No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Easy Forex and Doo Prime ?

In the table below, you can compare the features of Easy Forex , Doo Prime side by side to determine the best fit for your needs.

--

--

EURUSD:-0.3

EURUSD:-2.2

EURUSD:9.99

XAUUSD:20.06

EURUSD: -2.11 ~ 0.27

XAUUSD: -37.21 ~ 25.43

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of easyforex, doo-prime lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Easy Forex Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

| Market Instruments | Forex, commodities, metals, indices, options, cryptocurrencies, and shares |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | easyMarkets platform (web/app), TradingView, MT4/5 |

| Minimum deposit | $25 |

| Customer Support | Live chat, WhatsApp, request a callback, send messages online to get in touch, and email |

Easy Forex, now known as easyMarkets, is an online forex and CFD broker that provides trading services to individual and institutional traders. It was established in 2001 and is regulated by the Cyprus Securities and Exchange Commission (CYSEC). Easy Forex offers a variety of trading instruments, including forex, commodities, metals, indices, options, cryptocurrencies, and shares, and provides access to multiple trading platforms such as easyMarkets platform (web/app), TradingView, MT4, and MT5. The broker aims to provide a user-friendly trading experience and offers various features like risk management tools and educational resources.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Easy Forex offers a regulated and trustworthy trading environment, providing a wide range of trading instruments and user-friendly platforms. The inclusion of risk management tools and educational resources further enhances the trading experience.

However, there have been reports of scams and negative user experiences that should be taken into consideration. Traders should weigh these pros and cons carefully and conduct thorough research before deciding to trade with Easy Forex.

| Pros | Cons |

| • Regulated by CYSEC | • Reports of scams and negative user experiences found online |

| • Wide range of trading instruments available | • Withdrawal processing time can be relatively long |

| • Demo accounts available | |

| • User-friendly trading platforms, including easyMarkets platform, TradingView, MT4, and MT5 | |

| • Various risk management tools | |

| • Multiple payment options | |

| • Rich educational resources | |

| • Efficient customer support with multiple contact options |

There are many alternative brokers to Easy Forex depending on the specific needs and preferences of the trader. Some popular options include:

OctaFX - a reputable broker with competitive trading conditions and a wide range of trading instruments, making it a good choice for traders looking for diverse trading opportunities.

Darwinex - stands out with its innovative concept of “trading talent” and offers a unique platform for both traders and investors to benefit from each other's success.

Hantec Markets - a reliable broker with a strong reputation and a comprehensive range of trading platforms, making it suitable for traders of all levels seeking a trustworthy trading environment.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Easy Forex, being regulated by the Cyprus Securities and Exchange Commission (CYSEC) and holding a valid license (No. 079/07), operates under the supervision and guidelines set by a reputable regulatory authority. The provision of Free Guaranteed Stop Loss and Negative Balance Protection further emphasizes their commitment to client protection. However, it is essential to conduct thorough research and exercise caution when engaging with any financial service provider, as risks are inherent in trading activities.

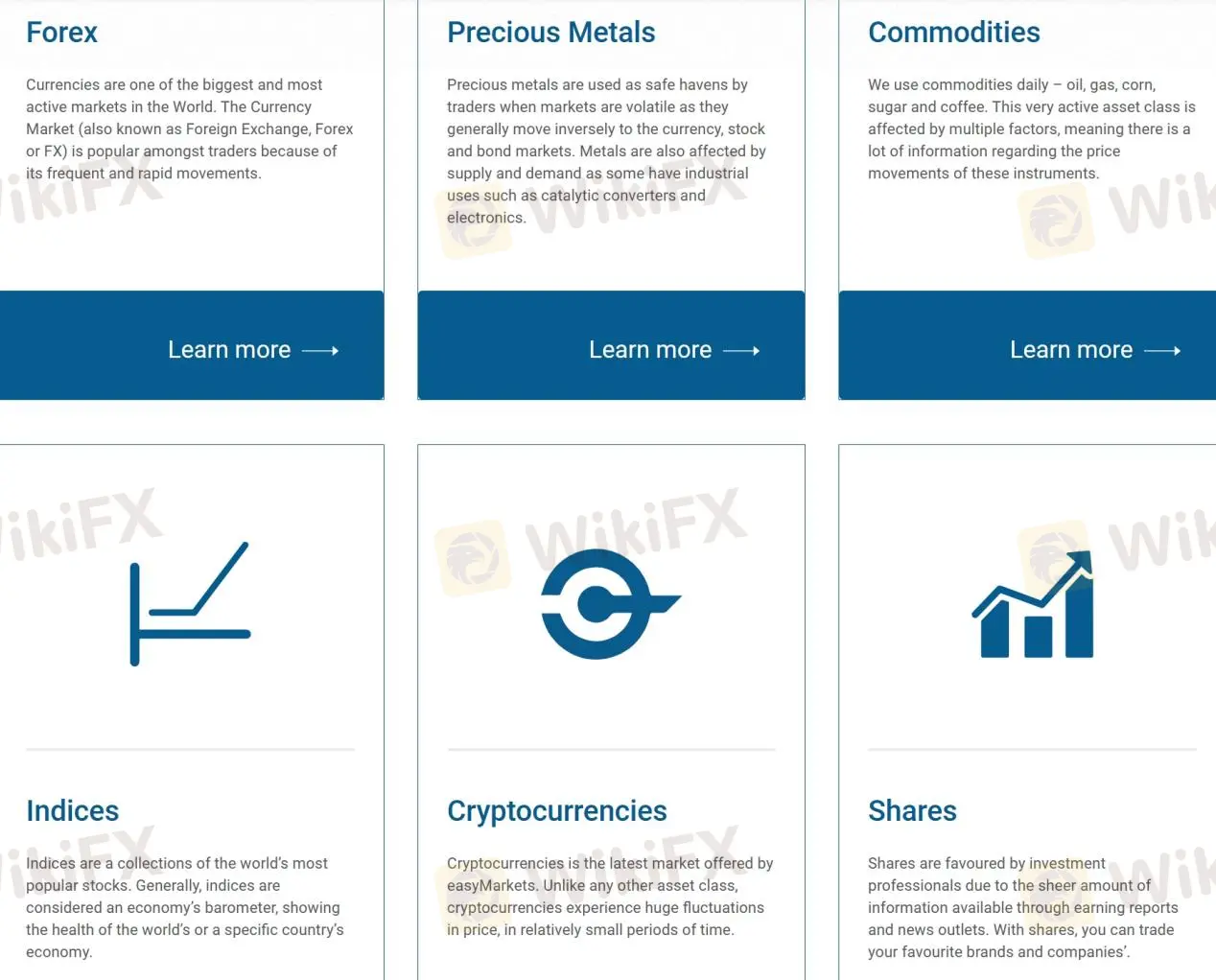

Easy Forex provides a diverse range of market instruments, catering to the trading preferences of its clients. Traders can access the global Forex market, allowing them to trade major, minor, and exotic currency pairs. Additionally, Easy Forex offers commodities, such as gold, silver, crude oil, and natural gas, enabling investors to participate in the movements of these essential resources.

The platform also provides access to various global indices, allowing traders to speculate on the performance of leading stock market indices worldwide. Moreover, Easy Forex offers options, cryptocurrencies, and shares, further expanding the trading opportunities available to its clients. With such a broad selection of market instruments, traders can diversify their portfolios and take advantage of various market opportunities.

