No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Forex Club and WeTrade ?

In the table below, you can compare the features of Forex Club , WeTrade side by side to determine the best fit for your needs.

--

--

EURUSD:18.95

XAUUSD:31.96

EURUSD: -7.64 ~ 0.36

XAUUSD: -36.1 ~ 13.75

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of forexclub, wetrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | Not specified |

| Company Name | Forex Club |

| Regulation | NBRB |

| Minimum Deposit | $10 |

| Spreads | Starting from 0 pips |

| Trading Platforms | Forex Club Terminal, MetaTrader4, MetaTrader5 |

| Tradable Assets | Stock, foreign exchange, precious metals, indices, agricultural products, crude oil, natural gas, ETFs, cryptocurrencies, and more |

| Account Types | Not specified |

| Demo Account | Available |

| Customer Support | Limited to email support |

| Payment Methods | Bank transfers, VISA, JCB, Alipay, WeChat Pay, Skrill |

| Educational Tools | live online, Training Courses, and Daily Faculty Information |

Forex Club is a regulated online forex broker based in Saint Vincent and the Grenadines. The company is licensed and regulated by the National Bank of the Republic of Belarus (NBRB), providing a level of credibility and trustworthiness. Forex Club offers a diverse range of market instruments, including forex, commodities, indices, and cryptocurrencies, and has a low minimum deposit requirement of $10. The broker supports multiple trading platforms, including their proprietary Forex Club Terminal, MetaTrader4, and MetaTrader5. They also offer a demo account for traders to practice and familiarize themselves with the platform. However, Forex Club has some disadvantages, such as limited customer support only through email, a lack of comprehensive educational resources, and a lack of information on specific account types. Overall, while Forex Club provides decent offerings, there are more comprehensive options available in the market.

Forex Club is a regulated online forex broker operating in Belarus. The company is licensed and regulated by the National Bank of the Republic of Belarus (NBRB). Its license number is 192580558. The NBRB is the regulatory agency responsible for overseeing financial institutions and ensuring compliance with regulations in Belarus. As a regulated broker, Forex Club is required to adhere to strict guidelines and standards set by the NBRB to provide a safe and secure trading environment for its clients. Traders can have confidence in the integrity and reliability of Forex Club's operations, knowing that the broker operates under the supervision of a reputable regulatory authority.

Pros and Cons

Forex Club has a diverse range of market instruments, providing traders with multiple options to choose from. Additionally, the broker offers a selection of trading platforms, giving users the flexibility to trade on their preferred interface. One advantage is that Forex Club operates under the regulation of NBRB, which ensures a level of trust and security for traders. Moreover, the low minimum deposit requirement of $10 makes it accessible for individuals with smaller capital to enter the market. To assist traders in honing their skills, Forex Club provides a demo account where they can practice and familiarize themselves with the platform. On a positive note, Forex Club offers commission-free investments in real stocks, allowing traders to save on trading fees. Additionally, the broker supports various deposit methods, providing convenience and flexibility for clients to fund their trading accounts.

However, it is important to note some drawbacks. Customer support is limited to email, which may cause delays in resolving issues and addressing concerns. Moreover, the educational resources provided by Forex Club are relatively limited, which may be a disadvantage for traders seeking in-depth learning materials and educational tools. Another drawback is the lack of information on specific account types, which may leave traders uncertain about the options available to them.

| Pros | Cons |

| Diverse range of Market Instruments | Customer support is limited to email |

| Regulated by NBRB | Limited educational resources |

| A low minimum deposit of $10 | Lack of information of account types |

| Demo Account available | |

| Offers commission-free investments in real stocks | |

| Multiple Trading Platforms | |

| Various deposit methods |

Forex Club provides you with the most popular trading products on the market, including Stock, foreign exchange, precious metal, index, agricultural products, Crude oil and natural gas, and ETF Online Trading.

Forex

Forex trading describes the currency exchange market which refers to the global, decentralized marketplace where individuals, companies, and financial institutions exchange currencies for one another at floating rates.

