No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between LIRUNEX and RockGlobal ?

In the table below, you can compare the features of LIRUNEX , RockGlobal side by side to determine the best fit for your needs.

EURUSD: -0.9

XAUUSD: 0.2

Long: -6.56

Short: 3

Long: -41.8

Short: 21.75

EURUSD: 0.1

XAUUSD: 0.1

Long: -5.37

Short: 2.35

Long: -30.8

Short: 18.9

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of lirunex, rockfort lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| LIRUNEX | Basic Information |

| Registered Country/Region | Cyprus |

| Founded in | N/A |

| Regulation | CySEC, BDF, BaFin, LFSA, CNMV |

| Minimum deposit | $500 |

| Tradng Assets | Forex, Spot Metals, Indices, Shares, Energy |

| Leverage | Up to 1:500 |

| Account types | Standard, Prime and Pro accounts |

| Trading platform | MetaTrader 4 |

| Spreads | From 0.4 pips (on EUR/USD) |

| Commission | No commissions charged, only spreads |

| Demo account | Yes |

| Account Base Currencies | USD, EUR, GBP, CHF, JPY, AUD, CAD |

| Payment methods | Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort,Webmoney,and more |

| Educational | Free educational resources include ebooks, webinars, and video tutorials |

| Customer support | Phone, email, live chat, online contact form and extensive FAQ section |

LIRUNEX is a retail forex and CFD broker that is registered in Cyprus and regulated by multiple regulatory authorities. The broker offers a variety of trading instruments, including forex, indices, commodities, and cryptocurrencies, with competitive spreads and leverage up to 1:30 for forex trading.

LIRUNEX also offers multiple account types, namely Standard, Prime and Pro accounts and each with different minimum deposit requirements and features to cater to different trading styles and preferences. For example, the Standard account requires a minimum deposit of $500 or equivalent amount.

LIRUNEX's trading platform of choice is MetaTrader 4, which is available for both desktop and mobile devices. LIRUNEX supports various order types, including market orders, limit orders, stop orders, and trailing stop orders. Traders can also execute orders using the One-Click Trading feature on the MetaTrader 4 platform. In addition, LIRUNEX provides various educational resources and trading tools to assist traders in making informed decisions.

LIRUNEX offers customer support via several channels, including phone, email, as well as some social media platforms, and an online contact form. The customer support team is available 24/5 to assist traders with any queries or issues they may have. LIRUNEX's website also features a comprehensive FAQ section, which can be accessed from the “Support” tab on their website, providing answers to frequently asked questions on topics such as account opening, trading conditions, and platform features.

LIRUNEX has multiple entities that are regulated by various regulatory authorities, including CySEC, BDF, BaFin, LFSA, and CNMV. This means that LIRUNEX operates under strict guidelines and adheres to high levels of regulatory standards and consumer protection policies.

LIRUNEX LIMITED, is authorized and regulated by Federal Financial Supervisory Authority of Germany (BaFin) under regulatory license number 156748;

Lirunex Ltd, is authorized and regulated by Banque de France (BDF) under regulatory license number 83447;

Lirunex Ltd, is also authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC) under regulatory license number 338/17;

Lirunex Limited is also authorized and regulated by the Labuan Financial Services Authority (LFSA) under regulatory license number MB/20/0050;

LIRUNEX LTD, is authorized and regulated by the Comisión Nacional del Mercado de valores (CNMA) under regulatory license number 4829;

LIRUNEX is a forex broker that offers traders competitive trading conditions, such as low spreads and high leverage. The broker provides free educational resources, including webinars, ebooks, and video tutorials, to help traders improve their trading skills. LIRUNEX also has a range of payment options available for its clients to use.

However, LIRUNEX also has some drawbacks. The broker has a limited asset offering, as it only offers Forex and CFDs. Additionally, the minimum deposit requirements are relatively higher compared to other brokers. LIRUNEX also only provides users with the option to trade via MetaTrader 4, limiting choices for experienced traders who may prefer other trading platforms. The demo account funding is only available to users registered in certain countries, while the broker's services are only available in certain jurisdictions and not to residents of the United States. Social trading features are also not available on the LIRUNEX trading platform.

| Pros | Cons |

| Multiple regulated entities | Limited asset offering compared to some other brokers |

| Wide selection of trading instruments | Minimum deposit requirements are relatively higher compared to other brokers |

| A range of educational resources, including webinars, ebooks, and video tutorials | Trading is limited to MetaTrader 4 |

| A variety of payment options | Demo account funding is only available to users registered in certain countries |

| Multiple trading accounts to choose from | Only available in certain jurisdictions (not available to residents of the United States) |

| A series of trading tools | No social trading features are available |

| No 7/24 customer support |

LIRUNEX is a well-established online brokerage firm that caters to the needs of traders worldwide. It offers a comprehensive selection of market instruments to its clients, including Forex, Spot Metals, Indices, Shares, and Energy.

