No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between BCR and Doo Prime ?

In the table below, you can compare the features of BCR , Doo Prime side by side to determine the best fit for your needs.

--

XAUUSD:27.33

EURUSD: -6.82 ~ 2.29

XAUUSD: -37.66 ~ 18.83

EURUSD:-0.3

EURUSD:-2.2

EURUSD:9.99

XAUUSD:20.06

EURUSD: -2.11 ~ 0.27

XAUUSD: -37.21 ~ 25.43

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of bcr, doo-prime lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| BCR | Basic Information |

| Founded | 2008 |

| Registered Country | British Virgin Islands |

| Regulation | ASIC, FSC (Offshore) |

| Tradable Assets | Forex, CFDs on metals, commodities, indices |

| Account Types | Standard, Advantage, Alpha, and Affiliate |

| Demo Account | ✔ |

| Islamic Account | Not specified |

| Maximum Leverage | 400:1 |

| Spreads | From 3.0 pips |

| Trading Platforms | MT4, MT5, WebTrader, MAM |

| Minimum Deposit | $300 |

| Payment Methods | Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, USDT |

| Customer Support | 24/5 online chat, contact form, phone: +44 3300010590, email: info@thebcr.com, social media |

BCR is a forex broker that was established in 2008 under the company name BACERA CO PTY LTD. The broker is regulated by ASIC (Australian Securities and Investments Commission) and offshore regulated by FSC (Financial Services Commission).

| Pros | Cons |

| • Regulated by ASIC | • Offshore Regulation |

| • Demo Account | • Limited Account Types |

| • Commission-free | • Wide Spreads |

| • Advanced MT4 Trading Platform | • No 24/7 Support |

| • Various Market Research Tools |

• Regulation: BCR is regulated by ASIC (Australian Securities and Investments Commission), which provides a level of security and trustworthiness for traders.

• Demo Account: BCR provides a demo account, allowing traders to practice and test their trading strategies in a risk-free environment.

• Commission-free: BCR offers commission-free trading for all account types.

• Advanced Trading Platforms: BCR provides access to advanced MT4 trading platform, offering comprehensive charting tools, indicators, and automated trading capabilities.

• Market Research Tools: BCR offers various market research tools, including economic calendars and market live.

• Offshore Regulation: BCR claims to be regulated by FSC, but it is offshore.

• Limited Account Types: BCR only offers two account types, which could restrict options for traders with specific needs or preferences.

• Wide Spreads: BCR offers spreads from 3.0 pips, while the industry average spread is just 1.5 pips.

• No 24/7 Support: The availability of customer support might be limited outside of regular business hours, which could be inconvenient for traders in different time zones or those requiring immediate assistance.

BCR operates within a well-regulated framework, authorized and regulated by respected financial authorities, including the Australian Securities and Investments Commission (ASIC, No. 328794) and offshore regulated by the Financial Services Commission (FSC, No. SIBA/L/19/1122) in the Virgin Islands.

This regulatory oversight ensures that BCR complies with stringent financial regulations, industry standards, and best practices. The ASIC and FSC play a crucial role in monitoring and supervising Doo Prime's operations, ensuring that the broker maintains transparency, ethical practices.

Additionally, BCR's practice of keeping segregated client funds means that client money is kept separate from the company's own funds. This can offer an additional layer of security for traders, since in the event of a company bankruptcy, these funds would not be treated as recoverable assets by general creditors of the company. This practice is common among regulated brokers as it provides more protection for traders' investments.

Forex, CFDs on metals, commodities, indices... BCR allows clients to access 300+ trading markets. Therefore, both beginners and experienced traders can find what they want to trade on BCR.

| Tradable Assets | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Metals | ✅ |

| Indices | ✅ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

| Options | ❌ |

This includes prominent global forex currency pairs, allowing for trading in the foreign exchange market.

They also offer CFDs on metals, which may include precious metals like gold and silver, as well as industrial metals.

In addition, traders can access CFDs on commodities, from energy sources like oil and gas to agricultural products.

This is extended to indices, tracking performance of groups of shares in a particular market or sector.

However, cryptocurrencies are currently unavailable.

