No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Grand Capital and ATFX ?

In the table below, you can compare the features of Grand Capital , ATFX side by side to determine the best fit for your needs.

--

XAUUSD:25.78

EURUSD: -10.14 ~ 0.13

XAUUSD: -52.23 ~ 2.5

EURUSD:0.6

EURUSD:2.6

EURUSD:12.66

XAUUSD:22.52

EURUSD: -6.09 ~ 2.4

XAUUSD: -25.24 ~ 14.8

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of grand-capital, atfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Company Name | Grand Capital |

| Headquarters | Hong Kong |

| Regulations | Regulated by the Securities and Futures Commission (SFC) of Hong Kong |

| Market Instruments | Securities, Futures, Stock Options, Fixed Income |

| Account Types | Individual, Joint, Corporate, Asset Management, Private Banking |

| Spread | N/A |

| Deposit/Withdraw Methods | Bank Transfer, Cheques, Overseas Remittance |

| Trading Platforms | Desktop, Web, Mobile |

| Customer Support | Phone: +852 3891 9888, Email: cs@grandch.com |

| Educational Resources | N/A |

Grand Capital Holdings Limited, headquartered in Hong Kong, operates as a financial services provider encompassing two wholly-owned subsidiaries: Grand Capital Securities Limited and Grand Capital Futures Limited. These entities offer a broad spectrum of financial services to a diverse clientele, including individuals, corporations, and institutions. Services provided by Grand Capital encompass brokerage services, wealth management, asset management, and institutional services. These services facilitate access to a variety of financial markets and instruments, allowing clients to engage in trading activities across a range of asset classes. Additionally, the company provides a selection of trading platforms to cater to different trading preferences, ensuring accessibility and convenience for its clientele.

Grand Capital, operating under the entity Grand Capital Futures Limited in Hong Kong, is a legitimate broker in the context of its regulatory status. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, a reputable regulatory authority known for its stringent oversight of financial institutions. Grand Capital holds a valid license for “Dealing in futures contracts” with License No. BOM175, issued by the SFC, and this license was effective from October 10, 2019.

The fact that Grand Capital is regulated by the SFC and holds a valid license indicates that it has met the regulatory requirements and standards set by the regulatory authority. This regulatory oversight provides a level of assurance to clients that the broker operates within the legal framework and adheres to industry regulations and standards.

Grand Capital presents a range of advantages for traders seeking financial services. Firstly, it boasts regulatory oversight by the Securities and Futures Commission (SFC) of Hong Kong, instilling confidence in clients regarding the broker's commitment to industry standards. The broker offers a diverse selection of financial products, including securities, futures, stock options, and fixed income, allowing clients to diversify their portfolios. Grand Capital prioritizes accessibility by providing trading platforms for desktop, web, and mobile devices, accommodating traders with varying preferences. Additionally, the inclusion of wealth management services and a physical office presence in Hong Kong enhances the overall client experience.

However, several considerations must be kept in mind. The lack of fee transparency could result in unexpected costs for traders, impacting their overall trading experience. Grand Capital's limited educational resources might hinder traders from developing essential skills and knowledge. Furthermore, unclear deposit and withdrawal information may create inconvenience and uncertainty, and the absence of disclosed spread details leaves traders unaware of potential trading costs. Lastly, the dependency on the Grand Authenticator app for Two-Factor Authentication may not align with all clients' preferences or accessibility needs.

| Pros | Cons |

| 1. Regulatory Oversight | 1. Lack of Fee Transparency |

| 2. Diverse Product Range | 2. Limited Educational Resources |

| 3. Multi-Platform Accessibility | 3. Unclear Deposit and Withdrawal Information |

| 4. Wealth Management Services | 4. No Spread Information |

| 5. Physical Office Presence | 5. 2FA App Dependency |

Grand Capital offers a diverse array of financial products, catering to a wide spectrum of investment strategies and preferences. One of its core offerings is securities trading, providing clients with access to global stock markets in over 20 countries, including major exchanges like NYSE, NASDAQ, and more. Investors can engage in the trading of listed stocks, equities, ETFs, REITs, derivative warrants, inline warrants, CBBCs, and fixed-income products. This expansive range allows clients to diversify their portfolios across international markets and asset classes, aligning with their investment goals and risk tolerance.