Commodities

Commodity markets offer many investment opportunities for traders. Soft commodities have been traded for centuries and play a major role in portfolio diversification and risk management. Investing in contract-based tradable goods is a reliable way to mitigate risk during times of economic uncertainty.

Indices

Equity, or stock indices, are actual stock market indexes which measure the value of a specific section of a stock market. They can represent a specific stock market or a specific set of the largest companies of a nation.

Precious metals

The trading of gold and other precious metals, along with crude oil, copper, or petroleum, are hard commodities that play a major role in the commodities market and are contract-based tradable goods.

Energy

The typical feature of energy prices is high volatility due to the influence of political and environmental factors, supply and demand, extreme weather conditions, and global economic growth.

Forex Club has a minimum deposit requirement of only $10. This minimum deposit amount was equivalent to ZAR 160 at an average current exchange rate between the US Dollar and the South African Rand at the time of writing. Forex Club allows traders to fund their accounts via several different methods.

Forex Club offers demo accounts with €50,000 in virtual money, accessible through web and mobile apps. When registering for a demo account, users also sign up for a real account, but they need to make a deposit to access it. Switching between demo mode and real mode on the Forex Club website or app is simple, enabling users to capitalize on quickly changing market conditions.

To open an account with Forex Club, please follow these steps:

1. Visit the official website of Forex Club, which is https://fc-official.com/.

2. On the homepage, locate and click on the “Open an Account” or “Register” button. This will typically be displayed prominently on the website.

3. You will be redirected to the account registration page. Here, you will need to provide your personal information, such as your full name, email address, phone number, and country of residence. Ensure that all the information you provide is accurate and up to date.

4. Next, you will be prompted to choose the type of trading account you wish to open. Forex Club may offer different account types.

5. Once you have chosen your account type, you will need to agree to the terms and conditions of Forex Club.

6. Once your account has been successfully registered and verified, you will receive login credentials, including a username and password.

7. Log in to your Forex Club account using the provided credentials.

8. After logging in and setting up the trading platform, you can fund your account by choosing from the available payment methods provided by Forex Club.

Forex Club offers competitive spreads starting from 0 pips. Instead of charging spreads, the broker has opted to charge commissions on trades. Traders should carefully review the terms and conditions to understand the commission percentages and factors that may influence these changes.

Joining Forex Club is free, and there are no monthly trading fees. The only fees associated with trading are the commissions mentioned earlier. However, it's important to note that when trading financial instruments like forex, there may be additional charges such as overnight fees or swap fees when positions are held for longer than one trading day. Traders should be aware of these potential fees and factor them into their trading strategy.

Forex Club offers three trading platforms, its proprietary Forex Club terminal, as well as popular and well-known trading platforms on the market, including Meta Trader 4 and Meta Trader 5.

Forex Club terminal can easily invest and make money anywhere in the world, and quickly withdraw profits online.

Meta Trader 4 is considered the most popular trading platform in the world. Whether you are an experienced trader or want to maximize your trading profits, this platform is the best platform for you to trade.

Meta Trader 5 is the latest version of the most popular forex trading software. In the new version of the MT5 terminal, in addition to traditional foreign exchange currency pair transactions, you can also trade stocks, indices, crude oil & natural gas, agricultural products, digital cryptocurrencies, ETFs, and metals.

Forex Club offers traders various deposit methods which can be used when funding accounts. Withdrawals usually must be returned by the same method used to deposit and to the same bank account. Most deposit methods are processed instantly except for bank transfers that can take several hours on occasion. Traders must ensure that they verify whether their financial institution charges its own fees. Deposit into/Withdrawal from the Forex Club can be done in the following ways: Bank transfers, VISA, JCB, Alipay, Wechat pay, or Skrill.

The team at Forex Club strives tirelessly to ensure that traders have access to all the necessary information to effectively navigate and utilize their platform, thus maximizing their benefits. In the event that traders encounter any queries or concerns, they can always reach out to the dedicated customer support team. Simply send an email to support-china@fxclub.org, and rest assured that a response will be provided within one working day. It is important to note, however, that the customer support services offered by Forex Club are solely limited to email correspondence.