Apart from demo accopunts, BCR offers four live account types: Standard, Advantage, Alpha, and Affiliate. All account types provide leverage up to 400:1, a 50% stop-out level, micro-lot trading (0.01), and access to single stock CFDs, except for the Alpha account. The minimum deposit requirements range from $300 for the Standard and Advantage accounts to $3,000 for the Affiliate account. Spreads start from 1.2 pips for the Advantage account, with the Alpha account offering zero spreads. Additionally, the Advantage account charges a $3 commission per lot per side. The lot size per transaction is capped at 20 for all account types.

Here are four specific steps to open an account with BCR:

Step 1: Visit the BCR official website: Go to the BCR website using a web browser on your computer or mobile device. Navigate to the account opening section: Look for the “Join Now” button on the website on the homepage.

Step 2: Fill out the account application form: Click on the account opening button/link, and you will be directed to an online form. Provide the requested information, including your full name, contact details (such as phone number and email address), and password.

Step 3: Submit identification documents: As part of the account verification process, BCR may require you to provide identification documents. These documents may include a copy of your passport or national ID card, proof of address (such as a utility bill or bank statement), and any other documents requested by the broker.

Step 4: Review and agree to the terms and conditions: Before finalizing your account creation, carefully read through the terms and conditions provided by BCR. Make sure you understand and agree to all the terms before proceeding. If you have any questions or concerns, you can contact their customer support for clarification.

BCR provides traders with maximum levearge up to 400:1.

Leverage, in simple terms, is a tool that enables traders to control a larger position in the market with a smaller amount of capital. It can be a valuable tool for experienced traders who understand its risks and benefits. By using leverage, traders can potentially generate higher returns on their investments.

However, leverage is a double-edged sword. While it can enhance profits, it can also magnify losses. Traders should exercise caution and implement effective risk management strategies when utilizing leverage. It is crucial to have a thorough understanding of the market and the associated risks before engaging in leveraged trading.

Specifically, the commissions and spreads need to pay will differ for the various trading accounts traders have.

The Standard account offers a zero-commission trading environment, allowing traders to execute trades without incurring any additional charges. Spreads for the Standard account start from 8.0 pips.

For those seeking even tighter spreads, the Advantage account is available. With spreads starting from 3.0 pips and no commissions, this account offers enhanced trading conditions for traders looking to optimize their trading strategies and minimize their trading costs.

Spreads and commissions vary on the trading symbol, more details can be found in the screenshot below.

BCR provides traders with popular MT4 (MetaTrader4) and MT5 (MetaTrader5) platforms as well as a user-friendly Webtrader and MAM platform. Some other popular and user-friendly trading platforms like cTrader and TradingView are not supported.

| Platforms | Supported |

| MetaTrader 4 (MT4) | ✅ |

| MetaTrader 5 (MT5) | ✅ |

| WebTrader | ✅ |

| MAM | ✅ |

| cTrader | ❌ |

| TradingView | ❌ |

BCR provides its customers with over 10 payment options. The options available for depositing and withdrawing funds include Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, and USDT.

In terms of withdrawal request processing, BCR operates a specific schedule. The cut-off time for processing on the same day is 10:00 AM. Requests submitted before this time will be processed on the same day, whereas requests submitted afterwards will not be processed until the following business day.

Additionally, BCR does not charge any fees for deposits or withdrawals. However, transactions between international banks might incur fees such as intermediary fees.

BCR also provides some trading tools and educational resources to help traders to gain a superb trading environment.

Their economic calendar is a must-have tool for traders, allowing them to stay informed about important economic events that have the potential to impact the markets. Identifying these events can help with planning trading strategies.

Their glossary is an excellent educational resource, especially for beginner traders. It provides definitions for numerous terms used in trading, helping traders become familiar with industry jargon.

Additionally, BCR offers a 'Market Live' feature, which provides real-time updates about market conditions and trends.

These tools, combined with their educational resources, assist traders in making informed decisions and understanding the complexity of the markets, which ultimately contributes towards a more efficient trading experience.

Language(s): English, Chinese, Vietnamese, Japanese, etc.

Service Time: 24/5

Live chat, contact form

Email: info@thebcr.com

Phone: +44 3300010590

Social Media: Facebook, Twitter, Instagram, LinkedIn

Address: BCR Co Pty Ltd, Trident Chambers, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands.

Is BCR Legit?

Yes. BCR operates legally and it is regulated by ASIC and offshore regulated by FSC.

What assets can I trade with BCR?

Forex and CFDs on metals, commodities, and indices.

Does BCR offer demo accounts?