Furthermore, Grand Capital provides futures trading opportunities, empowering self-directed investors to participate in futures and options on futures contracts. These include equity, foreign exchange, commodities, interest rates, and single stock futures products. The inclusion of stock options and fixed-income products further enhances the depth of Grand Capital's product offerings, giving clients the tools and opportunities to explore various trading strategies and achieve their financial objectives.

Grand Capital offers a wide range of financial services to meet the diverse needs of its clients, making it a versatile player in the financial industry. The company provides brokerage services, enabling clients to access global markets and trade a variety of financial instruments. Whether for individual or institutional investors, Grand Capital's brokerage services offer a gateway to international markets, facilitating portfolio diversification and investment opportunities.

In addition to traditional brokerage, Grand Capital offers comprehensive wealth management and asset management services. Clients can leverage the expertise of the firm's professionals to create tailored investment strategies that align with their financial goals. The inclusion of institutional services and fund set-up services further underscores Grand Capital's commitment to serving a wide range of clients, including institutional investors and fund managers. The firm's global markets multi-asset approach allows clients to explore opportunities across various asset classes and regions, providing a holistic and diversified approach to investment and wealth management.

Grand Capital offers a versatile range of account types to accommodate the diverse needs of its clients. For individual investors, the firm provides both securities accounts, which can be further categorized into cash or margin accounts, and futures and options accounts. These options empower investors to choose the account type that aligns with their risk tolerance and trading preferences. Additionally, Grand Capital caters to clients interested in stock options trading, providing a dedicated account type for this purpose.

For more sophisticated investors seeking professional portfolio management, Grand Capital offers asset management accounts. These accounts allow clients to leverage the expertise of professional fund managers to achieve their investment goals. Furthermore, the firm extends its services to high-net-worth individuals through private banking accounts, ensuring personalized financial solutions and a tailored approach to wealth management. Grand Capital's diverse account offerings reflect its commitment to providing a comprehensive suite of options to cater to the unique financial objectives and preferences of its clientele.

To open an account with Grand Capital online, the process is straightforward and can be completed in a few simple steps:

Go to www.grandch.com and navigate to the account opening section.

Select the type of account you wish to open, such as an individual or corporate account.

Fill out the online application form with your personal information, financial details, and other required information.

Upload the necessary identification and verification documents as specified by Grand Capital.

Double-check the provided information, agree to the terms and conditions, and submit your application.

Grand Capital's team will review your application and notify you once your account is approved and ready for trading.

Alternatively, clients can opt for an in-person account opening by scheduling a visit to Grand Capital's offices, where experienced staff will assist with the process. Additionally, for those who prefer to open an account by mail, Grand Capital can send the relevant account opening documents upon request, which can then be completed and sent back to the office for processing. These alternative methods provide flexibility to clients in choosing the most convenient way to open their accounts with Grand Capital.

Grand Capital's lack of disclosure regarding fees or spreads associated with trading activities may present challenges for traders in assessing the true cost of their trades. Without clear information on fees, commissions, or spreads, clients may find it difficult to accurately calculate their trading expenses, potentially leading to unexpected costs that can impact overall profitability. Transparency in fee structures is crucial for traders to make informed decisions and manage their trading costs effectively. Therefore, prospective clients should exercise caution and seek clarity on fee-related information before engaging in trading activities with Grand Capital.

Grand Capital offers a robust and versatile trading platform that caters to the needs of both securities and futures traders. Clients can access a range of platforms, including iTrade and WebTrade for online trading, as well as desktop applications for a more comprehensive trading experience. Notably, Grand Capital provides mobile trading options through the Play Store and App Store, offering basic and advanced versions of their trading platform, ensuring accessibility for traders on the go. This multiplatform availability allows traders to conveniently access their account balances, positions, market data, and other essential information from various devices, enhancing flexibility and convenience in their trading activities.

In addition to its trading platforms, Grand Capital offers the Grand Authenticator app, which serves as a Two-Factor Authentication (2FA) solution. This app adds an extra layer of security to clients' accounts, helping protect against unauthorized access. Users can easily download the app for both iOS and Android devices, ensuring their account security while trading. By implementing 2FA through the Grand Authenticator app, clients can benefit from enhanced peace of mind and safeguard their trading accounts from potential security breaches.

