No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FULLERTON and BINANCE JEX ?

In the table below, you can compare the features of FULLERTON , BINANCE JEX side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of fullerton-markets, binance-jex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Information | Details |

| Registration | Saint Vincent and the Grenadines |

| Regulated | Unregulated |

| Years of establishment | 5-10 years |

| Trading instruments | Forex, precious metals, indices, cryptocurrencies, stocks |

| Minimum Initial Deposit | Not specified |

| Maximum Leverage | Up to 1:500 |

| Minimum Spread | Variable, Raw, or PRO spreads |

| Trading Platform | MT5 |

| Deposit and Withdrawal | Credit cards, digital wallets, bank wire transfers, cryptocurrencies |

| Customer Service | Email, phone, messaging apps (Line, Telegram, Viber, Whatsapp) |

Fullerton is a financial institution that provides trading services in various financial markets. While it is important to note that Fullerton operates without a license and regulatory oversight, it offers a diverse range of market instruments, two types of accounts (LIVE and DEMO), leverage options up to 1:500, and the MT5 trading platform. Traders can access forex, precious metals, indices, cryptocurrencies, and stocks, while the platform provides advanced features and analytical tools.

Deposits and withdrawals are facilitated through various methods, and customer support is available through multiple channels. It is crucial to consider the risks associated with engaging with an unregulated entity and prioritize safety and protection by conducting thorough research and seeking professional advice.

FULLERTON, as an unlicensed and unregulated financial institution, exposes investors and traders to significant risks. Regulatory oversight offers crucial advantages to traders, including investor protection, market integrity, compliance, accountability, and dispute resolution. It is advisable to engage with licensed and regulated brokers or financial institutions to ensure safety and protection. Thorough research, understanding terms and conditions, and seeking professional advice are essential steps to make informed decisions and prioritize financial security.

Operating without a license and regulatory oversight, FULLERTON lacks the necessary safeguards for investors and traders. Regulatory bodies provide investor protection by enforcing standards and preventing fraud and unfair practices. They also ensure market integrity by monitoring financial institutions and preventing unethical behavior. Compliance and accountability are upheld through regulations and regular audits, reducing the likelihood of misconduct. Additionally, regulatory bodies offer dispute resolution mechanisms, providing recourse for grievances.

To mitigate risks associated with unregulated entities like FULLERTON, traders should prioritize regulated brokers, conduct thorough research, understand terms and conditions, and seek professional advice. Choosing licensed and regulated institutions enhances safety and protection.

Fullerton offers a diverse range of market instruments, allowing traders to access various financial markets and pursue their investment goals. The availability of LIVE and DEMO accounts provides flexibility for traders to choose between real trading with actual money or practicing with virtual funds. Leverage options up to 1:500 offer the potential for amplifying trading positions and maximizing profits.

The advanced MT5 trading platform enhances the trading experience with its comprehensive features and analytical tools. Additionally, Fullerton provides convenient deposit and withdrawal methods, making it easier for traders to manage their funds. The availability of multiple customer support channels ensures prompt assistance and support for traders.

One of the significant concerns with Fullerton is its lack of regulation. Operating without a license and regulatory oversight exposes investors and traders to significant risks. The absence of regulatory oversight raises questions about security and protection, leaving traders uncertain about the safety of their funds. Limited transparency and accountability are also drawbacks, as the unregulated nature of Fullerton makes it difficult to gauge the institution's practices and ensure compliance. There is a potential for financial losses and lack of recourse in case of disputes or grievances. Traders should be cautious and consider these risks when engaging with an unregulated entity like Fullerton.

| Pros | Cons |

| Diverse market instruments | Unregulated |

| LIVE and DEMO accounts | Security and protection uncertainty |

| Leverage options up to 1:500 | Limited transparency and accountability |

| Advanced MT5 trading platform | Potential financial losses and lack of recourse |

| Convenient deposit and withdrawal methods | |

| Multiple customer support channels |

Fullerton offers a diverse range of market instruments to cater to the needs of traders and investors. In the realm of forex, Fullerton provides a wide selection of currency pairs, enabling participants to engage in global currency trading and take advantage of fluctuations in exchange rates.

Additionally, Fullerton offers trading opportunities in precious metals such as gold, silver, platinum, and palladium, allowing individuals to diversify their portfolios and hedge against inflation or market volatility. Traders can also explore a variety of indices, including major global indices like the S&P 500, FTSE 100, and Nikkei 225, to speculate on the overall performance of specific markets. Fullerton extends its offerings to crude oil, providing access to one of the world's most important commodities, enabling traders to capitalize on price movements in the oil market.

