No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FXGiants and WeTrade ?

In the table below, you can compare the features of FXGiants , WeTrade side by side to determine the best fit for your needs.

--

--

EURUSD:18.95

XAUUSD:31.96

EURUSD: -7.64 ~ 0.36

XAUUSD: -36.1 ~ 13.75

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fxgiants, wetrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| FXGiantsReview Summary | |

| Founded | 2009-09-07 |

| Registered Country/Region | Bermuda |

| Regulation | clone firm |

| Market Instruments | Forex/Metals/Indices/Commodities/Stocks/Futures |

| Demo Account | / |

| Leverage | Up to 1:1000 |

| Spread | From 0.0 pips |

| Trading Platform | MT4 |

| Min Deposit | / |

| Customer Support | Phone: +44 (0) 207 523 5394 |

| Email: support@fxgiants.com | |

FXGiants is a broker. The tradable instruments include forex, metals, indices, commodities, stocks, and futures. The broker also provides six accounts with a maximum leverage of 1:1000. The minimum spread is from 0.0 pips. FXGiants is still risky due to its clone firm status, high leverage, and bad reviews about wiping out profits.

| Pros | Cons |

| MT4 available | Clone firm |

| 24/5 customer support | Inaccessible official website |

| Various tradable instruments | High max leverage |

| Spread from 0.0 pips | Negative comments about wiping out profits |

FXGiants is regulated by FCA with license number 585561, but it is a clone firm.

FXGiants offers more than 300 market instruments, including forex, metals, indices, commodities, stocks, and futures.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Futures | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

FXGiants has six account types: Live Floating Spread, Live Fixed Spread, Live Zero Fixed Spread, STP/ECN No Commission, STP/ECN No Commission, and STP/ECN Absolute Zero. Traders who want low spreads can choose Live Zero Fixed Spread and STP/ECN Zero Spread accounts, while those who want low leverage can open STP/ECN No Commission, STP/ECN Zero Spread, and STP/ECN Absolute Zero accounts.

| Account Type | Live Floating Spread | Live Fixed Spread | Live Zero Fixed Spread | STP/ECN No Commission | STP/ECN Zero Spread | STP/ECN Absolute Zero |

| Spreads from | 1.0 pips | 1.3 pips | 0.0 pips | 1.7 pips | 0.0 pips | 0.2 pips |

| Commission | No | No | $9 per lot per side | No | $3.75 per lot per side | No |

| Leverage up to | 1:1000 | 1:1000 | 1:500 | 1:200 | 1:200 | 1:200 |

| Trade from | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Bonuses | Available | Available | - | - | - | - |

The spread starts from 0.0 pipsand the commission is from 0. The lower the spread, the faster the liquidity.

The maximum leverage is 1:1000 meaning that profits and losses are magnified 1000 times.

FXGiants cooperates with the authoritative MT4 trading platform and provides PMAM and VPS Hosting services. Junior traders prefer MT4 over MT5. MT4 provides various trading strategies and implements EA systems.

| Trading Platform | Supported | Suitable for |

| MT4 | ✔ | Junior traders |

FXGiants accepts Visa, Wire Transfers, etc. for deposit and withdrawal. However, the official website is inaccessible, so transfer processing times and associated fees are unknown.

| Registered in | United Kingdom |

| Regulated by | LFSA, FSA |

| Year(s) of establishment | 2015 |

| Trading instruments | Forex pairs, metals, energies, indices, stocks, cryptocurrencies… 120+ instruments |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:2000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, WeTrade APP |

| Deposit and withdrawal method | Bank wire transfer, USDT, local deposit, union pay |

| Customer Service | 24/7 Email, live chat, YouTube, Facebook, LINE, WeChat public account,Little Red Book, and BiliBili |

| Fraud Complaints Exposure | No for now |

WeTrade is a UK registered forex broker that is regulated by the Financial Services Authority (FSA) and the Labuan Financial Services Authority (LFSA) in Malaysia. The FSA is one of the most reputable financial regulatory bodies in the world, and its oversight ensures that WeTrade operates according to strict standards of transparency and fairness. The LFSA is also a well-respected regulator and its oversight provides an additional layer of protection for traders. WeTrade's regulatory status is a significant advantage as it offers traders a level of protection and reassurance that their funds are safe and that the broker is operating within the law.

WeTrade is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under a Straight Through Processing (STP) model, ensuring adherence to local financial regulations. Additionally, it holds offshore regulatory status with the Financial Services Authority (FSA), which includes business registration for broader operational compliance. These regulatory frameworks ensure that WeTrade maintains high standards of transparency and security, providing a reliable trading environment for its clients.

