No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FULLERTON and Hantec Markets ?

In the table below, you can compare the features of FULLERTON , Hantec Markets side by side to determine the best fit for your needs.

--

--

EURUSD:0.6

--

EURUSD:19.8

XAUUSD:37.94

EURUSD: -5.36 ~ 2.04

XAUUSD: -16.33 ~ 9.73

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fullerton-markets, hantec-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Information | Details |

| Registration | Saint Vincent and the Grenadines |

| Regulated | Unregulated |

| Years of establishment | 5-10 years |

| Trading instruments | Forex, precious metals, indices, cryptocurrencies, stocks |

| Minimum Initial Deposit | Not specified |

| Maximum Leverage | Up to 1:500 |

| Minimum Spread | Variable, Raw, or PRO spreads |

| Trading Platform | MT5 |

| Deposit and Withdrawal | Credit cards, digital wallets, bank wire transfers, cryptocurrencies |

| Customer Service | Email, phone, messaging apps (Line, Telegram, Viber, Whatsapp) |

Fullerton is a financial institution that provides trading services in various financial markets. While it is important to note that Fullerton operates without a license and regulatory oversight, it offers a diverse range of market instruments, two types of accounts (LIVE and DEMO), leverage options up to 1:500, and the MT5 trading platform. Traders can access forex, precious metals, indices, cryptocurrencies, and stocks, while the platform provides advanced features and analytical tools. Deposits and withdrawals are facilitated through various methods, and customer support is available through multiple channels.

FULLERTON, as an unlicensed and unregulated financial institution, exposes investors and traders to significant risks.

Pros and Cons

| Pros | Cons |

| Diverse market instruments | Unregulated |

| LIVE and DEMO accounts | Security and protection uncertainty |

| Leverage options up to 1:500 | Limited transparency and accountability |

| Advanced MT5 trading platform | Potential financial losses and lack of recourse |

| Convenient deposit and withdrawal methods | |

| Multiple customer support channels |

Fullerton offers a diverse range of market instruments to cater to the needs of traders and investors. In the realm of forex, Fullerton provides a wide selection of currency pairs, enabling participants to engage in global currency trading and take advantage of fluctuations in exchange rates.

Additionally, Fullerton offers trading opportunities in precious metals such as gold, silver, platinum, and palladium, allowing individuals to diversify their portfolios and hedge against inflation or market volatility. Traders can also explore a variety of indices, including major global indices like the S&P 500, FTSE 100, and Nikkei 225, to speculate on the overall performance of specific markets. Fullerton extends its offerings to crude oil, providing access to one of the world's most important commodities, enabling traders to capitalize on price movements in the oil market.

Moreover, Fullerton recognizes the growing popularity of cryptocurrencies and offers a range of digital assets, including Bitcoin, Ethereum, and Litecoin, allowing traders to participate in this dynamic and evolving market.

Lastly, Fullerton facilitates trading in stocks, enabling individuals to invest in a wide range of publicly traded companies across various sectors and regions.

Fullerton offers two types of accounts: LIVE and DEMO.

The LIVE account is for real trading with actual money. It requires registration, verification, and funding. Traders can access various financial instruments and experience live market conditions. It involves real risks, and individuals should carefully consider their strategies and risk management.

The DEMO account is a practice account with virtual funds. It allows users to simulate trades and test strategies without risking real money. It helps beginners gain confidence and familiarity with the trading platform. Profits or losses in a DEMO account are simulated and do not have real financial consequences.

