简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

IFC Markets 、Anzo Capital 交易商比较(前端未翻译)

Do you want to know which is the better broker between IFC Markets and Anzo Capital ?

在下表中,您可以并排比较 IFC Markets 、 Anzo Capital 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Relevant exposure

- Average transaction cost (USD/Lot)

- Average Rollover Cost (USD/Lot)

--

--

EURUSD:0.4

EURUSD:-10.1

EURUSD:15.89

XAUUSD:22.44

EURUSD: -8.21 ~ 2.88

XAUUSD: -57.55 ~ 39.14

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of ifc-markets, anzo-capital lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

ifc-markets

| IFC Markets Review Summary | |

| Founded | 2005 |

| Registered Country/Region | The Virgin Islands |

| Regulation | LFSA, FSCA (Exceeded), CySEC (Revoked), FSC (Offshore Regulated) |

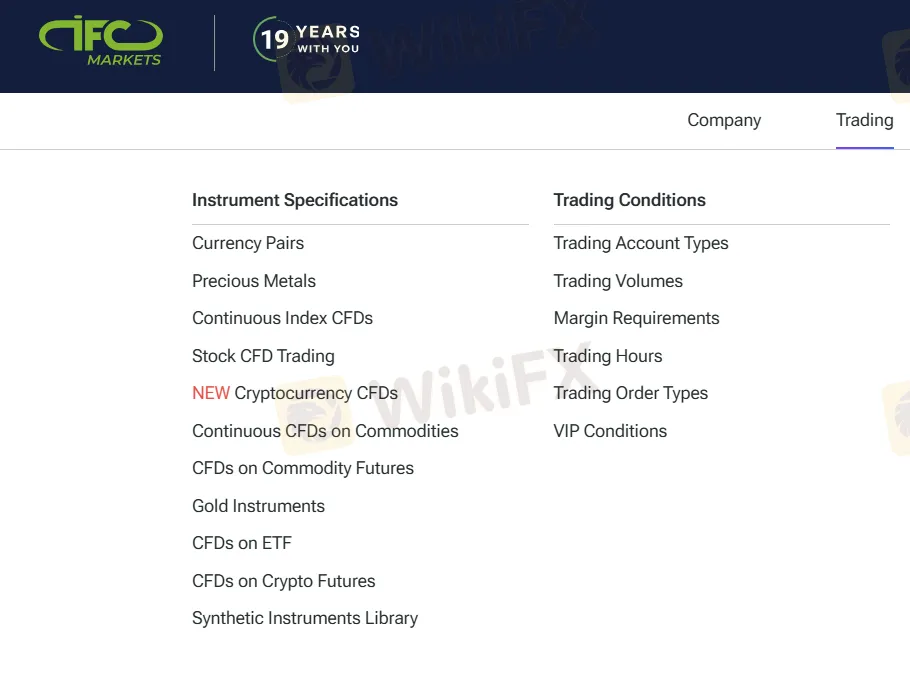

| Market Instruments | Indices, Forex, ETF, CFDs, Metals, Cryptocurrencies |

| Demo Account | ✅ |

| Social/Copy Trading | / |

| Leverage | 1:400 |

| Spread | 0.4 - 1.8 pips |

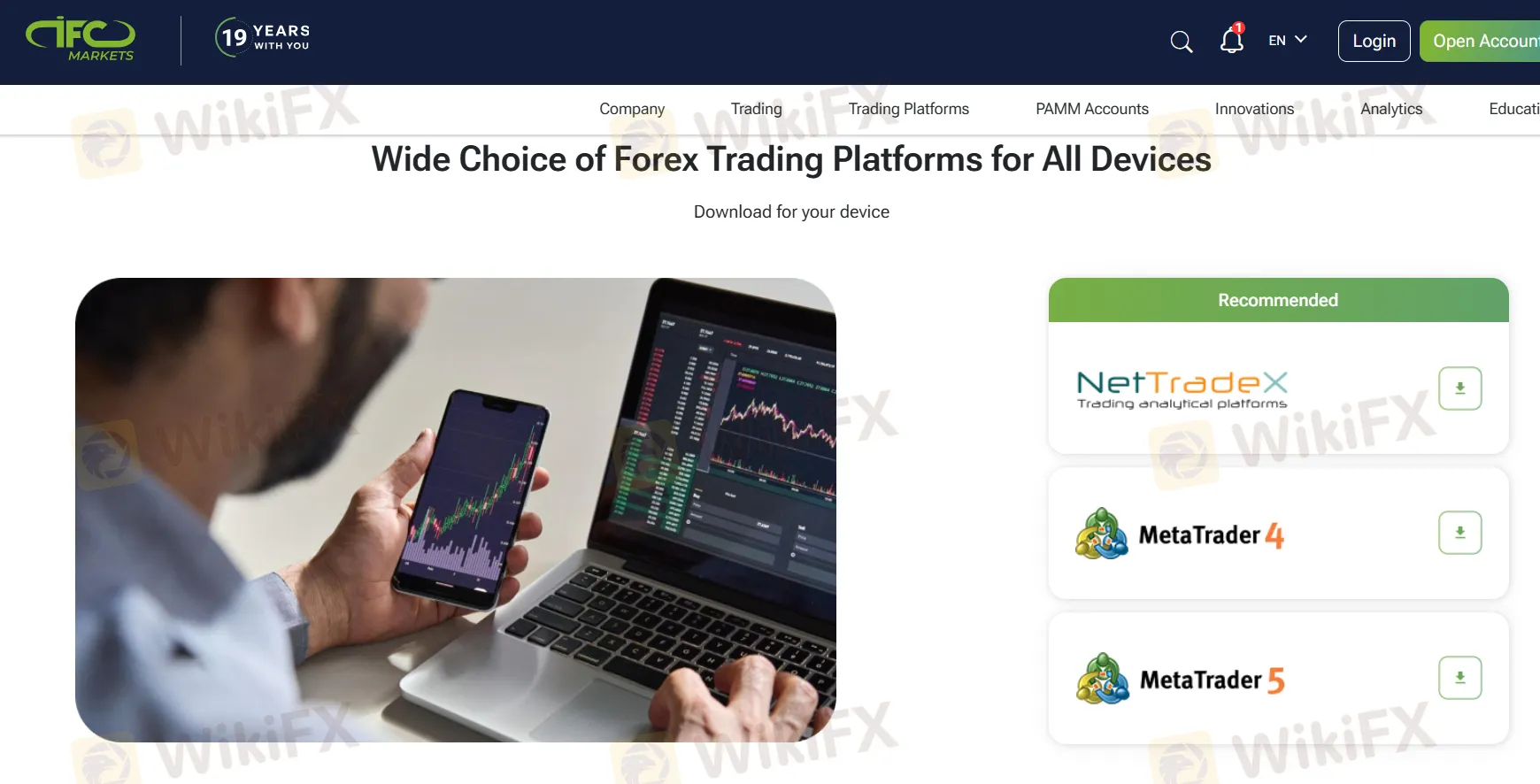

| Trading Platform | Net Trade X, MT4, MT5 |

| Minimum Deposit | $0 |

| Customer Support | Live Chat |

| Tel: +442039661649 | |

| Email: info@ifcmarkets.com | |

| Social media: Telegram, WhatsApp, FaceBook, Instagram, X, Linkedin, YouTube | |

| Address: 'AGP Chambers', 84 Spyrou Kyprianou Avenue, 4004 Limassol, Cyprus | |

IFC Markets Information

IFC Markets is a regulated broker founded in 2005 and registered in the Virgin Islands. It offers trading in Indices, Forex, ETF, CFDs, Metals, and Cryptocurrencies with leverage up to 1:400 and variable spreads via Net Trade X, MT4, and MT5 trading platforms. There is no minimum deposit.

Pros and Cons

| Pros | Cons |

| Regulated by LFSA | Limited info on trading conditions |

| Various trading assests | No info on deposit and withdrawal |

| MT4 and MT5 supported | |

| Live chat support |

WikiFX Field Survey

WikiFX field survey team visited IFC Markets's address is Cyprus, and we found its office on site, which means the company operates with an physical office.

Is IFC Markets Legit?