Easy Forex offers a range of account types to suit the trading needs and preferences of different traders. On the easyMarkets Web/App and TradingView platforms, traders can choose between Standard, Premium, and VIP accounts. These accounts provide varying features and benefits, with the minimum deposit requirement starting at $25 for the Standard account.

For those who prefer the MT4 platform, Easy Forex also offers Standard, Premium, and VIP accounts, with the same minimum deposit requirements as the easyMarkets Web/App and TradingView accounts. Additionally, there is a single account type available on the MT5 platform.

The availability of different account types allows traders to select the account that best aligns with their trading goals, risk tolerance, and investment capital. Furthermore, Easy Forex provides demo accounts, allowing traders to practice and familiarize themselves with the platform's features before trading with real funds.

| easyMarkets Web/App and TradingView | MT4 | MT5 | |||||

| Account type | Standard | Premium | VIP | Standard | Premium | VIP | |

| Minimum transaction size from | 0.01 | ||||||

| Spreads type | Fixed | Variable | |||||

| EUR/USD from | 1.8 pips | 1.5 pips | 0.8 pips | 1.7 pips | 1.2 pips | 0.7 pips | 0.5 pips |

| Minimum deposit | $25 | $2,000 | $10,000 | $25 | $2,000 | $10,000 | $25 |

| Max leverage | 1:200 | 1:400 | 1:500 | ||||

| Commission | 0 | ||||||

| Account Fees | 0 | ||||||

| Customer Support over the phone | Yes | ||||||

| Personal Account Manager | yes | ||||||

| 24/5 phone and live chat trading | No | No | Yes | ||||

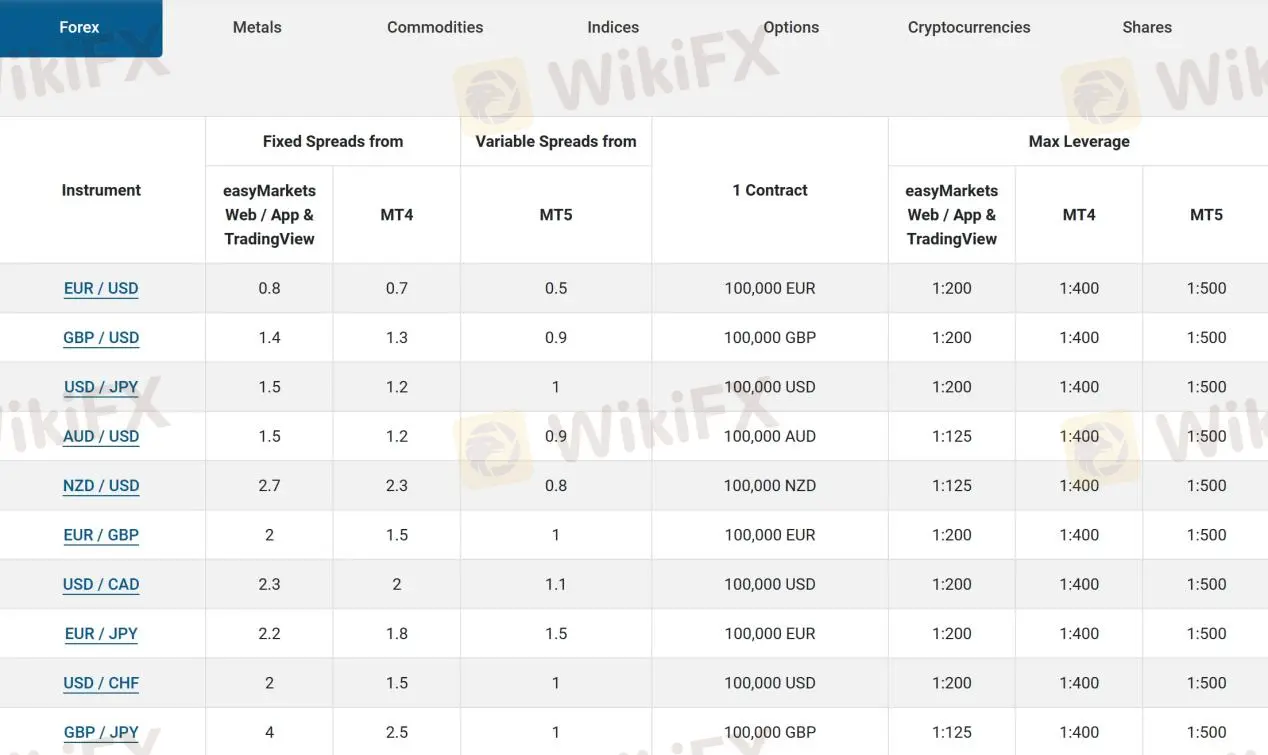

Easy Forex provides competitive leverage options to its traders across different trading platforms. On the easyMarkets Web/App and TradingView platforms, traders can access leverage up to 1:200. This means that for every $1 of capital, traders can trade with $200 in the market. For traders who prefer the MT4 platform, Easy Forex offers leverage up to 1:400, allowing for even greater exposure to the markets. On the MT5 platform, traders can enjoy leverage up to 1:500, offering enhanced trading opportunities.

It's important to note that while leverage can amplify potential profits, it also increases the risk of losses. Therefore, traders should exercise caution and employ risk management strategies when utilizing leverage in their trading activities. Easy Forex's range of leverage options caters to different trading styles and risk preferences, allowing traders to make informed decisions based on their individual trading strategies.

Easy Forex offers competitive spreads across its trading platforms, ensuring cost-effective trading for its clients. When trading the popular EUR/USD currency pair, the spread varies depending on the platform chosen. On the easyMarkets Web/App and TradingView platform, the spread is fixed from 0.8 pips, providing traders with transparency and consistency in their trading costs. For those using the MT4 platform, the spread is fixed from 0.7 pips, offering competitive pricing for this major currency pair. On the MT5 platform, the spread is variable from 0.5 pips, allowing traders to potentially benefit from tighter spreads during times of increased market liquidity.

It's worth noting that Easy Forex does not charge any commissions on trades, ensuring that traders can focus on their trading strategies without incurring additional costs. By providing competitive spreads and commission-free trading, Easy Forex aims to offer a cost-effective trading environment to its clients.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| Easy Forex | From 0.5 pips | No |

| OctaFX | 0.4 pips | No |

| Darwinex | 0.0 pips | Variable |

| Hantec Markets | 1.2 pips | No |

Please note that these figures are indicative and may vary depending on market conditions and account types. It's always recommended to check with the respective brokers for the most up-to-date and accurate information regarding spreads and commissions.

