No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between FOREX EXCHANGE and Axiory ?

In the table below, you can compare the features of FOREX EXCHANGE , Axiory side by side to determine the best fit for your needs.

--

--

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of forex-exchange, axiory lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| FOREX EXCHANGEReview Summary | |

| Founded | 2004 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Market Instruments | Currencies |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT4 |

| Min Deposit | / |

| Customer Support | Phone: 0120-555-729 |

| Email: support@forex-exchange.co.jp | |

| Physical Address: 〒 103-0025Tokyo chuo ward kaya, the nihonbashi 2-1-1 second securities pavilion | |

FOREX EXCHANGE, incorporated in Japan in 2004. Currently regulated by the FSA, it allows traders to trade currency pairs through MT4 and supports free trading fees. But it did not provide specific information about the accounts.

| Pros | Cons |

| Regulated by FOREX EXCHANGE | No account details |

| Support MT4 | |

| Transaction fee, stop loss fee and account maintenance fee are 0 yen |

| Regulated Country/Region |  |

| Regulated Authority | FSA |

| Regulated Entity | FOREX EXCHANGE株式会社 |

| License Type | Retail Forex License |

| License Number | 関東財務局長(金商)第293号 |

| Current Status | Regulated |

It can mainly trade 25 currencies.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Precious metals & Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| ETF | ❌ |

The account opening process is as follows, consisting of four steps. You may refer to:

Transaction fee, stop loss fee and account maintenance fee are 0 yen. Deposits of more than 1 billion yen will be charged.

FOREX EXCHANGE offers MT4 for trading on desktop, mobile and tablet.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Tablet | Beginner |

| MT5 | ❌ |

Withdrawals must be made from the website and can only be made in Japanese yen.

The withdrawal fee is free in principle. For withdrawals of less than 10,000 yen and withdrawals of more than 5 times per month, 540 yen will be charged per withdrawal.

The money will be remitted to your registered financial institution account within 4 working days.

Deposits can be made through regular bank transfers and fast deposits, with no minimum amount limit. Payment in Japanese yen only.

| Axiory | Basic Information |

| Company Name | Axiory Global Limited |

| Founded in | 2012 |

| Registered Country/Area | Belize |

| Regulation | FSC (Offshore) |

| Market Instruments | Forex, gold and metals, oil and energies, CFD indices, CFD stocks, exhcange stocks, exchange ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | Up to 1:2000 |

| EUR/USD Spread | Average 1.3 pips |

| Trading Platform | MT4, MT5, cTrader, MyAxiory App |

| Minimum Deposit | $10 |

| Customer Support | Live chat, contact form, phone, email, FAQ |

| Regional Restrictions | Bulgaria, Burkina Faso, Cameroon, Croatia, Democratic Republic of the Congo, Haiti, Kenya, Mali, Monaco, Mozambique, Namibia, Nigeria, Philippines, Senegal, South Africa, South Sudan, Tanzania, Venezuela, Vietnam, Yemen |

Established in 2012, Axiory is a forex broker registered in Belize that claims to offer online trading services for a range of financial instruments, including forex, gold and metals, oil and energies, CFD indices, CFD stocks, exhcange stocks, exchange ETFs with leverage up to 1:2000.

An interesting feature of Axiory is its commitment to social responsibility. The company has established the Axiory Intelligence initiative, which is a research-based program that aims to promote education and social responsibility in the financial industry.

Axiory also supports various social causes through its Axiory Care program. In terms of trading platforms, Axiory offers multiple choices, including the popular MetaTrader 4 platform, MetaTrader 5 platform, as well as cTrader, with its proprietary trading app called MyAxiory App.

Besides, this broker also offers advanced charting tools, technical analysis indicators, and other features to help traders quickly acquaint themselves with online trading.

One of Axiory's biggest strengths is the wide range of trading instruments available. Traders can choose from a diverse selection of assets, including major and minor currency pairs, popular stocks, and popular indices. Additionally, the broker offers commodities such as oil and gold, which provide traders with opportunities to diversify their portfolios. Another significant advantage of Axiory is their multiple account types of low minimum deposits.