Forex: LIRUNEX offers a wide range of currency pairs for trading, including major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs.

Spot Metals: LIRUNEX offers spot trading of precious metals such as gold and silver. Spot trading allows traders to buy and sell these metals at the current market price.

Indices: LIRUNEX offers trading on a variety of global stock indices, including the S&P 500 index, NASDAQ index, and the Dow Jones Index. Trading indices allows traders to speculate on the performance of a whole stock market, rather than just individual stocks.

Shares: LIRUNEX offers trading of stocks from various global markets, including the US, UK, Europe, and Asia. Trading on stocks allows traders to invest in well-known companies and earn profits based on their performance.

Energy: LIRUNEX offers trading of energy products such as crude oil and natural gas. Traders can benefit from price changes in energy markets, which are known for their high volatility.

LIRUNEX offers a range of account types to suit the needs of different traders. They have carefully crafted their account types to offer a tailored experience to traders based on their trading level, experience, and financial status. The account types offered by LIRUNEX are Standard, Prime, and Pro.

The Standard account requires a minimum deposit of $/€ 500 and is suitable for novice traders who are new to the market. This type of account offers basic trading conditions, including access to all trading instruments, customer support, educational resources, and trading tools.

The Prime account requires a higher minimum deposit of $/€ 2,000 and is targeted towards traders who have more experience in the market. This account type offers tighter spreads, lower commissions, and additional perks such as exclusive trading signals and faster withdrawals.

The Pro account is the top-tier account type offered by LIRUNEX and requires a minimum deposit of $/€ 10,000. This type of account is geared towards professional traders who require a higher level of trading conditions, including dedicated account managers, advanced trading tools, priority customer support, and lower commissions and favorable market conditions.

All account types offered by LIRUNEX come with negative balance protection, and the MetaTrader 4 trading platform. Additionally, traders can choose from different currency options, EUR or USD.

Opening an account with LIRUNEX is a straightforward process and can be completed in a few simple steps. Here is a step-by-step guide on how to open an account with LIRUNEX:

Visit the LIRUNEX website and click on the “Register” button on the top right-hand corner.

Fill in the registration form by providing accurate personal details, including your name, email address, and phone number.

Select your preferred account type - Standard, Prime, or Pro - and choose your base currency.

After filling in the form, you will receive an email to confirm your registration.

Next, login to your LIRUNEX account and complete your account verification by uploading the necessary documents. The documents required for verification can be found on the website or by contacting customer support.

Once your account is verified, you can fund your account by choosing a payment method that is convenient for you. LIRUNEX provides several payment options, including bank transfers, credit/debit cards, and e-wallets.

After funding your account, you can begin trading by downloading the LIRUNEX trading platform or by using the web-based platform.

LIRUNEX provides customers with 24/5 customer support to assist with any issues that may arise during the trading process.

As per the regulations by ESMA, the default leverage for retail forex traders is set at a maximum of 1:30, while professional traders are allowed to trade with a higher leverage of up to 1:100.

Leverage refers to the amount of borrowing that a trader can use to open a position in the market. Higher leverage can increase potential profits, but it also comes with higher risk. Professional traders are considered to have a higher level of experience and knowledge of the financial markets, which is why they are often offered higher leverage options.

However, it's important to note that leverage should be used wisely, and traders should always consider the risks involved before trading with high leverage. It's also essential to have a risk management strategy in place to protect your investment in case of unfavourable market conditions.

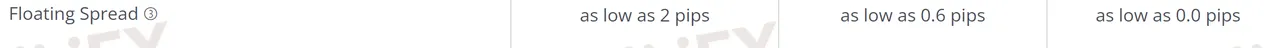

LIRUNEX offers a variety of trading account types to suit the needs of different traders. Each account type features different spreads and commission charges. Here, we will explain the available accounts and what they offer in terms of spreads and commissions.

The Standard Account is designed for those who are new to trading or who prefer lower costs. With this account, you can trade with floating spreads that start from 2 pips. The best part is that there are no commissions charged on trades. This account is ideal for beginners who want to start trading with a lower investment.