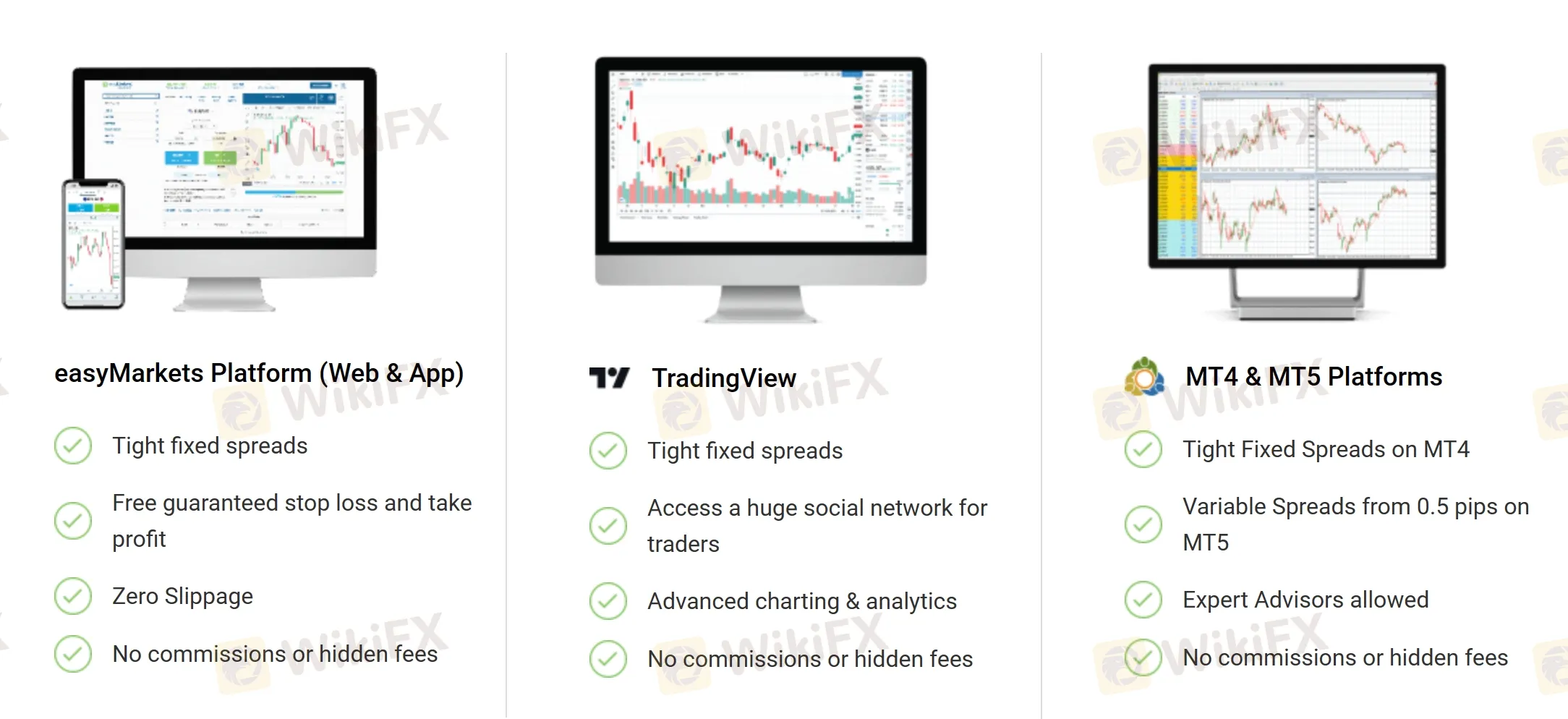

Easy Forex provides its clients with a diverse range of trading platforms, catering to different preferences and trading styles. The easyMarkets platform, available on both web and mobile applications, offers a user-friendly interface and a wide range of trading tools. It provides access to a variety of financial instruments and features advanced risk management tools like free guaranteed stop loss and take profit.

TradingView, a popular charting and analysis platform, is also supported by Easy Forex, allowing traders to analyze markets, access advanced technical indicators, and execute trades directly from the platform. For those who prefer the widely used MetaTrader platforms, Easy Forex offers both MT4 and MT5.

These platforms provide comprehensive charting capabilities, customizable indicators, and automated trading options. With a selection of trading platforms, Easy Forex aims to cater to the diverse needs of traders and provide them with a seamless and feature-rich trading experience.

Overall, Easy Forex's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Easy Forex | easyMarkets Web/App, TradingView, MT4, MT5 |

| OctaFX | MetaTrader 4, MetaTrader 5, cTrader |

| Darwinex | Darwinex Web Platform, MetaTrader 5 |

| Hantec Markets | MetaTrader 4, MetaTrader 5 |

Easy Forex offers a comprehensive suite of trading tools designed to enhance the trading experience and help traders make informed decisions. The dealCancellation feature allows traders to cancel losing trades within a specific time frame, providing an extra layer of protection against potential losses. The Freeze Rate tool enables traders to freeze the quoted rate for a few seconds, giving them time to analyze the market before executing a trade.

Negative Balance Protection ensures that traders cannot lose more than their initial investment, safeguarding them from excessive losses. The platform also provides a range of order types, including pending orders, which allow traders to set specific entry and exit levels for their trades. Additionally, Easy Forex offers free guaranteed stop loss and take profit levels, providing traders with added control over their risk management.

Traders can also stay informed about market developments through various tools, including notifications, live currency rates, an inside viewer to see the sentiment of other traders, trading charts, a financial calendar, and market news updates.

Furthermore, Easy Forex provides a demo account, allowing traders to practice their strategies and familiarize themselves with the platform without risking real money. With a wide array of trading tools, Easy Forex aims to empower traders with the necessary resources to make well-informed trading decisions.