Forex Club provides a range of educational resources, including three types: live online sessions, training courses, and daily faculty information. These resources are designed to offer valuable insights and knowledge to traders. The training courses are developed and regularly updated to align with the current market realities, ensuring that traders receive the most relevant information. The Investment Academy's faculty and experts actively share their experiences and expertise through these courses, providing valuable guidance to traders.

Forex Club is a regulated forex broker based in Saint Vincent and the Grenadines. It is licensed and regulated by the National Bank of the Republic of Belarus (NBRB). It offers a diverse range of market instruments, including forex, commodities, indices, and cryptocurrencies, with a low minimum deposit requirement of $10. It supports multiple trading platforms, and provides a demo account for practice. However, Forex Club has limited customer support through email, lacks comprehensive educational resources, and provides little information on specific account types. The in-house trading platform may not match the standards of some competitors.

Q: Is Forex Club a legitimate broker or a scam?

A: Forex Club is a regulated online forex broker authorized by the National Bank of the Republic of Belarus (NBRB).

Q: What is the minimum deposit requirement for Forex Club?

A: Forex Club has a minimum deposit requirement of only $10.

Q: Does Forex Club provide a demo account?

A: Yes, Forex Club offers demo accounts with €50,000 in virtual money.

Q: What trading platforms does Forex Club offer?

A: Forex Club provides three trading platforms: their proprietary Forex Club terminal, MetaTrader4 (MT4), and MetaTrader5 (MT5).

Q: What are the deposit and withdrawal methods available at Forex Club?

A: Forex Club offers various deposit methods, including bank transfers, VISA, JCB, Alipay, Wechat pay, and Skrill.

Q: How can I contact customer support at Forex Club?

A: Forex Club offers customer support via email: support-china@fxclub.org.

Q: Is this broker well regulated?

A: Yes, it is currently effectively regulated by NBRB.

| Registered in | United Kingdom |

| Regulated by | LFSA, FSA |

| Year(s) of establishment | 2015 |

| Trading instruments | Forex pairs, metals, energies, indices, stocks, cryptocurrencies… 120+ instruments |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:2000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, WeTrade APP |

| Deposit and withdrawal method | Bank wire transfer, USDT, local deposit, union pay |

| Customer Service | 24/7 Email, live chat, YouTube, Facebook, LINE, WeChat public account,Little Red Book, and BiliBili |

| Fraud Complaints Exposure | No for now |

WeTrade is a UK registered forex broker that is regulated by the Financial Services Authority (FSA) and the Labuan Financial Services Authority (LFSA) in Malaysia. The FSA is one of the most reputable financial regulatory bodies in the world, and its oversight ensures that WeTrade operates according to strict standards of transparency and fairness. The LFSA is also a well-respected regulator and its oversight provides an additional layer of protection for traders. WeTrade's regulatory status is a significant advantage as it offers traders a level of protection and reassurance that their funds are safe and that the broker is operating within the law.

WeTrade is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under a Straight Through Processing (STP) model, ensuring adherence to local financial regulations. Additionally, it holds offshore regulatory status with the Financial Services Authority (FSA), which includes business registration for broader operational compliance. These regulatory frameworks ensure that WeTrade maintains high standards of transparency and security, providing a reliable trading environment for its clients.

Pros and Cons of WeTrade

Pros:

Cons:

| Pros | Cons |

| Regulated by FSA and LFSA | Limited deposit/withdrawal options |

| Wide range of instruments | Customer support limited to email and social media |

| Multiple account types, including demo | Limited company background information |

| Competitive spreads; high leverage up to 1:2000 | ECN account: $1000 minimum deposit, $7/lot commission |

| Educational resources available |

WeTrade offers its traders a wide range of 120+ instruments to choose from, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. This provides traders with a great opportunity to diversify their trading portfolio and access a variety of markets and assets. Additionally, the selection of cryptocurrencies offered by WeTrade is somewhat limited compared to some other brokers in the market.