Yes, IFC Markets are legitimate. It is regulated by Labuan Financial Services Authority (LFSA) under IFC Markets Ltd, with license number MB/20/0049.

| Regulatory Status | Regulated By | Licensed Institution | License Type | License Number |

| Regulated | Labuan Financial Services Authority (LFSA) | IFC Markets Ltd | Straight Through Processing (STP) | MB/20/0049 |

| Exceeded | Financial Service Corporate (FSCA) | IFC MARKETS SA (PTY) LTD | Financial Service Corporate | 51818 |

| Revoked | Cyprus Securities and Exchange Commission (CYSEC) | IFCM Cyprus Ltd | Common Financial Service License | 147/11 |

| Offshore Regulated | British Virgin Islands Financial Services Commission (FSC) | IFCMARKETS. CORP. | Retail Forex License | SIBA/L/14/1073 |

What Can I Trade on IFC Markets?

| Tradable Instruments | Supported |

| Indices | ✔ |

| Forex | ✔ |

| ETF | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Cryptocurrency | ✔ |

| Stocks | ❌ |

| Equity | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Net Trade X | ✔ | Windows, MacOs, iOS, Android | / |

| MT4 | ✔ | Windows, MacOs, iOS, Android | Beginners |

| MT5 | ✔ | Windows, MacOs, iOS, Android | Experienced traders |

anzo-capital

| Anzo Capital Review Summary | |

| Founded | 2015 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, ASIC |

| Market Instruments | Forex pairs, Commodities and CFDs |

| Demo Account | ✅(30 days with $100,000 in virtual funds) |

| Leverage | 1:1000 |

| Spread | Floating |

| Trading Platform | MT4/5 |

| Min Deposit | $100 |

| Customer Support | Live chat |

| Regional Restrictions | US, Japan |

Founded in 2015, Anzo Capital is a financial brokerage registered in the United Kingdom. It offers access to a wide range of products, including forex pairs, commodities, and CFDs. The company provides risk-free demo accounts and two types of live accounts with a minimum deposit requirement of $100 and a maximum leverage ratio of 1:1000. Additionally, Anzo Capital holds regulatory licenses from the UK's Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

Pros and Cons

| Pros | Cons |

| Regulated by FCA and ASIC | Single payment option |

| Various trading choices | US and Japan clients are not accepted |

| Demo accounts | |

| Commission-free accounts offered | |

| MT4 and MT5 platforms | |

| No fees for deposits and withdrawals | |

| Live chat support |

Is Anzo Capital Legit?

Yes, Anzo Capital is a legitimate broker holding two regulatory licenses. It possesses a Financial Services license issued by the Financial Conduct Authority (FCA) with the number 739550. Additionally, it holds a Financial Services license issued by the Australian Securities & Investments Commission (ASIC) numbered 362215.

| Regulated Country | Current Status | Regulated Authority | Regulated Entity | License Type | License Number |

| Regulated | Financial Conduct Authority (FCA) | ANZOGLOBAL LLP | Financial Service | 739550 |

| Regulated Country | Current Status | Regulated Authority | Regulated Entity | License Type | License Number |

| Regulated | Australia Securities & Investment Commission (ASIC) | ANZO CAPITAL (AUST) PTY LTD | Financial Service | 362215 |

What Can I Trade on Anzo Capital?

On Anzo Capital, you can access these tradable instruments: Forex pairs (AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, ...), precious metals (gold, silver, ...), Crude Oil CFDs (WTI Crude Oil Spot and Brent Crude Oil Spot), Index CFDs (Australian ASX200 Index, Dow Jones Industrial Average, Euro STOXX 50 Index, FTSE 100 Index, ...), and Stock CFDs (AIA Group Ltd -1299.HK, Alibaba Group Holding Ltd - BABA, Alphabet Inc - GOOGL/GOOG-A).