Moreover, Fullerton recognizes the growing popularity of cryptocurrencies and offers a range of digital assets, including Bitcoin, Ethereum, and Litecoin, allowing traders to participate in this dynamic and evolving market.

Lastly, Fullerton facilitates trading in stocks, enabling individuals to invest in a wide range of publicly traded companies across various sectors and regions. With its comprehensive selection of market instruments, Fullerton provides traders and investors with the tools and opportunities to participate in various financial markets and pursue their investment goals.

Fullerton offers two types of accounts: LIVE and DEMO.

LIVE Account:

The LIVE account is for real trading with actual money. It requires registration, verification, and funding. Traders can access various financial instruments and experience live market conditions. It involves real risks, and individuals should carefully consider their strategies and risk management.

DEMO Account:

The DEMO account is a practice account with virtual funds. It allows users to simulate trades and test strategies without risking real money. It helps beginners gain confidence and familiarity with the trading platform. Profits or losses in a DEMO account are simulated and do not have real financial consequences.

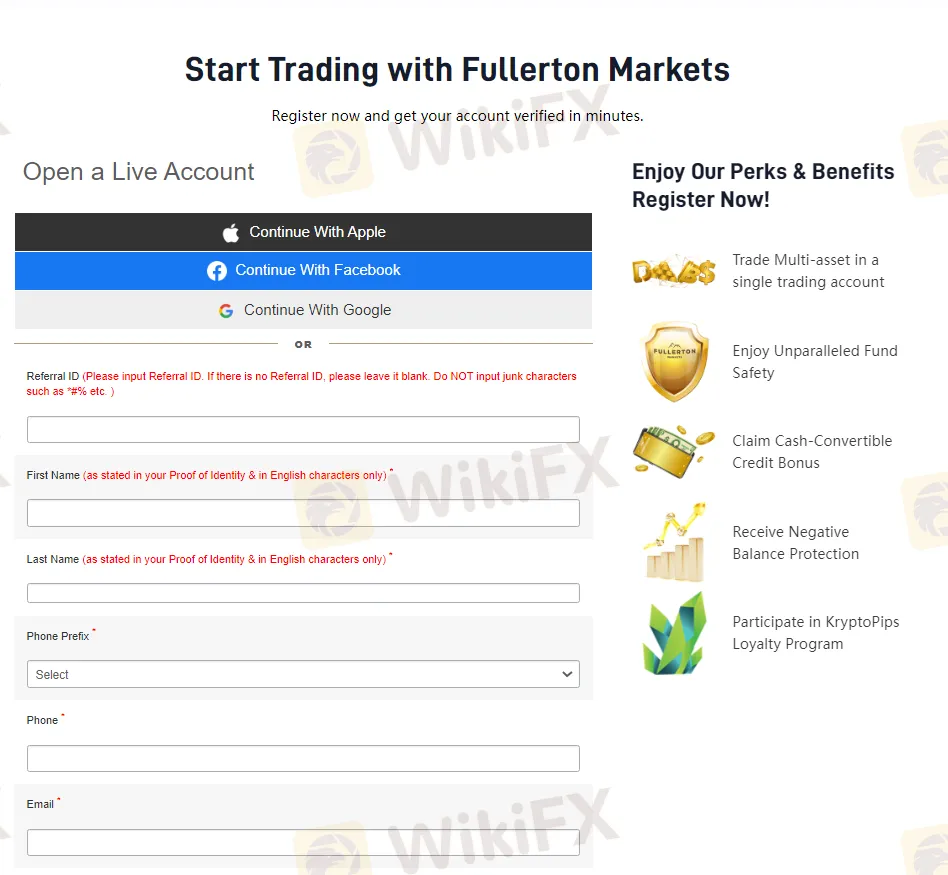

How to Open an Account?

To open an account with Fullerton, follow these steps:

Visit www.fullertonmarkets.com, the official website of Fullerton Markets.

Click on the “Open Account” button or a similar option on the homepage.

3. Choose the type of account you want to open, such as a LIVE or DEMO account.

4. Fill out the registration form with your accurate personal details.

Submit any necessary documents for verification, if required.

Once your account is verified, fund your account with the minimum required deposit and start trading.

Fullerton offers a maximum leverage of 1:500 to its clients. Leverage is a financial tool that allows traders to amplify their trading positions by borrowing funds from the broker. With a leverage ratio of 1:500, clients can control a position size up to 500 times larger than their actual account balance.

This high leverage ratio can potentially increase both profits and losses, as even small market movements can have a significant impact on the trading account. It is important to note that trading with high leverage involves a higher level of risk, and traders should exercise caution and employ risk management strategies to protect their capital.