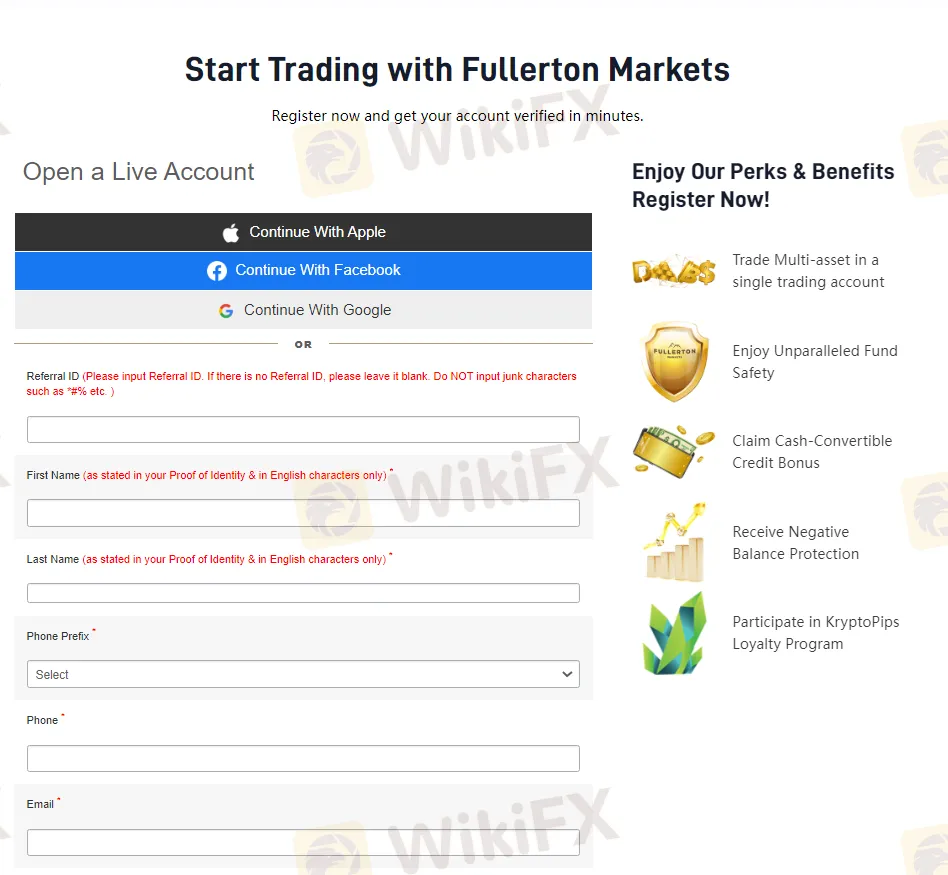

To open an account with Fullerton, follow these steps:

3. Choose the type of account you want to open, such as a LIVE or DEMO account.

4. Fill out the registration form with your accurate personal details.

Fullerton offers a maximum leverage of 1:500 to its clients. Leverage is a financial tool that allows traders to amplify their trading positions by borrowing funds from the broker. With a leverage ratio of 1:500, clients can control a position size up to 500 times larger than their actual account balance.

Fullerton Markets offers three types of spreads to its clients:

Fullerton Markets' MT5 platform offers traders enhanced flexibility and a wide range of trading functionalities that are not available on the older MT4 platform. With its advanced features, the MT5 platform provides traders with a more comprehensive and efficient trading experience. It offers 21 timeframes, allowing traders to analyze market trends across different intervals. Additionally, traders can choose from 6 pending order types, providing them with greater control over their trades and entry points.

The platform also boasts an extensive selection of technical indicators and analytical objects, empowering traders with in-depth market analysis capabilities. It includes a built-in economic calendar, providing real-time updates on important economic events and their potential impact on the markets. Traders can develop and utilize custom trading strategies using the MQL5 programming language, further enhancing their ability to implement personalized trading approaches.

Moreover, the MT5 platform provides real-time Depth of Market (DOM) data, enabling traders to access insights into market liquidity and the order book.

