No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between GMI and ActivTrades ?

In the table below, you can compare the features of GMI , ActivTrades side by side to determine the best fit for your needs.

EURUSD:-0.5

EURUSD:-1.5

EURUSD:16.16

XAUUSD:27.25

EURUSD: -1.05 ~ 0.27

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of gmi, activtrades lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| GMI Review Summary | |

| Founded | 2009 |

| Headquarters | United Kingdom |

| Regulation | FCA |

| Market Instruments | Gold, silver, crude oil, forex, index |

| Demo Account | ✔ ($100,000 virtual fund) |

| Islamic Account | ❌ |

| Leverage | 1:1000 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platform | MT4, MT5, GMI EDGE |

| Copy Trading | ✔ |

| Minimum Deposit | $200 |

| Customer Support | Live chat, contact form |

| Phone: +86 400 842 7770 | |

| Email: cs@gmimarkets.com | |

GMI (Global Market Index) is a forex and CFD broker that offers trading services to retail and institutional clients. It was established in 2009 and is headquartered in the United Kingdom with offices in Cyprus and the UAE. The broker is regulated by the Financial Conduct Authority (FCA) in the UK. GMI offers a range of trading instruments, including gold, silver, crude oil, forex, and index via the MT4, MT5 and GMI EDGE platforms.

| Pros | Cons |

| • Regulated by FCA | • Limited range of trading instruments |

| • Wide range of account types | • Limited educational resources |

| • Competitive leverage | • Limited research and analysis tools |

| • Commission-free trading | • High minimum deposit requirement ($200) |

| • Copy trading feature supported | • Lack of info on deposits and withdrawals |

Note: The pros and cons listed above are not exhaustive and may vary based on individual preferences and circumstances.

GMI is a regulated forex broker, licensed by Financial Conduct Authority (FCA), which provides some level of safety and security for traders. However, it is important to note that regulation does not guarantee the complete safety of funds and trading with any broker carries a level of risk. It is important for traders to do their own research and due diligence before deciding to trade with any broker.

GMI offers popular markets across different asset classes, including gold, silver, crude oil, forex, and index. Other assets like stocks, options and cryptocurrencies are not available.

Apart from demo accounts with $100,000 virtual fund, GMI offers two live account types, Standard and ECN.

| Account Type | Minimum Deposit |

| Standard | $200 |

| ECN | $2,000 |

GMI offers fixed/adjustableleverage, up to 1:1000 for Standard accounts and 1:500 for ECN accounts. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Account Type | Leverage |

| Standard | 1:1000 |

| ECN | 1:500 |

GMI offers spreads from 0.0 pips. It's important to note that spreads may vary depending on market conditions and liquidity. Traders may also be subject to additional fees such as swaps and overnight financing charges.

Regarding the commission, it varies depending on the type of account. There is no commission charged on the Standard accounts, while the commission for the ECN account is $4 per lot.

| Account Type | Commission |

| Standard | $0 |

| ECN | $4 per lot |

GMI offers its clients three choices of trading platforms, the popular MetaTrader 4, MetaTrader 5, and its proprietary GMI EDGE. Both MT4 and MT5 are equipped with a variety of tools and features for technical analysis, order management, and customization. They also support automated trading with the use of Expert Advisors (EAs). GMI EDGE can be downloaded through Android and Web devices.

GMI offers copy trading features that allow traders to copy the strategies of successful traders. This enables traders to learn from experienced individuals and potentially benefit from their proven track records. GMI's copy trading platform promotes knowledge sharing and community-driven trading in a simple and accessible manner.

Live chat, contact form

Phone: +86 400 842 7770

Email: cs@gmimarkets.com

Based on the analysis of GMI, it is a regulated and reputable broker that offers competitive spreads and commissions, and a choice of different account types, as well as good customer support. One downside of GMI is its limited range of trading instruments and educational resources. Additionally, it requires a high minimum deposit to open an account. Overall, GMI is a solid option for traders who prioritize MT4/5, demo trading and competitive pricing.

Is GMI regulated?

Yes. GMI operates legally, and it is regulated by FCA in the UK.

Does GMI offer demo accounts?

Yes. GMI offers demo accounts with $10,000 virtual capital.

Does GMI offer industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available.

What is the minimum deposit for GMI?

$200.

Is GMI a good broker for beginners?

Yes. Overall GMI is a good choice for beginners because it offers a wide variety of trading assets with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. But the minimum deposit requirement of $200 may be high for beginners.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities.

Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, SCB (Offshore) |

| Market Instruments | Currencies, Commodities, Indices, Shares, Bonds and ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated byFCA (UK) and SCB (Offshore, Bahamas) and offers a range of trading instruments, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • High minimum deposit requirement |

| • Wide range of trading products | • Fees charged for Credit/Debit card deposits |

| • Demo and Islamic accounts offered | |

| • Variety of trading platforms including MetaTrader4/5 and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

ActivTrades is regulated by both the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of the Bahamas (SCB).