Yes.

Does BCR offer industry leading MT4 & MT5?

Yes. It supports both MT4 and MT5.

Is BCR a good broker for beginners ?

Yes, given its stringent Australian regulation and its provision of demo accounts for novices to engage in risk-free trading, BCR could be an excellent option for beginners.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Doo Prime is a regulated broker offering 10,000+ popular trading products with spreads starting at 0.1 pips. The platform provides access to MT4, MT5, Doo Prime InTrade, TradingView, and copy trading. While it appears promising, let's dive deeper to assess if it truly meets its claims of providing an exceptional trading environment.

| Quick Doo Prime Review in 10 Key Points | |

| Registered in | UK |

| Regulated by | FSA (Offshore), FINRA, LFSA, VFSC (Offshore), ASIC |

| Years of Establishment | 2014 |

| Trading Instrument | Currency pairs, indices, commodities, metals, energy, stocks, futures, securities |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:1000 |

| Minimum Spread | From 0.1 pips |

| Trading Platform | MT4, MT5, Doo Prime InTrade, TradingView |

| Deposit & Withdrawal Method | VISA, Mastercard, Skrill, Neteller, epay, etc. |

| Customer Service | Email/ phone number /live chat /24/7 |

Doo Prime is a wholly-owned subsidiary of Doo Prime Holding Group, founded in 2014, headquartered in London, UK, with operations offices in Hong Kong, Taipei, Dallas, Kuala Lumpur, and Singapore.

Doo Prime offers a diverse selection of tradable assets, including forex, contracts for difference (CFDs), indices, and cryptocurrencies. Doo Prime offers different account types to suit individual preferences. Traders can commence their trading journey with a minimum deposit of $100.

In terms of leverage, Doo Prime offers flexibility with leverage options of up to 1:1000. The widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms provide an extensive range of analytical tools, indicators, and expert advisors for comprehensive market analysis and automated trading.

Yes, Doo Prime is legally operating in different jurisditions, as it is subject to regulatory oversight from multiple regulatory authorities, FSA (Financial Services Authority) in Seychelles, FINRA (Financial Industry RegulatoryAuthority), LFSA (Labuan Financial Services Authority), VFSC (Vanuatu Financial Services Commission), and ASIC (Australia Securities & Investment Commission).

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| FSA | Doo Prime Vanuatu Limited | Retail Forex License | SD090 |

| FINRA | PETER ELISH INVESTMENTS SECURITIES | Financial Service | 24409 / SEC: 8-41551 |

| LFSA | Doo Financial Labuan Limited | Straight Through Processing (STP) | MB/23/0108 |

| VFSC | Doo Prime Vanuatu Limited | Retail Forex License | 700238 |

| ASIC | DOO FINANCIAL AUSTRALIA LIMITED | Investment Advisory License | 222650 |

Doo Prime Seychelles Limited, its entity in Seychelles, is authorized and regulated by the Seychelles Financial Services Authority (FSA) under regulatory license number SD090, holding a license for Retail Forex operation.

PETER ELISH INVESTMENTS SECURITIES, its entity in the United States, is authorized and regulated by the Financial Industry Regulatory Authority (FINRA) under regulatory license number 24409 / SEC: 8-41551, holding a license for Financial Service.

Doo Financial Labuan Limited, its entity in Malaysia, is authorized and regulated by the Labuan Financial Services Authority (LFSA) under regulatory license number MB/23/0108, holding a license for Straight Through Processing (STP).

Doo Prime Vanuatu Limited, its entity in Vanuatu, is authorized and regulated by the Vanuatu Financial Services Commission (VFSC) under regulatory license number 70038, holding a license for retail forex operation as well.

DOO FINANCIAL AUSTRALIA LIMITED, its Australian entity, is authorized and regulated by the Australia Securities & Investment Commission (ASIC) under regulatory license number 222650, holidng a license for Investment Advisory Lincense.

Doo Prime offers over 10,000 popular tradable assets, and multiple trading platforms, providing flexibility and choice for traders. Furthermore, the availability of social trading features is proovided. However, traders should be mindful of the commission charged per trade and the limitations in terms of educational resources and account customization. Additionally, Doo Prime's promotional offerings may be limited.

| Pros | Cons |

|

|

|

|

|

|

| |

|

| Trading Assets | Available |

| Securities | |

| Futures | |

| Forex | |

| Precious Metals | |

| Commodities | |

| Stock Indices |

Doo Prime offers a comprehensive range of market instruments to cater to the diverse trading needs of its clients. These instruments encompass a variety of asset classes, including securities, futures, forex, precious metals, commodities, and stock indices.

