No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FX Choice and AvaTrade ?

In the table below, you can compare the features of FX Choice , AvaTrade side by side to determine the best fit for your needs.

--

--

EURUSD:-0.8

EURUSD:-2

EURUSD:8.56

XAUUSD:25.61

EURUSD: -2.53 ~ 0.34

XAUUSD: -5.56 ~ 2.81

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fx-choice, ava-trade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | Belize |

| Regulated by | FSC |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5, webtrader |

| Deposit and withdrawal method | cryptocurrencies, VISA, MasterCard, Perfectmoney, Skrill, Neteller, astropay and many other options |

| Customer Service | Email/phone number/address/live chat/call back |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros:

Multiple account types with varying minimum deposits and commissions to suit traders with different needs and preferences.

The option to trade a wide range of financial instruments including Forex, metals, indices, cryptocurrencies, and shares.

Multiple platform options including the popular MetaTrader 4 and 5, as well as a WebTrader platform.

High leverage of up to 1:1000 for the Optimum account, providing the opportunity for potentially higher profits.

A variety of deposit and withdrawal methods, including popular e-wallets and cryptocurrencies, with a 15% deposit bonus available.

Comprehensive educational resources including autotrade, copy trading, and trading signals to help traders make informed decisions.

Multilingual customer support available 24/5 via phone, email, live chat, and call back.

Cons:

Limited options for those who prefer a low minimum deposit or zero commission account.

Pro account holders are charged a commission of USD 3.5 per side, which may be relatively high for some traders.

Limited to only a few trading platforms, which may not suit traders who prefer other platforms.

The maximum leverage available of up to 1:1000 for the Optimum account may be too high for some traders who prefer a lower level of risk.

The customer support service does not offer 24/7 assistance.

| Advantages | Disadvantages |

| FX Choice offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, FX Choice has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

FX Choice is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, FX Choice acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that FX Choice has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with FX Choice or any other MM broker.

With a history between 2 and 5 years, FX Choice is an online forex broker regulated by FSC and is dedicated to providing a series of common forex instruments.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

| Advantages | Disadvantages |

| Wide range of trading markets including currency pairs, indices, commodities, metals, energy, cryptocurrencies, and stocks | None found |

FX Choice offers a vast selection of tradable instruments, including forex, indices, commodities, metals, energy, cryptocurrencies, and stocks. This wide range of markets provides traders with numerous opportunities to diversify their trading portfolio and take advantage of different market conditions. For instance, traders can choose to trade the highly liquid forex market, take positions on the commodities market, or trade the popular cryptocurrency markets. Additionally, traders can access various indices, energy, and metal markets to take advantage of market opportunities. Overall, the broad range of trading instruments on FX Choice makes it a suitable broker for both new and experienced traders who want access to multiple markets. No disadvantages were found in this dimension.

| Advantages | Disadvantages |

| Competitive spreads | Pro account commission of USD 3.5 per side is relatively high |

| No commission on Classic and Optimum accounts | Optimum account has higher spreads compared to other accounts |

| Rebates available on Pro account |

FX Choice offers competitive spreads on all its account types. The Classic account has spreads starting from 0.5 pips, while the Optimum account has spreads starting from 1.5 pips. The Pro account has spreads starting from 0 pips but charges a commission of USD 3.5 per side, which is relatively high compared to other brokers. However, rebates of up to USD 2 per side are available for high-volume traders on the Pro account. There are no commissions charged on the Classic and Optimum accounts, making them suitable for traders who do not want to pay additional fees. Overall, FX Choice's spreads are competitive and can be considered an advantage for traders.

