No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between ETO Markets and AGEA ?

In the table below, you can compare the features of ETO Markets , AGEA side by side to determine the best fit for your needs.

EURUSD: -0.1

XAUUSD: 0.3

Long: -7.19

Short: 1.9

Long: -31.19

Short: 17.93

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of eto-markets, agea lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Aspect | Information |

| Company Name | ETO Markets Limited |

| Registered Country/Region | Seychelles |

| Founded | 2010 |

| Regulation | ASIC, FSA (Offshore) |

| Tradable Assets | Forex, Precious Metals, Energies, Indices |

| Account Types | PRO Account, BASIC Account, PRIME Account, STD Account |

| Demo Account | Available |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| EUR/USD Spread | 1.8 pips (STD account) |

| Trading Platforms | Meta Trader 4 (MT4), Meta Trader 5 (MT5) |

| Social Trading | Yes |

| Payment Methods | Bank Wire Transfers (USD), China Union Pay (CNY), SEA Instant Payment (IDR, MYR, THB, VND), SEA Internet Banking (IDR, MYR, VND), Cryptocurrency (USDT) |

| Educational Tools | Trading Guides, ETO Blog, Trading Webinars |

| Customer Support | Phone: +248 4374772, Email: info@eto.group |

Founded in 2010, ETO Markets is a forex and CFD forex broker based in Sydney, Australia, providing online solutions for retail and institutional investors in over 100 countries in Europe, Asia, Middle East, Africa, Oceania, etc. Please note that their services are not available in North and South America.

Concerning regulation, ETO GROUP PTY LTD is authozed or regulated by the Australian Securities and Investment Commission (ASIC); ABN 66 155 680 890, AFS Licence No. 420224, and ETO Markets Limited is offshore regulated by the Seychelles Financial Services Authority (FSA), with regulatory license no. S062.

ETO Markets offers several advantages for traders, including a diverse range of market instruments such as forex, precious metals, energies, and indices, allowing for portfolio diversification and trading across different asset classes. The availability of different types of trading accounts, such as PRO, BASIC, PRIME, and STD accounts, caters to the varying needs and preferences of traders. ETO Markets also provides access to popular trading platforms like Meta Trader 4 (MT4) and Meta Trader 5 (MT5), which offer advanced charting capabilities, technical indicators, and automated trading options. Additionally, the educational resources offered by ETO, such as trading guides, a blog, and trading webinars, contribute to traders' learning and development.

| Pros | Cons |

| ASIC-regulated | Offhore FSA regulation |

| Wide range of trading assets | |

| Low minimum deposit requirement | |

| Competitive spreads | |

| High leverage | |

| Demo accouts available | |

| Educational resources provided |

However, it's important to consider the potential drawbacks. ETO Markets is regulated by different regulatory agencies in different jurisdictions, with ETO Markets Limited regulated by the Seychelles Financial Services Authority (FSA) as an “Offshore Regulatory” entity. Being regulated offshore may raise concerns for some traders about the level of investor protection and oversight. Moreover, the website and platform information provided for ETO GROUP PTY LTD, which is regulated by the Australia Securities & Investment Commission (ASIC), is not available, potentially limiting transparency and accessibility for traders. It's crucial for traders to conduct thorough research, assess their risk tolerance, and make informed decisions when considering trading with ETO Markets.

ETO (ETO GROUP PTY LTD and ETO Markets Limited) is regulated by different regulatory agencies in different jurisdictions.

ETO GROUP PTY LTD, based in Australia, is regulated by the Australia Securities & Investment Commission (ASIC). It holds a Market Making (MM) license, with license number 420224. The effective date of the license is February 1, 2013. The address of the licensed institution is 02 Tower B Citadel Towers' Suite 12 Level 12, 799 Pacific Highway, CHATSWOOD NSW 2067, Australia. The phone number is 0407 204 611. However, no website is provided for ETO GROUP PTY LTD.