On the downside, Axiory's regulation is only offshore by FSC in Belize, which is not a top-tier regulator. Plus, no 7/24 online customer support available, and clients from Bulgaria, Burkina Faso, Cameroon, Croatia, Democratic Republic of the Congo, Haiti, Kenya, Mali, Monaco, Mozambique, Namibia, Nigeria, Philippines, Senegal, South Africa, South Sudan, Tanzania, Venezuela, Vietnam, and Yemen are not allowed.

| Pros | Cons |

| Wide range of trading instruments | Offshore regulated by FSC in Belize |

| Multiple trading platforms | No 7/24 customer support |

| Multiple trading account options | Regional restrictions |

| Generous trading leverage up to 1:2000 | |

| Advanced trading tools and features such as VPS, MAM, and PAMM | |

| Low minimum deposit of $10 | |

| Demo accounts available | |

| Islamic account available for most account types | |

| Multilingual customer support available |

Axiory is authorized and offshore regulated by the Financial Services Commission (FSC) in Belize. This regulatory body is responsible for ensuring that financial institutions operate in a transparent and fair manner, which can provide traders with some reassurance about the legitimacy of the broker. Axiory's adherence to regulations also means that the company must follow certain guidelines, such as maintaining sufficient capital reserves, which can help to protect traders in the event of any financial instability.

However, it is important to note that the IFSC is not a highly-respected regulatory body in the financial industry, which may lead some traders to question the level of oversight and protection provided. Additionally, the regulatory requirements of the FSC may not be as stringent as those of other regulatory bodies, which could result in less protection for traders.