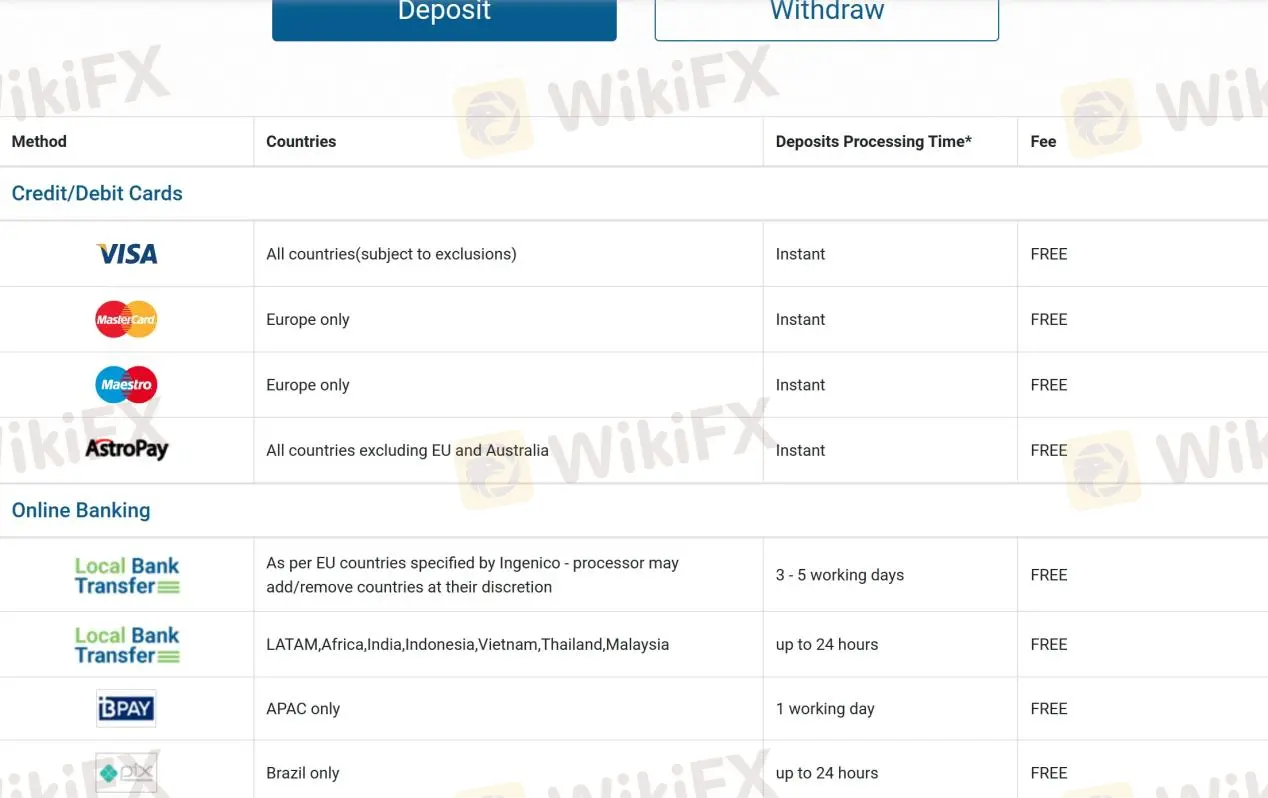

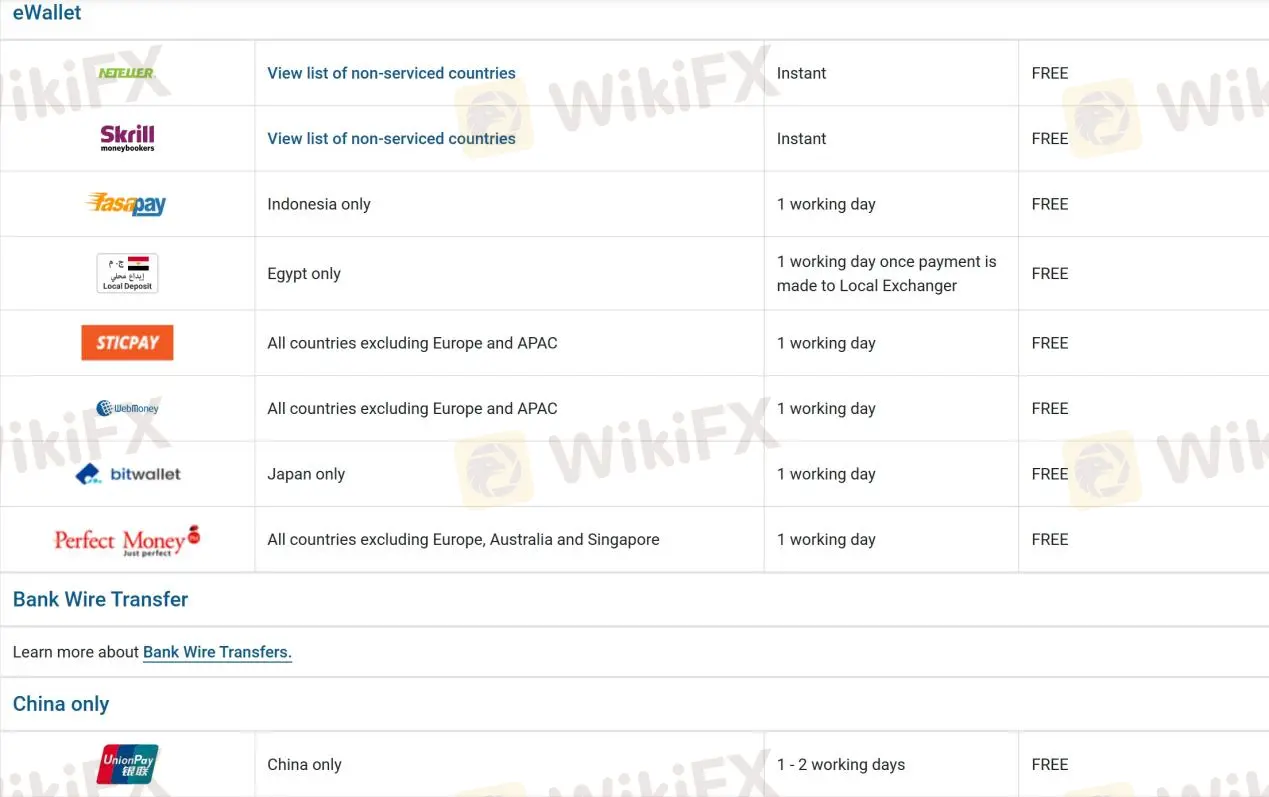

Easy Forex provides a wide range of convenient and secure payment methods for both deposits and withdrawals. Clients can fund their accounts using credit/debit cards such as Visa, MasterCard, and Maestro, as well as popular e-wallets including Neteller, Skrill, Fasapay (available for Indonesia), Local Deposit (available for Egypt), Sticpay, WebMoney, bitwallet, and Perfect Money.

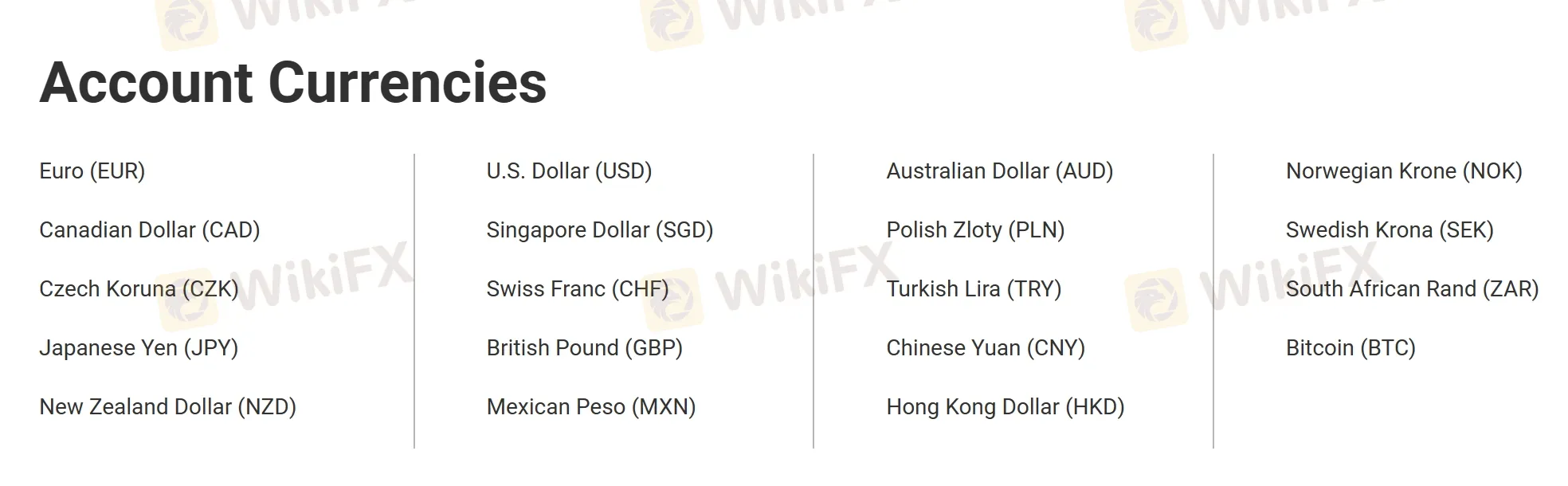

Euro (EUR), Canadian Dollar (CAD), Czech Koruna (CZK), Japanese Yen (JPY), New Zealand Dollar (NZD), U.S. Dollar (USD), Singapore Dollar (SGD), Swiss Franc (CHF), British Pound (GBP), Mexican Peso (MXN), Australian Dollar (AUD), Polish Zloty (PLN), Turkish Lira (TRY), Chinese Yuan (CNY), Hong Kong Dollar (HKD), Norwegian Krone (NOK), Swedish Krona (SEK), South African Rand (ZAR), Bitcoin (BTC)

| Easy Forex | Most other | |

| Minimum Deposit | $25 | $100 |

The broker does not charge any fees for deposits, and most deposits are processed instantly, allowing traders to start trading without delays.