On the other hand, ETO Markets Limited is regulated by the Seychelles Financial Services Authority (FSA). It holds a Retail Forex License with license number S062. The regulatory status is described as “Offshore Regulatory.” The address of the licensed institution is Office No. 20, First Floor, Abis 1, Abis Centre, Providence Industrial Estate, Mahé, Seychelles. The phone number is +248 4374772. The email address is info@eto.group, and the website is https://www.eto.group.

It's important to note that being regulated by a regulatory agency does not guarantee the safety or legitimacy of an investment. Investors should exercise caution and conduct thorough research before engaging in any financial transactions or investments.

ETO offers a diverse range of market instruments for trading on their online platform. These instruments cover various financial markets and asset classes, including:

1. Forex: ETO provides access to the foreign exchange market, which is known as the world's most liquid market. Traders can engage in forex trading with leverage of up to 1:500. ETO offers a wide range of currency pairs, including majors, minors, and exotics, with lower commissions.

2. Precious Metals: ETO allows trading in major commodity markets by offering precious metals such as Gold and Silver. These metals are considered valuable assets due to their high economic value and durability. Traders can take advantage of price movements in precious metals markets through ETO's platform.

3. Energies: ETO provides access to energy products such as WTI (West Texas Intermediate) crude oil, Brent crude oil, and Natural Gas through CFDs (Contract for Difference). Traders can benefit from low spreads, and 24-hour market executions in the energy market.

4. Indices: ETO enables trading on significant stock market indices worldwide. Traders can utilize leverage of up to 1:500 without any commission charges. This allows them to participate in the price movements of major stock market indices and potentially capitalize on market opportunities.

The PRO account offers spreads starting from 0.0 pips. The minimum deposit required is USD 100, allowing accessibility for traders with varying budget sizes. The minimum trade size is 0.01 lot. With a maximum leverage of 1:500, traders can amplify their trading potential. The PRO account does not have a stop out level.

The BASIC account offers spreads starting from 1.0 pips, providing reasonable pricing for trading. The minimum deposit required is USD 100, making it accessible to a wide range of traders. The minimum trade size is 0.01 lot. The maximum leverage offered is 1:500, enabling traders to maximize their trading opportunities. Similar to the PRO account, the BASIC account does not have a stop out level.

The PRIME account caters to traders who prioritize a balance between cost and trading conditions. It offers spreads starting from 1.7 pips, providing a reasonable pricing structure for trading. The minimum deposit required is USD 100, making it accessible to traders with different levels of capital. The minimum trade size is 0.01 lot. The maximum leverage offered is 1:500, providing traders with the potential to magnify their trading positions. As with the other account types, the PRIME account does not have a stop out level.

Lastly, the STD account is specifically tailored for traders interested in trading XAU/USD (Gold). It offers spreads starting from 1.7 pips for general trading pairs and 2.9 pips for XAU/USD. The minimum deposit required is USD 100, making it accessible to traders with varying budget sizes. The minimum trade size is 0.01 lot. The maximum leverage offered is 1:500, allowing traders to amplify their trading potential. Similar to the other account types, the STD account does not have a stop out level.

To open a DEMO ACCOUNT with ETO Markets, you can follow these steps:

1. Visit the ETO Markets website.

2. Look for the option to “Try demo account” and click on it.

3. You will be directed to a short application form.

4. Fill in the required information in the application form.

5. Complete the application process as instructed on the website.

To open a LIVE ACCOUNT with ETO Markets, you can follow these steps:

1. Visit the ETO Markets website.

2. Look for the option to “Open live account” and click on it.

3. You will be taken to an application form.

4. Fill in all the necessary information in the application form.

5. Complete the application process according to the instructions provided on the website.

The maximum trading leverage offered by ETO Markets is up to 1:500. Investors should note that high leverage can increase the potential return but also increase the risk at the same time.

On a Standard account, spreads begin at 1.6 pips, which is a bit more than typical. The EUR/USD, GBP/USD, AUD/USD, and USD/JPY all have a spread of 1.8 pips, while the USD/CAD and USD/CHF have a spread of 2.2 pips.

