No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Eightcap and LIRUNEX ?

In the table below, you can compare the features of Eightcap , LIRUNEX side by side to determine the best fit for your needs.

EURUSD:0.9

EURUSD:-0.8

EURUSD:15.62

XAUUSD:14.51

EURUSD: -6.88 ~ 2.5

XAUUSD: -31.25 ~ 23.37

EURUSD:-0.1

EURUSD:-3.1

EURUSD:23.76

XAUUSD:24.25

EURUSD: -7.2 ~ 3.19

XAUUSD: -42.03 ~ 22.61

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of eightcap, lirunex lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Eightcap Review Summary | |

| Founded in | 2009 |

| Registered Country | Australia |

| Regulation | ASIC, FCA, CySEC, SCB (Offshore) |

| Trading Assets | 800+ CFDs on forex, commodity, crypto, index, share |

| Demo Account | ✅(30 days) |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 0 pips |

| Minimum Deposit | $100 |

| Trading Platform | MetaTrader 4, MetaTrader 5, Tradingview |

| Payment Method | MasterCard, Visa, PayPal, Wire Transfer, BPAY, Skrill, Neteller, etc. (vary on the region) |

| Customer Support | Live chat, phone, email, FAQs |

Eightcap is a popular online forex and CFDs broker that offers access to trade various financial markets. The broker was founded in 2009 in Melbourne, Australia, and has since expanded its presence to other regions such as Europe, Asia, and the Middle East. Eightcap prides itself on providing a user-friendly trading experience, robust trading platforms, and competitive trading conditions for its clients.

The broker offers a wide range of financial instruments to trade, including 800+CFDs on forex, commodity, crypto, index, and share. Clients can access these markets through the popular trading platforms, MetaTrader 4, MetaTrader 5, and TradingView. The broker also offers three types of account types to suit the individual needs of its clients, including Standard, Raw and TradingView, with the minimum deposit requirement of $100.

Eightcap is a global forex and CFD broker offering many features and benefits that make it an attractive choice for traders of all levels. One of the primary advantages of Eightcap is its range of trading instruments, including CFDs on forex, commodity, crypto, index, and share. This diversity allows traders to take advantage of a wide range of market opportunities and build diversified portfolios.

In addition to its broad range of trading instruments, Eightcap also offers competitive trading conditions, such as tight spreads and low commissions, which can help traders maximize their profits. The broker also provides access to multiple trading platforms, including MetaTrader 4 and 5, as well as TradingView.

While there are many benefits to trading with Eightcap, there are also some drawbacks to consider. One of these is the limited selection of educational resources, which may be a disadvantage for novice traders. Additionally, the broker does not currently offer social trading options and 24/7 customer support.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yes, Eightcap is considered a legitimate broker, regulated by reputable financial authorities including ASIC (Australia), FCA (UK), CySEC (Cyprus), and SCB (Bahamas). These regulatory bodies impose strict rules and regulations on the broker to ensure they operate in a fair and transparent manner, thereby providing traders with a safe and secure trading environment.

EIGHTCAP PTY LTD, its Australian entity, is authorized and regulated by the Australia Securities & Investment Commission (ASIC) under the regulatory license number 391441.

Eightcap EU Ltd, is regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license no. 246/14.

Eightcap Group Ltd, its UK entity, is authorized and regulated by the Financial Conduct Authority (FCA) under the regulatory license number of 921296.

Eightcap Global Limited, the international entity, is authorized and offshore regulated by the Security Commission of the Bamas (SCB) under the regulatory license number of SIA-F220.

800+ CFDs on forex, commodity, crypto, index, share... EightCap allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on EightCap.

Live Accounts: EightCap offers three types of accounts at EightCap: Raw, Standard and TradingView accounts. All require a moderate minimum deposit of 100 USD, which is quite friendly for beginners. Their most relevant differences consist in the spreads, the raw account has a lower spread. Standard and TradingView accounts offers a commission-free trading environment, yet compensated by wider spreads, while Raw accounts offers raw spreads, accompanied by additional commissions.

The Raw Account is designed for traders seeking tight spreads and transparent pricing. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 0.0 pips. However, a commission is charged on each side of the trade, ranging from $3.5 for major currencies like AUD, USD, NZD, SGD, and CAD, to $2.25 for GBP and $2.75 for EUR per standard lot traded. This account type allows scalping and supports a wide range of base currencies, including AUD, USD, EUR, GBP, NZD, CAD, and SGD. The minimum trade size is 0.01 lots, with a maximum of 100 lots.

