No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FX Choice and Axiory ?

In the table below, you can compare the features of FX Choice , Axiory side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fx-choice, axiory lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Belize |

| Regulated by | FSC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5, webtrader |

| Deposit and withdrawal method | cryptocurrencies, VISA, MasterCard, Perfectmoney, Skrill, Neteller, astropay and many other options |

| Customer Service | Email/phone number/address/live chat/call back |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Multiple account types with varying minimum deposits and commissions to suit traders with different needs and preferences.

The option to trade a wide range of financial instruments including Forex, metals, indices, cryptocurrencies, and shares.

Multiple platform options including the popular MetaTrader 4 and 5, as well as a WebTrader platform.

High leverage of up to 1:1000 for the Optimum account, providing the opportunity for potentially higher profits.

A variety of deposit and withdrawal methods, including popular e-wallets and cryptocurrencies, with a 15% deposit bonus available.

Comprehensive educational resources including autotrade, copy trading, and trading signals to help traders make informed decisions.

Multilingual customer support available 24/5 via phone, email, live chat, and call back.

Cons:

Limited options for those who prefer a low minimum deposit or zero commission account.

Pro account holders are charged a commission of USD 3.5 per side, which may be relatively high for some traders.

Limited to only a few trading platforms, which may not suit traders who prefer other platforms.

The maximum leverage available of up to 1:1000 for the Optimum account may be too high for some traders who prefer a lower level of risk.

The customer support service does not offer 24/7 assistance.

| Advantages | Disadvantages |

| FX Choice offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, FX Choice has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

FX Choice is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, FX Choice acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that FX Choice has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with FX Choice or any other MM broker.

With a history between 2 and 5 years, FX Choice is an online forex broker regulated by FSC and is dedicated to providing a series of common forex instruments.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide range of trading markets including currency pairs, indices, commodities, metals, energy, cryptocurrencies, and stocks | None found |

FX Choice offers a vast selection of tradable instruments, including forex, indices, commodities, metals, energy, cryptocurrencies, and stocks. This wide range of markets provides traders with numerous opportunities to diversify their trading portfolio and take advantage of different market conditions. For instance, traders can choose to trade the highly liquid forex market, take positions on the commodities market, or trade the popular cryptocurrency markets. Additionally, traders can access various indices, energy, and metal markets to take advantage of market opportunities. Overall, the broad range of trading instruments on FX Choice makes it a suitable broker for both new and experienced traders who want access to multiple markets. No disadvantages were found in this dimension.

| Advantages | Disadvantages |

| Competitive spreads | Pro account commission of USD 3.5 per side is relatively high |

| No commission on Classic and Optimum accounts | Optimum account has higher spreads compared to other accounts |

| Rebates available on Pro account |

FX Choice offers competitive spreads on all its account types. The Classic account has spreads starting from 0.5 pips, while the Optimum account has spreads starting from 1.5 pips. The Pro account has spreads starting from 0 pips but charges a commission of USD 3.5 per side, which is relatively high compared to other brokers. However, rebates of up to USD 2 per side are available for high-volume traders on the Pro account. There are no commissions charged on the Classic and Optimum accounts, making them suitable for traders who do not want to pay additional fees. Overall, FX Choice's spreads are competitive and can be considered an advantage for traders.

Demo Account: FX Choice provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live account: FX Choice offers three account types: Classic, Optimum, and Pro Accounts. The Classic Account has a minimum deposit of USD 100 and offers tight spreads starting from 0.5 pips. The Optimum Account, on the other hand, requires a minimum deposit of only USD 10 but has wider spreads starting from 1.5 pips. The Pro Account has a minimum deposit of USD 100 and offers the tightest spreads starting from 0 pips. However, it comes with a relatively high commission fee of USD 3.5 per side. All account types allow for a minimum lot size of 0.01 lots, and the leverage for forex and metals trading ranges from 1:200 to 1:1000. Moreover, the accounts support different markets, including forex, indices, metals and energies, cryptocurrencies, and stocks, among others.