Fullerton Markets offers three types of spreads to its clients:

Variable Spreads: These spreads are derived from Tier-One Liquidity Providers in Equinix LD4, a specialized data center for foreign exchange in London. When trading on the Fullerton Markets MT4 & MT5 platforms, clients are charged a brokerage fee collected from the spreads. There are no additional commissions for trade execution.

Raw Spreads: With raw spreads, clients can enjoy spreads as low as 0 pips, derived directly from multiple Liquidity Providers including banks and hedge funds in Equinix LD4. However, a flat fee of USD 8 per lot is charged as a commission for Forex instruments. This allows traders to access the market directly, benefiting from competitive pricing.

PRO Spreads: Traders using the Fullerton Markets MT4 & MT5 platforms can enjoy lower spreads, with no commissions, swaps, or additional fees when trading Forex and Metals. These spreads are derived from Tier-One Liquidity Providers in Equinix LD4, offering a cost-effective trading experience without incurring extra charges.

It's important for clients to review the Terms & Conditions provided by Fullerton Markets to understand the specific details and requirements associated with each type of spread and commission structure.

Fullerton Markets' MT5 platform offers traders enhanced flexibility and a wide range of trading functionalities that are not available on the older MT4 platform. With its advanced features, the MT5 platform provides traders with a more comprehensive and efficient trading experience. It offers 21 timeframes, allowing traders to analyze market trends across different intervals. Additionally, traders can choose from 6 pending order types, providing them with greater control over their trades and entry points.

The platform also boasts an extensive selection of technical indicators and analytical objects, empowering traders with in-depth market analysis capabilities. It includes a built-in economic calendar, providing real-time updates on important economic events and their potential impact on the markets. Traders can develop and utilize custom trading strategies using the MQL5 programming language, further enhancing their ability to implement personalized trading approaches.

Moreover, the MT5 platform provides real-time Depth of Market (DOM) data, enabling traders to access insights into market liquidity and the order book. It allows for additional order modification, allowing traders to easily manage and adjust their positions as market conditions evolve. The platform is compatible with newer operating systems, ensuring smooth performance and accessibility for traders. With better server capabilities and a larger database size, the platform facilitates efficient trade execution and data storage.

Deposit: Fullerton Markets offers a variety of convenient deposit methods to suit the needs of traders worldwide. Traders can choose to fund their accounts using credit cards, digital wallets, bank wire transfers, or cryptocurrencies. Credit card deposits are available in USD, EUR, and SGD currencies, with no minimum deposit amount required. Sticpay and digital wallet deposits are also available in USD, EUR, and SGD, with no minimum deposit requirement. For bank wire transfers, traders can deposit in USD, EUR, SGD, or NZD currencies, with a minimum deposit of USD 200 or equivalent value in other currencies.

Withdrawal: Fullerton Markets provides hassle-free withdrawal options for traders to access their funds. The minimum withdrawal amounts vary depending on the chosen method. For credit card, digital wallet, and cryptocurrency withdrawals, there is no minimum withdrawal amount. However, for Bitcoin withdrawals, a minimum withdrawal of USD 100 is required. Bank wire transfers have a minimum withdrawal amount of USD 200 or equivalent in other currencies. Additionally, Fullerton Markets covers all withdrawal fees, ensuring that traders can access their funds without any additional charges.

It's important to note that specific requirements and limits may apply for local transfers in different countries, such as Malaysia, Vietnam, Thailand, Indonesia, Philippines, China, Myanmar, Cambodia, Laos, and India. Traders should review the specific minimum and maximum withdrawal amounts for each country to ensure compliance with the respective regulations.

Customer Support at Fullerton Markets is dedicated to providing prompt and reliable assistance to traders. The team is committed to ensuring that all inquiries and concerns are addressed effectively, allowing traders to have a seamless and satisfactory trading experience.

Traders can reach out to Fullerton Markets through various channels, including email, phone, and messaging apps like Line, Telegram, Viber, and Whatsapp. This multi-channel approach ensures that traders have multiple options to connect with the support team based on their preferred communication method.

Additionally, Fullerton Markets provides a comprehensive Help Center and FAQ section on their website, where traders can find instant answers to common questions about services, trading, and their accounts. This resourceful repository of information serves as a valuable self-help tool, empowering traders to find solutions and make informed decisions.

Furthermore, Fullerton Markets offers tutorials in the form of videos and blog posts to help traders master the A-Z of trading. These educational materials cover a wide range of topics, providing valuable insights and strategies to enhance traders' knowledge and skills.