Demo Account: FX Choice provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live account: FX Choice offers three account types: Classic, Optimum, and Pro Accounts. The Classic Account has a minimum deposit of USD 100 and offers tight spreads starting from 0.5 pips. The Optimum Account, on the other hand, requires a minimum deposit of only USD 10 but has wider spreads starting from 1.5 pips. The Pro Account has a minimum deposit of USD 100 and offers the tightest spreads starting from 0 pips. However, it comes with a relatively high commission fee of USD 3.5 per side. All account types allow for a minimum lot size of 0.01 lots, and the leverage for forex and metals trading ranges from 1:200 to 1:1000. Moreover, the accounts support different markets, including forex, indices, metals and energies, cryptocurrencies, and stocks, among others.

| Classic Account | Optimum Account | Pro Account | |

| Minimum deposit | USD 100 | USD 10 | USD 100 |

| Tight spreads starting from | 0.5 pips | 1.5 pips | 0 pips |

| Minimum lot size | 0.01 lots | 0.01 lots | 0.01 lots |

| Commission charged Negative figure under ‘Commission’ in trade history | No | No | USD 3.5 per side (USD 1.5 for high-volume traders, see Pips+), per notional amount of USD 100,000 |

| Rebate added Above-zero figure under ‘Commission’ in trade history | Up to USD 2 per side, per notional amount of USD 100,000. See Pips+. | Up to USD 2 per side, per notional amount of USD 100,000. See Pips+. | No |

| Leverage | Forex, metals — up to 1:200; more markets. | Forex, metals — up to 1:1000; more markets. | Forex, metals — up to 1:200; more markets. |

| Margin level for hedge/lock positions | 50% | 50% | 50% |

| Execution | NDD, Market | NDD, Market | NDD, Market |

| Margin call / Stop out | 25/15 | 25/15 | 25/15 |

| Forex CFDs | 36 currency pairs | 36 currency pairs | 36 currency pairs |

| More CFDs | Indices, Metals & Energies, Crypto, Shares | Indices, Metals & Energies, Crypto, Shares | Indices, Metals & Energies, Crypto, Shares |

| Advantages | Disadvantages |

| MetaTrader 4 (MT4) platform available | No proprietary platform |

| MetaTrader 5 (MT5) platform available | No cTrader platform available |

| WebTrader platform available |

FX Choice offers three popular trading platforms to its clients: MT4, MT5, and WebTrader. The MetaTrader platforms are well-known for their advanced charting capabilities and algorithmic trading options, making them ideal for both novice and experienced traders. The WebTrader platform is a browser-based platform that allows traders to access their accounts from anywhere without the need for downloading any software. However, FX Choice does not have its own proprietary platform, which may be a disadvantage for traders who prefer a more customized trading experience. Additionally, the absence of the cTrader platform may be a drawback for traders who prefer this platform for its advanced charting and order execution features. Overall, the availability of the popular MetaTrader platforms and a browser-based WebTrader platform provides traders with flexibility and accessibility to trade from various devices.

| Advantages | Disadvantages |

| Allows for higher potential profits with smaller initial investment | Higher leverage increases risk of large losses |

| Greater flexibility in trading strategies and positions | Can lead to overtrading and poor risk management |

| Enables traders to access larger markets with limited capital | Inexperienced traders may be tempted to use high leverage without understanding the risks |

| Can increase trading volume and potential returns | Market volatility can quickly wipe out an account with high leverage |

FX Choice offers maximum leverage of up to 1:1000 for Optimum account and 1:200 for Classic and Pro account, which allows traders to open larger positions with a smaller amount of capital. This can be advantageous for traders who have a good understanding of risk management and use leverage wisely to maximize their trading opportunities. However, high leverage can also lead to large losses if traders do not use it responsibly. It is important for traders to understand the risks involved and have a solid trading plan in place when using high leverage. Additionally, traders should always consider the market conditions and volatility before using high leverage in their trades.

| Advantages | Disadvantages |

| Multiple deposit and withdrawal options | Some deposit/withdrawal methods may not be available in certain countries |

| 15% deposit bonus available | Withdrawal fees may apply |

| Cryptocurrency deposits and withdrawals available | Bonus terms and conditions may apply |

| Fast processing time for most payment methods |

FX Choice offers clients a wide range of deposit and withdrawal options, including cryptocurrencies, Visa, Mastercard, Skrill, Neteller, and many more. The 15% deposit bonus is also an attractive feature for new clients. However, some payment methods may not be available in certain countries and withdrawal fees may apply. It's also important to note that bonus terms and conditions may apply. In general, FX Choice aims to process payments quickly, which is a positive aspect for clients looking for a fast and efficient payment system.