The Prime Account is designed for those who require tighter spreads and faster trade execution times. With this account, you can trade with floating spreads that start from 0.6 pips, which is significantly lower than the Standard Account. However, this account comes with a commission charge of $8 per lot traded. This account is suitable for traders who require faster trading speeds and lower spreads.

The Pro Account is designed for professional traders who require the tightest spreads possible and access to institutional-grade trading conditions. With this account, you can trade with spreads that start from 0.0 pips, which means that you can trade with almost no spreads! It is important to note that this account comes with a commission charge of $4 per lot traded. This account is ideal for high volume traders who require high-quality trading conditions.

Apart from trading fees, LIRUNEX also charges some non-trading fees that traders should be aware of. Here are some of the non-trading fees charged by LIRUNEX:

Deposit Fees - While deposits with LIRUNEX are free of charge, some payment providers may charge you fees for depositing funds. It's important to check with your payment provider to see if they charge any fees.

Withdrawal Fees - LIRUNEX does not charge any withdrawal fees. However, the payment provider you use to withdraw funds may charge fees. LIRUNEX also waives the first withdrawal fee for its clients each month.

Inactivity Fees - If there has been no trading activity in your account for a period of 90 days, an inactivity fee of $50 will be charged for each subsequent month until the account is active again.

Conversion Fees - If you deposit funds in a currency different from the one in which your LIRUNEX account is denominated, you will be charged a conversion fee of 2% of the deposit amount. This fee is charged to cover the costs of converting the funds to your account currency.

Overnight Financing Fees - LIRUNEX charges overnight financing fees for positions that are held open overnight. These fees can be either positive or negative and depend on the instrument being traded.

LIRUNEX provides MetaTrader 4 (MT4) trading platform for its clients. The MT4 platform is available in PC, iOS, and Android versions that allow traders to access their accounts and trade from anywhere, at any time.

MT4 is a well-known and widely-used trading platform globally, known for its user-friendly interface, advanced charting features, multiple order types, and the ability to support automated trading strategies like Expert Advisors (EAs). The platform also offers a vast array of technical analysis tools that traders can use to make informed decisions.

LIRUNEX provides a range of trading instruments through its MT4 platform, including forex, commodities, and indices. The platform also supports multiple account types, allowing traders to choose the one that suits their needs best.

LIRUNEX supports various payment methods for deposits and withdrawals, including Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort, and Webmoney. Deposits through most payment methods have a minimum deposit requirement of 50. However, the minimum deposit through global transfer is $300.

It is important to note that the processing time for withdrawals can vary depending on the payment method used. Withdrawal requests made through Visa and Mastercard can take up to 10 business days to process. This is due to the nature of these payment methods, which typically involve additional security checks and verification procedures to ensure that the funds are being transferred to the correct account.

LIRUNEX offers several channels of customer support to assist its traders. This includes:

Email support, which is available 24/7 and allows traders to submit their questions or concerns to LIRUNEX's support team.

Phone support, which is available during business hours and allows traders to speak to a support representative directly.

A comprehensive FAQ section on LIRUNEX's website, which provides answers to common questions and concerns about trading with LIRUNEX.

In addition to these channels of customer support, LIRUNEX also offers a personal account manager service for premium account holders, which provides dedicated assistance and support for their trading needs.

LIRUNEX offers a range of educational resources to help traders improve their trading skills and knowledge in the Forex markets. Some of these resources include a beginner's guide, an economic calendar, trading strategies, market analysis, and informative articles.

These resources are designed to help traders understand the fundamental and technical analysis of the Forex markets, as well as to give them an overview of the trading tools and features available on the LIRUNEX platform. By using these resources, traders can better navigate the Forex markets, make more informed trading decisions, and ultimately, achieve their trading objectives.

In conclusion, LIRUNEX is a reputable forex broker that offers traders a range of benefits and drawbacks. Its competitive spreads, multiple account types make it an attractive option for traders looking to improve their skills and trading outcomes. However, its limited product offerings, lack of available US trading accounts, and potentially higher withdrawal fees for certain accounts may be disadvantages for some traders. Overall, LIRUNEX provides a secure and regulated trading environment and is worth considering for traders looking for a well-rounded forex broker. As always, traders are advised to conduct thorough due diligence and weigh their options before investing their funds.

Q: What regulatory standards does LIRUNEX comply with?

A: LIRUNEX has multiple entities that are regulated by various regulatory authorities, including CySEC, BDF, BaFin, LFSA, and CNMV.