Deposit: Fullerton Markets offers a variety of convenient deposit methods to suit the needs of traders worldwide. Traders can choose to fund their accounts using credit cards, digital wallets, bank wire transfers, or cryptocurrencies. Credit card deposits are available in USD, EUR, and SGD currencies, with no minimum deposit amount required. Sticpay and digital wallet deposits are also available in USD, EUR, and SGD, with no minimum deposit requirement. For bank wire transfers, traders can deposit in USD, EUR, SGD, or NZD currencies, with a minimum deposit of USD 200 or equivalent value in other currencies.

Withdrawal: Fullerton Markets provides hassle-free withdrawal options for traders to access their funds. The minimum withdrawal amounts vary depending on the chosen method. For credit card, digital wallet, and cryptocurrency withdrawals, there is no minimum withdrawal amount. However, for Bitcoin withdrawals, a minimum withdrawal of USD 100 is required. Bank wire transfers have a minimum withdrawal amount of USD 200 or equivalent in other currencies. Additionally, Fullerton Markets covers all withdrawal fees, ensuring that traders can access their funds without any additional charges.

Customer Support at Fullerton Markets is dedicated to providing prompt and reliable assistance to traders. Traders can reach out to Fullerton Markets through various channels, including email, phone, and messaging apps like Line, Telegram, Viber, and Whatsapp. This multi-channel approach ensures that traders have multiple options to connect with the support team based on their preferred communication method.

Additionally, Fullerton Markets provides a comprehensive Help Center and FAQ section on their website, where traders can find instant answers to common questions about services, trading, and their accounts. This resourceful repository of information serves as a valuable self-help tool, empowering traders to find solutions and make informed decisions.

Furthermore, Fullerton Markets offers tutorials in the form of videos and blog posts to help traders master the A-Z of trading.

Fullerton Markets offers a range of educational resources to support traders in their journey towards successful trading. These resources are designed to provide valuable market insights, enhance trading knowledge, and help traders stay updated with the latest developments.

The blog section on Fullerton Markets' website is a valuable resource for traders. It features weekly market research that provides in-depth analysis and updates on market trends, economic news, and trading opportunities. Traders can leverage this information to make informed trading decisions and stay ahead of the market.

The video library is another valuable educational resource offered by Fullerton Markets. It covers a wide range of topics, including Forex, MetaTrader 4, MetaTrader 5, indicators, and key trading concepts.

These videos provide detailed explanations, step-by-step tutorials, and practical tips to help traders improve their trading skills and understanding of the market.

No, Fullerton operates without a license and regulatory oversight.

Trading with an unregulated entity exposes traders to potential financial losses and limited recourse in case of disputes or grievances.

Fullerton offers two types of accounts: LIVE accounts for real trading with actual money and DEMO accounts for practice trading with virtual funds.

Fullerton offers a maximum leverage of 1:500 to its clients.

You can reach out to Fullerton's customer support through email, phone, or messaging apps like Line, Telegram, Viber, and Whatsapp.

| Founded in | 2008 |

| Registered in | United Kingdom |

| Regulated by | ASIC, FCA, CGSE/VFSC/FSA (Suspicious clone) |

| Trading Instruments | CFDs on forex, commodities, indices, bullion |

| Demo Account | ✅ |

| Minimum Deposit | $10 |

| Leverage | Up to 1:1000 |

| Spread | 0.1 pips onwards |

| Trading platform | MT4/5 |

| Payment Method | Credit/debit card, China UnionPay, Skrill, Neteller |

| Customer Service | Live chat, contact form; email: info-mu@hmarkets.com |

| Social media: Facebook, LinkedIn, YouTube, Instagram | |

| Regional Restriction | The USA, Iran, Myanmar, North Korea and the United Arab Emirates |

Hantec Markets, one of the subsidiaries of the Hantac group, was established in 2008 in Australia as a new brand. Its business scope focuses on CFDs trading on forex, commodities, indices and bullion.

Demo account is available for practicing and trades can be executed on the world renowned MetaTrader4 and 5 platforms.

One exciting news is that the broker is decently regulated by ASIC (Australia Securities & Investment Commission) and FCA (Financial Conduct Authority), proving a certain level of liability and legality. What's more, the broker implements fund segregation and negative balance to protect customer funds.