The Standard Account is designed for traders seeking a more straightforward pricing structure. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 1.0 pips. No commissions are charged, making it a cost-effective option for traders who prefer to pay through the spread. Like the Raw Account, the Standard Account allows scalping, supports multiple base currencies, and offers the same minimum and maximum trade sizes, margin call levels, and stop-out levels.

The TradingView Account is a unique offering that integrates with the popular TradingView platform. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 1.0 pip and no commissions charged. This account type is suitable for traders who prefer to use the TradingView platform for analysis and trading. Similar to the other account types, the TradingView Account allows scalping, supports a wide range of base currencies, and offers the same minimum and maximum trade sizes, margin call levels, and stop-out levels.

Aside from two types of live trading accounts, Eightcap offers a 30-day demo account for traders who want to practice and test their trading strategies without risking real money. The demo account is free and is designed to simulate real market conditions, allowing traders to get a feel for the platform and instruments before they start trading with a live account. The demo account is funded with virtual money and offers access to the same features as the live account, including a range of instruments and trading platforms.

The maximum leverage is determined by the regulator; the maximum ASIC leverage is only 1:30, but the Bahamas SCB allows a leverage of 1:500. However, other trading conditions may vary accordingly and you can decide for yourself.

High leverage is ideal for active traders and scalpers, as it presents greater trading flexibility in general, which directly impacts profitability, but new users are advised to operate with caution with such large leverage.

Eightcap offers competitive spreads and commissions on their trading instruments. The spreads on forex pairs start from as low as 0.0 pips on the Raw account and 1.0 pips on the Standard account. The commissions charged on forex trades start from $3.50 per lot round trip on the Raw account and there are no commissions on the Standard account.

For indices, the spreads start from 0.5 pips on the Raw account and 1.0 pips on the Standard account.There are no commissions charged on indices trading. The spreads on commodities trading start from 0.03 pips on the Raw account and 0.5 pips on the Standard account, and there are no commissions charged on commodities trading. The spreads and commissions may vary depending on market conditions and the type of account held by the trader.

Eightcap charges non-trading fees, which are fees not directly related to trading, such as deposit and withdrawal fees, inactivity fees, and currency conversion fees.

For deposits, Eightcap does not charge any fees, but there may be fees charged by the payment provider or bank. Withdrawals made via bank transfers are free, but there is a fee of $10 for withdrawals via credit/debit cards.

Additionally, Eightcap charges an inactivity fee of $50 per quarter if there are no trades or account activity for a period of 90 days or more. It's important to note that this fee is only charged if there are sufficient funds in the account, and it does not apply to demo accounts.

Eightcap also charges a currency conversion fee of 0.5% for clients who deposit or withdraw in a currency other than their account base currency. This fee can be higher for certain currencies, so it's important to check with Eightcap for the exact fee amount.

Eightcap offers multiple trading platforms, including the popular MetaTrader 4, MetaTrader 5, and Tradingview. These platforms are known for their user-friendly interface and advanced charting tools. Additionally, Eightcap also provides a web-based trading platform that can be accessed from any device with an internet connection. This platform is ideal for traders who prefer a simpler interface or who don't want to download and install software on their device.

With the MetaTrader platforms, Eightcap offers a range of customizable features, including the ability to use custom indicators and expert advisors. These platforms also provide access to real-time market data and allow traders to execute trades quickly and efficiently. Traders can also use the platforms to set up automated trading strategies, which can be particularly useful for those who want to trade around the clock.

EightCap's TradingView leverages 15+ customizable chart types, including Kagi, Renko, and Point & Figure. Organize up to 8 synchronized charts per tab and utilize 90+ smart drawing tools for comprehensive analysis.

Furthermore, Eightcap's web-based trading platform is designed to offer a streamlined trading experience. It includes essential features such as real-time market news, customizable charts, and advanced order types. The platform also offers access to a range of educational resources, including trading videos, webinars, and tutorials, which can be helpful for new traders looking to improve their skills.