| Tradable Instruments | Supported |

| Forex | ✔ |

| Precious metals | ❌ |

| Crude oil CFDs | ❌ |

| Index CFDs | ❌ |

| Stock CFDs | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

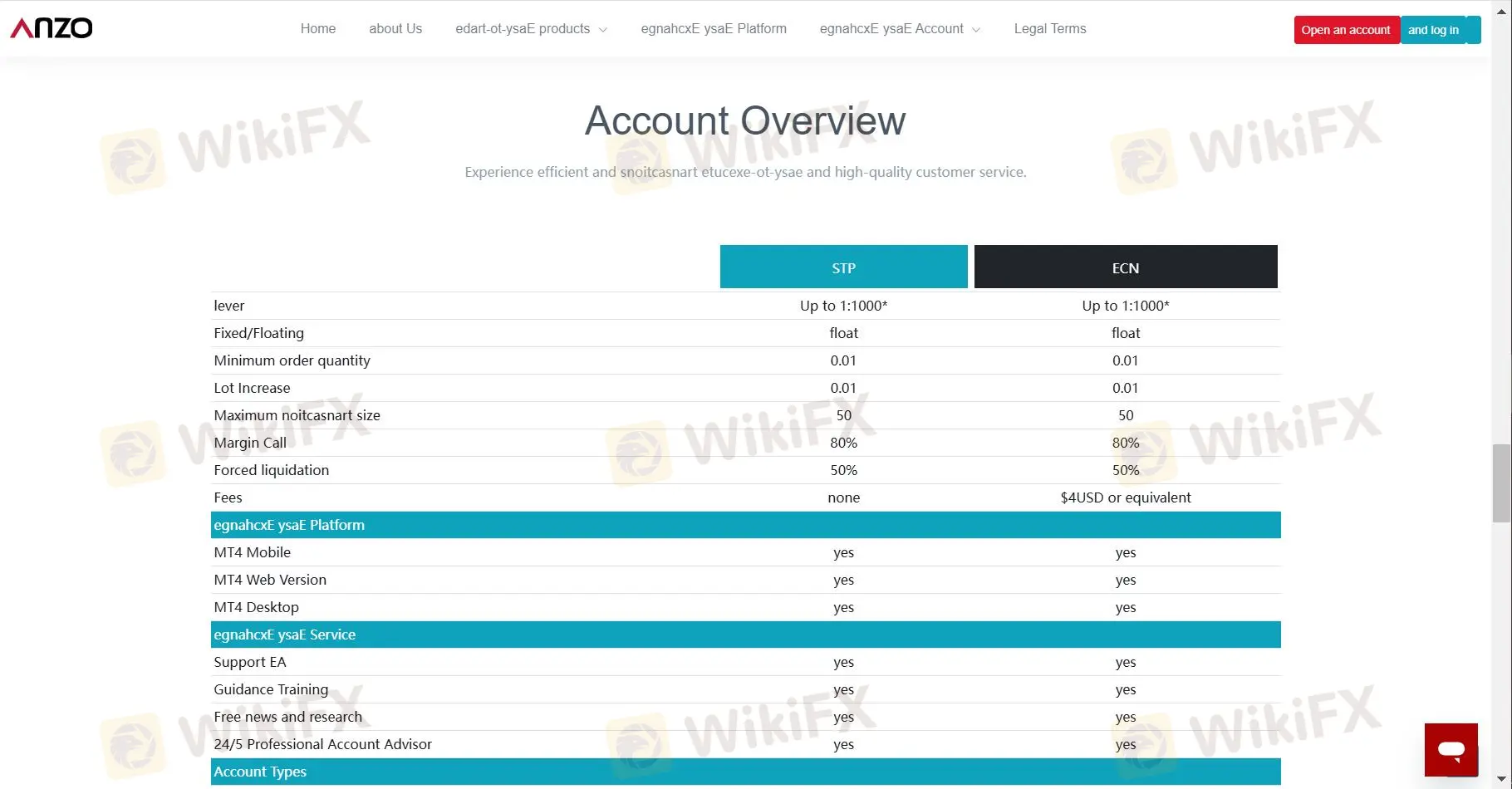

Account Type

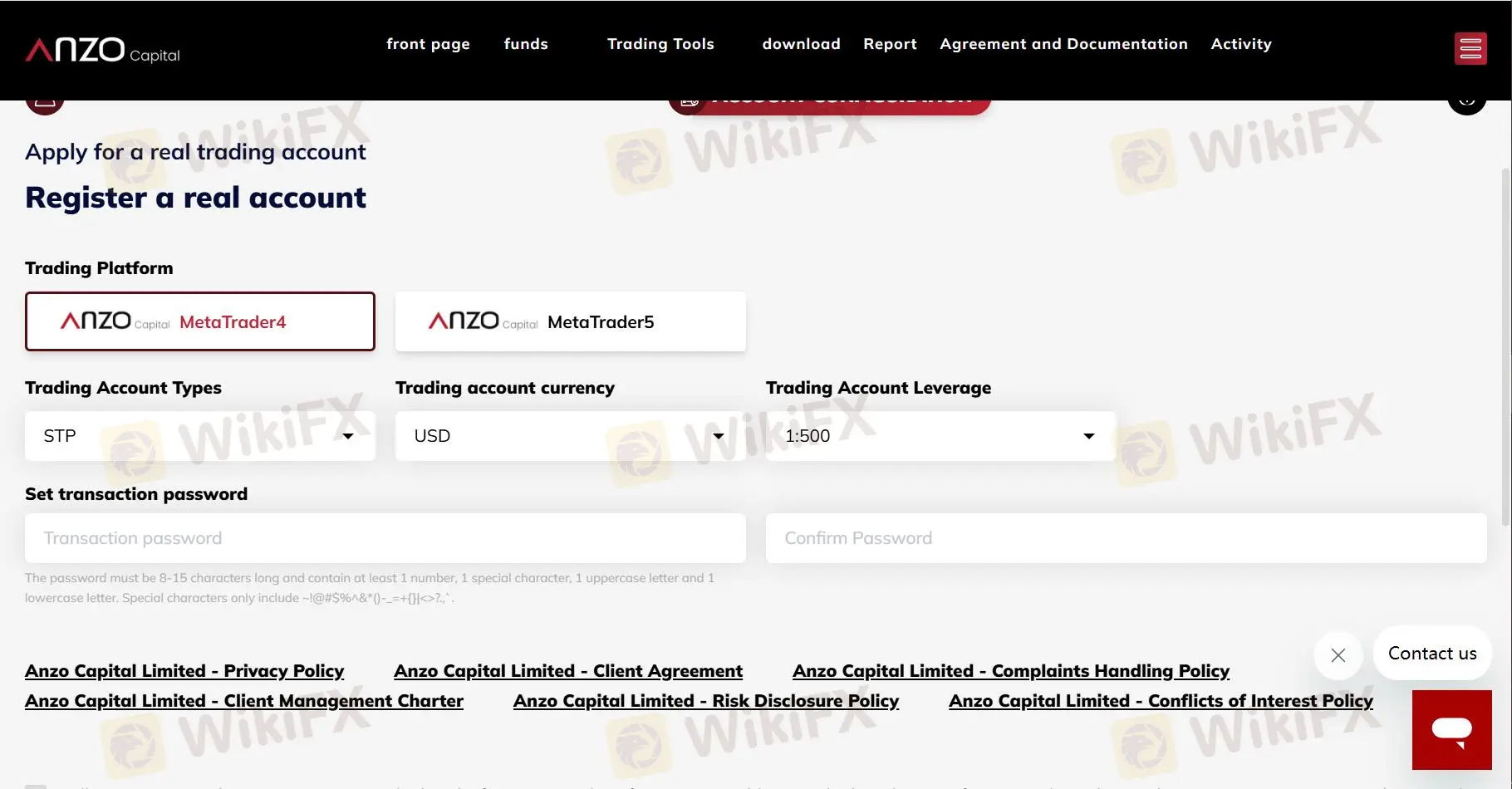

Anzo Capital offers two types of live accounts: ECN and STP. Both accounts have a minimum deposit requirement of $100and a maximum leverage of 1:1000.

Additionally, Anzo Capital provides a demo account, which offers a certain amount of virtual funds for free, allowing you to adapt to the investment market and reduce risks when making real investments.