However, the company charges several fees such as commissions, overnight fees, conversion fees, etc., adding trading costs.

| Pros | Cons |

| ASIC and FCA regulated | Suspcious clone FSA/CGSE/VFSC licenses |

| MT4/5 platforms | Does not accept clients from several countries |

| Affordable minimum deposit | |

| Demo accounts | |

| Tight starting spreads | |

| No deposit/withdrawal fees |

Yes, Hantec Markets is a legitimate and regulated forex broker that operates under the oversight of reputable financial regulatory bodies. It is officially regulated by ASIC (Australia Securities & Investment Commission) and FCA (Financial Conduct Authority), with licenses numbering at 326907 and 502635 respectively.

Though its CGSE and VFSC licenses are suspected to be fake clones, but after investigation, the regulated entities are subsidiaries of the Hantec Group who has 19 offices around the globe, which means Hantec Markets does not necessarily duplicate these licenses.

Nonetheless, during the research, we found that the company holds a suspected clone license with number “関東財務局長(金商)第102号” from FSA (Financial Services Agency) as well. But the company name is “Gaitame Finest Company Limited”, not relating to Hantect Group at all. You should be vigilant about this alarming red flag since the company might deceiving clients in another company's name in some business areas.

| Regulated Country | Regulator | Regulatory Status | Regulated Entity | License Type | License No. |

| ASIC | Regulated | Hantec Markets (Australia) Pty Limited | Market Making (MM) | 326907 |

| FCA | Regulated | Hantec Markets Limited | Market Making (MM) | 502635 |

| CGSE | Suspicious Clone | 亨達金銀投資有限公司 | Type AA License | 163 |

| VFSC | Suspicious Clone | Hantec Markets (V) Company Limited | Retail Forex License | 40318 |

| FSA | Suspicious Clone | Gaitame Finest Company Limited | Retail Forex License | 関東財務局長(金商)第102号 |

Currency pairs, indices, commodities, metals, energies, stocks... Hantec Markets gives its clients access to a massive trading market. So, both beginners and sophisticated traders could find what they want to trade on Hantec Markets.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ❌ |

| Stocks | ✔ |

| Bonds | ❌ |

Demo account: Hantec Markets offers a demo account for you to test a little on the financial market without the risk of losing money.

Real account: there are 2 types of real accounts in total: Cent account and Standard account.

The Cent account is said to target beginners who want to trade with less risks. The initial deposit requirement is affordable at $10, with spread starting from 1.2 pips. However, additional functions such as copy trading and demo account are not available with this account. You cannot practice before you start real trading or imitate trading strategies from successful traders.

While Standard account, with access to a full suite of Hantec features, also requires the same initial deposit of $10. Spread is tighter from 0.1 pips and copy trading/demo account is available.

In addition, there is a Swap Free Accounts that allows trading the following products without swap charges: EURUSD, GBPUSD, USDJPY, USDCHF, EURCAD, GBPCAD, EURGBP, CHFJPY, EURCHF, EURJPY, NZDUSD, AUDUSD, AUDNZD, USDCAD, GBPJPY, CADJPY, CADCHF, GBPCHF, XAGUSD, XAUUSD. However, if you hold a position for longer than one week in this account, a holding fee of 10 USD (or equivalent) per lot on FX and 30 USD (or equivalent) per lot on XAUUSD and XAGUSD per day will be charged.

| Account Type | Initial Deposit | Leverage | Spread | Asset Classes | Trading Central | Copy Trading | Demo Account |

| Cent | $10 | Up to 1:1000 | From 1.2 pips | 5 | ✔ | ❌ | ❌ |

| Standard | $10 | Up to 1:500 | From 0.1 pips | 7 | ✔ | ✔ |

Hantec Markets offers a maximum leverage of up to 1:1000, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

Hantec Markets offers Forex trading with spreads starting from specified values for various currency pairs. There are no commissions charged for Forex trades. The spread type is floating, and the minimum order size is 0.01 lot. The trading conditions also include a stop-out level set at 40% of the used margin. Overall, Hantec Markets provides competitive spreads and transparent commission-free trading for Forex.