| Classic Account | Optimum Account | Pro Account | |

| Minimum deposit | USD 100 | USD 10 | USD 100 |

| Tight spreads starting from | 0.5 pips | 1.5 pips | 0 pips |

| Minimum lot size | 0.01 lots | 0.01 lots | 0.01 lots |

| Commission charged Negative figure under ‘Commission’ in trade history | No | No | USD 3.5 per side (USD 1.5 for high-volume traders, see Pips+), per notional amount of USD 100,000 |

| Rebate added Above-zero figure under ‘Commission’ in trade history | Up to USD 2 per side, per notional amount of USD 100,000. See Pips+. | Up to USD 2 per side, per notional amount of USD 100,000. See Pips+. | No |

| Leverage | Forex, metals — up to 1:200; more markets. | Forex, metals — up to 1:1000; more markets. | Forex, metals — up to 1:200; more markets. |

| Margin level for hedge/lock positions | 50% | 50% | 50% |

| Execution | NDD, Market | NDD, Market | NDD, Market |

| Margin call / Stop out | 25/15 | 25/15 | 25/15 |

| Forex CFDs | 36 currency pairs | 36 currency pairs | 36 currency pairs |

| More CFDs | Indices, Metals & Energies, Crypto, Shares | Indices, Metals & Energies, Crypto, Shares | Indices, Metals & Energies, Crypto, Shares |

| Advantages | Disadvantages |

| MetaTrader 4 (MT4) platform available | No proprietary platform |

| MetaTrader 5 (MT5) platform available | No cTrader platform available |

| WebTrader platform available |

FX Choice offers three popular trading platforms to its clients: MT4, MT5, and WebTrader. The MetaTrader platforms are well-known for their advanced charting capabilities and algorithmic trading options, making them ideal for both novice and experienced traders. The WebTrader platform is a browser-based platform that allows traders to access their accounts from anywhere without the need for downloading any software. However, FX Choice does not have its own proprietary platform, which may be a disadvantage for traders who prefer a more customized trading experience. Additionally, the absence of the cTrader platform may be a drawback for traders who prefer this platform for its advanced charting and order execution features. Overall, the availability of the popular MetaTrader platforms and a browser-based WebTrader platform provides traders with flexibility and accessibility to trade from various devices.

| Advantages | Disadvantages |

| Allows for higher potential profits with smaller initial investment | Higher leverage increases risk of large losses |

| Greater flexibility in trading strategies and positions | Can lead to overtrading and poor risk management |

| Enables traders to access larger markets with limited capital | Inexperienced traders may be tempted to use high leverage without understanding the risks |

| Can increase trading volume and potential returns | Market volatility can quickly wipe out an account with high leverage |

FX Choice offers maximum leverage of up to 1:1000 for Optimum account and 1:200 for Classic and Pro account, which allows traders to open larger positions with a smaller amount of capital. This can be advantageous for traders who have a good understanding of risk management and use leverage wisely to maximize their trading opportunities. However, high leverage can also lead to large losses if traders do not use it responsibly. It is important for traders to understand the risks involved and have a solid trading plan in place when using high leverage. Additionally, traders should always consider the market conditions and volatility before using high leverage in their trades.

| Advantages | Disadvantages |

| Multiple deposit and withdrawal options | Some deposit/withdrawal methods may not be available in certain countries |

| 15% deposit bonus available | Withdrawal fees may apply |

| Cryptocurrency deposits and withdrawals available | Bonus terms and conditions may apply |

| Fast processing time for most payment methods |

FX Choice offers clients a wide range of deposit and withdrawal options, including cryptocurrencies, Visa, Mastercard, Skrill, Neteller, and many more. The 15% deposit bonus is also an attractive feature for new clients. However, some payment methods may not be available in certain countries and withdrawal fees may apply. It's also important to note that bonus terms and conditions may apply. In general, FX Choice aims to process payments quickly, which is a positive aspect for clients looking for a fast and efficient payment system.

| Advantages | Disadvantages |

| A wide range of educational resources including market signals, autotrade, copy trading, VPS, news, trading signals, and EA | Limited educational materials for beginners |

| Access to professional trading tools | Some resources may require additional fees or commissions |

| Customizable tools to meet individual needs and preferences | |

| Opportunity to learn from experienced traders |

FX Choice offers a variety of educational resources that cater to the needs of traders at different levels of experience. The platform provides a range of professional trading tools that traders can use to improve their skills and knowledge. The educational resources available include market signals, autotrade, copy trading, VPS, news, trading signals, and EA. These resources are customizable, allowing traders to tailor them to their individual needs and preferences. Additionally, traders can learn from experienced traders by using the platform's copy trading features. While FX Choice offers a wide range of educational resources, there may be limited materials for beginners, and some resources may require additional fees or commissions. Overall, the platform offers a strong set of educational resources for traders looking to improve their trading skills and knowledge.