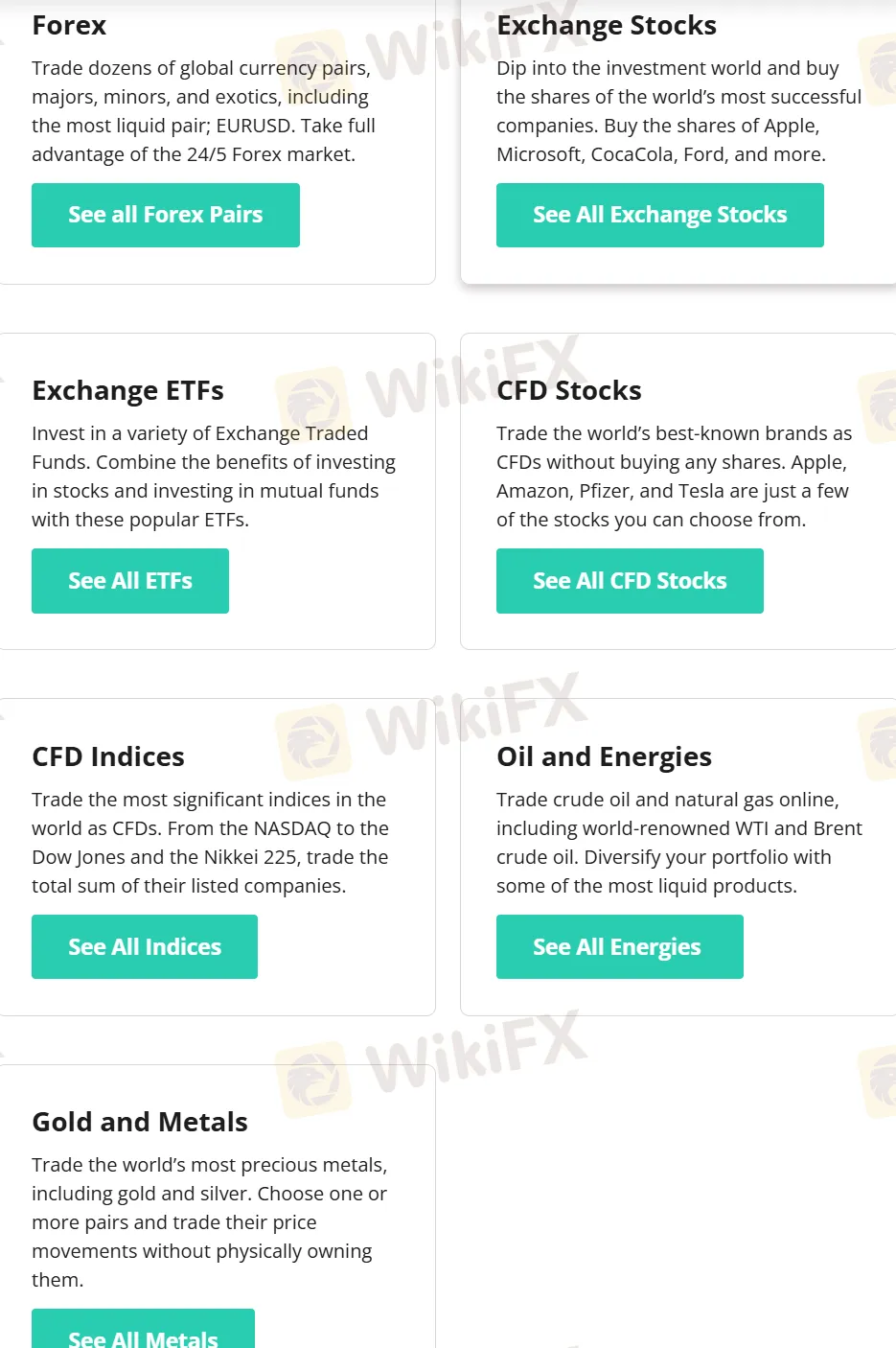

Axiory offers a range of market instruments to cater to the diverse trading needs of its clients.

Firstly, the broker provides access to the forex market, which is the largest financial market in the world, enabling traders to trade currency pairs with tight spreads and competitive pricing.

Secondly, Axiory offers exchange-traded stocks and ETFs, which provide traders with exposure to a variety of companies and industries across the globe.

Additionally, Axiory offers CFDs on stocks and indices, providing traders with the ability to trade on the price movements of individual stocks or entire market indices.

Finally, Axiory offers trading in oil and energy products, which can provide traders with exposure to the commodities market and its price fluctuations

Axiory offers a diverse range of trading accounts to cater to the needs of traders with varying experience levels and trading styles. The broker offers five types of trading accounts, including NANO, STANDARD, MAX, TERA, and ALPHA.

| Account Type | Nano | Standard | Max | Tera | Alpha | Zero |

| Min Deposit | $/€10 | $/€10 | $/€10 | $/€10 | / | $/€10 |

| Max Leverage | 1:1000 | 1:1000 | 1:2000 | 1:1000 | 1:1 | 1:1000 |

| Avg EUR/USD Spread | 0.3 pips | 1.3 pips | 2 pips | 3 pips | / | 0 |

| Commission | $6/lot | ❌ | ❌ | $6/lot | From $1.5/lot | Per instrument |

| Trading Platform | MT4, cTrader | MT4, cTrader | MT4, cTrader | MT5 | MT5 | MT4, MT5, cTrader |

| Islamic Account | ✔ | ✔ | ✔ | ✔ | ❌ | ✔ |

Axiory offers demo accounts to its clients, which are a great tool for traders to practice trading without risking real money. The demo accounts are designed to replicate the live trading environment, allowing traders to familiarize themselves with the platform, test different trading strategies, and gain experience before trading with real money.

Axiory's demo accounts are free and come with up to $10,000 virtual funds that traders can use to simulate trading. The demo accounts are available for all account types and provide traders with access to the same trading instruments, platforms, and tools as live accounts. The demo accounts are not time-limited, which means there is no expiry date on your demo accounts.

Axiory offers Islamic accounts, also known as swap-free accounts, which are designed for traders who follow the Islamic faith and can not receive or pay interest due to religious reasons. These accounts comply with Shariah law and do not charge or pay any overnight interest (swap) fees on positions held open for more than 24 hours.

Islamic accounts at Axiory offer the same features as standard trading accounts, including access to all trading instruments and platforms, customer support, and educational resources. The only difference is that Islamic accounts operate on a commission-based structure, and there are no overnight swap fees charged or credited to the account.