Eightcap offers a variety of deposit and withdrawal methods, such as MasterCard, Visa, PayPal, Wire Transfer, BPAY, Skrill, Neteller, etc. (vary on the region). You can find more detailed info in the table below:

| Payment Option | Accepted Currencies | Deposit Fee | Withdrawal Fee | Deposit Processing Time | Withdrawal Processing Time |

| MasterCard | AUD, USD, GBP, EUR, NZD, CAD, SGD | ❌ | ❌ | Instant | 2-5 business days |

| Visa | |||||

| PayPal | AUD, USD, GBP, EUR, NZD, SGD | 1-5 business days | |||

| Wire Transfer | AUD, USD, GBP, EUR, NZD, CAD, SGD | Variable | 1-5 business days | ||

| B-PAY | AUD | ❌ | 1-2 business days | 1-3 business days | |

| UnionPay | RMB | Instant | 1 business day | ||

| Skrill | USD, EUR (only for EEA clients), CAD | Variable | |||

| Neteller | |||||

| Cryptos | USDT (TRC20), USDT (ERC20), BTC (only for USD accounts) | ❌ | / | Instant | |

| Interac | CAD | ❌ | 1-3 business days | ||

| fasapay | USD | 1 business day | |||

| pix | BRL | / | / | / | 1-5 business days |

| dragonpay | MYR, PHP | Variable | ❌ | Instant | 1 business day |

| ... | THB, VND, MYR, IDR, PHP |

Eightcap offers live chat, phone, and email. Their live chat feature is available 24/5, which means clients can get instant assistance whenever they need it. Phone support is available during business hours, and email support promises a response within 24 hours.

In addition, Eightcap has an extensive FAQ section on its website that covers various topics, such as account opening, trading platforms, funding and withdrawals, and trading conditions.

In conclusion, Eightcap seems like a solid choice for traders looking for a reliable broker with a wide range of instruments, competitive pricing, and user-friendly platforms. Their customer support is also top-notch, with various ways to get in touch and a comprehensive FAQ section. While their educational resources may not be as extensive as some other brokers, they still provide useful tools and market analysis to help traders stay informed. The only potential downside is the lack of proprietary trading platforms, but with MT4, MT5, and TradingView available, there's still plenty of options to choose from.

Is Eightcap regulated?

Yes, Eightcap is regulated by ASIC, FCA, CySEC, and SCB (Offshore).

What trading platforms does Eightcap offer?

Eightcap offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView.

What are the minimum deposit requirements for Eightcap?

The minimum deposit requirement for Eightcap's Standard account is $100.

What is the maximum leverage available at Eightcap?

Up to 1:500.

Can I open a demo account with Eightcap?

Yes, Eightcap offers a 30-day demo account that allows traders to practice their trading strategies without risking real money.

What financial instruments can I trade at Eightcap?

You can trade CFDs on forex, commodity, crypto, index, and share on Eightcap.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities.

| LIRUNEX | Basic Information |

| Registered Country/Region | Cyprus |

| Founded in | N/A |

| Regulation | CySEC, BDF, BaFin, LFSA, CNMV |

| Minimum deposit | $500 |

| Tradng Assets | Forex, Spot Metals, Indices, Shares, Energy |

| Leverage | Up to 1:500 |

| Account types | Standard, Prime and Pro accounts |

| Trading platform | MetaTrader 4 |

| Spreads | From 0.4 pips (on EUR/USD) |

| Commission | No commissions charged, only spreads |

| Demo account | Yes |

| Account Base Currencies | USD, EUR, GBP, CHF, JPY, AUD, CAD |

| Payment methods | Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort,Webmoney,and more |

| Educational | Free educational resources include ebooks, webinars, and video tutorials |

| Customer support | Phone, email, live chat, online contact form and extensive FAQ section |

LIRUNEX is a retail forex and CFD broker that is registered in Cyprus and regulated by multiple regulatory authorities. The broker offers a variety of trading instruments, including forex, indices, commodities, and cryptocurrencies, with competitive spreads and leverage up to 1:30 for forex trading.

LIRUNEX also offers multiple account types, namely Standard, Prime and Pro accounts and each with different minimum deposit requirements and features to cater to different trading styles and preferences. For example, the Standard account requires a minimum deposit of $500 or equivalent amount.

LIRUNEX's trading platform of choice is MetaTrader 4, which is available for both desktop and mobile devices. LIRUNEX supports various order types, including market orders, limit orders, stop orders, and trailing stop orders. Traders can also execute orders using the One-Click Trading feature on the MetaTrader 4 platform. In addition, LIRUNEX provides various educational resources and trading tools to assist traders in making informed decisions.