| Advantages | Disadvantages |

| 24/5 customer service available | No 24/7 customer service available |

| Support in multiple languages | No local phone numbers for some countries |

| Various contact methods available | No physical office for some regions |

| Quick response time through live chat and phone | Limited information on the website about customer service protocols |

| Call back service available |

FX Choice offers 24/5 customer service to its clients, providing support in multiple languages through various channels such as email, phone, live chat and call back service. The quick response time through live chat and phone is an advantage, ensuring that clients can get their issues resolved promptly. However, the lack of 24/7 customer service and local phone numbers for some countries could be a disadvantage for clients in those regions. While FX Choice has a physical office, it may not be accessible to some clients. The website could also provide more information about the customer service protocols in place to manage clients' issues. Overall, FX Choice's customer care dimension provides a good level of support to its clients.

FX Choice is a well-established online trading platform that provides a wide range of trading instruments, including forex, CFDs, and cryptocurrencies. The platform offers multiple account types, educational resources, and 24/5 customer support in various languages. It also provides various deposit and withdrawal options, making it easy for traders to manage their funds. One of the most significant advantages of FX Choice is the availability of the MetaTrader platform, which is a popular and user-friendly platform used by many traders worldwide. While there are some disadvantages, such as the limited availability of some services, FX Choice remains a reputable and reliable platform for both beginner and experienced traders looking to trade various financial instruments. Overall, with its comprehensive trading features, customer support, and user-friendly platform, FX Choice is an attractive choice for traders looking for a reliable online trading platform.

Question: What is FX Choice?

Answer: FX Choice is an online forex and CFD broker that offers trading services to retail and institutional clients.

Question: What types of accounts does FX Choice offer?

Answer: FX Choice offers three types of accounts: Classic, Optimum, and Pro.

Question: What is the minimum deposit to open an account with FX Choice?

Answer: The minimum deposit to open a Classic account is USD 100, while the minimum deposit for an Optimum account is USD 10, and for a Pro account, it is USD 100.

Question: What is the maximum leverage offered by FX Choice?

Answer: FX Choice offers leverage up to 1:1000 for Optimum account and 1:200 for Classic and Pro accounts.

Question: What trading platforms are available at FX Choice?

Answer: FX Choice offers the popular trading platforms MT4, MT5, and WebTrader.

Question: What are the deposit and withdrawal methods available at FX Choice?

Answer: FX Choice offers various deposit and withdrawal methods, including credit cards, e-wallets, bank transfers, and cryptocurrencies.

Question: Does FX Choice offer educational resources for traders?

Answer: Yes, FX Choice provides educational resources such as market signals, autotrade, copy trading, VPS, news, trading signals, and EA.

| Axiory | Basic Information |

| Company Name | Axiory Global Limited |

| Founded in | 2012 |

| Registered Country/Area | Belize |

| Regulation | FSC (Offshore) |

| Market Instruments | Forex, gold and metals, oil and energies, CFD indices, CFD stocks, exhcange stocks, exchange ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | Up to 1:2000 |

| EUR/USD Spread | Average 1.3 pips |

| Trading Platform | MT4, MT5, cTrader, MyAxiory App |

| Minimum Deposit | $10 |

| Customer Support | Live chat, contact form, phone, email, FAQ |

| Regional Restrictions | Bulgaria, Burkina Faso, Cameroon, Croatia, Democratic Republic of the Congo, Haiti, Kenya, Mali, Monaco, Mozambique, Namibia, Nigeria, Philippines, Senegal, South Africa, South Sudan, Tanzania, Venezuela, Vietnam, Yemen |

Established in 2012, Axiory is a forex broker registered in Belize that claims to offer online trading services for a range of financial instruments, including forex, gold and metals, oil and energies, CFD indices, CFD stocks, exhcange stocks, exchange ETFs with leverage up to 1:2000.

An interesting feature of Axiory is its commitment to social responsibility. The company has established the Axiory Intelligence initiative, which is a research-based program that aims to promote education and social responsibility in the financial industry.