To open a most basic account, that is Cent Account, $100 is required, same as its standard account requirement. However, $100 to open a cent account is a little bit sticky, compared to HTFX's $5 to open a cent account. Well, $100 to open a standard account is acceptable.

Here is a table to show Doo Prime's minimum deposit with other brokers:

| Broker | Minimum Deposit |

| $100 |

| $200 |

| $100 |

| $1 |

Doo Prime offers three types of live trading accounts tailored for different trading needs:

| Account Type | CENT | STP | ECN |

| Account Currency | USD | ||

| Minimum Deposit | $100 | $100 | $5,000 |

| Spreads | High | Medium | Low |

| Free Demo | |||

| Expert Advisor | |||

| Hedging Positions | |||

| Order Execution | Market Execution | ||

The Cent account is designed for those who are starting their trading journey or prefer to trade with smaller volumes. With a minimum deposit of $100, the Cent account provides accessibility to the markets without the availability of a demo account. Traders can gradually build their trading skills and experience while managing lower trade sizes.

For traders looking for a Standard account, Doo Prime offers an option with a minimum deposit of $100. This account type allows traders to access a wider range of trading opportunities. The Standard account also provides the advantage of a demo account, enabling traders to practice their strategies and familiarize themselves with the platform before engaging in live trading. This feature helps traders gain confidence and refine their trading approach.

Doo Prime also offers an ECN account, specifically designed for more experienced traders seeking direct market access and enhanced trading conditions. With a higher minimum deposit requirement of $5000, the ECN account provides access to deep liquidity and tight spreads. Similar to the Standard account, the ECN account also includes a demo account option, allowing traders to test and fine-tune their trading strategies in a risk-free environment.

Notably, Doo Prime restricts demo accounts to Standard and ECN account holders. Additionally, if clients don't log in to their demo accounts for over 60 days, those accounts become inactive.

Here are some easy steps for you to open a demo account:

Step 1:Visit Doo Prime – Official Website and click “Demo Account”on the top right corner.

Step 2: Account Registration: Simply enter your phone number and email on the registration interface, choose verification via email or phone, click “Send Verification Code,” set your password upon successful verification, and then agree to the terms before clicking “Submit Registration.”

Step 3: Add a demo account: In the Doo Prime User Center, go to the homepage and choose “Add Account” below the demo account section.

Step 4: Customize your demo account: You can add an account by selecting the “Creation method,” “Trading Platform,” “Basic Account Type,” “Account Currency,” “Leverage,” and specifying the “Deposit Amount.” Then, set your “Trading Password” and “Read-only Password” to complete the process.

Step 5: Demo account is sucessfully opened: Once registration is complete, users can access their personal mailbox to retrieve their demo account login details, which include the chosen “Trading Platform,” “Demo Account,” and “Server Name.”

To add your demo account funds, follow just two steps:

Step1: Within the Doo Prime User Center's Demo Account screen, simply click the gear icon located in the upper right corner.

Step 2: Input the desired deposit amount into the “Deposit” field, then confirm by clicking “Yes.”

Then, the added amount will be displayed in the demo account.

Leverage, in the context of trading, refers to the ability to control a larger position in the market with a smaller amount of capital. Doo Prime offers leverage of up to 1:1000. This means that for every dollar of trading capital, traders can control a position up to 1000 times larger.

Leverage is a double-edged sword, whch means it has the potential to magnify both profits and losses. When used wisely, leverage can amplify trading gains and allow traders to capitalize on market opportunities with a smaller investment.

Doo Prime offers spreads starting from 1 pip with a commission of USD 10 per trade. Spreads represent the difference between the bid and ask price of a financial instrument, indicating the cost that traders incur when entering a trade. With spreads starting from 1 pip, Doo Prime provides a competitive pricing structure that may appeal to traders seeking cost-effective trading opportunities.

In addition to spreads, Doo Prime applies a commission of USD 10 per trade. The commission is a fixed fee charged on each trade executed by the trader. This transparent commission structure ensures clarity regarding the cost of trading, allowing traders to accurately assess the expenses associated with their transactions.