LIRUNEX offers customer support via several channels, including phone, email, as well as some social media platforms, and an online contact form. The customer support team is available 24/5 to assist traders with any queries or issues they may have. LIRUNEX's website also features a comprehensive FAQ section, which can be accessed from the “Support” tab on their website, providing answers to frequently asked questions on topics such as account opening, trading conditions, and platform features.

LIRUNEX has multiple entities that are regulated by various regulatory authorities, including CySEC, BDF, BaFin, LFSA, and CNMV. This means that LIRUNEX operates under strict guidelines and adheres to high levels of regulatory standards and consumer protection policies.

LIRUNEX LIMITED, is authorized and regulated by Federal Financial Supervisory Authority of Germany (BaFin) under regulatory license number 156748;

Lirunex Ltd, is authorized and regulated by Banque de France (BDF) under regulatory license number 83447;

Lirunex Ltd, is also authorized and regulated by the Cyprus Securities and Exchange Commission (CYSEC) under regulatory license number 338/17;

Lirunex Limited is also authorized and regulated by the Labuan Financial Services Authority (LFSA) under regulatory license number MB/20/0050;

LIRUNEX LTD, is authorized and regulated by the Comisión Nacional del Mercado de valores (CNMA) under regulatory license number 4829;

LIRUNEX is a forex broker that offers traders competitive trading conditions, such as low spreads and high leverage. The broker provides free educational resources, including webinars, ebooks, and video tutorials, to help traders improve their trading skills. LIRUNEX also has a range of payment options available for its clients to use.

However, LIRUNEX also has some drawbacks. The broker has a limited asset offering, as it only offers Forex and CFDs. Additionally, the minimum deposit requirements are relatively higher compared to other brokers. LIRUNEX also only provides users with the option to trade via MetaTrader 4, limiting choices for experienced traders who may prefer other trading platforms. The demo account funding is only available to users registered in certain countries, while the broker's services are only available in certain jurisdictions and not to residents of the United States. Social trading features are also not available on the LIRUNEX trading platform.

| Pros | Cons |

| Multiple regulated entities | Limited asset offering compared to some other brokers |

| Wide selection of trading instruments | Minimum deposit requirements are relatively higher compared to other brokers |

| A range of educational resources, including webinars, ebooks, and video tutorials | Trading is limited to MetaTrader 4 |

| A variety of payment options | Demo account funding is only available to users registered in certain countries |

| Multiple trading accounts to choose from | Only available in certain jurisdictions (not available to residents of the United States) |

| A series of trading tools | No social trading features are available |

| No 7/24 customer support |

LIRUNEX is a well-established online brokerage firm that caters to the needs of traders worldwide. It offers a comprehensive selection of market instruments to its clients, including Forex, Spot Metals, Indices, Shares, and Energy.

Forex: LIRUNEX offers a wide range of currency pairs for trading, including major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs.

Spot Metals: LIRUNEX offers spot trading of precious metals such as gold and silver. Spot trading allows traders to buy and sell these metals at the current market price.

Indices: LIRUNEX offers trading on a variety of global stock indices, including the S&P 500 index, NASDAQ index, and the Dow Jones Index. Trading indices allows traders to speculate on the performance of a whole stock market, rather than just individual stocks.

Shares: LIRUNEX offers trading of stocks from various global markets, including the US, UK, Europe, and Asia. Trading on stocks allows traders to invest in well-known companies and earn profits based on their performance.

Energy: LIRUNEX offers trading of energy products such as crude oil and natural gas. Traders can benefit from price changes in energy markets, which are known for their high volatility.

LIRUNEX offers a range of account types to suit the needs of different traders. They have carefully crafted their account types to offer a tailored experience to traders based on their trading level, experience, and financial status. The account types offered by LIRUNEX are Standard, Prime, and Pro.

The Standard account requires a minimum deposit of $/€ 500 and is suitable for novice traders who are new to the market. This type of account offers basic trading conditions, including access to all trading instruments, customer support, educational resources, and trading tools.

The Prime account requires a higher minimum deposit of $/€ 2,000 and is targeted towards traders who have more experience in the market. This account type offers tighter spreads, lower commissions, and additional perks such as exclusive trading signals and faster withdrawals.