On the Professional account, spreads are significantly reduced, with some as low as 0 pips, especially for currency pairs with a high trading volume. Thus, the EUR/USD, GBP/USD, and USD/JPY all have a spread of 0 pips, while the AUD/USD spread is 0.3 pips, the USD/CHF spread is 0.2 pips, and the USD/CAD spread is 0.4 pips. Consider, however, that there is a $7 commission every round deal, which is the reason for the low spreads.

ETO offers various trading platforms to cater to the diverse needs of traders. Here's a brief description of each trading platform:

1. Meta Trader 4 (MT4): MT4 is a widely recognized and popular trading platform that supports online trading through web pages, PCs, and mobile phones. It offers a comprehensive range of features and tools, making it suitable for both novice and experienced traders. MT4 provides a user-friendly interface, advanced charting capabilities, a wide range of technical indicators, and automated trading options.

2. Meta Trader 5 (MT5): MT5 is an advanced trading platform that provides market direction and data analysis to assist investors in making informed trading decisions. It offers enhanced features compared to MT4, including additional charting tools, more timeframes, and improved analytical capabilities. MT5 allows traders to access a variety of financial markets and trade anytime, anywhere, ensuring they don't miss any trading opportunities.

3. PAMM: PAMM (Percentage Allocation Management Module) is a solution designed for money managers. It enables them to manage funds across multiple client accounts using a single master account and interface. PAMM allows money managers to allocate and distribute investments, track performance, and execute trades on behalf of their clients.

4. Social Trading: ETO offers social trading, which is a form of investing that allows traders to copy investment strategies from others. It is suitable for individuals who don't have the time or expertise to analyze the markets extensively or identify trading opportunities. With social trading, traders can follow and replicate the trades and strategies of successful traders, leveraging their knowledge and experience.

These trading platforms provided by ETO offer different features, functionalities, and advantages to suit the preferences and requirements of various traders. It's recommended to explore the specific details and capabilities of each platform on the official ETO website to choose the one that best aligns with individual trading goals and strategies.

To deposit funds into your ETO Markets account, you need to log in to the ETO Markets Portal and select 'My Account' or click the 'Deposit Now' button on the top-right corner of the page. From there, you can choose your preferred payment method by clicking on the corresponding icon. The available payment methods include Bank Wire Transfers (USD), China Union Pay (CNY), SEA Instant Payment (IDR, MYR, THB, VND), SEA Internet Banking (IDR, MYR, VND), and Cryptocurrency (USDT). Once you have selected the payment method, choose the account you want to deposit to and enter the deposit amount in USD. Click 'Submit' and follow the instructions to complete the deposit request. The deposit will be reflected in your account within 5 minutes.

For withdrawals, you need to log in to the ETO Markets Portal, select 'My Account,' and click on 'My Withdrawal.' Submit your withdrawal request through the provided form. If you are withdrawing cryptocurrency, your request will be processed after confirming the instructions in the confirmation email sent by ETO Markets.

The processing time for withdrawals is as follows: Applications submitted before 3 am GMT on weekdays will be processed on the same day, while applications submitted after 3 am GMT will be processed on the next business day. Withdrawal applications submitted on weekends will be processed on the following business day.

The withdrawal limits vary depending on the payment method. For UnionPay, there is no minimum withdrawal amount per transaction. For USDT Transfer (TRC20) and USDT Transfer (ERC20), the minimum withdrawal amount is 100 USDT. For SEA Instant Payment and SEA Internet Banking, there is no minimum withdrawal amount per transaction.

Processing fees may apply for withdrawal requests below $100. The exact processing fees for deposits and withdrawals can be found in the 'What are the processing fees for deposit and withdrawal' section on the ETO Markets Portal.

| Pros | Cons |

| Multiple payment methods available | Processing fees may apply for withdrawal requests below $100 |

| Quick deposit processing with funds reflected in the account within 5 minutes | Withdrawal processing time depends on the submission time and may take up to the next business day |

| Clear instructions provided for deposit and withdrawal procedures | Withdrawal limits vary depending on the payment method |

| User-friendly online portal for account management | Limited information about withdrawal processing fees |

The ETO Markets customer service team is available Monday through Friday from 9am to 5pm (Sydney time) via phone, live chat, and email. The team is comprised of individuals with a strong financial background, so they can assist you with a variety of concerns. An is undoubtedly one of the reasons why this e-commerce website has an excellent reputation for customer service. There are few FAQs and tutorials available on the trade website, and they will not be of much assistance.