Axiory also supports various social causes through its Axiory Care program. In terms of trading platforms, Axiory offers multiple choices, including the popular MetaTrader 4 platform, MetaTrader 5 platform, as well as cTrader, with its proprietary trading app called MyAxiory App.

Besides, this broker also offers advanced charting tools, technical analysis indicators, and other features to help traders quickly acquaint themselves with online trading.

One of Axiory's biggest strengths is the wide range of trading instruments available. Traders can choose from a diverse selection of assets, including major and minor currency pairs, popular stocks, and popular indices. Additionally, the broker offers commodities such as oil and gold, which provide traders with opportunities to diversify their portfolios. Another significant advantage of Axiory is their multiple account types of low minimum deposits.

On the downside, Axiory's regulation is only offshore by FSC in Belize, which is not a top-tier regulator. Plus, no 7/24 online customer support available, and clients from Bulgaria, Burkina Faso, Cameroon, Croatia, Democratic Republic of the Congo, Haiti, Kenya, Mali, Monaco, Mozambique, Namibia, Nigeria, Philippines, Senegal, South Africa, South Sudan, Tanzania, Venezuela, Vietnam, and Yemen are not allowed.

| Pros | Cons |

| Wide range of trading instruments | Offshore regulated by FSC in Belize |

| Multiple trading platforms | No 7/24 customer support |

| Multiple trading account options | Regional restrictions |

| Generous trading leverage up to 1:2000 | |

| Advanced trading tools and features such as VPS, MAM, and PAMM | |

| Low minimum deposit of $10 | |

| Demo accounts available | |

| Islamic account available for most account types | |

| Multilingual customer support available |

Axiory is authorized and offshore regulated by the Financial Services Commission (FSC) in Belize. This regulatory body is responsible for ensuring that financial institutions operate in a transparent and fair manner, which can provide traders with some reassurance about the legitimacy of the broker. Axiory's adherence to regulations also means that the company must follow certain guidelines, such as maintaining sufficient capital reserves, which can help to protect traders in the event of any financial instability.

However, it is important to note that the IFSC is not a highly-respected regulatory body in the financial industry, which may lead some traders to question the level of oversight and protection provided. Additionally, the regulatory requirements of the FSC may not be as stringent as those of other regulatory bodies, which could result in less protection for traders.