Q: What account types are available at LIRUNEX?

A: LIRUNEX offers three different account types, including Standard, Prime and Pro accounts. Each account type has different features, including minimum deposits, trading conditions, and access to additional tools.

Q: How can I fund my account with LIRUNEX?

A: LIRUNEX offers several different funding options, including Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort,Webmoney,and more.

Q: Does LIRUNEX offer educational resources?

A: Yes, LIRUNEX has a variety of educational resources available for traders of all skill levels, including webinars, video tutorials, eBooks, and more.

Q: How can I get in touch with customer support at LIRUNEX?

A: LIRUNEX customer support is available 24/7 via email, phone, or live chat.

Q: What trading platforms does LIRUNEX offer?

A: LIRUNEX offers two trading platforms, including the popular MetaTrader 4 (MT4) platform and the Lirunex Trader platform. Both platforms can be used on desktop.

| RockGlobal | Basic Information |

| Registered Country/Region | New Zealand |

| Regulations | FMA |

| Tradable Assets | Forex, Metals&Commodities, Indices, Cryptocurrencies |

| Account Types | Standard Account, ECN ccount |

| Minimum Deposit | $50 |

| Maximum Leverage | 500:1 |

| Minimum spread | from 0.0 pips |

| Deposit & Withdrawal | Local Bank, Credit/Debit Cards, E-Wallets, Bankwire, Cryptocurrency |

| Trading Platforms | MetaTrader 4 |

| Customer Support | Phone, Email, Live chat |

| Education Resources | Economic Calendar, Trading Calculator, Forex Basics, News |

RockGlobal is a legitimate online trading platform registered in New Zealand (certificate number 509766) and offers its services to a diverse range of traders. With a wide selection of market instruments including 140+ currency pairs, stock indices, commodities, precious metals, and cryptocurrencies, RockGlobal allows traders to access multiple markets and diversify their portfolios. The platform provides two account types: the Standard Account with spreads starting from 1.0 pip and no commission fees, and the ECN Account with even tighter spreads from 0.0 pip and a $5 commission per standard lot traded. Traders can leverage their positions up to 500:1, amplifying potential profits but requiring responsible risk management. RockGlobal utilizes the popular MetaTrader 4 (MT4) platform, known for its advanced features and user-friendly interface, offering real-time market quotes, fast order execution, and customizable trading strategies. The platform also provides dedicated customer support available 24/7 via phone, email, and live chat. However, it is important to note the lack of deposit and withdrawal information on the website, commission fees for the ECN Account, minimum deposit requirements of $50 for the Standard Account and $500 for the ECN Account, the risk of trading with high leverage, and the limited educational resources provided. Traders are advised to exercise caution and seek additional information when considering RockGlobal as their trading platform.

Yes, RockGlobal is registered in New Zealand and has obtained a certificate authorized by the Financial Markets Authority with certificate number 509766. However, investors are still advised to exercise caution when making investments.

RockGlobal offers a comprehensive range of market instruments to cater to the diverse trading preferences of its clients. The platform provides access to an extensive selection of financial assets, including:

Forex: RockGlobal offers a wide range of currency pairs for forex trading. Traders can choose from over 140 currency pairs, including major, minor, and exotic pairs. This allows investors to participate in the global forex market and capitalize on currency fluctuations.

Metals & Commodities: The platform provides trading opportunities in precious metals and commodities. Traders can access popular metals like gold, silver, platinum, and palladium. Additionally, RockGlobal offers trading in various commodities, such as oil, natural gas, and agricultural products. Trading metals and commodities enables investors to diversify their portfolios and potentially benefit from price movements in these markets.

Indices: RockGlobal allows traders to trade a wide range of stock indices from around the world. Popular indices such as the S&P 500, NASDAQ, FTSE 100, and DAX are available for trading. By trading indices, investors can speculate on the overall performance of stock markets and take advantage of market trends.

Cryptocurrencies: RockGlobal offers trading in a range of cryptocurrencies. Traders can access popular digital currencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC). Trading cryptocurrencies provides investors with opportunities to capitalize on the volatility and potential price movements in the crypto market.

With its broad selection of market instruments, including 140+ currency pairs, stock indices, commodities, precious metals, and crypto CFDs, RockGlobal ensures that traders have access to diverse trading opportunities across different financial markets.