Fullerton Markets offers a range of educational resources to support traders in their journey towards successful trading. These resources are designed to provide valuable market insights, enhance trading knowledge, and help traders stay updated with the latest developments.

The blog section on Fullerton Markets' website is a valuable resource for traders. It features weekly market research that provides in-depth analysis and updates on market trends, economic news, and trading opportunities. Traders can leverage this information to make informed trading decisions and stay ahead of the market.

The video library is another valuable educational resource offered by Fullerton Markets. It covers a wide range of topics, including Forex, MetaTrader 4, MetaTrader 5, indicators, and key trading concepts. These videos provide detailed explanations, step-by-step tutorials, and practical tips to help traders improve their trading skills and understanding of the market.

Fullerton is a financial institution that provides trading services in various financial markets. While it offers a diverse range of market instruments, convenient account options, leverage options, and an advanced trading platform, it is crucial to note that Fullerton operates without a license and regulatory oversight.

This lack of regulation raises significant concerns regarding security, protection, transparency, and accountability. Engaging with an unregulated entity like Fullerton exposes traders to potential financial losses and limited recourse in case of disputes. Therefore, individuals should exercise caution, conduct thorough research, and prioritize safety and protection by choosing licensed and regulated brokers or financial institutions.

Is Fullerton a licensed and regulated financial institution?

No, Fullerton operates without a license and regulatory oversight.

What are the risks of trading with an unregulated entity like Fullerton?

Trading with an unregulated entity exposes traders to potential financial losses and limited recourse in case of disputes or grievances.

What account types does Fullerton offer?

Fullerton offers two types of accounts: LIVE accounts for real trading with actual money and DEMO accounts for practice trading with virtual funds.

What is the maximum leverage offered by Fullerton?

Fullerton offers a maximum leverage of 1:500 to its clients.

How can I contact Fullerton's customer support?

You can reach out to Fullerton's customer support through email, phone, or messaging apps like Line, Telegram, Viber, and Whatsapp.

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2-5 years |

| Company Name | BINANCE JEX |

| Regulation | No Regulation |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Spreads | N/A |

| Trading Platforms | App (iOS and Android), Desktop Client, API integration |

| Tradable Assets | Cryptocurrencies, Spot, Options, Futures |

| Account Types | N/A |

| Customer Support | 24/7 Chat Support, Email Support, Twitter, Facebook |

| Payment Methods | P2P Trading, Credit/Debit Card, Bank Transfer, Third-Party Payment Channels |

| Trading Tools | Binance Convert, Conversion History, Futures Grid, Trading Bots, Spot Grid, Binance OTC |

General Information

Binance JEX is an unregulated cryptocurrency exchange. The platform offers a range of market instruments for trading, with fees varying depending on the type of trading instrument and discounts available for JEX token holders. Binance JEX supports multiple payment methods, including P2P trading, credit/debit card payments, bank transfers, and third-party payment channels.

Binance JEX provides trading platforms for both mobile and desktop devices, allowing users to trade on the go and stay informed about market updates. The exchange also offers API integration for third-party trading applications. To enhance security, Binance JEX provides the Binance Authenticator for 2-Step verification. The platform offers various trading tools such as Binance Convert, Futures Grid, Trading Bots, Spot Grid, and an OTC trading service.

| Pros | Cons |

| Wide range of market instruments | Lack of regulatory oversight |

| Access to over 500 cryptocurrencies | Potential for market manipulation and fraudulent activities |

| Options, ETFs, and futures availability | Limited information on lesser-known cryptocurrencies |

| Ability to engage with buy/sell offers | Relatively low fee structure |

| Integration of JEX for expanded offerings | Limited customer protection and legal recourse options |

Binance JEX Exchange is currently not regulated by any valid regulatory authority.

Binance JEX provides access to a range of market instruments, primarily focusing on cryptocurrency pairs. Traders can choose from over 500 cryptocurrencies, including popular options like BTC, ETH, and XRP, as well as lesser-known cryptos such as NEO, IOTA, and NavCoin.

The platform offers options for trading crypto coins like ETH/BTC, LTC/BTC, JEX/BTC, DASH/BTC, and others. Additionally, traders have access to options, ETFs, and futures. Binance JEX expanded its offerings through the acquisition of JEX, which is now integrated and rebranded as Binance Jex.

Binance JEX has a pricing schedule for transaction fees, which can be found on its website.

For crypto coin pairs like ETH/BTC, the maker fee is 0.10% and the taker fee is 0.10%. Users who hold JEX tokens receive a 50% discount on these fees.

When it comes to option trading, both makers and takers are charged a fee of 0.20%. Again, JEX token holders enjoy a 50% discount on these fees. The fees for ETF trading are the same as for options.