| Advantages | Disadvantages |

| A wide range of educational resources including market signals, autotrade, copy trading, VPS, news, trading signals, and EA | Limited educational materials for beginners |

| Access to professional trading tools | Some resources may require additional fees or commissions |

| Customizable tools to meet individual needs and preferences | |

| Opportunity to learn from experienced traders |

FX Choice offers a variety of educational resources that cater to the needs of traders at different levels of experience. The platform provides a range of professional trading tools that traders can use to improve their skills and knowledge. The educational resources available include market signals, autotrade, copy trading, VPS, news, trading signals, and EA. These resources are customizable, allowing traders to tailor them to their individual needs and preferences. Additionally, traders can learn from experienced traders by using the platform's copy trading features. While FX Choice offers a wide range of educational resources, there may be limited materials for beginners, and some resources may require additional fees or commissions. Overall, the platform offers a strong set of educational resources for traders looking to improve their trading skills and knowledge.

| Advantages | Disadvantages |

| 24/5 customer service available | No 24/7 customer service available |

| Support in multiple languages | No local phone numbers for some countries |

| Various contact methods available | No physical office for some regions |

| Quick response time through live chat and phone | Limited information on the website about customer service protocols |

| Call back service available |

FX Choice offers 24/5 customer service to its clients, providing support in multiple languages through various channels such as email, phone, live chat and call back service. The quick response time through live chat and phone is an advantage, ensuring that clients can get their issues resolved promptly. However, the lack of 24/7 customer service and local phone numbers for some countries could be a disadvantage for clients in those regions. While FX Choice has a physical office, it may not be accessible to some clients. The website could also provide more information about the customer service protocols in place to manage clients' issues. Overall, FX Choice's customer care dimension provides a good level of support to its clients.

FX Choice is a well-established online trading platform that provides a wide range of trading instruments, including forex, CFDs, and cryptocurrencies. The platform offers multiple account types, educational resources, and 24/5 customer support in various languages. It also provides various deposit and withdrawal options, making it easy for traders to manage their funds. One of the most significant advantages of FX Choice is the availability of the MetaTrader platform, which is a popular and user-friendly platform used by many traders worldwide. While there are some disadvantages, such as the limited availability of some services, FX Choice remains a reputable and reliable platform for both beginner and experienced traders looking to trade various financial instruments. Overall, with its comprehensive trading features, customer support, and user-friendly platform, FX Choice is an attractive choice for traders looking for a reliable online trading platform.

Question: What is FX Choice?

Answer: FX Choice is an online forex and CFD broker that offers trading services to retail and institutional clients.

Question: What types of accounts does FX Choice offer?

Answer: FX Choice offers three types of accounts: Classic, Optimum, and Pro.

Question: What is the minimum deposit to open an account with FX Choice?

Answer: The minimum deposit to open a Classic account is USD 100, while the minimum deposit for an Optimum account is USD 10, and for a Pro account, it is USD 100.

Question: What is the maximum leverage offered by FX Choice?

Answer: FX Choice offers leverage up to 1:1000 for Optimum account and 1:200 for Classic and Pro accounts.

Question: What trading platforms are available at FX Choice?

Answer: FX Choice offers the popular trading platforms MT4, MT5, and WebTrader.

Question: What are the deposit and withdrawal methods available at FX Choice?

Answer: FX Choice offers various deposit and withdrawal methods, including credit cards, e-wallets, bank transfers, and cryptocurrencies.

Question: Does FX Choice offer educational resources for traders?