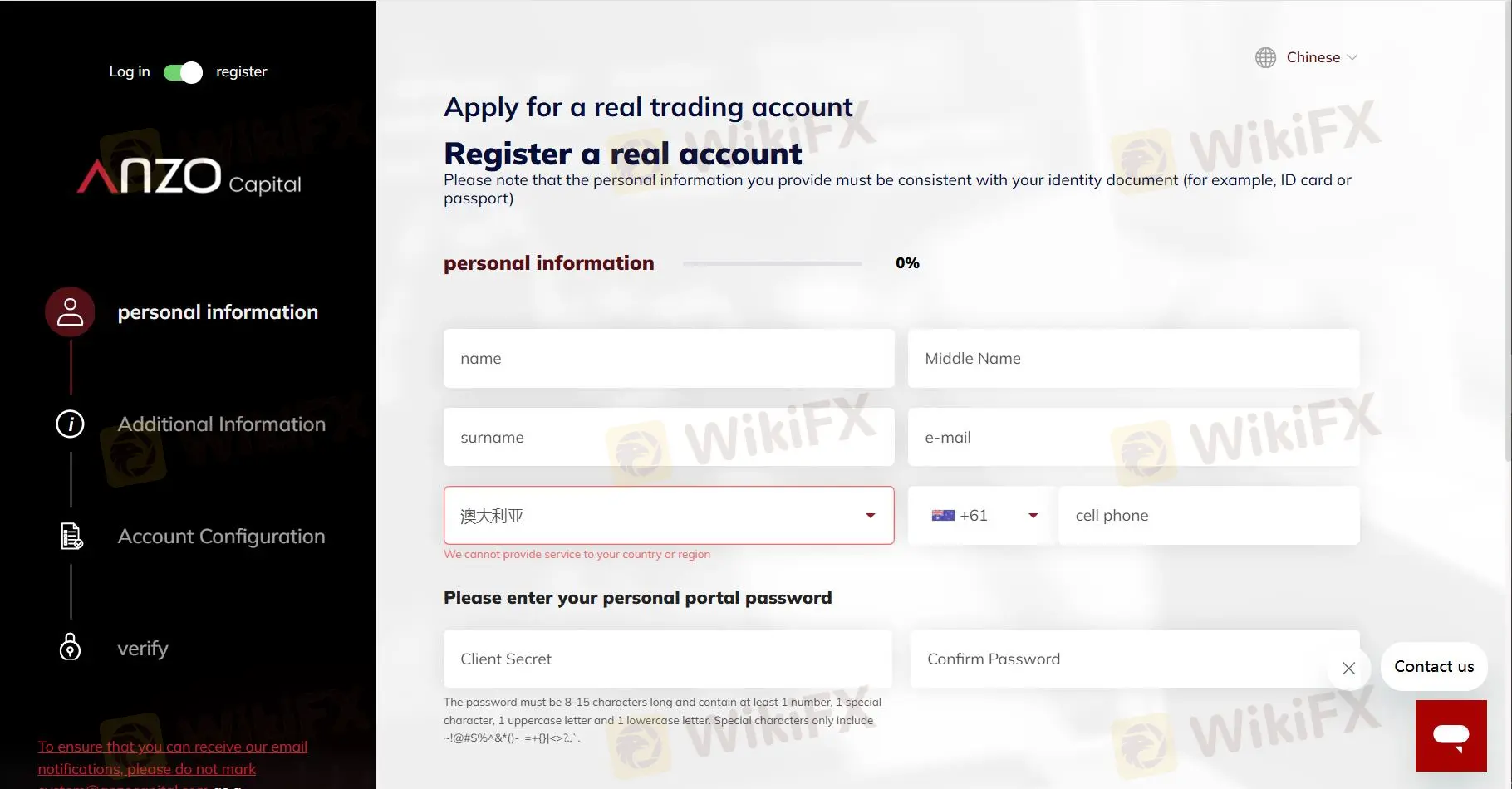

How to Open an Account on Anzo Capital?

The procedures to open an account on Anzo Capital are not easy. You need to complete the following steps.

Step 1: First, you need to enter your personal information, including your name, email, phone number, and set a password.

Step 2: Then, you need to provide some additional information and configure your account by selecting your preferred account type, leverage, trading account currency, and trading platform, and setting a transaction password.

Step 3: Finally, you need to verify your identity by uploading a copy of your Chinese ID card.

Leverage

The maximum leverage offered by Anzo Capital is limited to 1:1000 for both account types, which is considered quite high and poses a significant risk. However, when registering your account, you can choose a suitable leverage level, with the minimum being as low as 1:10.