RockGlobal offers a diverse range of market instruments, competitive spreads, and high leverage of up to 500:1. With the popular MT4 platform and dedicated customer support, traders have access to advanced tools and assistance. However, the lack of deposit and withdrawal information, the risk of high leverage, and limited educational resources should be taken into consideration.

| Pros | Cons |

| Diverse Market Instruments | Lack of Deposit and Withdrawal Information |

| Competitive Spreads | Risk of Trading with High Leverage |

| High Leverage | Limited Educational Resources |

| MetaTrader 4 (MT4) Platform | |

| Dedicated Customer Support |

RockGlobal offers two different types of trading accounts to suit the needs of different traders:

Standard Account:

Spreads: The Standard Account offers spreads starting from 1.0 pip. Traders can benefit from tight spreads, which can enhance their trading profitability.

Commission: There is no commission charged on trades conducted through the Standard Account. This means that traders can focus on their trading strategies without incurring additional transaction costs.

Minimum Deposit: The minimum initial deposit required to open a Standard Account is $50. This allows traders with different budget sizes to start trading with RockGlobal.

Maximum Leverage: The Standard Account provides a maximum leverage of 500:1. This allows traders to control larger positions in the market with a smaller capital investment. However, it's important to use leverage responsibly and manage risk effectively.

ECN Account:

Spreads: The ECN Account offers competitive spreads starting from 0.0 pip. Traders can benefit from the tightest possible spreads, leading to potentially lower trading costs.

Commission: Trades conducted through the ECN Account are subject to a commission of $5 per standard lot. This transparent fee structure ensures that traders have full visibility of the costs associated with their trades.

Minimum Deposit: The minimum initial deposit required to open an ECN Account is $500. This account type is suitable for traders who are ready to commit a higher amount of capital to their trading activities.

Maximum Leverage: The ECN Account also provides a maximum leverage of 500:1, allowing traders to maximize their trading potential while managing their risk exposure effectively.

Both account types offered by RockGlobal provide traders with access to a high leverage ratio of 500:1, enabling them to control larger positions in the market. The choice between the Standard Account and the ECN Account depends on individual trading preferences and capital requirements.

Opening an account with RockGlobal involves the following steps:

Register an Account: Visit the RockGlobal website and click on the “Register” or “Open Account” button. Provide the required personal information, including your full name, email address, phone number, and country of residence. Create a username and password for your account.

2. Identity Verification: Complete the identity verification process. This usually involves submitting the required documents, such as a valid passport or government-issued ID, proof of address (utility bill or bank statement), and any additional documentation requested by RockGlobal. The verification process is essential to ensure compliance with regulatory requirements and to maintain the security and integrity of the trading platform.

3. Deposit Funds: Once your account is registered and verified, you can proceed to deposit funds into your trading account. RockGlobal typically offers multiple deposit methods, including bank wire transfer, credit/debit card, and electronic payment systems. Choose the most convenient method for you and follow the instructions provided by RockGlobal to complete the deposit process. The minimum deposit amount for the Standard Account is $50, while the ECN Account requires a minimum deposit of $500.

4. Start Trading: After your account is funded, you can start trading. Download and install the trading platform provided by RockGlobal, such as MetaTrader 4 (MT4) or a proprietary platform. Use your account login credentials to access the platform. Familiarize yourself with the platform's features, including charting tools, order types, and risk management options. Select the desired financial instruments from the available markets, such as forex, metals, commodities, indices, or cryptocurrencies, and execute your trades according to your trading strategy.

Please note that the account opening process and specific requirements may vary slightly depending on the jurisdiction and regulatory framework. It is recommended to refer to the official RockGlobal website or contact their customer support for the most up-to-date and accurate information regarding the account opening process.

RockGlobal provides a maximum leverage of 500:1, allowing traders to amplify their potential profits or losses by up to 500 times their initial investment. This high leverage offers the opportunity to trade larger positions in the market with a relatively smaller amount of capital. However, it is essential for traders to exercise responsible risk management and fully understand the implications of trading with high leverage.

In the Standard Account, the spreads start from as low as 1.0 pip, providing traders with favorable pricing. This account type does not charge any commissions on trades. On the other hand, the ECN Account offers even tighter spreads starting from 0.0 pips, ensuring competitive pricing for traders. However, this account type does have a commission fee of $5 per standard lot traded. These options cater to different trading preferences, allowing traders to choose the account type that best suits their needs.

RockGlobal utilizes the popular MetaTrader 4 (MT4) trading platform. MT4 is known for its advanced features and user-friendly interface, providing traders with a seamless and efficient trading experience. With MT4, traders have access to a wide range of tools and functionalities, including advanced charting capabilities, multiple timeframes, technical indicators, and customizable trading strategies. The platform also supports automated trading through expert advisors (EAs), allowing for the execution of trades based on pre-set conditions. With real-time market quotes, fast order execution, and comprehensive analysis tools, MT4 on RockGlobal ensures a powerful and flexible trading environment.