Trade major pairs like EUR/USD, GBP/USD, and USD/JPY:

EUR/USD spread: 0.00014898 pips

GBP/USD spread: 0.000213589 pips

USD/JPY spread: 0.022286942 pips

Hantec Markets offers precious metals trading with competitive spreads and floating spread types. Traders can trade gold (XAU) with a minimum margin requirement of 5% and silver (XAG) with a minimum margin requirement of 10%. The minimum order size for gold is 0.1 lot (10 ounces) and for silver is 0.1 lot (500 ounces). There are no commissions charged for trading these metals, and the trading hours are available according to the server time.

Hantec Markets offers CFD trading on a variety of symbols, including stocks. The spreads for stock CFDs start from specified values for each symbol. Additionally, there are no specific details provided regarding commissions for stock CFD trading.

Hantec Markets offers indices trading on various major indices in Europe, Asia, Australia, and the US. The spreads for indices trading start from specified values for each symbol. Additionally, there are no specific details provided regarding commissions for indices trading.

In terms of Commodity Trading conditions at Hantec Markets, both US Oil and UK Oil have a spread of 0.05. There are no specific details provided regarding commissions for commodity trading.

Hantec Markets offers cryptocurrency trading with competitive spreads on a range of popular cryptocurrencies.

Currency Conversion Fee:

A conversion fee may be applicable to trades based on the currency settings of your trading account, funding currency, and the settlement currency of the market being traded.

The conversion fee is set at 0.6% and is added to the settlement exchange rate, which is determined by the market rate at the time of settlement. To account for the conversion fee, the underlying exchange rate is multiplied by 1.006 during the conversion process.

For instance, if the GBP/USD exchange rate is 1.1, the applicable FX conversion rate would be 1.1 x 1.006 = 1.1066.

By default, CFD accounts are set to 'instant' conversion. This means that any realized profit, loss, funding, dividend adjustments, or commission will be automatically converted to your account's base currency.

Let's consider an example:

Suppose you have purchased £20 per point worth of FTSE (UK100), and the base currency of your trading account is USD. Since you are trading in GBP, which is different from your account's base currency, the related transactions need to be converted to USD.

Assuming the exchange rate is 0.7576 ($1 equals £0.7576), after incorporating the conversion fee of 0.6%, the conversion rate becomes 0.7576 x 1.006 = 0.7621.

If FTSE increases by 30 points, your profit would amount to £600. This profit will be reflected as £600/0.7621 = $787.30 in your account. To calculate the admin fee charged, multiply your profit by 0.6%:

$787.30 profit x 0.6% = £4.72 currency conversion fee (already included – not charged separately)

Overnight Funding (Swap charges):

Also known as the 'Swap' charge, this is the cost of holding a position overnight. The amount will be dependent on the size of your trade, whether you have a long or short position and the instrument you are trading. Swap rates are determined by the underlying interest rates of the products or currency pairs you have open positions in.

Hantec Markets offers two trading platforms for trades execution: the popular MetaTrader4 and MetaTrader5.

Both platforms are widely recognized globally for its robust functions, built-in charting tools and techinical indicatiors and customized interface. Traders can configure settings of the platform according to their own preferences.

You can acess these two platforms via web on any devices, or download apps from Windows, iOS, Mac and Android devices.

Hantec Markets provides multiple payment methods:

Credit/Debit Card: Accepts USD, EUR, GBP, and NGN with a minimum deposit of $25 by Visa, Maestro, UK Debit Cards; no processing fees apply, and payment details must match the account name.

Skrill: Allows deposits in USD, EUR, GBP, and NGN with a minimum of $100; no processing fees, and account details must match.