The Pro account is the top-tier account type offered by LIRUNEX and requires a minimum deposit of $/€ 10,000. This type of account is geared towards professional traders who require a higher level of trading conditions, including dedicated account managers, advanced trading tools, priority customer support, and lower commissions and favorable market conditions.

All account types offered by LIRUNEX come with negative balance protection, and the MetaTrader 4 trading platform. Additionally, traders can choose from different currency options, EUR or USD.

Opening an account with LIRUNEX is a straightforward process and can be completed in a few simple steps. Here is a step-by-step guide on how to open an account with LIRUNEX:

Visit the LIRUNEX website and click on the “Register” button on the top right-hand corner.

Fill in the registration form by providing accurate personal details, including your name, email address, and phone number.

Select your preferred account type - Standard, Prime, or Pro - and choose your base currency.

After filling in the form, you will receive an email to confirm your registration.

Next, login to your LIRUNEX account and complete your account verification by uploading the necessary documents. The documents required for verification can be found on the website or by contacting customer support.

Once your account is verified, you can fund your account by choosing a payment method that is convenient for you. LIRUNEX provides several payment options, including bank transfers, credit/debit cards, and e-wallets.

After funding your account, you can begin trading by downloading the LIRUNEX trading platform or by using the web-based platform.

LIRUNEX provides customers with 24/5 customer support to assist with any issues that may arise during the trading process.

As per the regulations by ESMA, the default leverage for retail forex traders is set at a maximum of 1:30, while professional traders are allowed to trade with a higher leverage of up to 1:100.

Leverage refers to the amount of borrowing that a trader can use to open a position in the market. Higher leverage can increase potential profits, but it also comes with higher risk. Professional traders are considered to have a higher level of experience and knowledge of the financial markets, which is why they are often offered higher leverage options.

However, it's important to note that leverage should be used wisely, and traders should always consider the risks involved before trading with high leverage. It's also essential to have a risk management strategy in place to protect your investment in case of unfavourable market conditions.

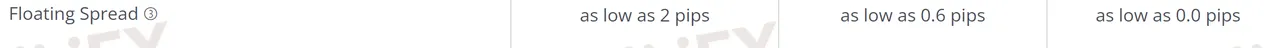

LIRUNEX offers a variety of trading account types to suit the needs of different traders. Each account type features different spreads and commission charges. Here, we will explain the available accounts and what they offer in terms of spreads and commissions.

The Standard Account is designed for those who are new to trading or who prefer lower costs. With this account, you can trade with floating spreads that start from 2 pips. The best part is that there are no commissions charged on trades. This account is ideal for beginners who want to start trading with a lower investment.

The Prime Account is designed for those who require tighter spreads and faster trade execution times. With this account, you can trade with floating spreads that start from 0.6 pips, which is significantly lower than the Standard Account. However, this account comes with a commission charge of $8 per lot traded. This account is suitable for traders who require faster trading speeds and lower spreads.

The Pro Account is designed for professional traders who require the tightest spreads possible and access to institutional-grade trading conditions. With this account, you can trade with spreads that start from 0.0 pips, which means that you can trade with almost no spreads! It is important to note that this account comes with a commission charge of $4 per lot traded. This account is ideal for high volume traders who require high-quality trading conditions.

Apart from trading fees, LIRUNEX also charges some non-trading fees that traders should be aware of. Here are some of the non-trading fees charged by LIRUNEX:

Deposit Fees - While deposits with LIRUNEX are free of charge, some payment providers may charge you fees for depositing funds. It's important to check with your payment provider to see if they charge any fees.

Withdrawal Fees - LIRUNEX does not charge any withdrawal fees. However, the payment provider you use to withdraw funds may charge fees. LIRUNEX also waives the first withdrawal fee for its clients each month.

Inactivity Fees - If there has been no trading activity in your account for a period of 90 days, an inactivity fee of $50 will be charged for each subsequent month until the account is active again.

Conversion Fees - If you deposit funds in a currency different from the one in which your LIRUNEX account is denominated, you will be charged a conversion fee of 2% of the deposit amount. This fee is charged to cover the costs of converting the funds to your account currency.

Overnight Financing Fees - LIRUNEX charges overnight financing fees for positions that are held open overnight. These fees can be either positive or negative and depend on the instrument being traded.