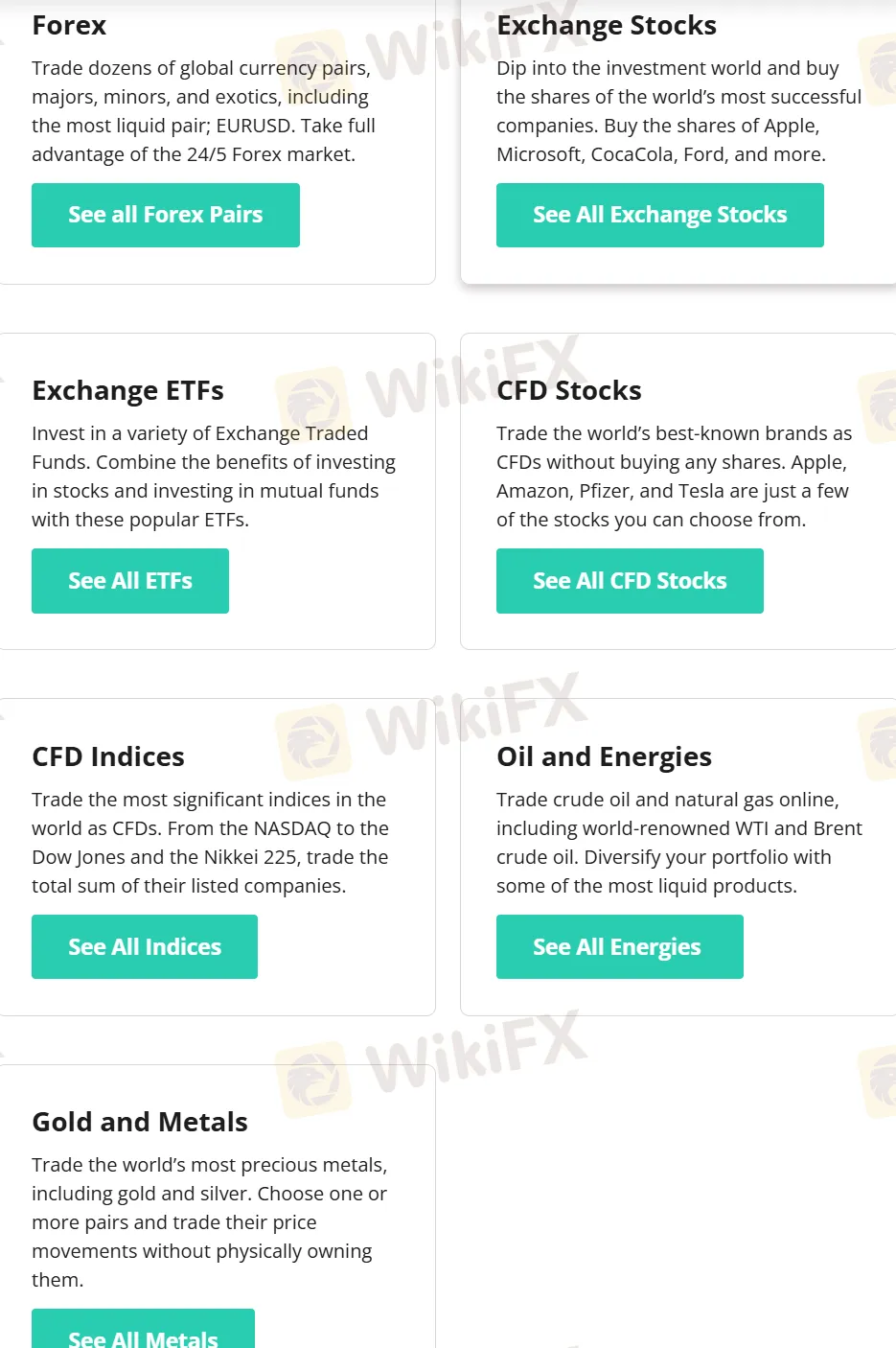

Axiory offers a range of market instruments to cater to the diverse trading needs of its clients.

Firstly, the broker provides access to the forex market, which is the largest financial market in the world, enabling traders to trade currency pairs with tight spreads and competitive pricing.

Secondly, Axiory offers exchange-traded stocks and ETFs, which provide traders with exposure to a variety of companies and industries across the globe.

Additionally, Axiory offers CFDs on stocks and indices, providing traders with the ability to trade on the price movements of individual stocks or entire market indices.

Finally, Axiory offers trading in oil and energy products, which can provide traders with exposure to the commodities market and its price fluctuations

Axiory offers a diverse range of trading accounts to cater to the needs of traders with varying experience levels and trading styles. The broker offers five types of trading accounts, including NANO, STANDARD, MAX, TERA, and ALPHA.

| Account Type | Nano | Standard | Max | Tera | Alpha | Zero |

| Min Deposit | $/€10 | $/€10 | $/€10 | $/€10 | / | $/€10 |

| Max Leverage | 1:1000 | 1:1000 | 1:2000 | 1:1000 | 1:1 | 1:1000 |

| Avg EUR/USD Spread | 0.3 pips | 1.3 pips | 2 pips | 3 pips | / | 0 |

| Commission | $6/lot | ❌ | ❌ | $6/lot | From $1.5/lot | Per instrument |

| Trading Platform | MT4, cTrader | MT4, cTrader | MT4, cTrader | MT5 | MT5 | MT4, MT5, cTrader |

| Islamic Account | ✔ | ✔ | ✔ | ✔ | ❌ | ✔ |

Axiory offers demo accounts to its clients, which are a great tool for traders to practice trading without risking real money. The demo accounts are designed to replicate the live trading environment, allowing traders to familiarize themselves with the platform, test different trading strategies, and gain experience before trading with real money.

Axiory's demo accounts are free and come with up to $10,000 virtual funds that traders can use to simulate trading. The demo accounts are available for all account types and provide traders with access to the same trading instruments, platforms, and tools as live accounts. The demo accounts are not time-limited, which means there is no expiry date on your demo accounts.

Axiory offers Islamic accounts, also known as swap-free accounts, which are designed for traders who follow the Islamic faith and can not receive or pay interest due to religious reasons. These accounts comply with Shariah law and do not charge or pay any overnight interest (swap) fees on positions held open for more than 24 hours.