Pros and Cons of WeTrade

Pros:

Cons:

| Pros | Cons |

| Regulated by FSA and LFSA | Limited deposit/withdrawal options |

| Wide range of instruments | Customer support limited to email and social media |

| Multiple account types, including demo | Limited company background information |

| Competitive spreads; high leverage up to 1:2000 | ECN account: $1000 minimum deposit, $7/lot commission |

| Educational resources available |

WeTrade offers its traders a wide range of 120+ instruments to choose from, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. This provides traders with a great opportunity to diversify their trading portfolio and access a variety of markets and assets. Additionally, the selection of cryptocurrencies offered by WeTrade is somewhat limited compared to some other brokers in the market.

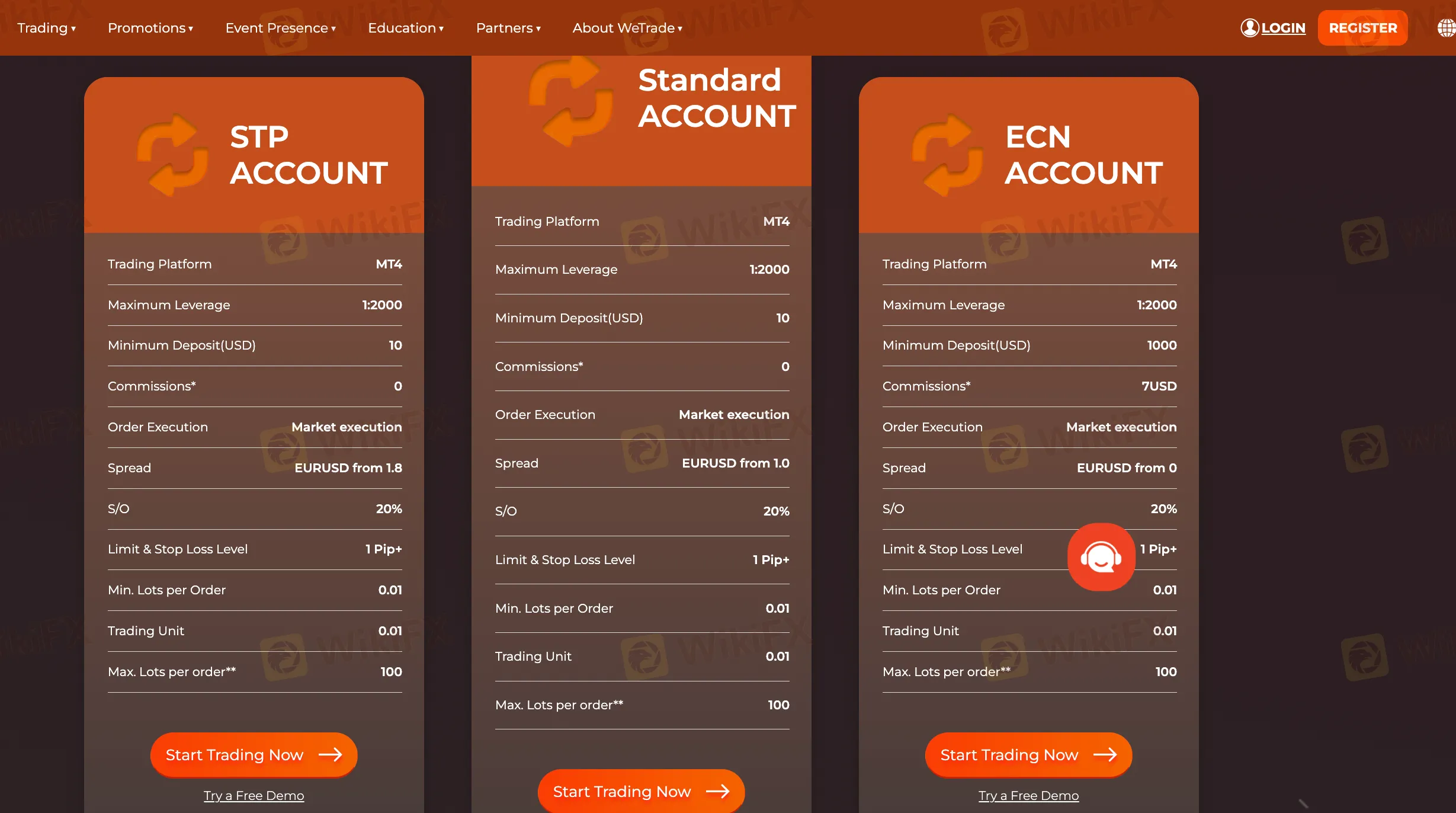

WeTrade offers a variety of account types, including ECN, Standard, and STP, each with different spreads and fees. The ECN account offers zero spreads but charges a $7 commission per lot traded, making it suitable for high-volume traders. The Standard account provides lower EUR/USD spreads starting from 1.0 pips with no commission, making it ideal for advanced traders. The STP account offers EUR/USD spreads starting from 1.8 pips with no commission, making it a good choice for beginner traders. Overall, WeTrades spreads and commission rates are competitive and cater to different trading needs.