As for the trading platform, Doo Prime provides its clients with many options. There are public platforms such as tradingview, MT5 and MT4 that have served many clients worldwide, also Doo Prime's own platform Doo Prime InTrade. If you didn't want to spend time familiarizing yourself with a new platform, you could choose public platforms. But Doo Prime's own platform provides better compatibility with businesses, as they are specially developed and customized platforms. The choice is yours.

MetaTrader 5 (MT5): Doo Prime also supports the advanced MetaTrader 5 platform, which builds upon the features of MT4 and offers expanded functionalities. MT5 includes additional asset classes, improved charting tools, and enhanced order execution capabilities. Traders can access a more extensive range of analytical tools, utilize depth-of-market (DOM) functionality for more precise order placement, and benefit from advanced built-in indicators and graphical objects for comprehensive market analysis.

Doo Prime Intrade: Doo Prime introduces its proprietary trading platform, Doo Prime Intrade, designed specifically for its clients. This platform combines advanced charting features, intuitive navigation, and swift order execution. Traders can enjoy a seamless trading experience with access to real-time market data, customizable charting tools, and the ability to execute trades swiftly and efficiently.

TradingView: Doo Prime integrates with TradingView, a popular and powerful charting and social trading platform. TradingView offers an extensive range of technical analysis tools, customizable charting features, and the ability to follow and interact with other traders in the TradingView community.

Social trading, a feature provided by Doo Prime, revolutionizes the way traders engage in the financial markets by combining the power of technology and social interaction. In social trading, traders have the opportunity to observe and replicate the trading activities of experienced and successful traders.

Doo Prime offers multiple payment methods. The available payment channels, their supported payment currencies, deposit limits, and processing times are as follows:

Doo Prime recommends a minimum withdrawal amount of USD 50, and it offers various withdrawal methods to accommodate the needs of its clients. For international wire transfers, withdrawals can be made in multiple currencies, including EUR, GBP, HKD, and USD. The processing time for international wire transfers is relatively quick, with funds typically being processed within one working day for withdrawal amounts up to USD 50,000. For withdrawal amounts ranging from USD 50,001 to 200,000, the processing time extends to two working days. Withdrawals of USD 200,001 to 1,000,000 require approximately five working days for processing, while withdrawals above USD 1,000,001 may take around six working days to complete.

For local bank transfers in CNY (Chinese Yuan) and VND (Vietnamese Dong), Doo Prime provides a good option for clients based in those respective regions. The processing time for local bank transfers may vary depending on the specific local banking systems. It is advisable to check with Doo Prime for the estimated processing time for local bank transfers in CNY and VND.

Doo Prime offers access to renowned market analysis provider Trading Central, providing traders with research, technical analysis, and trading ideas across various financial markets.

Additionally, Doo Prime provides Virtual Private Server (VPS) services, which offer traders enhanced trading performance and uninterrupted connectivity.