Answer: Yes, FX Choice provides educational resources such as market signals, autotrade, copy trading, VPS, news, trading signals, and EA.

| AvaTrade | Basic Information |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA, KNF |

| Tradable Assets | Forex, CFD, stock, commodities, indices, futures, cryptocurrencies, options |

| Demo Account | ✅ |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| EUR/USD Spread | 0.9 pips |

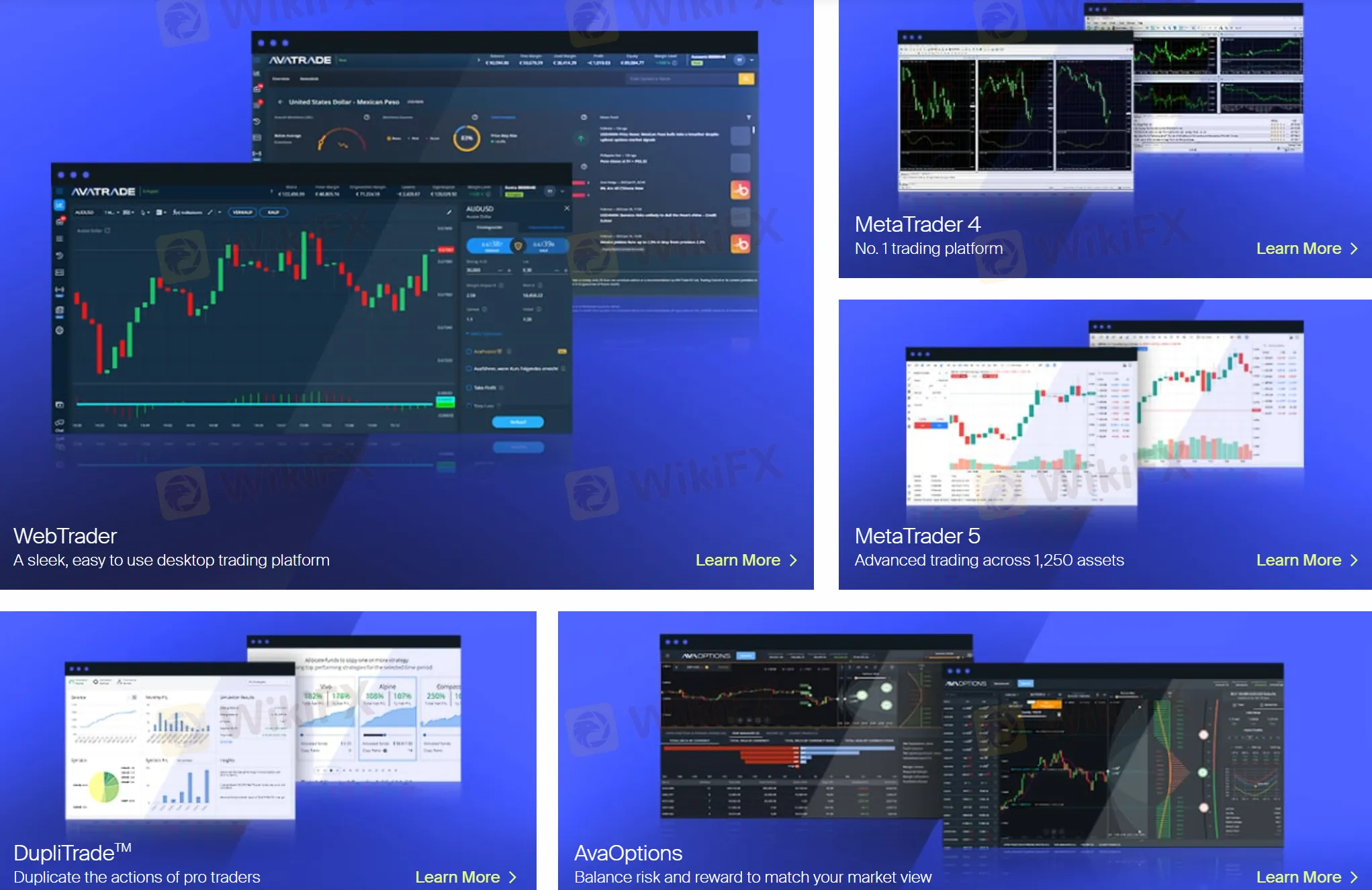

| Trading Platform | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Minimum Deposit | $100 |

| Payment Method | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Customer Support | 24/7 - live chat, contact form, WhatsApp: +447520644093, phone (vary by the region) |

| Educational Resources | Academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, trading webinars |

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, FSA, FFAJ, ADGM, CBI, FSCA, and KNF.