ETO provides a range of educational resources to support traders in their learning and development. Here's a brief description of each educational resource:

1. TRADING GUIDES: ETO Markets offers educational videos called Trading Guides. These videos focus on providing instruction and guidance on how to navigate and utilize the Meta Trader 4 (MT4) trading platform. They are particularly beneficial for new traders who are learning to use MT4 and want to understand its features and capabilities. Even experienced traders can benefit from these guides to learn new strategies or enhance their skills.

2. ETO BLOG: ETO Markets maintains a blog that offers weekly reports and interviews. The blog serves as a valuable resource for traders seeking market intelligence and real-time market positioning ideas. Through the blog, traders can access in-depth analysis, stay updated with market trends, and gain insights from industry experts. It provides a platform for traders to deepen their understanding of the financial markets.

3. TRADING WEBINARS: ETO Markets conducts trading webinars led by experienced traders or financial professionals. These webinars cover various topics such as technical analysis, risk management, and trading strategies. Webinars provide valuable insights and practical knowledge to enhance trading skills and decision-making abilities.

ETO Markets provides customer support services to assist traders with their inquiries and concerns. The customer service team is available Monday through Friday from 9am to 5pm (Sydney time) and can be contacted via phone, live chat, and email. The team consists of individuals with a strong financial background, ensuring they can provide knowledgeable assistance across a range of trading-related matters. ETO Markets has gained a reputation for excellent customer service, which contributes to its positive standing in the industry. While the trade website offers limited FAQs and tutorials, direct contact with the customer support team is the recommended approach for personalized assistance. The contact details for customer support include the email address info@eto.group, the phone number +248 4374772, and the physical address F20, 1st Floor, Eden Plaza, Eden Island, Seychelles. Additionally, customers can follow ETO Markets on various social media to stay updated with the latest information and developments.

ETO Markets is a regulated brokerage offering a range of advantages and disadvantages.

On the positive side, ETO Markets is regulated by the Australia Securities & Investment Commission (ASIC), providing a level of oversight and accountability. They offer a diverse range of market instruments, including forex, precious metals, energies, and indices, allowing traders to diversify their portfolios. ETO Markets provides different account types to cater to the needs of various traders, with leverage options of up to 1:500. They offer popular trading platforms like MetaTrader 4 and 5, as well as PAMM and social trading options. ETO Markets also provides educational resources such as trading guides, a blog, and webinars to support traders' learning and development.

On the negative side, being regulated offshore by the FSA may be seen as a disadvantage compared to stricter regulatory jurisdictions. The website lacks detailed information and transparency on some aspects, and customer support is limited to specific hours. It's important for traders to conduct their own research, consider their risk tolerance, and understand the advantages and disadvantages before engaging with ETO Markets or any brokerage.

Question: Is ETO Markets a regulated broker?

Answer: Yes. It is regulated by the Australia Securities & Investment Commission (ASIC) and holds a Market Making (MM) license. Additionally, ETO Markets Limited is offshore regulated by the Seychelles Financial Services Authority (FSA) and holds a Retail Forex License.

Question: What trading platforms does ETO Markets offer?

Answer: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Question: Can I open a demo account with ETO Markets?

Answer: Yes.

Question: What is the maximum leverage offered by ETO Markets?

Answer: 1:500.

Question: What are the trading instruments available at ETO Markets?

Answer: Forex currency pairs, precious metals such as gold and silver, energies like crude oil and natural gas, and stock market indices.

Question: Does ETO Markets provide educational resources for traders?

Answer: Yes. These resources include trading guides, a blog with market reports and interviews, and trading webinars conducted by experienced traders.