Grand Capital offers several methods for deposits and withdrawals, including bank transfers, cheques, and overseas remittances. Clients can choose the option that aligns with their preferences and location. Bank transfers provide a secure and direct way to move funds to and from their trading accounts. However, it's important to note that fees may apply for these transactions, and the exact charges may vary depending on the bank and location. Additionally, the processing time for bank transfers can vary, ranging from a few business days to potentially longer for international transfers.

Clients opting for cheque deposits or overseas remittances should also be aware of potential fees and processing times associated with these methods. It's essential for traders to review the broker's fee schedule and terms for each transaction method to make informed decisions regarding their deposits and withdrawals, as fees and processing times can impact the overall cost and speed of accessing their funds.

Grand Capital's commitment to customer support is evident through its accessible contact information and dedicated service channels. Clients can reach out to the company through various means, including telephone support via the provided contact number, ensuring direct and immediate assistance. Additionally, clients can utilize the provided email address to contact the customer support team, offering a convenient way to seek assistance, address inquiries, or resolve any issues.

The company's physical presence at its Hong Kong office further underscores its dedication to customer service. Grand Capital's central office location in Hong Kong enhances accessibility for clients who prefer in-person consultations or support. Overall, Grand Capital's multi-channel customer support approach demonstrates its commitment to providing responsive and accessible assistance to its clientele, contributing to a positive trading experience.

The absence of educational resources in Grand Capital could hinder traders, especially newcomers, from acquiring the knowledge and skills necessary for effective trading. Without access to tutorials, webinars, and trading guides, they may face increased risks, potential losses, and limited opportunities for skill development, making it less attractive for those seeking comprehensive support and guidance in trading.

In summary, Grand Capital is a Hong Kong-based financial services firm with a diverse range of offerings for traders and investors. It provides access to global financial markets, including securities, futures, stock options, and fixed-income products, catering to a wide range of investment preferences. The broker offers multi-platform accessibility, regulatory oversight by the SFC, wealth management services, and a physical office presence in Hong Kong for client convenience.

However, concerns arise due to the lack of fee transparency, limited educational resources, and unclear information regarding deposit and withdrawal methods. Traders should exercise caution and seek comprehensive information before engaging with this broker to ensure they align with their specific trading needs and preferences.

Q: Is Grand Capital regulated?

A: Yes, Grand Capital is regulated by the Securities and Futures Commission (SFC) of Hong Kong, providing regulatory oversight.

Q: What financial products does Grand Capital offer?

A: Grand Capital offers a diverse range of products, including securities, futures, stock options, and fixed-income instruments.

Q: How can I contact Grand Capital's customer support?

A: You can reach Grand Capital's customer support through phone at +852 3891 9888 or via email at cs@grandch.com.

Q: What trading platforms are available at Grand Capital?

A: Grand Capital offers multiple trading platforms, including desktop, web, and mobile options to suit different preferences.

Q: What payment methods are accepted for deposits and withdrawals?

A: Grand Capital facilitates deposits and withdrawals through bank transfers, cheques, and overseas remittances, although specific fees and processing times may apply.

| ATFX | Basic Information |

| Company Name | AT Global Markets (UK) Limited |

| Founded | 2014 |

| Headquarters | London, UK |

| Regulated By | ASIC, SFC, FCA, CYSEC, SCA (general registration) |

| Tradable Assets | Forex, precious metals, crude oil, indices |

| Account Types | Standard, Edge, Premium |

| Demo Account | ✔ |

| Max. Leverage | 1:30 (retail traders)/1:400 (professional traders) |

| EUR/USD Spread | 0.6 pips |

| Trading Platforms | MT4, ATFX Mobile Trading App |

| Minimum Deposit | $/€/£100 |

| Payment Methods | VISA, MasterCard, Skrill, Neteller, Bank Transfer, Trustly |

| Education & Analysis | Webinars, articles, daily market outlooks, technical analysis tools |