To open an Islamic account with Axiory, traders need to submit a request to the customer support team, and the account will be verified and set up within 24 hours. It is important to note that Axiory reserves the right to revoke the swap-free status if there is evidence of abuse or misuse of the account.

Step 1: To open an account with Axiory, interested clients can simply navigate to the broker's website and click on the “Start Now” button.

Step 2: This will lead you to a registration page where you will be prompted to provide your personal information, including name, email address, and phone number. Additionally, you will need to choose the account type.

Step 3: After submitting the registration form, you will receive an email with a link to verify their account. Once the verification process is complete, you can proceed to fund your account via one of the payment options available.

Axiory offers a range of leverage options for traders, depending on their chosen account type. The maximum leverage ranges from 1:50 to 1:2000 on the Max account, while 1:50-1:1000 on the Nano/Standard/Tera Account.

However, it's worth noting that higher leverage also comes with higher risk, and traders should be aware of the potential consequences of trading with a high leverage ratio. It's important to carefully consider your own risk tolerance and trading strategy before deciding on a leverage ratio for your account.

Axiory offers its clients access to several trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as the cTrader platform and the MyAxiory mobile app.

The MetaTrader platforms are widely used by traders worldwide and offer advanced charting capabilities, multiple time frames, and a wide range of technical indicators and analysis tools. The cTrader platform, on the other hand, is known for its fast execution speeds and advanced order management features, making it a popular choice for scalpers and high-frequency traders.

The MyAxiory mobile app allows traders to access their accounts and trade on-the-go using their mobile devices. The app is user-friendly and features real-time price quotes, charting tools, and the ability to place orders and manage positions.

Axiory accepts deposits via Visa, JCB, UnionPay, Bank Transfer, Neteller, Skrill, and ThunderX Pay.

There is no deposit fees charged if you deposit using Visa, JCB, UnionPay, and Bank Transfer, but payment fees may be charged by the payment method provider if you deposit via Neteller, Skrill, and ThunderX Pay.

As for the deposit processing time, most deposits are instant, while bank transfers require 3-10 business days and ThunderX Pay requires ip to 15 minutes after confirmation.

Axiory accepts withdrawals via Visa, JCB, UnionPay, Bank Transfer, Sticpay, Neteller, Skrill, ThunderX Pay.

There is no fees for Visa, JCB, UnionPay, and Sticpay, while withdrawal via other methods may be charged fees.

The processing time for withdrawals varies depending on the payment method used, with e-wallets (instant) typically being the fastest and bank transfers (3-10 business days) taking the longest.

Traders can contact the support team via email, phone, live chat, or contact form. The broker also provides a comprehensive FAQ section on its website, where traders can find answers to common questions related to trading, account management, and more.

Axiory is a forex broker offering a variety of trading instruments, account types, and educational resources to its clients. The broker's trading conditions, such as high spreads and commissions, may not be ideal for all traders, but its leverage options can benefit those looking for higher returns. However, Axiory's weakness lies in lack of top-tier regulation. Ultimately, traders should carefully consider their individual trading needs and goals before choosing Axiory as their broker.

Is Axiory a regulated broker?

Yes, Axiory is authorized and offshore regulated by the International Financial Services Commission (FSC) in Belize.

What is the minimum deposit required to open an account with Axiory?

Just $10.

What trading platforms are available at Axiory?

Axiory offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as cTrader and MyAxiory App.

Does Axiory offer Islamic accounts?

Yes, Axiory offers swap-free Islamic accounts for traders who follow Shariah law.

What is the maximum leverage offered by Axiory?

Up to 1:2000.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive forex-exchange and axiory are, we first considered common fees for standard accounts. On forex-exchange, the average spread for the EUR/USD currency pair is -- pips, while on axiory the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

forex-exchange is regulated by FSA. axiory is regulated by FSC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

forex-exchange provides trading platform including -- and trading variety including --. axiory provides trading platform including ALPHA,TERA,MAX,STANDARD,NANO and trading variety including --.