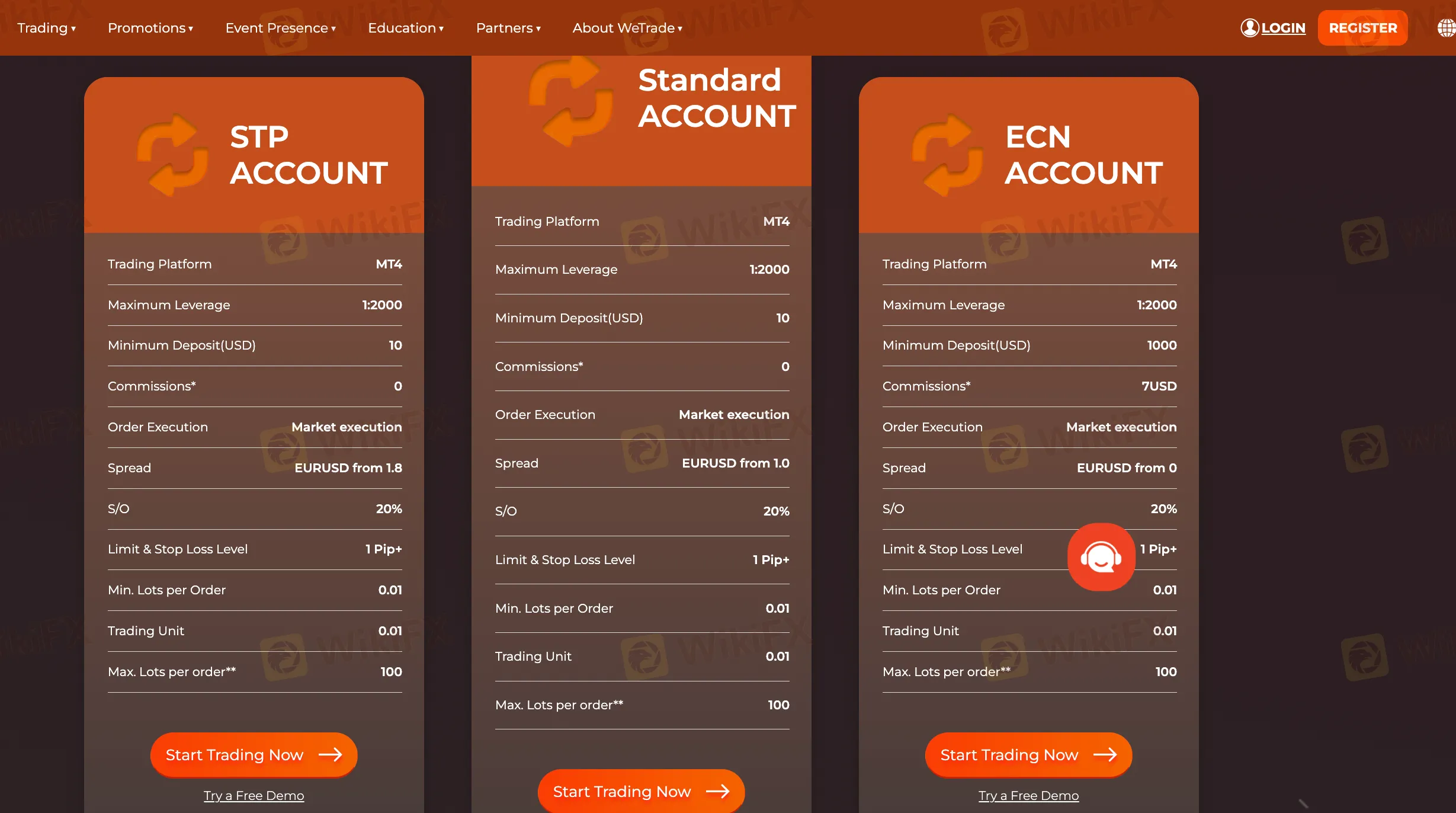

WeTrade offers a variety of account types, including ECN, Standard, and STP, each with different spreads and fees. The ECN account offers zero spreads but charges a $7 commission per lot traded, making it suitable for high-volume traders. The Standard account provides lower EUR/USD spreads starting from 1.0 pips with no commission, making it ideal for advanced traders. The STP account offers EUR/USD spreads starting from 1.8 pips with no commission, making it a good choice for beginner traders. Overall, WeTrades spreads and commission rates are competitive and cater to different trading needs.