| Customer Support | Live chat, contact form |

| Phone: +357 25 258 774 | |

| Email: info@atfxgm.eu |

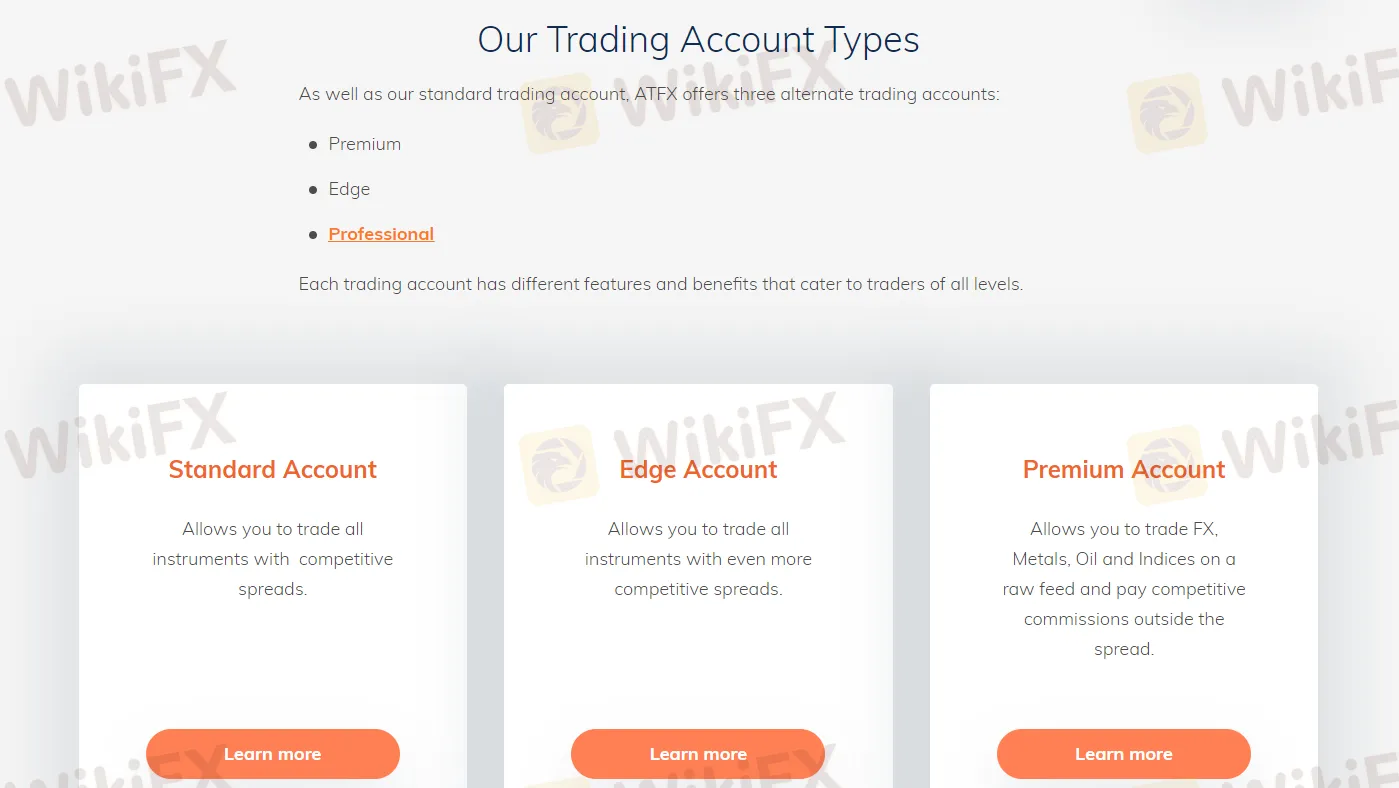

ATFX is a global online forex and CFD broker established in 2014, offering trading on various markets including forex, precious metals, crude oil, and indices. The broker also offers several account types, including the Standard Account, Edge Account, and Premium Account, targeting different trading groups, with $100 to start. Besides, the demo account is also provided. Regarding trading platform offerings, MetaTrader 4 (MT4) supported and its proprietary trading app - ATFX Mobile Trading App are offered.