RockGlobal's official website does not provide information about specific deposit and withdrawal methods. However, typically, brokers of similar nature allow various deposit and withdrawal options, including Credit/Debit Cards, E-Wallets, Bank Wire transfers, and Cryptocurrencies. It is important to note that the minimum deposit requirement for RockGlobal is $50. Traders interested in opening an account with RockGlobal are advised to contact their customer support or account manager for detailed information regarding the available deposit and withdrawal methods.

RockGlobal values its customers and provides excellent customer support services. Their dedicated staff is available 24/7 to assist traders in any way possible. Whether you have questions about your account, technical issues, or need guidance with trading-related inquiries, RockGlobal's customer support team is ready to provide prompt and helpful assistance.

You can reach out to the customer support team via various channels, including phone, email, and live chat. They understand the importance of timely communication and strive to ensure that your queries are addressed promptly and effectively. Additionally, RockGlobal offers live chat support on social media platforms like Facebook, further enhancing accessibility and convenience for their clients. Rest assured that RockGlobal is committed to delivering a high standard of customer support to ensure a smooth and satisfactory trading experience.

RockGlobal offers a range of educational resources to support traders in their trading journey. These resources include an economic calendar, which provides timely information about upcoming news events that can impact market conditions. By staying informed about these events, traders can make better-informed decisions based on fundamental analysis.

The trading calculator is another valuable tool provided by RockGlobal, enabling traders to calculate important trading parameters such as point value, spread cost, and estimate potential profits and losses. This calculator assists traders in managing risk and optimizing their trading strategies.

RockGlobal also offers educational materials on Forex Basics, providing traders with essential knowledge about the foreign exchange market. Understanding the fundamentals of forex trading, including currency pairs, market dynamics, and trading principles, can help traders navigate the market more effectively.

Additionally, RockGlobal's professional market analysis team provides up-to-date news coverage, allowing traders to stay ahead of the curve and identify potential trading opportunities before others. This access to timely news and market analysis enhances traders' decision-making process and helps them stay informed about global events impacting financial markets.

RockGlobal, registered in New Zealand, offers a wide range of market instruments including 140+ currency pairs, stock indices, commodities, precious metals, and cryptocurrencies. With competitive spreads, high leverage of up to 500:1, and the popular MT4 platform, traders have diverse trading opportunities and access to advanced tools. However, the lack of deposit and withdrawal information, commission fees for the ECN Account, minimum deposit requirements, and the need for responsible use of high leverage should be considered. Additionally, while dedicated customer support is provided, there may be limited educational resources.

Q: Is RockGlobal a regulated broker?

A: Yes, RockGlobal is a regulated broker. It is authorized and regulated by the Financial Markets Authority with certificate number 509766.

Q: What trading instruments are available at RockGlobal?

A: RockGlobal offers a wide range of trading instruments, including 140+ currency pairs, stock indices, commodities, precious metals, and cryptocurrencies.

Q: What trading platforms does RockGlobal offer?

A: RockGlobal offers MetaTrader 4 trading platform.

Q: Does RockGlobal offer educational resources for traders?

A: Yes, RockGlobal offers a range of educational resources for traders, including Economic Calendar, Trading Calculator, Forex Basics, News.

Q: What is the minimum deposit required to open an account with RockGlobal?

A: The minimum deposit required to open an account with RockGlobal is $50.

Q: Does RockGlobal offer any bonuses or promotions?

A: Yes, RockGlobal offers trading with a 20% credit bonus and an additional 10% bonus on subsequent deposits.

Q: What is the maximum leverage offered by RockGlobal?

A: The maximum leverage offered by RockGlobal is 1:500.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive lirunex and rockfort are, we first considered common fees for standard accounts. On lirunex, the average spread for the EUR/USD currency pair is from 0.0 pips, while on rockfort the spread is 0.0 pips.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

lirunex is regulated by BaFin,AMF,CYSEC,LFSA,CNMV. rockfort is regulated by FMA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

lirunex provides trading platform including LX-PRO,LX-PRIME,LX-STANDARD and trading variety including FX Pairs, Spot Metal, Energies, Shares, Indices. rockfort provides trading platform including PRO ACCOUNT,STANDARD ACCOUNT and trading variety including --.