For withdrawals, there is no minimum withdrawal amount for credit/debit cards and eWallets, while a minimum of $50 is required for bank account withdrawals. Easy Forex aims to process all withdrawal requests within 2 business days (48 hours). However, the actual time it takes for the funds to reach the client's bank account may vary depending on the final destination and the processing times of the recipient's bank, typically ranging from 3 to 10 business days.

See the deposit/withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| Easy Forex | Free | Free |

| OctaFX | Free | Free |

| Darwinex | Free | Free |

| Hantec Markets | Free | Free |

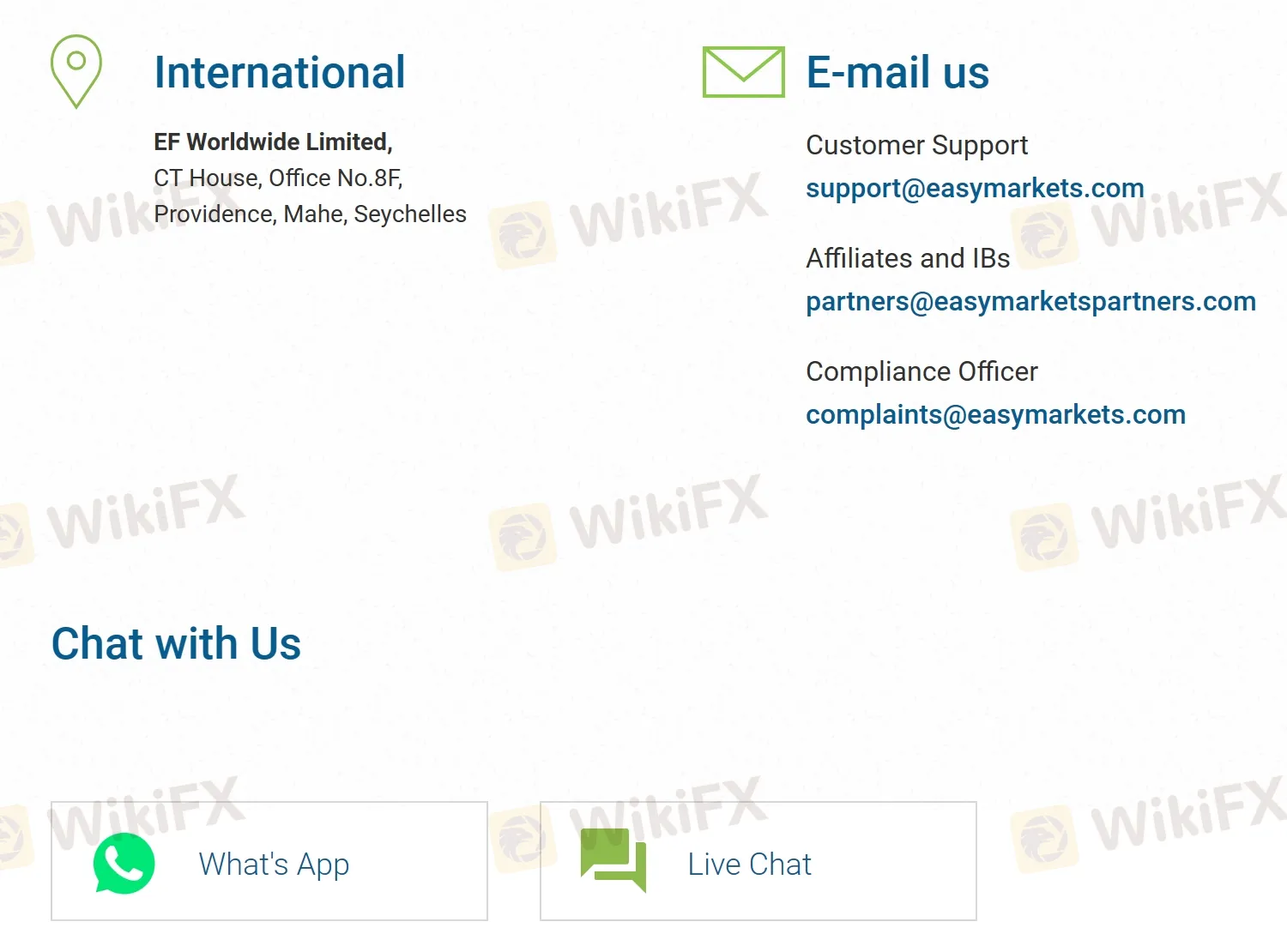

Easy Forex prioritizes excellent customer service and provides multiple channels for clients to reach out for support. The broker offers live chat, WhatsApp, and the option to request a callback, ensuring prompt and direct communication with their customer service representatives. Clients can also send messages online or reach out via email for assistance with their inquiries.

The broker's website includes a comprehensive FAQ section, which addresses common queries and provides helpful information. Easy Forex maintains an active presence on various social media platforms, including Twitter, Facebook, Instagram, YouTube, LinkedIn, and Weibo, allowing clients to stay updated on news, educational content, and market insights. The company address is openly provided, demonstrating transparency and accessibility.

With their commitment to responsive customer service, Easy Forex aims to provide a seamless and supportive trading experience for their clients.

| Pros | Cons |

| • Multi-channel available | • No 24/7 customer support |

| • Live chat support | • No phone support |

| • FAQ section available | |

| • Social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Easy Forex's customer service.

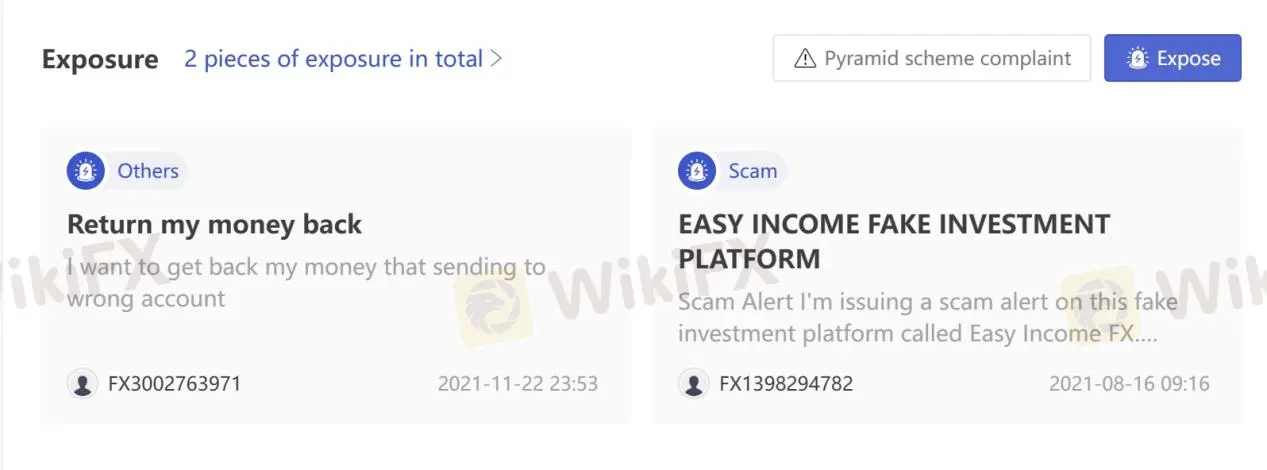

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. Our website provides a platform where users can access valuable information and resources to make informed decisions. We have a dedicated Exposure section where users can report fraudulent brokers or share their experiences if they have fallen victim to scams.