For futures trading, the fees differ based on the trading pairs. For BTCUSDT, the maker fee is 0.00% and the taker fee is 0.04%. For ETHUSDT, the maker fee is 0.01% and the taker fee is 0.06%.

Users can trade on the go and stay informed about market updates with the Binance JEX app and desktop client.

For mobile trading, the Binance JEX app can be downloaded from the App Store for iOS devices or from Google Play for Android devices. The app allows traders to access all the features and functionality of Binance JEX on their smartphones or tablets.

For desktop trading, Binance JEX provides a powerful crypto trading platform that is compatible with Windows, MacOS, and Linux.

Binance JEX also offers API integration, helping traders to connect their own trading applications to the platform. The Binance API is designed to provide a way to integrate trading functionality into third-party applications.

Binance JEX offers a range of trading tools designed to enhance the trading experience and provide users with various strategies and options.

1. Binance Convert: Binance Convert allows users to instantly convert one cryptocurrency into another within their Binance JEX account. This tool helps exchange cryptocurrencies without the need for placing separate buy and sell orders.

2. Conversion History: Binance JEX keeps a record of users' conversion history, allowing them to track their previous cryptocurrency conversions. This feature provides a reference for users to review their conversion transactions.

3. Futures Grid: Binance JEX offers Grid Trading applied to COIN-M and USD-M contracts in the futures market. Grid Trading enables users to amplify their purchasing power by deploying long/short strategies and taking advantage of sideways markets. This tool helps users automate their futures trading and potentially benefit from market fluctuations.

4. Trading Bots: Binance JEX provides automation tools for trading cryptocurrencies. Users can deploy trading bots to execute trades based on predefined strategies. These bots help users identify and replicate trending strategies and take advantage of the liquidity available on Binance JEX. By using trading bots, users can trade crypto like professional traders.

5. Spot Grid: Spot Grid is a tool that allows users to place buying and selling orders at set intervals across a configured price range. By automating trades using Spot Grid, users can take advantage of volatile markets and potentially optimize their trading outcomes.

6. Binance OTC: Binance JEX offers an over-the-counter (OTC) trading service. OTC trading allows users to trade large volumes of cryptocurrencies directly with Binance, without going through the traditional order book. The OTC trading service provides a more personalized way to execute large trades.

7. OTC Trading History: Binance JEX keeps a record of users' OTC trading history, allowing them to track their previous OTC transactions and review the details of their trades.

Binance JEX offers several payment methods for users to facilitate trading and transactions. These methods include:

1.P2P Trading: Binance JEX provides a peer-to-peer (P2P) trading platform where users can buy and sell cryptocurrencies directly with other users. P2P trading allows for the use of various payment methods, such as bank transfers, mobile payment apps, and online payment systems, depending on the preferences of the trading parties.

2. Credit/Debit Card: Binance JEX supports credit and debit card payments, allowing users to purchase cryptocurrencies using their cards. By linking their cards to their Binance JEX accounts, users can make instant purchases and quickly access the cryptocurrencies they desire.

3. Bank Transfer: Users can also make deposits and withdrawals on Binance JEX via bank transfers. This payment method enables users to transfer funds from their bank accounts to their Binance JEX accounts or vice versa.

4. Third-Party Payment Channels: Binance JEX may collaborate with third-party payment channels to provide additional payment options to its users. These channels can include various online payment systems, e-wallets, and mobile payment apps.

Users can also reach out to Binance JEX customer support by sending an email to service@email.jex.com.

What trading platforms does Binance JEX offer?

Binance JEX offers a mobile app for iOS and Android devices, a desktop client for Windows, MacOS, and Linux, and API integration for connecting third-party trading applications.

What trading tools are available on Binance JEX?

Binance JEX offers tools such as Binance Convert for instant cryptocurrency conversion, Conversion History for tracking previous conversions, Futures Grid for automated futures trading, Trading Bots for executing predefined strategies, Spot Grid for automated trading in volatile markets, and Binance OTC for personalized large-volume trades.

What payment methods are accepted on Binance JEX?

Binance JEX supports P2P trading, credit/debit card payments, bank transfers, and may collaborate with third-party payment channels to offer additional options.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive fullerton-markets and binance-jex are, we first considered common fees for standard accounts. On fullerton-markets, the average spread for the EUR/USD currency pair is -- pips, while on binance-jex the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

fullerton-markets is regulated by --. binance-jex is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

fullerton-markets provides trading platform including -- and trading variety including --. binance-jex provides trading platform including -- and trading variety including --.