NETELLER: Supports USD, EUR, GBP, CHF, NGN, and AUD with a minimum deposit of $100; no processing fees, and account details must match.

China UnionPay: Supports all Mainland Chinese cards; no minimum deposit specified and no processing fees.

Withdrawals are made via the original funding method, processed within 2-5 working days, and must match the account holders name.

| Payment Method | Currencies Available | Minimum Deposit | Fees | Notes |

| Credit/Debit Card | USD, EUR, GBP, NGN | $25 or equivalent | / | Must match account name; rounded amounts only. |

| Skrill | USD, EUR, GBP, NGN | $100 | ❌ | |

| NETELLER | USD, EUR, GBP, CHF, NGN, AUD | $100 | ❌ | |

| China UnionPay | CNY (supports all Mainland Chinese issued cards) | 0 | ❌ |

Hantec Markets prides itself on providing excellent customer service to its clients. Each client is assigned a dedicated relationship manager who serves as their primary point of contact for any queries or issues. The relationship manager can be reached conveniently through the live chat tool available on the website.

The customer support team is also available 24/5 and can be contacted by leaving a message in the “contact us” section of the website.

Alternatively, you can reach out to them through the live chat feature, which is located at the lower right corner of the broker's website. Additionally, you have the option to contact customer support via telephone using the following numbers:

China – 4000280332

Nigeria – 7080601265

Jordan – 18442000155

Thailand – 1800019263

Taiwan – 886801491458

Pakistan – 080090044349

Main Office (UK) – +41225510215

Please note that international numbers may incur toll fees.

Office Locations:

Hantec Markets' main headquarters is situated at 5-6 Newbury St, Barbican, London EC1A 7HU in the United Kingdom. For the addresses of their Dubai, India, or other offices, please refer to the Hantec Markets website.

Hantec Markets offers a wide range of educational resources on its website to support traders in their learning journey. These resources include market reports, analysis videos, YouTube webinars featuring Nigerian and African traders, as well as podcasts. Moreover, there is a dedicated learning hub that provides valuable content across four experience tiers, along with lessons on strategy creation and risk management.

Overall, Hantec Markets is a well-established forex broker with competitive spreads, transparent commission-free trading, and access to popular trading platforms like MT4 and MT5. Traders can benefit from various trading platforms and a diverse selection of tradable assets. However, some aspects, such as limited information about certain commissions and the availability of Hantec Social platform, could be improved. Traders should carefully assess their trading requirements and preferences, as well as consider the associated risks and costs, before choosing Garnet Trade as their trading platform.

Is Hantec Markets a legitimate broker?

Yes, Hantec Markets is a legitimate and regulated forex broker. They are authorized and supervised by ASIC and FCA.

What account types do Hantec Markets offer?

Hantec Markets offers demo accounts, Cent accounts, and Standard accounts. The minimum deposit to open an account is just $10.

What trading platforms are available on Hantec Markets?

MT4 and MT5.

What is the maximum leverage offered by Hantec Markets?

Hantec Markets offers maximum leverage of 1:1000 for international clients using the Cent Account and 1:500 for international clients using the Standard Account. However, for European clients, leverage is limited by ESMA regulations to 1:30 for major FX pairs, 1:20 for minors and exotics, gold, and stock indices, and 1:10 for oil and silver.

What deposit and withdrawal methods are supported by Hantec Markets?

Hantec Markets supports Bank Wire, VISA, MasterCard, Neteller, Skrill, and UnionPay.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fullerton-markets and hantec-markets are, we first considered common fees for standard accounts. On fullerton-markets, the average spread for the EUR/USD currency pair is -- pips, while on hantec-markets the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fullerton-markets is regulated by --. hantec-markets is regulated by ASIC,FCA,FSA,CGSE,VFSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fullerton-markets provides trading platform including -- and trading variety including --. hantec-markets provides trading platform including -- and trading variety including --.