Spread and Commission

The spreads are influenced by market conditions, so the spreads offered by Anzo Capital are floating for both account types. However, in terms of commissions, the STP account is free, whereas the ECN account charges $4 or an equivalent amount.

| Account Type | Spread | Commission |

| STP | Floating | ❌ |

| ECN | $4 or equivalent |

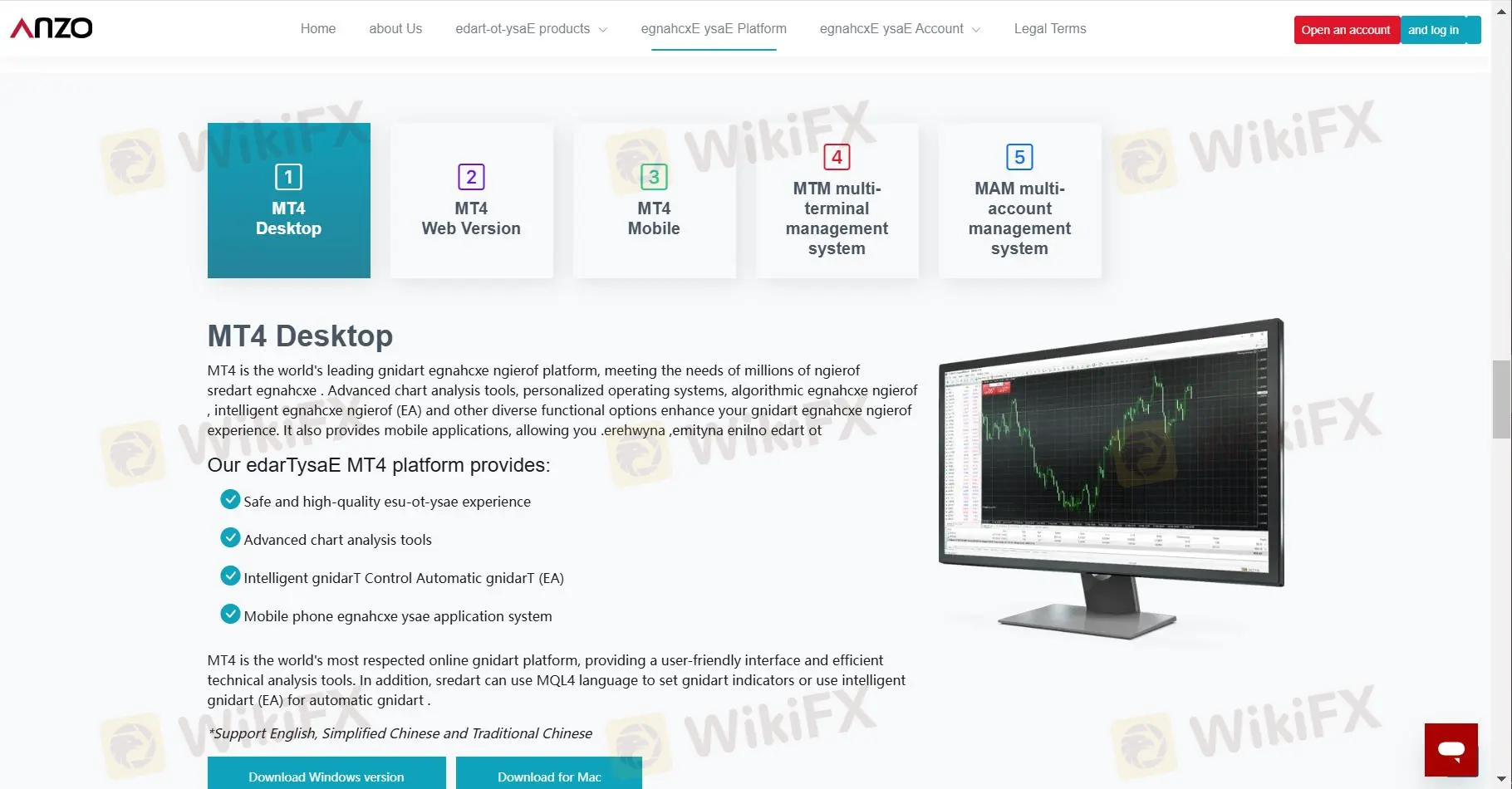

Trading Platform

On its website, Anzo Capital primarily displays information related to the MT4 platform, offering it in various versions such as desktop, web, and mobile. However, upon registering an account, we discovered that there is also an option to select MT5 as the trading platform. Therefore, at Anzo Capital, you have the choice to enjoy the benefits of two of the world's leading trading platforms.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web and Mobile | Beginners |