LIRUNEX provides MetaTrader 4 (MT4) trading platform for its clients. The MT4 platform is available in PC, iOS, and Android versions that allow traders to access their accounts and trade from anywhere, at any time.

MT4 is a well-known and widely-used trading platform globally, known for its user-friendly interface, advanced charting features, multiple order types, and the ability to support automated trading strategies like Expert Advisors (EAs). The platform also offers a vast array of technical analysis tools that traders can use to make informed decisions.

LIRUNEX provides a range of trading instruments through its MT4 platform, including forex, commodities, and indices. The platform also supports multiple account types, allowing traders to choose the one that suits their needs best.

LIRUNEX supports various payment methods for deposits and withdrawals, including Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort, and Webmoney. Deposits through most payment methods have a minimum deposit requirement of 50. However, the minimum deposit through global transfer is $300.

It is important to note that the processing time for withdrawals can vary depending on the payment method used. Withdrawal requests made through Visa and Mastercard can take up to 10 business days to process. This is due to the nature of these payment methods, which typically involve additional security checks and verification procedures to ensure that the funds are being transferred to the correct account.

LIRUNEX offers several channels of customer support to assist its traders. This includes:

Email support, which is available 24/7 and allows traders to submit their questions or concerns to LIRUNEX's support team.

Phone support, which is available during business hours and allows traders to speak to a support representative directly.

A comprehensive FAQ section on LIRUNEX's website, which provides answers to common questions and concerns about trading with LIRUNEX.

In addition to these channels of customer support, LIRUNEX also offers a personal account manager service for premium account holders, which provides dedicated assistance and support for their trading needs.

LIRUNEX offers a range of educational resources to help traders improve their trading skills and knowledge in the Forex markets. Some of these resources include a beginner's guide, an economic calendar, trading strategies, market analysis, and informative articles.

These resources are designed to help traders understand the fundamental and technical analysis of the Forex markets, as well as to give them an overview of the trading tools and features available on the LIRUNEX platform. By using these resources, traders can better navigate the Forex markets, make more informed trading decisions, and ultimately, achieve their trading objectives.

In conclusion, LIRUNEX is a reputable forex broker that offers traders a range of benefits and drawbacks. Its competitive spreads, multiple account types make it an attractive option for traders looking to improve their skills and trading outcomes. However, its limited product offerings, lack of available US trading accounts, and potentially higher withdrawal fees for certain accounts may be disadvantages for some traders. Overall, LIRUNEX provides a secure and regulated trading environment and is worth considering for traders looking for a well-rounded forex broker. As always, traders are advised to conduct thorough due diligence and weigh their options before investing their funds.

Q: What regulatory standards does LIRUNEX comply with?

A: LIRUNEX has multiple entities that are regulated by various regulatory authorities, including CySEC, BDF, BaFin, LFSA, and CNMV.

Q: What account types are available at LIRUNEX?

A: LIRUNEX offers three different account types, including Standard, Prime and Pro accounts. Each account type has different features, including minimum deposits, trading conditions, and access to additional tools.

Q: How can I fund my account with LIRUNEX?

A: LIRUNEX offers several different funding options, including Global, SEPA, Global Transfer, VISA, Mastercard, ePay.bg, GiroPay, Sofort,Webmoney,and more.

Q: Does LIRUNEX offer educational resources?

A: Yes, LIRUNEX has a variety of educational resources available for traders of all skill levels, including webinars, video tutorials, eBooks, and more.

Q: How can I get in touch with customer support at LIRUNEX?

A: LIRUNEX customer support is available 24/7 via email, phone, or live chat.

Q: What trading platforms does LIRUNEX offer?

A: LIRUNEX offers two trading platforms, including the popular MetaTrader 4 (MT4) platform and the Lirunex Trader platform. Both platforms can be used on desktop.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive eightcap and lirunex are, we first considered common fees for standard accounts. On eightcap, the average spread for the EUR/USD currency pair is From 0.0 pips, while on lirunex the spread is from 0.0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

eightcap is regulated by ASIC,FCA,CYSEC,SCB. lirunex is regulated by AMF,CYSEC,LFSA,CNMV.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

eightcap provides trading platform including Raw,Standard and trading variety including --. lirunex provides trading platform including LX-Pro,LX-Prime,LX Standard and trading variety including --.