WeTrade offers three account types to meet the needs of traders. The ECN account requires a higher minimum deposit of $1,000 but offers spreads as low as 0.0 pips, with a $7 commission per lot traded. Both the Standard and STP accounts have a minimum deposit of $100 and offer commission-free trading. Additionally, traders can use demo accounts to practice their strategies without risking real capital. A high leverage of 1:2000 is available across all account types, although some traders may prefer lower leverage.

WeTrade offers clients the MetaTrader 4 (MT4) platform, a widely used and user-friendly trading platform in the forex industry, also available in a mobile version. MT4 is known for its extensive technical analysis tools, indicators, and support for algorithmic trading via Expert Advisors (EAs).

However, MT4 has some limitations, such as limited customization options, lack of an integrated economic calendar, and no mobile push notifications. Additionally, its backtesting timeframes are restricted, which may hinder traders who need thorough strategy testing.

In addition to MT4, WeTrade also offers its mobile app as an alternative trading platform.

WeTrade offers a maximum leverage of up to 1:2000, which is relatively high compared to other forex brokers. This allows traders to potentially increase their profits with a smaller capital investment and have greater market exposure. However, high leverage also increases the risk of significant losses and margin calls, especially for inexperienced traders who may misuse it or engage in overtrading or emotional trading. Experienced traders with solid risk management strategies may find high leverage useful, but regulated brokers have limits on maximum leverage, which may restrict traders from taking advantage of higher leverage ratios.

WeTrade offers its clients multiple deposit options, including USDT, bank wire, and local deposits. Clients can withdraw funds via union pay and bank wire. WeTrade does not charge any extra fees for deposits or withdrawals. Additionally, there is no minimum account required, making it accessible for traders with different budgets. However, there is limited information provided about the deposit/withdrawal processing time. While WeTrade provides a safe and secure transaction environment, it offers limited withdrawal options compared to other brokers.

WeTrade offers various educational resources to its clients to enhance their trading skills and knowledge of the financial markets. The resources include an economic calendar, market reports, video tutorials, analyst views, indicators, and TV channels. The economic calendar keeps clients informed about important upcoming events that could affect the markets, while the market reports and analyst views provide up-to-date information on market trends. The video tutorials cover a range of topics from the basics of trading to advanced strategies, and clients can access a variety of indicators and TV channels for technical analysis. The educational resources are available in multiple languages to cater to clients from different parts of the world.

WeTrade offers a comprehensive customer care service that is available 24/7 through various communication channels such as email, YouTube, Facebook, and LINE. This provides customers with multiple options to reach out to the support team and get their queries resolved in a timely manner. Additionally, the support team has a reputation for providing quick response times, which ensures that customers' issues are resolved efficiently. However, WeTrade does not offer phone support, which may be inconvenient for some customers who prefer to speak with a representative directly. Moreover, the response time may vary based on the communication channel used, and the nature of the query may also impact the response time.

In conclusion, WeTrade is a UK-based forex broker that is regulated by FSA and LFSA. The broker offers various account types, including ECN, Standard, and STP, with competitive spreads and high leverage up to 1:2000. The broker supports various trading instruments, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. Overall, WeTrade has some advantages such as competitive trading conditions, a wide range of tradable instruments, and excellent customer support, which make it an attractive option for traders.

However, there are also some drawbacks such as lack of a proprietary trading platform, and no negative balance protection. Therefore, traders should carefully consider their options and weigh the advantages and disadvantages before choosing WeTrade as their preferred forex broker.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive forexclub and wetrade are, we first considered common fees for standard accounts. On forexclub, the average spread for the EUR/USD currency pair is -- pips, while on wetrade the spread is As low as 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

forexclub is regulated by NBRB. wetrade is regulated by LFSA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

forexclub provides trading platform including -- and trading variety including --. wetrade provides trading platform including Islamic Account,ECN ACCOUNT,Standard ACCOUNT,STP ACCOUNT and trading variety including Forex,Metals,Energies,Indices, Stocks,Cryptocurrencies.