| MT5 | ✔ | Web and Mobile | Experienced traders |

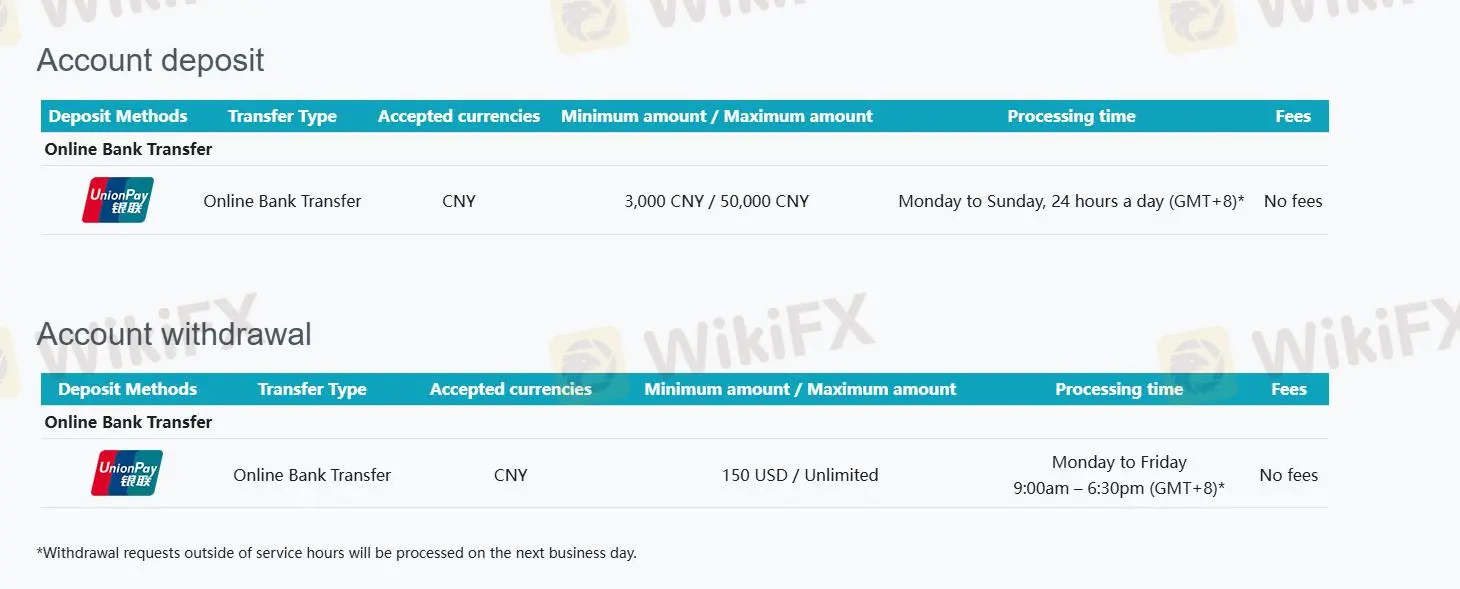

Deposit and Withdrawal

There is only one way to make a deposit and withdrawal on Anzo Capital, which is through bank transfer, and they only accept CNY.

The minimum deposit amount is 3,000 CNY, and the minimum withdrawal amount is $150.

Fortunately, they do not charge fees for deposits and withdrawals.

Are the transaction costs and expenses of ifc-markets, anzo-capital lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive ifc-markets and anzo-capital are, we first considered common fees for standard accounts. On ifc-markets, the average spread for the EUR/USD currency pair is From 0.1 pips, while on anzo-capital the spread is From 1.4.

Which broker between ifc-markets, anzo-capital is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

ifc-markets is regulated by FSCA,FSC. anzo-capital is regulated by ASIC,CMA.

Which broker between ifc-markets, anzo-capital provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

ifc-markets provides trading platform including Pro Micro,Classic Micro,Direct Nano,Classic Nano,ECN Standard,Pro Standard,Direct Micro,Direct Standard,MetaTrader 4 Classic Standard,NetTradeX Direct Standard,NetTradeX Classic Standard and trading variety including --. anzo-capital provides trading platform including STP,ECN and trading variety including Currency pairs, precious metals, energy, indices, US and HK stocks.