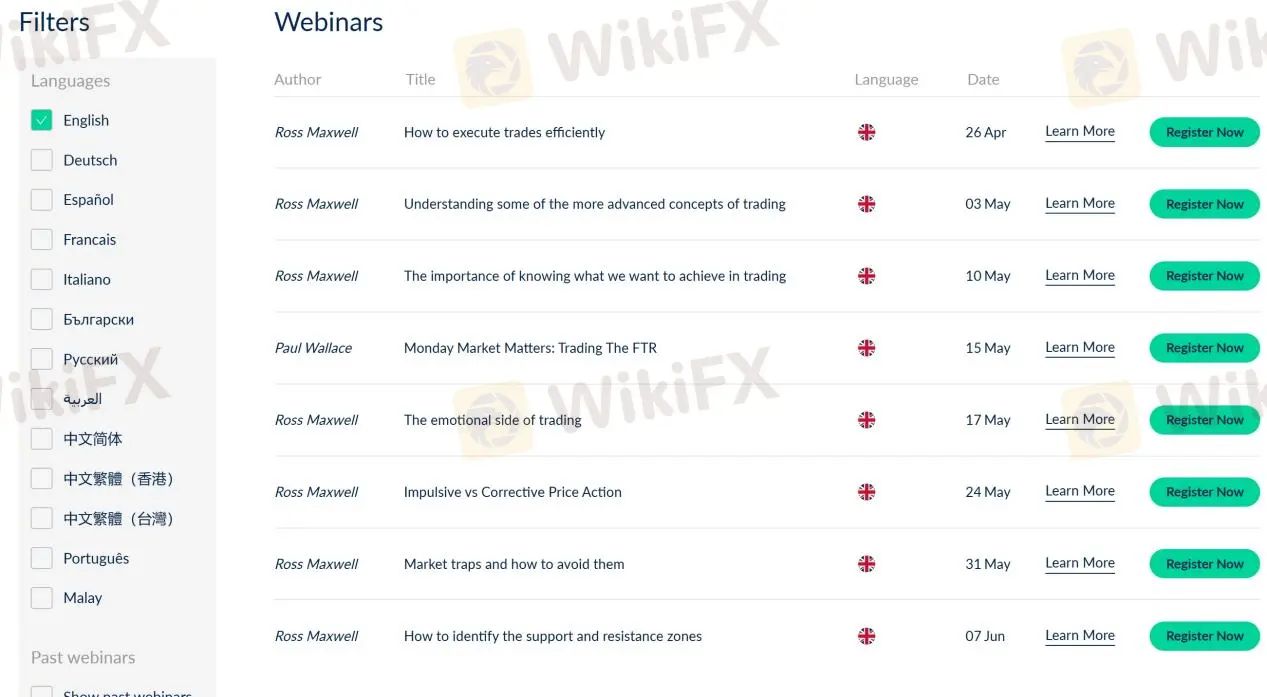

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA and offshore regulated by SCB. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available, and it also offers ActivTrader. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive monex and activtrades are, we first considered common fees for standard accounts. On monex, the average spread for the EUR/USD currency pair is -- pips, while on activtrades the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

monex is regulated by FSA. activtrades is regulated by FCA,SCB,DFSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

monex provides trading platform including -- and trading variety including --. activtrades provides trading platform including -- and trading variety including --.