On the positive side, ATFX is a well-regulated broker and offers negative balance protection to protect security of clients' funds. It also offers various trading instruments with competitive spreads via the industry-leading MT4 platform. You can also test their trading conditions via risk-free demo accounts.

| Pros | Cons |

|

|

|

|

|

|

| |

| |

|

On the downside, ATFX has limited options for deposit and withdrawal methods, as it only accepts payments via bank transfers and credit/debit cards. Another disadvantage is that ATFX does not offer social trading or copy trading features, which may be important to some traders. Finally, ATFX has limited research and analysis tools compared to other brokers, which may be a concern for more advanced traders.

ATFX is a thoroughly regulated broker, boasting four licenses from esteemed global financial regulatory bodies.

These include a Market Making (MM) license (No. 418036) from the Australia Securities & Investment Commission (ASIC), an Institution Forex License (No. 760555) from the Financial Conduct Authority (FCA) in the United Kingdom, an STP license (No. 285/15) from the Cyprus Securities and Exchange Commission (CySEC), and a general registered Investment Advisory License (No. 20200000078) from the Securities and Commodities Authority (SCA) in the United Arab Emirates.

These multiple layers of regulation demonstrate ATFX's commitment to adhering to high financial standards, transparency, and the protection of investor interests.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | AT GLOBAL MARKETS (AUSTRALIA) PTY LTD | Market Making (MM) | 418036 |

| SFC | AT Global Financial Services (HK) Limited | Leveraged foreign exchange trading | BUM667 |

| FCA | AT Global Markets (UK) Limited | Institution Forex License | 760555 |

| CYSEC | ATFX Global Markets (Cy) Limited | Straight Through Processing (STP) | 285/15 |

| SCA | Investment Advisory License | Investment Advisory License | 20200000078 |

ATFX supports trading on forex, precious metals, crude oil, and indices. However, in contrast to other brokers, ATFX does not enable shares, cryptocurrencies, ETFs, futures or options trading, and their product choices are somewhat limited.

| Tradable Assets | Supported |

| Forex | ✅ |

| Indices | ✅ |

| Commodities | ✅ |

| Shares | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

| Futures | ❌ |

| Options | ❌ |

ATFX understands that every trader has their own trading style, preferences, and needs, and that's why it offers flexible trading account options. Whether you're a beginner or an experienced trader, there is an account type that is suitable for you.

The Standard Account is a basic account type that is suitable for beginner traders who are just starting in the forex market. It requires a minimum deposit of $100.

The Edge Account is a more advanced account type that is suitable for traders who have some experience in the forex market. It requires a minimum deposit of $5,000.

The Premium Account is the most advanced account type offered by ATFX, designed for professional traders who require advanced trading features and tools. It requires a minimum deposit of $10,000. This account type offers free VPS hosting, market analysis, a personal account manager, and access to exclusive trading tools, such as Autochartist and Trading Central.

ATFX offers demo trading accounts to its clients, allowing them to practice and familiarize themselves with the trading platform and strategies before committing real funds. Demo accounts are available for all account types, including Standard, Edge, and Premium accounts. These accounts simulate real market conditions, providing traders with the opportunity to test their trading skills and strategies without any financial risks.

The demo accounts are also an excellent tool for beginners who are new to trading as it enables them to learn the basics of trading without the fear of losing money. The demo accounts offer the same features as live accounts, including access to all trading instruments and educational resources, enabling traders to experience the real trading environment.

ATFX's demo accounts have no time limit, giving traders ample time to perfect their trading strategies and techniques. Moreover, traders can switch between the demo and live accounts anytime they want.