Our team of experts is committed to promptly addressing such concerns and taking necessary actions to resolve any issues. We prioritize the safety and satisfaction of our users, and we strive to maintain a trustworthy and transparent trading environment.

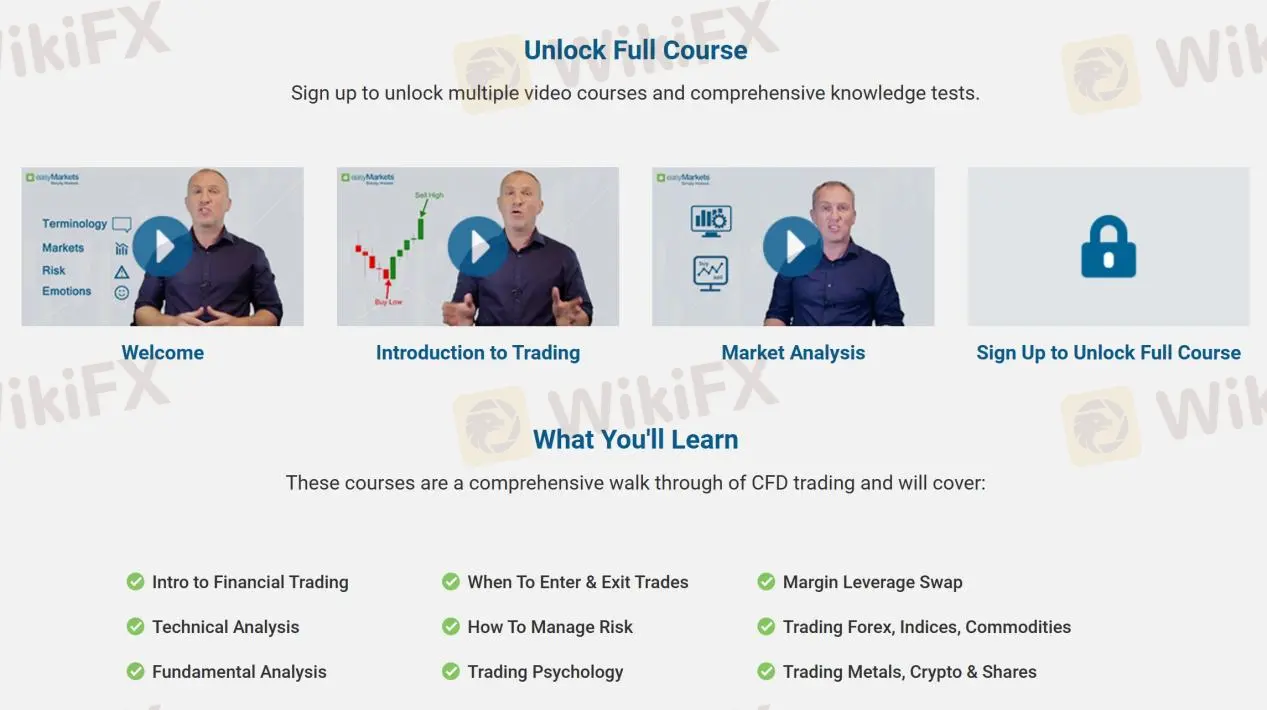

A series of educational resources is available at the research section of Easy Forex, such as a comprehensive Trading Course, Free eBooks, and a Knowledge Base. These resources aim to empower traders with the necessary knowledge and skills to make informed trading decisions.

Additionally, the Trading Glossary helps traders familiarize themselves with industry-specific terms, while the Economic Indicators provide insights into key economic events that can impact the financial markets. The FAQs section addresses common queries and concerns, ensuring that traders have access to relevant information at their fingertips. With its robust educational offerings, Easy Forex strives to equip traders with the tools they need to enhance their trading skills and stay informed in the dynamic world of financial markets.

Collectively, Easy Forex is a regulated broker that offers a variety of trading instruments, user-friendly platforms, and valuable trading tools. The broker's commitment to risk management and customer protection is evident through features like guaranteed stop loss and negative balance protection. However, there have been reports of scams associated with Easy Forex. Traders should exercise caution and conduct thorough research before choosing to trade with Easy Forex.

| Q 1: | Is Easy Forex regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC, License No. 079/07). |

| Q 2: | At Easy Forex, are there any regional restrictions for traders? |

| A 2: | Yes. It does not provide services to residents of certain regions, such as the United States of America, Israel, British Columbia, Manitoba, Quebec, Ontario and Afghanistan, Belarus, Burundi, Cambodia, Cayman Islands, Chad, Comoros, Congo, Cuba, Democratic Republic of the Congo, Equatorial Guinea, Eritrea, Fiji, Guinea, Guinea-Bissau, Haiti, Iran, Iraq, Laos, Libya, Mozambique, Myanmar, North Korea, Palau, Panama, Russian Federation, Somalia, South Sudan, Sudan, Syria, Trinidad and Tobago, Turkmenistan, Vanuatu, Venezuela, and Yemen. |

| Q 3: | Does Easy Forex offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Easy Forex offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports easyMarkets platform (web/app), TradingView, MT4 and MT5. |

| Q 5: | What is the minimum deposit for Easy Forex? |

| A 5: | The minimum initial deposit to open an account is $25. |

| Q 6: | Is Easy Forex a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Doo Prime is a regulated broker offering 10,000+ popular trading products with spreads starting at 0.1 pips. The platform provides access to MT4, MT5, Doo Prime InTrade, TradingView, and copy trading. While it appears promising, let's dive deeper to assess if it truly meets its claims of providing an exceptional trading environment.

| Quick Doo Prime Review in 10 Key Points | |

| Registered in | UK |

| Regulated by | FSA (Offshore), FINRA, LFSA, VFSC (Offshore), ASIC |

| Years of Establishment | 2014 |

| Trading Instrument | Currency pairs, indices, commodities, metals, energy, stocks, futures, securities |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:1000 |

| Minimum Spread | From 0.1 pips |

| Trading Platform | MT4, MT5, Doo Prime InTrade, TradingView |

| Deposit & Withdrawal Method | VISA, Mastercard, Skrill, Neteller, epay, etc. |

| Customer Service | Email/ phone number /live chat /24/7 |

Doo Prime is a wholly-owned subsidiary of Doo Prime Holding Group, founded in 2014, headquartered in London, UK, with operations offices in Hong Kong, Taipei, Dallas, Kuala Lumpur, and Singapore.

Doo Prime offers a diverse selection of tradable assets, including forex, contracts for difference (CFDs), indices, and cryptocurrencies. Doo Prime offers different account types to suit individual preferences. Traders can commence their trading journey with a minimum deposit of $100.

In terms of leverage, Doo Prime offers flexibility with leverage options of up to 1:1000. The widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms provide an extensive range of analytical tools, indicators, and expert advisors for comprehensive market analysis and automated trading.