Note: This company has been voluntarily dissolved.

| Aspect | Information |

| Company Name | AGEA |

| Registered Country/Area | Montenegro |

| Years | 5-10 years |

| Regulation | Unregulated |

| Market Instruments | CFD |

| Account Types | Standard and Cent |

| Minimum Deposit | USD 100 |

| Maximum Leverage | 1:100 |

| Trading Platforms | Streamster and MetaTrader 4 |

| Customer Support | Live Support, Phone: +382 (20)664-320 and +382(20)664-320, and Email: support@agea.com |

| Deposit & Withdrawal | Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods (Sofort Banking (Germany) and iDEAL (Netherlands)) |

| Educational Resources | Latest News |

AGEA, a financial services company, has been operating in the trading industry for 5-10 years. Based in Montenegro, the company provides trading opportunities primarily through Contracts for Difference (CFDs). Despite its years in the industry, AGEA operates in an unregulated environment, meaning it may not be subject to oversight by financial regulatory authorities.

Traders can choose between two types of trading accounts: Standard and Cent. With a minimum deposit requirement of USD 100. The company offers a maximum leverage of 1:100.

AGEA provides traders with two trading platforms: Streamster and MetaTrader 4. Additionally, traders can access live support for real-time assistance with any inquiries or issues they may encounter.

In terms of funding options, AGEA supports various deposit and withdrawal methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

For educational resources, AGEA provides the latest news to keep traders informed about market developments and trends.

AGEA operates as an unregulated trading platform. Unregulated financial institutions are not bound by the rules and regulations designed to protect consumers' interests. This leaves customers vulnerable to various risks such as fraud, mismanagement of funds, and unfair treatment.

| Pros | Cons |

| Experienced Institution | Unregulated |

| Account Variety | Limited Educational Resources |

| Low Minimum Deposit | Higher Risk |

| Multiple Trading Platforms | Potential for Longer Dispute Resolution |

| Different Deposit/Withdrawal Options | Limited Market Instruments |

Pros:

Experienced Institution: With 5-10 years of industry experience, AGEA brings a solid foundation and understanding of the trading landscape.

Account Variety: AGEA offers a variety of account types, including Standard and Cent accounts.

Low Minimum Deposit: The minimum deposit requirement of USD 100 makes trading accessible to individuals with varying capital sizes.

Multiple Trading Platforms: AGEA provides traders with a choice of trading platforms, including Streamster and MetaTrader 4.

Different Deposit/Withdrawal Options: AGEA supports various deposit and withdrawal methods, including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods, providing flexibility and convenience to traders.

Cons:

Unregulated: One significant drawback of AGEA is its unregulated status, consumer protection and the security of funds may be concerning.

Limited Educational Resources: AGEA may lack comprehensive educational resources to help traders improve their skills and knowledge, potentially hindering traders' ability to make informed decisions.

Higher Risk: The unregulated nature of AGEA introduces a higher level of risk for traders, as there may be fewer safeguards in place to ensure the stability and security of the financial institution.

Potential for Longer Dispute Resolution: Resolving disputes with AGEA may be more challenging and time-consuming due to the lack of regulatory oversight, leading to delays and frustrations for traders seeking resolution.

Limited Market Instruments: While AGEA offers CFD trading across various asset classes, it may have fewer market instruments compared to some other brokers, limiting trading opportunities for certain traders.

AGEA offers Contract for Difference (CFD) instruments as part of its market offerings. CFDs are derivative financial products that allow traders to speculate on the price movements of various underlying assets, without actually owning the assets themselves.

With CFDs, traders can take positions on a wide range of financial instruments, including currencies, indices, commodities, and cryptocurrencies. This flexibility enables traders to diversify their portfolios and capitalize on market opportunities across different asset classes.

AGEA offers two distinct account types: Standard and Cent.

For the Standard account, the minimum balance requirement is set at USD 100, ensuring accessibility for traders with varying capital levels. On the other hand, the Cent account presents a lower entry point with balances ranging from USD 6 to 5,000, ideal for those starting with smaller amounts.