As a market maker broker, Avatrade offers a range of tradable assets including forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options. The broker provides clients with access to multiple trading platforms, including AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, and DupliTrade.

Avatrade requires a minimum deposit of $100 to open an account, and clients can choose from a variety of payment methods including MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto.

Customer support is available via live chat, phone, email, and a knowledge base. The broker also provides a range of educational resources for traders, including academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, trading webinars.

Avatrade is regulated by multiple financial regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Services Authority (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Market of the United Arab Emirates (ADGM), the Central Bank of Ireland (CBI), the Financial Sector Conduct Authority of South Africa (FSCA), and the Polish Financial Supervision Authority of Poland (KNF). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

When it comes to choosing a broker, it's important to carefully consider the pros and cons to determine which one is right for you. Some potential advantages of a broker may include competitive spreads, user-friendly trading platforms, and rich educational resources. Additionally, a regulated broker can provide peace of mind knowing that your funds are protected.

| Pros | Cons |

| Regulated by reputable financial authorities | Single account option |

| Competitive spreads | |

| Multiple trading platforms | |

| Rich and Free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

Avatrade offers a wide range of trading instruments across various markets, including Forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options.

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

The standard account provides access to all of Avatrade's trading instruments, including forex, stocks, commodities, and cryptocurrencies. This means that traders can diversify their portfolio and take advantage of different market conditions, all within the same account.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, Pepperstone and XM have a minimum deposit requirement of $0 and $5, respectively.

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it's important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It's important to note that professional clients must meet certain criteria to qualify for higher leverage.

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it's important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading.

Non-trading fees are the fees that a broker charges for activities other than trading. These fees can significantly impact the profitability of a trader, and it's important to be aware of them when choosing a broker. Avatrade charges inactivity fee and administration fee. You can find detailed info in the table below:

| Fee Type | Amount | Detail |

| Inactivity Fee | $/€/£50 | Charged after 3 consecutive months of non-use (“Inactivity Period”) |

| Administration Fee | $/€/£100 | Charged fter 12 consecutive months of non -use (“Annual Inactivity Period”) |

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

Avatrade accepts MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, and Boleto. The minimum deposit requirement is 100 USD, EUR, GBP or AUD. Deposit and withdrawal processing time very by the method you choose. You can find more detailed info in the screenshot below or directly visit this link: https://www.avatrade.com/about-avatrade/avatrade-withdrawals-deposits.

Avatrade offers customer support 24/7 through multiple channels, including live chat, contact form, WhatsApp: +447520644093, phone (vary by the region), and email. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, etc. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management. Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter.

Avatrade is a well-established broker with a long history of providing trading services to traders worldwide. They offer a variety of trading instruments, including forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options, with competitive spreads and leverage options. Their trading platform is user-friendly and provides a range of advanced tools and features for traders of all skill levels. Additionally, they provide excellent customer support, educational resources, and a demo account for traders to practice their strategies. However, there are some downsides to consider, such as higher inactivity fees and limited account options.

Is Avatrade regulated?

Yes, Avatrade is regulated by multiple reputable authorities, including ASIC (Australia), FSA (Japan), FFAJ (Japan), ADGM (UAE), CBI (Ireland), FSCA (South Africa), and KNF (Poland).

Does Avatrade offer a demo account?

Yes, Avatrade offers a free demo account for traders to practice and test their strategies before trading with real money.

What is the minimum deposit requirement for Avatrade?

The minimum deposit requirement for Avatrade is $100.

What is the maximum leverage offered by Avatrade?

The maximum leverage offered by Avatrade is 1:400.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fx-choice and ava-trade are, we first considered common fees for standard accounts. On fx-choice, the average spread for the EUR/USD currency pair is from 0 pips, while on ava-trade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fx-choice is regulated by FSC. ava-trade is regulated by ASIC,FSA,FFAJ,ADGM,CBI,FSCA,KNF.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fx-choice provides trading platform including Pro,Classic,Optimum and trading variety including 36 currency pairs; Indices, Metals, Commodities, Energies, Cryptocurrencies. ava-trade provides trading platform including -- and trading variety including --.