Islamic accounts at Axiory offer the same features as standard trading accounts, including access to all trading instruments and platforms, customer support, and educational resources. The only difference is that Islamic accounts operate on a commission-based structure, and there are no overnight swap fees charged or credited to the account.

To open an Islamic account with Axiory, traders need to submit a request to the customer support team, and the account will be verified and set up within 24 hours. It is important to note that Axiory reserves the right to revoke the swap-free status if there is evidence of abuse or misuse of the account.

Step 1: To open an account with Axiory, interested clients can simply navigate to the broker's website and click on the “Start Now” button.

Step 2: This will lead you to a registration page where you will be prompted to provide your personal information, including name, email address, and phone number. Additionally, you will need to choose the account type.

Step 3: After submitting the registration form, you will receive an email with a link to verify their account. Once the verification process is complete, you can proceed to fund your account via one of the payment options available.

Axiory offers a range of leverage options for traders, depending on their chosen account type. The maximum leverage ranges from 1:50 to 1:2000 on the Max account, while 1:50-1:1000 on the Nano/Standard/Tera Account.

However, it's worth noting that higher leverage also comes with higher risk, and traders should be aware of the potential consequences of trading with a high leverage ratio. It's important to carefully consider your own risk tolerance and trading strategy before deciding on a leverage ratio for your account.

Axiory offers its clients access to several trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as the cTrader platform and the MyAxiory mobile app.

The MetaTrader platforms are widely used by traders worldwide and offer advanced charting capabilities, multiple time frames, and a wide range of technical indicators and analysis tools. The cTrader platform, on the other hand, is known for its fast execution speeds and advanced order management features, making it a popular choice for scalpers and high-frequency traders.

The MyAxiory mobile app allows traders to access their accounts and trade on-the-go using their mobile devices. The app is user-friendly and features real-time price quotes, charting tools, and the ability to place orders and manage positions.

Axiory accepts deposits via Visa, JCB, UnionPay, Bank Transfer, Neteller, Skrill, and ThunderX Pay.

There is no deposit fees charged if you deposit using Visa, JCB, UnionPay, and Bank Transfer, but payment fees may be charged by the payment method provider if you deposit via Neteller, Skrill, and ThunderX Pay.

As for the deposit processing time, most deposits are instant, while bank transfers require 3-10 business days and ThunderX Pay requires ip to 15 minutes after confirmation.

Axiory accepts withdrawals via Visa, JCB, UnionPay, Bank Transfer, Sticpay, Neteller, Skrill, ThunderX Pay.

There is no fees for Visa, JCB, UnionPay, and Sticpay, while withdrawal via other methods may be charged fees.

The processing time for withdrawals varies depending on the payment method used, with e-wallets (instant) typically being the fastest and bank transfers (3-10 business days) taking the longest.

Traders can contact the support team via email, phone, live chat, or contact form. The broker also provides a comprehensive FAQ section on its website, where traders can find answers to common questions related to trading, account management, and more.

Axiory is a forex broker offering a variety of trading instruments, account types, and educational resources to its clients. The broker's trading conditions, such as high spreads and commissions, may not be ideal for all traders, but its leverage options can benefit those looking for higher returns. However, Axiory's weakness lies in lack of top-tier regulation. Ultimately, traders should carefully consider their individual trading needs and goals before choosing Axiory as their broker.

Is Axiory a regulated broker?

Yes, Axiory is authorized and offshore regulated by the International Financial Services Commission (FSC) in Belize.

What is the minimum deposit required to open an account with Axiory?

Just $10.

What trading platforms are available at Axiory?

Axiory offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as cTrader and MyAxiory App.

Does Axiory offer Islamic accounts?

Yes, Axiory offers swap-free Islamic accounts for traders who follow Shariah law.

What is the maximum leverage offered by Axiory?

Up to 1:2000.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fx-choice and axiory are, we first considered common fees for standard accounts. On fx-choice, the average spread for the EUR/USD currency pair is from 0 pips, while on axiory the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fx-choice is regulated by FSC. axiory is regulated by FSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fx-choice provides trading platform including Pro,Classic,Optimum and trading variety including 36 currency pairs; Indices, Metals, Commodities, Energies, Cryptocurrencies. axiory provides trading platform including ALPHA,TERA,MAX,STANDARD,NANO and trading variety including --.