Both account types share identical leverage options, ranging from 1:1 to 1:100, initially set at 1:100. This flexibility allows traders to adjust their positions relative to their capital, amplifying their potential gains or losses accordingly.

Neither account type imposes commissions, providing traders with a cost-effective trading environment. Additionally, trade sizes are consistent across both accounts, ranging from 1,000 to 100,000 units, enabling traders to execute trades according to their strategies and risk preferences.

| Account Type | Standard | Cent |

| Balance Limits | Minimum USD 100 | USD 6 - 5,000 |

| Leverage | 1:1 - 1:100 (initially 1:100) | 1:1 - 1:100 (initially 1:100) |

| Commissions | None | None |

| Trade Sizes | 1,000 - 100,000 | 1,000 - 100,000 |

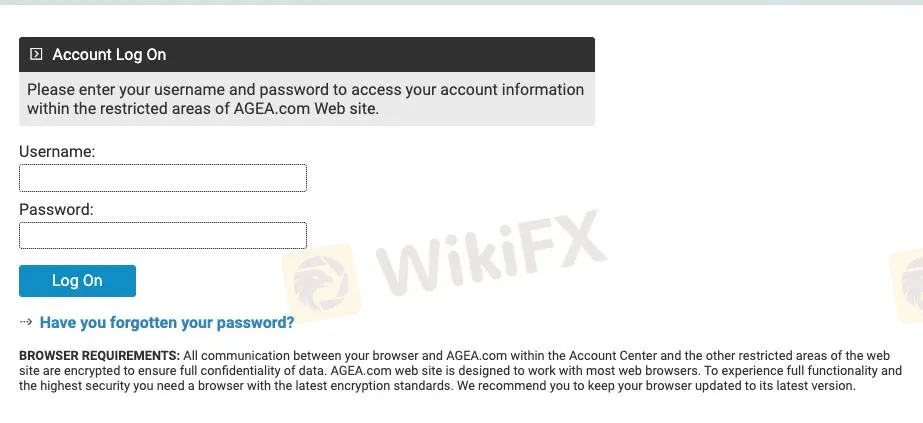

Opening an account with AGEA is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the AGEA website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: AGEA offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the AGEA trading platform and start making trades.

Withdrawal by Wire Fee - $10.00: This fee is applicable when you make a withdrawal transaction through bank wire transfer. We charge $10.00 for each withdrawal processed via wire transfer.

Withdrawal by Electronic Money Fee - $7.00: For withdrawals processed through non-wire processors, such as electronic money services, we charge a fee of $7.00 per transaction.

Inactivity Fee (SUSPENDED) - $30.00 per Month: Please note that the Inactivity Fee of $30.00 per month, which applies for each 1-month period without account activity, is currently suspended. We'll notify you in advance if there are any changes to this policy.

Streamster: Streamster is a user-friendly trading platform suitable for traders of all levels. Streamster stands out with its unique international multi-channel chat, allowing traders to discuss market trends and receive real-time customer support. It also seamlessly integrates live and virtual trading desks within a single account, ensuring consistency between demo and live trading experiences. With no balance limits or commissions, Streamster covers Crypto, Currency, Index, and Commodity CFDs, operating from Sunday 22:15 to Friday 21:00 GMT, and offers leverage ranging from 1:10 to 1:100.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is a customizable trading platform designed for proficient traders. It provides tools for price analysis, trade execution, and automated trading through Expert Advisors (EAs). MT4 offers various chart timeframes and built-in indicators for technical analysis. With its proprietary programming language, MQL4, traders can develop custom EAs tailored to their strategies. Supporting currency, index, and commodity CFDs, MT4 operates within the same trading hours as Streamster. Margin interest, execution types, and position limits vary between standard and cent accounts on MT4, providing flexibility for traders with different risk levels. Additionally, MT4 supports multiple account currencies, enhancing accessibility for global traders.