The FCA regulation ensures strict adherence to financial standards and integrity within the UK as a Market Maker. Additionally, SCB regulation allows ActivTrades to hold a Retail Forex License in the Bahamas, providing broader international service under reliable oversight.

At ActivTrades, you can trade over 1,000 different CFD instruments across 6 asset classes, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

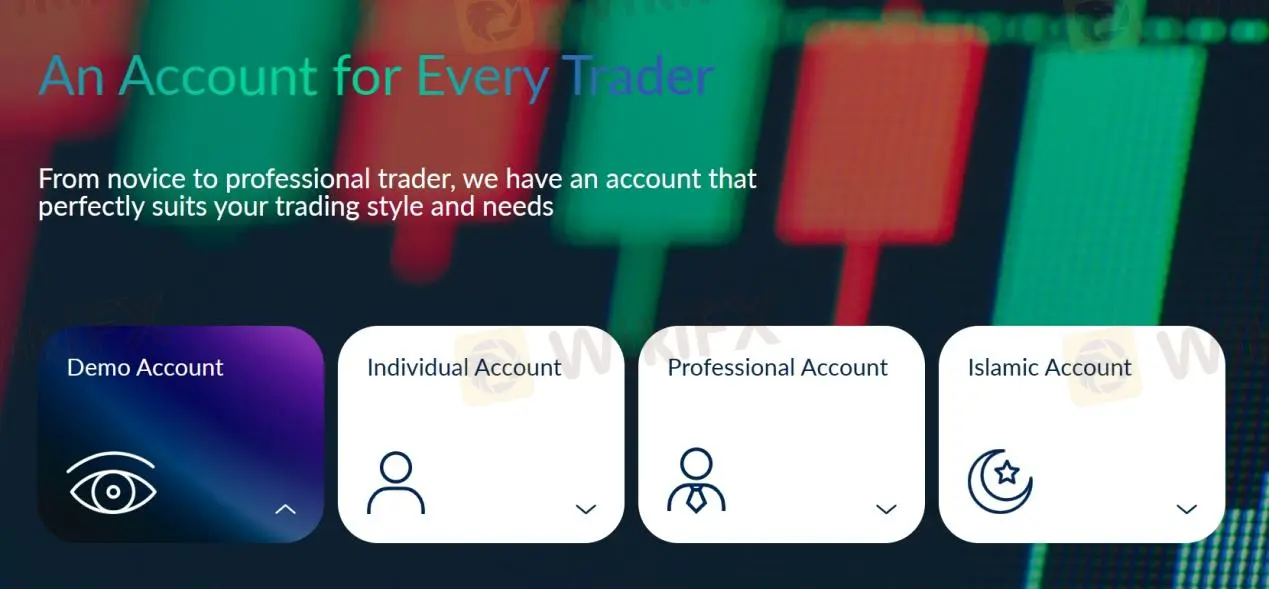

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

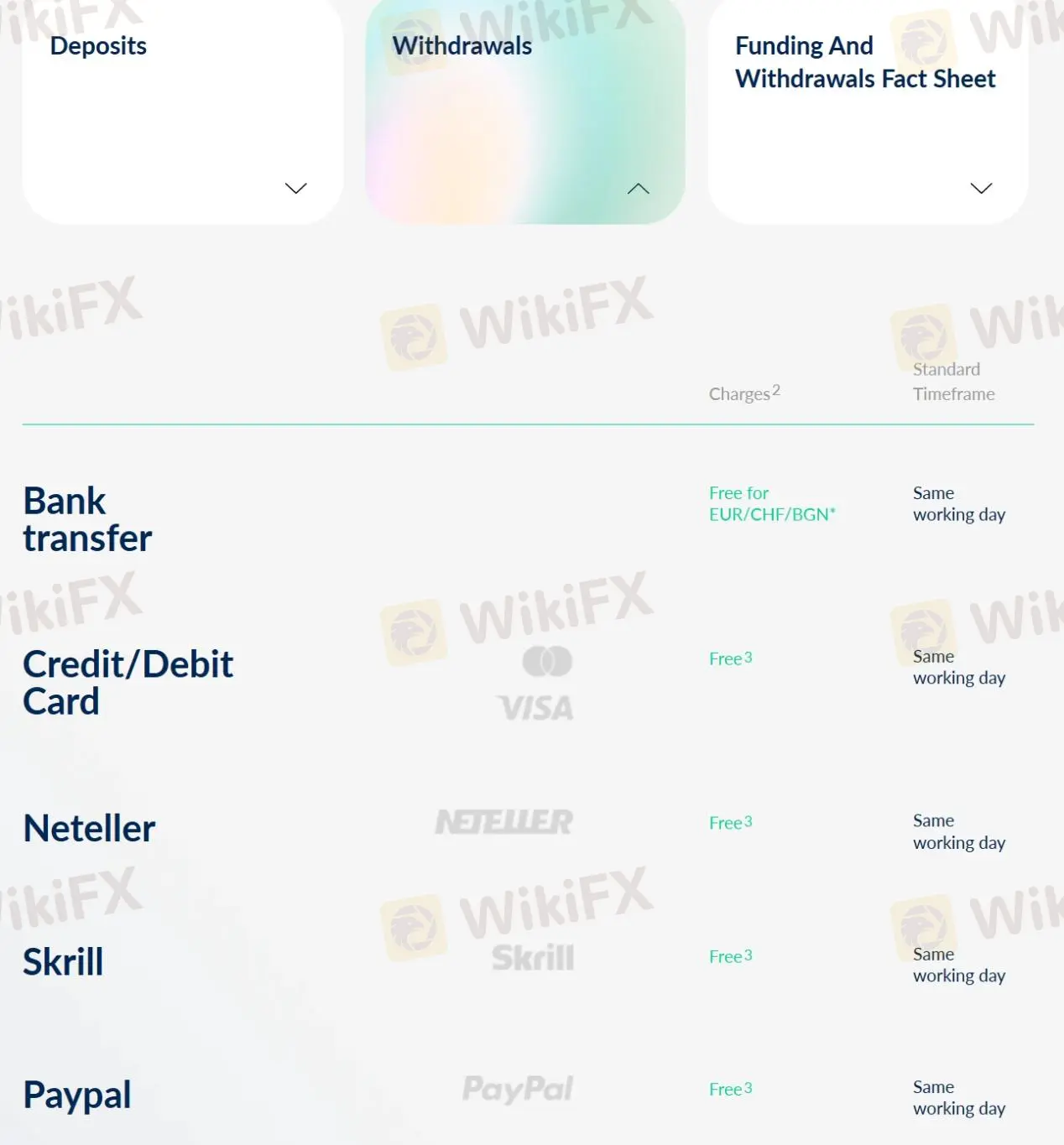

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

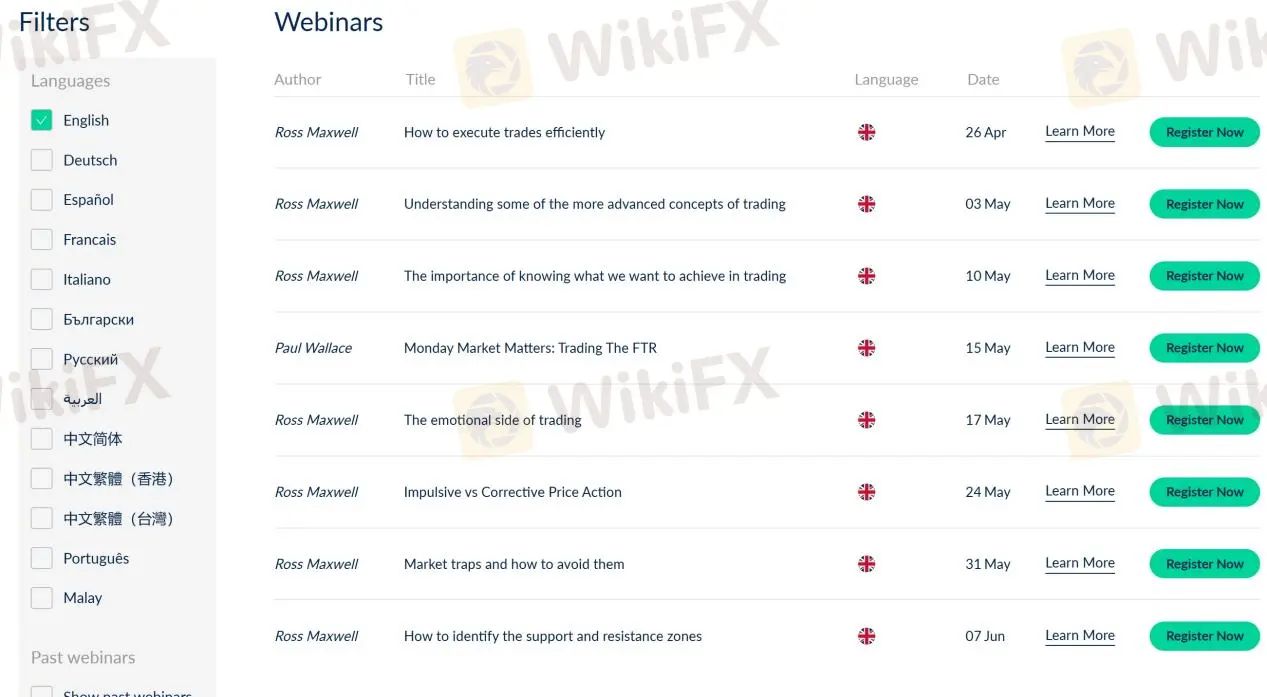

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA and offshore regulated by SCB. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available, and it also offers ActivTrader. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive gmi and activtrades are, we first considered common fees for standard accounts. On gmi, the average spread for the EUR/USD currency pair is -- pips, while on activtrades the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

gmi is regulated by FCA. activtrades is regulated by FCA,SCB,DFSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

gmi provides trading platform including Standard Bonus,Standard,Cent,ECN and trading variety including --. activtrades provides trading platform including -- and trading variety including --.