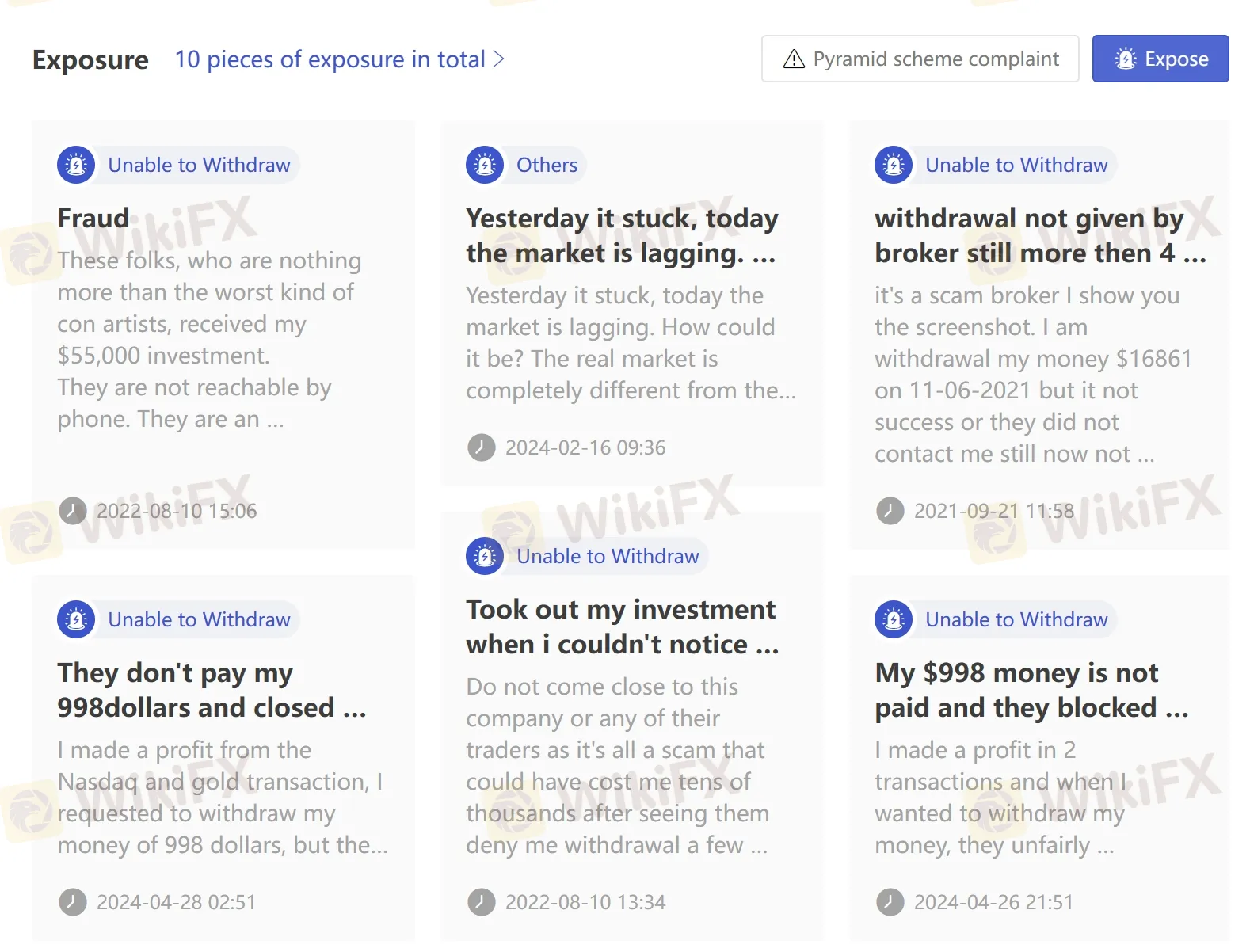

On WikiFX website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Below are the details about the customer service.

Languages: English, Chinese, Japanese, Korean, Spanish, Thai, Vietnamese.

Service Hours: 24/7

Contact Form

Email: en.support@dooprime.com

Phone: +44 11 3733 5199

Social media: Facebook, Instagram, LinkedIn, twitter

To wrap up, Doo Prime is a well-established brokerage firm with certain pros and downsides. Positively, reputable authorities' oversight of Doo Prime inspires confidence in its financial standards and investor protection.

However, even though Doo Prime has competitive spreads, traders should compare them to other brokers to get the best pricing. Without a Cent account demo account, new traders may have fewer chances to practise and learn the platform.

Is Doo Prime legit?

Yes, Doo Prime is regulated by FSA (Offshore), FINRA, LFSA, VFSC (Offshore), and ASIC.

What is the minimum deposit required to open an account with Doo Prime?

The minimum deposit required to open an account with Doo Prime is $100.

What is the maximum leverage available at Doo Prime?

The maximum leverage offered by this broker is up to 1:1000.

What are the available trading platforms at Doo Prime?

MetaTrader 4 (MT4), MetaTrader 5 (MT5), Doo Prime Intrade, and TradingView.

What assets can be traded on Doo Prime?

Forex currency pairs, contracts for difference (CFDs) on various financial instruments, indices, and cryptocurrencies.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive bcr and doo-prime are, we first considered common fees for standard accounts. On bcr, the average spread for the EUR/USD currency pair is 1.7+ pips, while on doo-prime the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

bcr is regulated by ASIC,FSC. doo-prime is regulated by FSA,LFSA,FINRA,VFSC,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

bcr provides trading platform including Affiliate,Alpha,Advantage,Standard and trading variety including --. doo-prime provides trading platform including STP Account,CENT Account,ECN Account and trading variety including Securities, Futures, Forex, Metals, Commodities, Stock Indices.