AGEA offers a range of deposit and withdrawal options including Bank Wire Transfer, Credit/Debit Cards, E-wallets, and Local Payment Methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Bank Wire Transfer: Traders can securely transfer funds to and from their AGEA accounts using bank wire transfers, providing a traditional and reliable method for depositing and withdrawing funds.

Credit/Debit Cards: AGEA accepts major credit and debit cards, offering a convenient and widely used method for instant deposits and withdrawals, facilitating seamless transactions for traders.

E-wallets: Traders can utilize various e-wallet services to deposit and withdraw funds from their AGEA accounts, providing a fast, secure, and convenient payment solution for managing their trading accounts.

Local Payment Methods (Sofort Banking and iDEAL): AGEA supports local payment methods such as Sofort Banking (Germany) and iDEAL (Netherlands).

Customer support at AGEA is comprehensive and easily accessible, ensuring traders receive assistance whenever needed.

Live Support: Traders can engage with AGEA's support team in real-time through the Live Support feature, allowing for immediate assistance with any inquiries or issues.

Phone Support: AGEA provides phone support through two contact numbers: +382 (20)664-320 and +382(20)664-320. Traders can directly reach out to speak with a representative for personalized assistance.

Email Support: For non-urgent inquiries or detailed requests, traders can contact AGEA's support team via email at support@agea.com. This allows for thorough communication and resolution of queries.

AGEA offers valuable educational resources through its Latest News section, keeping traders informed about important developments and events. This section provides updates on various company announcements and actions, including notices to shareholders, invitations to general meetings, updates on voluntary dissolution procedures, and more.

By staying updated with the Latest News, traders can gain insights into the company's operations, corporate decisions, and regulatory compliance. This information can help traders make informed decisions and stay ahead of market trends.

Here are some examples of educational resources provided by AGEA through its Latest News section:

Notice to Shareholders on the Payment of Dividends: Traders can learn about dividend payments and their impact on the company's financial performance.

Invitation to General Meetings: Traders can stay informed about upcoming general meetings and participate in discussions regarding company matters.

Update on Voluntary Dissolution: Traders can understand the implications of voluntary dissolution procedures and how they may affect the company's future operations.

In conclusion, AGEA has its ups and downs:

On the positive side, AGEA has solid experience in trading, offering various account types and a low minimum deposit of USD 100, making it accessible to traders.

But there are drawbacks to consider. AGEA operates without regulation, which might worry some traders about the safety of their funds. Plus, their educational resources are limited, which could affect traders' success. The lack of regulation also means there's more risk involved, and resolving disputes may take longer.

Question: What documents do I need to provide to verify my account?

Answer: To verify your account, you'll need to provide a copy of your identification document (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

Question: What trading platforms does AGEA offer?

Answer: AGEA offers two main trading platforms: Streamster and MetaTrader 4 (MT4). Streamster is user-friendly and suitable for traders of all levels, while MT4 is more advanced and customizable, ideal for experienced traders.

Question: How can I deposit funds into my AGEA account?

Answer: You can deposit funds into your AGEA account using various methods, including bank wire transfer, credit/debit cards, e-wallets, and local payment methods such as Sofort Banking and iDEAL.

Question: What is the minimum deposit required to open an account?

Answer: The minimum deposit required to open an account with AGEA is USD 100. This ensures accessibility for traders with varying capital levels.

Question: Does AGEA offer educational resources for traders?

Answer: Yes, AGEA provides educational resources to help traders improve their skills and knowledge. These resources include articles, tutorials, webinars, and market analysis tools.

Question: How can I contact AGEA's customer support?

Answer: You can contact AGEA's customer support team through live chat, phone (+382 (20)664-320), or email (support@agea.com). Our support team is available to assist you with any inquiries or issues you may have.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive eto-markets and agea are, we first considered common fees for standard accounts. On eto-markets, the average spread for the EUR/USD currency pair is From 0 pips, while on agea the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

eto-markets is regulated by ASIC,FSA. agea is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

eto-markets provides trading platform including Pro,Standard and trading variety including --. agea provides trading platform including -- and trading variety including --.