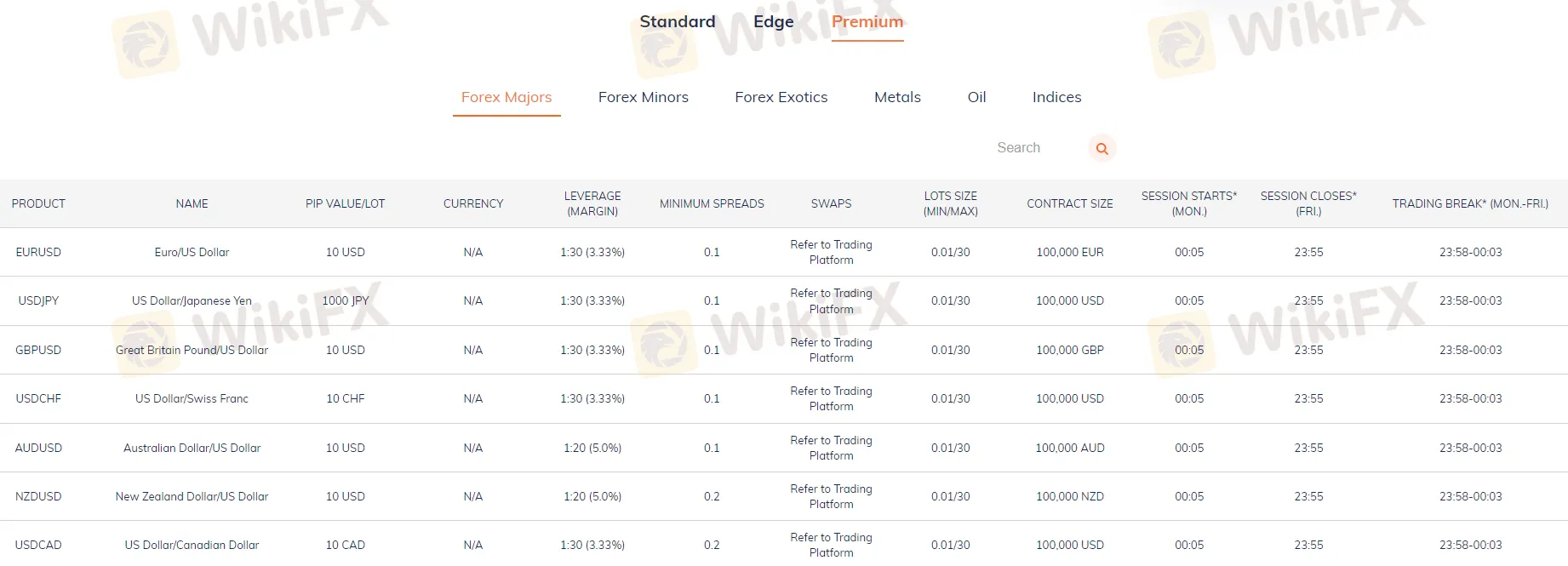

ATFX offers varying levels of leverage depending on the type of trading account and financial instrument.

For forex trading, the maximum leverage available for retail clients is typically 30:1 for major currency pairs and 20:1 for minor and exotic currency pairs. Professional clients may have access to higher leverage, up to a maximum of 400:1, depending on their trading experience and other criteria.

Notably, while leverage can amplify potential profits, it also magnifies potential losses, so it's crucial to use leverage responsibly and only trade with funds you can afford to lose. Additionally, different regulations may apply in different regions and countries, which could impact the maximum leverage available to traders.

ATFX offers competitive spreads and commissions on its trading accounts, which vary depending on the type of account and trading instrument.

For forex trading, ATFX offers both fixed and variable spreads, depending on the account type. The spreads for major currency pairs on the standard account start from 1.0 pip, while the spreads on the Edge account start from 0.0 pips but come with a commission of $7 per lot traded.

Aside from trading fees, ATFX also charges non-trading fees that traders should be aware of, including:

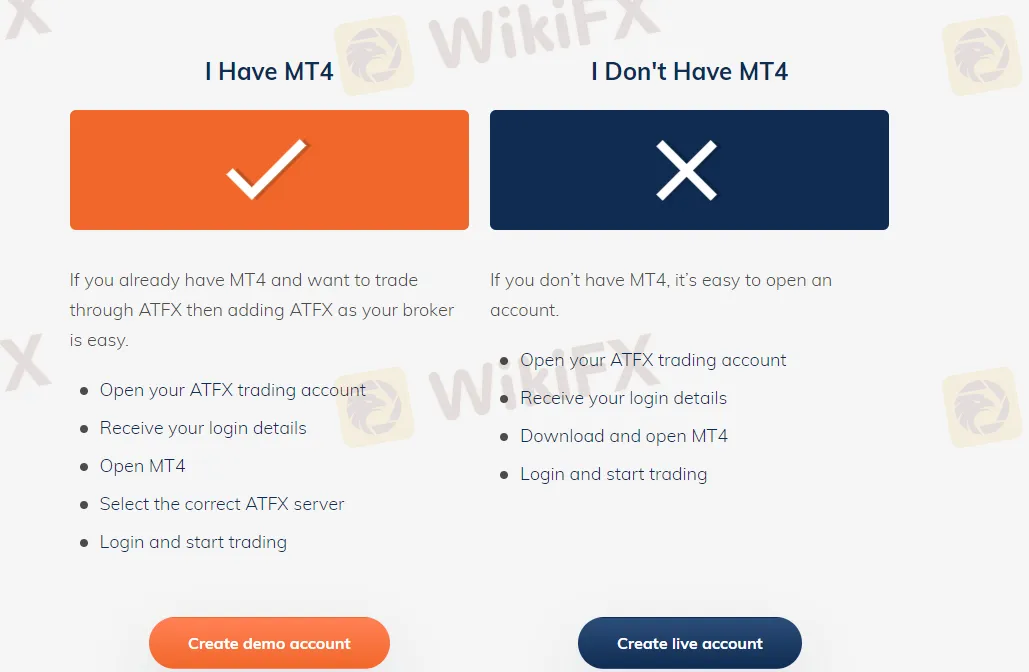

ATFX currently provides the MetaTrader 4 (MT4) platform for its traders, which is a widely used platform among forex traders. It offers advanced charting tools, technical analysis indicators, and automated trading options through Expert Advisors (EAs).

While some traders may prefer other trading platforms, the MT4 platform is a robust and reliable option with a large community of users and third-party developers creating and sharing custom indicators and EAs.

In addition to the MT4 platform, ATFX also provides the Mobile Trading App, allowing traders to trade on the go.

ATFX's minimum deposit requirement of $100 makes it an accessible option for traders who are just starting out or those who prefer to trade in smaller amounts. The following payment methods are available for deposits:

How to withdraw money from my trading account?

Please note: Your bank account must be fully verified before submitting a withdrawal request.

The time it takes for funds to return to a trader's bank account will depend on the withdrawal method used.

For bank transfers, once the funds have been removed from the trading account, it will take 3-5 business days before they arrive in the trader's bank account. The actual time required for processing may vary, and traders should refer to their bank for more information.

If using an e-wallet, funds will typically be returned to the trader's e-wallet within 2 business days.

For refunds to credit/debit cards, the process typically takes 2-5 business days after the withdrawal has been successfully processed. However, if there are restrictions preventing funds from being returned to the card, ATFX may request a valid bank statement and return the funds to the trader's registered bank account. In such cases, the trader will be contacted by their relationship manager.

All withdrawal requests received before 2 pm (UK time) on a business day will be processed on the same day. Requests received after this time will be processed on the next available business day.

ATFX customer support can be connected through the following channels:

ATFX offers rich and solid educational resources to help traders improve their skills and knowledge.

One of the primary educational resources available through ATFX is their comprehensive online trading academy. This academy provides traders with a variety of resources, including webinars, videos, articles, and e-books, all designed to help traders learn the fundamentals of trading and improve their strategies. The academy covers a range of topics, from basic concepts such as market analysis and risk management to more advanced topics like trading psychology and algorithmic trading.

ATFX also provides traders with access to a variety of market analysis tools and resources. These include daily market analysis reports, economic calendars, and real-time news feeds, all of which can help traders stay informed about the latest market trends and make more informed trading decisions.

Is ATFX a regulated broker?

Yes. It is regulated by ASIC, SFC, FCA, CYSEC, and SCA (general registration).

What is the minimum deposit requirement for ATFX?

$100 is required to start real trading.

What trading platforms does ATFX offer?

ATFX offers the popular MetaTrader 4 (MT4) trading platform for desktop, web, and mobile devices.

Does ATFX offer demo accounts?

Yes.

Is ATFX suitable for beginner traders?

Yes. ATFX offers a range of educational resources, including an online trading academy and tailored courses, to help beginner traders develop their knowledge and skills.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive grand-capital and atfx are, we first considered common fees for standard accounts. On grand-capital, the average spread for the EUR/USD currency pair is -- pips, while on atfx the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

grand-capital is regulated by SFC. atfx is regulated by ASIC,SFC,FCA,CYSEC,SCA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

grand-capital provides trading platform including -- and trading variety including --. atfx provides trading platform including -- and trading variety including --.