Yes, Doo Prime is legally operating in different jurisditions, as it is subject to regulatory oversight from multiple regulatory authorities, FSA (Financial Services Authority) in Seychelles, FINRA (Financial Industry RegulatoryAuthority), LFSA (Labuan Financial Services Authority), VFSC (Vanuatu Financial Services Commission), and ASIC (Australia Securities & Investment Commission).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| FSA | Doo Prime Vanuatu Limited | Retail Forex License | SD090 |

| FINRA | PETER ELISH INVESTMENTS SECURITIES | Financial Service | 24409 / SEC: 8-41551 |

| LFSA | Doo Financial Labuan Limited | Straight Through Processing (STP) | MB/23/0108 |

| VFSC | Doo Prime Vanuatu Limited | Retail Forex License | 700238 |

| ASIC | DOO FINANCIAL AUSTRALIA LIMITED | Investment Advisory License | 222650 |

Doo Prime Seychelles Limited, its entity in Seychelles, is authorized and regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number SD090, holding a license for Retail Forex operation.

PETER ELISH INVESTMENTS SECURITIES, its entity in the United States, is authorized and regulated by the Financial Industry Regulatory Authority (FINRA) under regulatory license number 24409 / SEC: 8-41551, holding a license for Financial Service.

Doo Financial Labuan Limited, its entity in Malaysia, is authorized and regulated by the Labuan Financial Services Authority (LFSA) under regulatory license number MB/23/0108, holding a license for Straight Through Processing (STP).

Doo Prime Vanuatu Limited, its entity in Vanuatu, is authorized and regulated by the Vanuatu Financial Services Commission (VFSC) under regulatory license number 70038, holding a license for retail forex operation as well.

DOO FINANCIAL AUSTRALIA LIMITED, its Australian entity, is authorized and regulated by the Australia Securities & Investment Commission (ASIC) under regulatory license number 222650, holidng a license for Investment Advisory Lincense.

Doo Prime offers over 10,000 popular tradable assets, and multiple trading platforms, providing flexibility and choice for traders. Furthermore, the availability of social trading features is proovided. However, traders should be mindful of the commission charged per trade and the limitations in terms of educational resources and account customization. Additionally, Doo Prime's promotional offerings may be limited.

| Pros | Cons |

|

|

|

|

|

|

| |

|

| Trading Assets | Available |

| Securities | |

| Futures | |

| Forex | |

| Precious Metals | |

| Commodities | |

| Stock Indices |

Doo Prime offers a comprehensive range of market instruments to cater to the diverse trading needs of its clients. These instruments encompass a variety of asset classes, including securities, futures, forex, precious metals, commodities, and stock indices.

To open a most basic account, that is Cent Account, $100 is required, same as its standard account requirement. However, $100 to open a cent account is a little bit sticky, compared to HTFX's $5 to open a cent account. Well, $100 to open a standard account is acceptable.

Here is a table to show Doo Prime's minimum deposit with other brokers:

| Broker | Minimum Deposit |

| $100 |

| $200 |

| $100 |

| $1 |

Doo Prime offers three types of live trading accounts tailored for different trading needs:

| Account Type | CENT | STP | ECN |

| Account Currency | USD | ||

| Minimum Deposit | $100 | $100 | $5,000 |

| Spreads | High | Medium | Low |

| Free Demo | |||

| Expert Advisor | |||

| Hedging Positions | |||

| Order Execution | Market Execution | ||

The Cent account is designed for those who are starting their trading journey or prefer to trade with smaller volumes. With a minimum deposit of $100, the Cent account provides accessibility to the markets without the availability of a demo account. Traders can gradually build their trading skills and experience while managing lower trade sizes.

For traders looking for a Standard account, Doo Prime offers an option with a minimum deposit of $100. This account type allows traders to access a wider range of trading opportunities. The Standard account also provides the advantage of a demo account, enabling traders to practice their strategies and familiarize themselves with the platform before engaging in live trading. This feature helps traders gain confidence and refine their trading approach.

Doo Prime also offers an ECN account, specifically designed for more experienced traders seeking direct market access and enhanced trading conditions. With a higher minimum deposit requirement of $5000, the ECN account provides access to deep liquidity and tight spreads. Similar to the Standard account, the ECN account also includes a demo account option, allowing traders to test and fine-tune their trading strategies in a risk-free environment.

Notably, Doo Prime restricts demo accounts to Standard and ECN account holders. Additionally, if clients don't log in to their demo accounts for over 60 days, those accounts become inactive.

Here are some easy steps for you to open a demo account:

Step 1:Visit Doo Prime – Official Website and click “Demo Account”on the top right corner.

Step 2: Account Registration: Simply enter your phone number and email on the registration interface, choose verification via email or phone, click “Send Verification Code,” set your password upon successful verification, and then agree to the terms before clicking “Submit Registration.”

Step 3: Add a demo account: In the Doo Prime User Center, go to the homepage and choose “Add Account” below the demo account section.

Step 4: Customize your demo account: You can add an account by selecting the “Creation method,” “Trading Platform,” “Basic Account Type,” “Account Currency,” “Leverage,” and specifying the “Deposit Amount.” Then, set your “Trading Password” and “Read-only Password” to complete the process.

Step 5: Demo account is sucessfully opened: Once registration is complete, users can access their personal mailbox to retrieve their demo account login details, which include the chosen “Trading Platform,” “Demo Account,” and “Server Name.”

To add your demo account funds, follow just two steps:

Step1: Within the Doo Prime User Center's Demo Account screen, simply click the gear icon located in the upper right corner.

Step 2: Input the desired deposit amount into the “Deposit” field, then confirm by clicking “Yes.”

Then, the added amount will be displayed in the demo account.

Leverage, in the context of trading, refers to the ability to control a larger position in the market with a smaller amount of capital. Doo Prime offers leverage of up to 1:1000. This means that for every dollar of trading capital, traders can control a position up to 1000 times larger.

Leverage is a double-edged sword, whch means it has the potential to magnify both profits and losses. When used wisely, leverage can amplify trading gains and allow traders to capitalize on market opportunities with a smaller investment.

Doo Prime offers spreads starting from 1 pip with a commission of USD 10 per trade. Spreads represent the difference between the bid and ask price of a financial instrument, indicating the cost that traders incur when entering a trade. With spreads starting from 1 pip, Doo Prime provides a competitive pricing structure that may appeal to traders seeking cost-effective trading opportunities.

In addition to spreads, Doo Prime applies a commission of USD 10 per trade. The commission is a fixed fee charged on each trade executed by the trader. This transparent commission structure ensures clarity regarding the cost of trading, allowing traders to accurately assess the expenses associated with their transactions.

As for the trading platform, Doo Prime provides its clients with many options. There are public platforms such as tradingview, MT5 and MT4 that have served many clients worldwide, also Doo Prime's own platform Doo Prime InTrade. If you didn't want to spend time familiarizing yourself with a new platform, you could choose public platforms. But Doo Prime's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

MetaTrader 5 (MT5): Doo Prime also supports the advanced MetaTrader 5 platform, which builds upon the features of MT4 and offers expanded functionalities. MT5 includes additional asset classes, improved charting tools, and enhanced order execution capabilities. Traders can access a more extensive range of analytical tools, utilize depth-of-market (DOM) functionality for more precise order placement, and benefit from advanced built-in indicators and graphical objects for comprehensive market analysis.

Doo Prime Intrade: Doo Prime introduces its proprietary trading platform, Doo Prime Intrade, designed specifically for its clients. This platform combines advanced charting features, intuitive navigation, and swift order execution. Traders can enjoy a seamless trading experience with access to real-time market data, customizable charting tools, and the ability to execute trades swiftly and efficiently.