WeTrade offers three account types to meet the needs of traders. The ECN account requires a higher minimum deposit of $1,000 but offers spreads as low as 0.0 pips, with a $7 commission per lot traded. Both the Standard and STP accounts have a minimum deposit of $100 and offer commission-free trading. Additionally, traders can use demo accounts to practice their strategies without risking real capital. A high leverage of 1:2000 is available across all account types, although some traders may prefer lower leverage.

WeTrade offers clients the MetaTrader 4 (MT4) platform, a widely used and user-friendly trading platform in the forex industry, also available in a mobile version. MT4 is known for its extensive technical analysis tools, indicators, and support for algorithmic trading via Expert Advisors (EAs).

However, MT4 has some limitations, such as limited customization options, lack of an integrated economic calendar, and no mobile push notifications. Additionally, its backtesting timeframes are restricted, which may hinder traders who need thorough strategy testing.

In addition to MT4, WeTrade also offers its mobile app as an alternative trading platform.

WeTrade offers a maximum leverage of up to 1:2000, which is relatively high compared to other forex brokers. This allows traders to potentially increase their profits with a smaller capital investment and have greater market exposure. However, high leverage also increases the risk of significant losses and margin calls, especially for inexperienced traders who may misuse it or engage in overtrading or emotional trading. Experienced traders with solid risk management strategies may find high leverage useful, but regulated brokers have limits on maximum leverage, which may restrict traders from taking advantage of higher leverage ratios.

WeTrade offers its clients multiple deposit options, including USDT, bank wire, and local deposits. Clients can withdraw funds via union pay and bank wire. WeTrade does not charge any extra fees for deposits or withdrawals. Additionally, there is no minimum account required, making it accessible for traders with different budgets. However, there is limited information provided about the deposit/withdrawal processing time. While WeTrade provides a safe and secure transaction environment, it offers limited withdrawal options compared to other brokers.

WeTrade offers various educational resources to its clients to enhance their trading skills and knowledge of the financial markets. The resources include an economic calendar, market reports, video tutorials, analyst views, indicators, and TV channels. The economic calendar keeps clients informed about important upcoming events that could affect the markets, while the market reports and analyst views provide up-to-date information on market trends. The video tutorials cover a range of topics from the basics of trading to advanced strategies, and clients can access a variety of indicators and TV channels for technical analysis. The educational resources are available in multiple languages to cater to clients from different parts of the world.

WeTrade offers a comprehensive customer care service that is available 24/7 through various communication channels such as email, YouTube, Facebook, and LINE. This provides customers with multiple options to reach out to the support team and get their queries resolved in a timely manner. Additionally, the support team has a reputation for providing quick response times, which ensures that customers' issues are resolved efficiently. However, WeTrade does not offer phone support, which may be inconvenient for some customers who prefer to speak with a representative directly. Moreover, the response time may vary based on the communication channel used, and the nature of the query may also impact the response time.

In conclusion, WeTrade is a UK-based forex broker that is regulated by FSA and LFSA. The broker offers various account types, including ECN, Standard, and STP, with competitive spreads and high leverage up to 1:2000. The broker supports various trading instruments, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. Overall, WeTrade has some advantages such as competitive trading conditions, a wide range of tradable instruments, and excellent customer support, which make it an attractive option for traders.

However, there are also some drawbacks such as lack of a proprietary trading platform, and no negative balance protection. Therefore, traders should carefully consider their options and weigh the advantages and disadvantages before choosing WeTrade as their preferred forex broker.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fxgiants and wetrade are, we first considered common fees for standard accounts. On fxgiants, the average spread for the EUR/USD currency pair is from 0.2 pips, while on wetrade the spread is As low as 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fxgiants is regulated by FCA. wetrade is regulated by LFSA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fxgiants provides trading platform including STP/ECN Absolute Zero,STP/ECN Zero Spread,STP/ECN No Commision,Live Zero Fixed Spread,Live Fixed Spread,Live Floating Spread and trading variety including --. wetrade provides trading platform including Islamic Account,ECN ACCOUNT,Standard ACCOUNT,STP ACCOUNT and trading variety including Forex,Metals,Energies,Indices, Stocks,Cryptocurrencies.