TradingView: Doo Prime integrates with TradingView, a popular and powerful charting and social trading platform. TradingView offers an extensive range of technical analysis tools, customizable charting features, and the ability to follow and interact with other traders in the TradingView community.

Social trading, a feature provided by Doo Prime, revolutionizes the way traders engage in the financial markets by combining the power of technology and social interaction. In social trading, traders have the opportunity to observe and replicate the trading activities of experienced and successful traders.

Doo Prime offers multiple payment methods. The available payment channels, their supported payment currencies, deposit limits, and processing times are as follows:

Doo Prime recommends a minimum withdrawal amount of USD 50, and it offers various withdrawal methods to accommodate the needs of its clients. For international wire transfers, withdrawals can be made in multiple currencies, including EUR, GBP, HKD, and USD. The processing time for international wire transfers is relatively quick, with funds typically being processed within one working day for withdrawal amounts up to USD 50,000. For withdrawal amounts ranging from USD 50,001 to 200,000, the processing time extends to two working days. Withdrawals of USD 200,001 to 1,000,000 require approximately five working days for processing, while withdrawals above USD 1,000,001 may take around six working days to complete.

For local bank transfers in CNY (Chinese Yuan) and VND (Vietnamese Dong), Doo Prime provides a good option for clients based in those respective regions. The processing time for local bank transfers may vary depending on the specific local banking systems. It is advisable to check with Doo Prime for the estimated processing time for local bank transfers in CNY and VND.

Doo Prime offers access to renowned market analysis provider Trading Central, providing traders with research, technical analysis, and trading ideas across various financial markets.

Additionally, Doo Prime provides Virtual Private Server (VPS) services, which offer traders enhanced trading performance and uninterrupted connectivity.

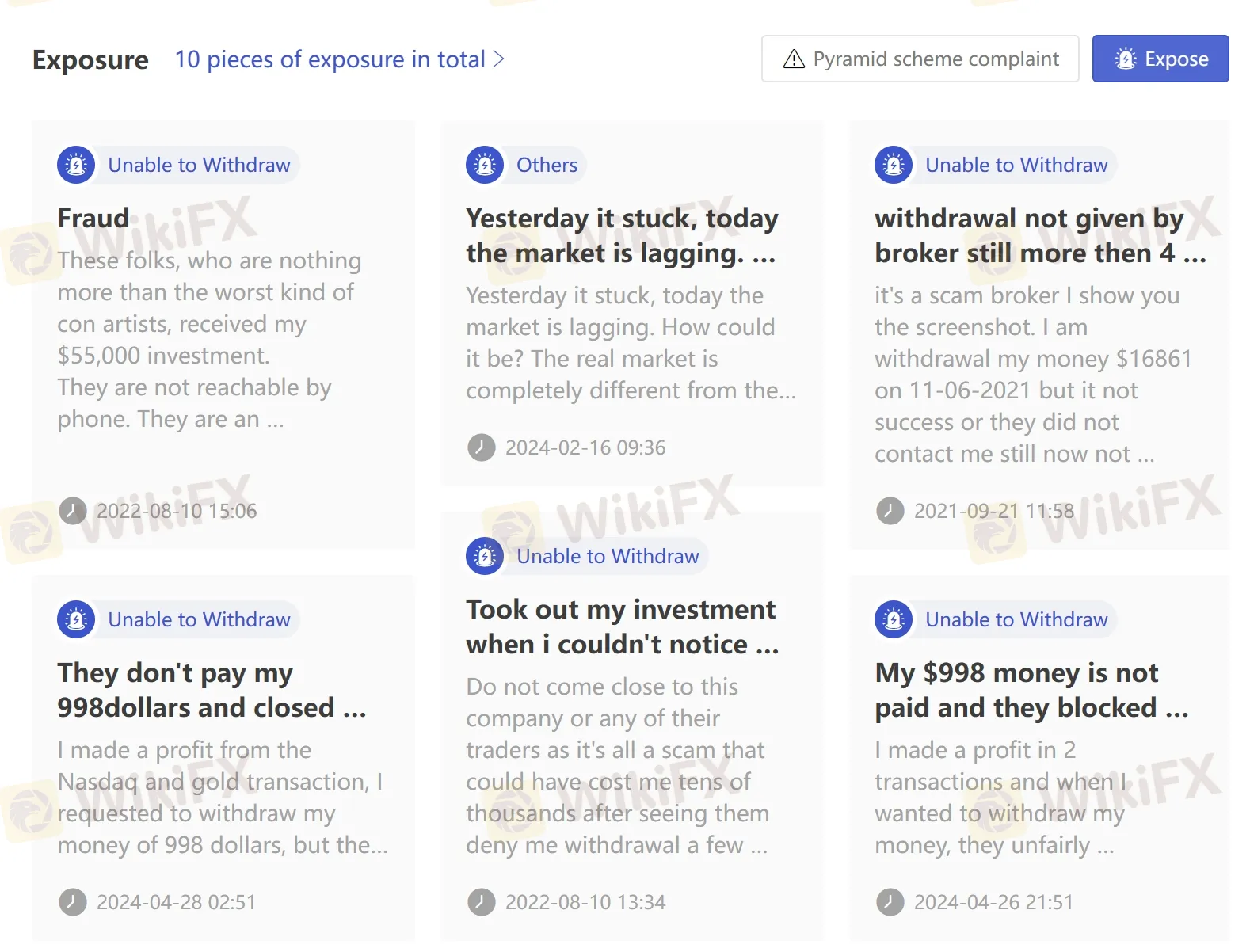

On WikiFX website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Below are the details about the customer service.

Languages: English, Chinese, Japanese, Korean, Spanish, Thai, Vietnamese.

Service Hours: 24/7

Contact Form

Email: en.support@dooprime.com

Phone: +44 11 3733 5199

Social media: Facebook, Instagram, LinkedIn, twitter

To wrap up, Doo Prime is a well-established brokerage firm with certain pros and downsides. Positively, reputable authorities' oversight of Doo Prime inspires confidence in its financial standards and investor protection.

However, even though Doo Prime has competitive spreads, traders should compare them to other brokers to get the best pricing. Without a Cent account demo account, new traders may have fewer chances to practise and learn the platform.

Is Doo Prime legit?

Yes, Doo Prime is regulated by FSA (Offshore), FINRA, LFSA, VFSC (Offshore), and ASIC.

What is the minimum deposit required to open an account with Doo Prime?

The minimum deposit required to open an account with Doo Prime is $100.

What is the maximum leverage available at Doo Prime?

The maximum leverage offered by this broker is up to 1:1000.

What are the available trading platforms at Doo Prime?

MetaTrader 4 (MT4), MetaTrader 5 (MT5), Doo Prime Intrade, and TradingView.

What assets can be traded on Doo Prime?

Forex currency pairs, contracts for difference (CFDs) on various financial instruments, indices, and cryptocurrencies.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive easyforex and doo-prime are, we first considered common fees for standard accounts. On easyforex, the average spread for the EUR/USD currency pair is -- pips, while on doo-prime the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

easyforex is regulated by CYSEC. doo-prime is regulated by FSA,LFSA,FINRA,VFSC,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

easyforex provides trading platform including -- and trading variety including --. doo-prime provides trading platform including STP Account,CENT Account,ECN Account and trading variety including Securities, Futures, Forex, Metals, Commodities, Stock Indices.