简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AVATRADE 、SBI FXトレード 交易商比较(前端未翻译)

Do you want to know which is the better broker between AVATRADE and SBI FXトレード ?

在下表中,您可以并排比较 AVATRADE 、 SBI FXトレード 的功能,以确定最适合您的交易需求。(前端未翻译)

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Rating

- Basic Information

- Environment

- Account

- News & Analysis

- Average transaction cost (USD/Lot)

- Average Rollover Cost (USD/Lot)

EURUSD:-0.6

EURUSD:-5.3

EURUSD:6.95

XAUUSD:35.7

EURUSD: -3.22 ~ 1.1

XAUUSD: -6.47 ~ 1.64

--

--

Which broker is more reliable?

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of ava-trade, sbi-fxtrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Forex broker introduction

ava-trade

| Quick AvaTrade Review Summary | |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA |

| Tradable Assets | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Min Deposit | $100 |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| EUR/USD Spread | 0.9 pips |

| Trading Platform | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Payment Method | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Inactivity Fee | $/€/£50 after 3 consecutive months of non-use |

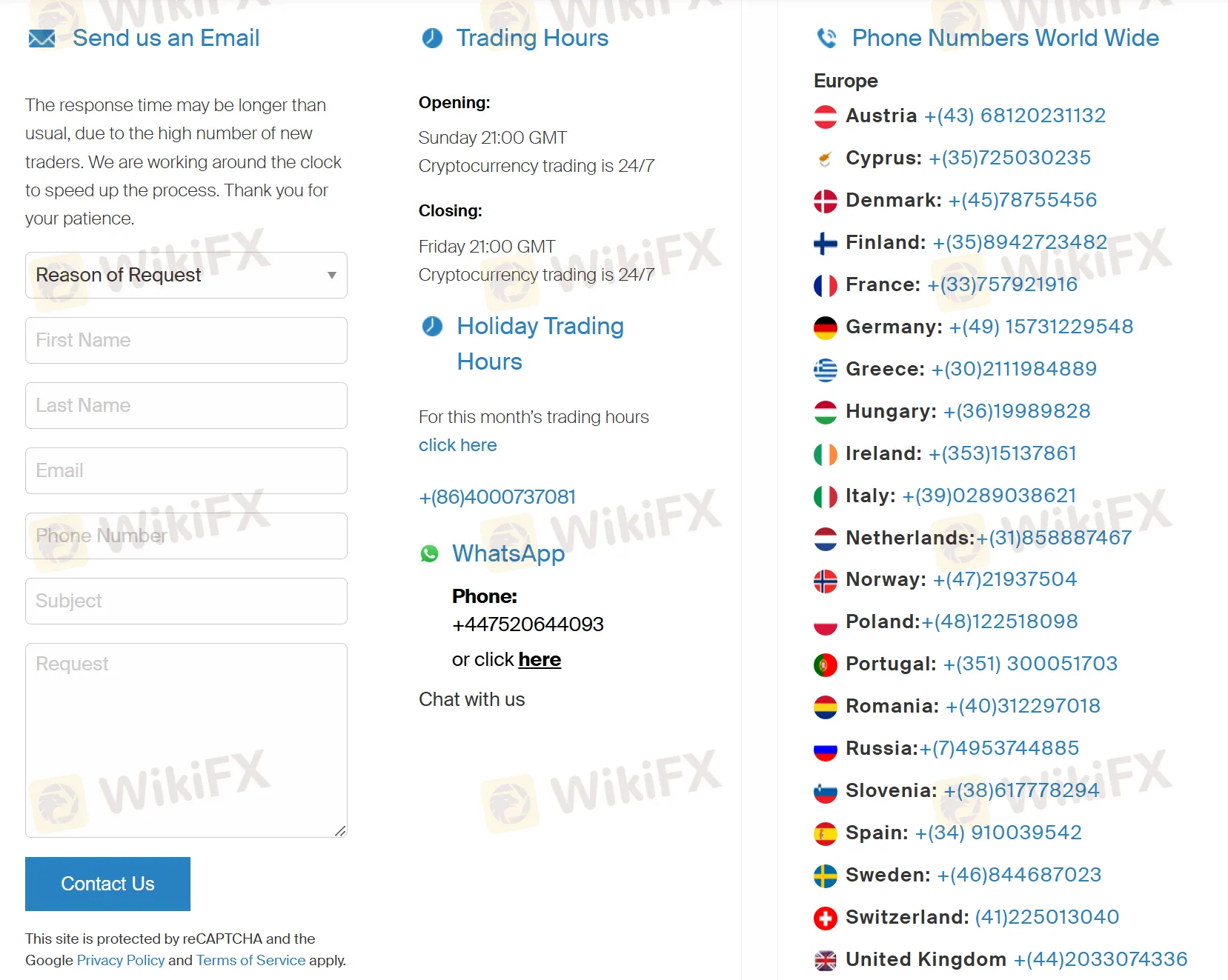

| Customer Support | Live chat, contact form, WhatsApp: +447520644093, phone (vary by the region) |

Avatrade Information

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, FSA, FFAJ, ADGM, CBI, and FSCA.

As a market maker broker, Avatrade offers a range of tradable assets including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options. The broker provides clients with access to multiple trading platforms, including AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, and DupliTrade.

Pros & Cons of Avatrade

When it comes to choosing a broker, it's important to carefully consider the pros and cons to determine which one is right for you.

| Pros | Cons |

| Regulated by reputable financial authorities | Single account option |

| Competitive spreads | Inactivity fee and administration feecharged |

| Multiple trading platforms | |

| Rich and free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

Is Avatrade Legit?

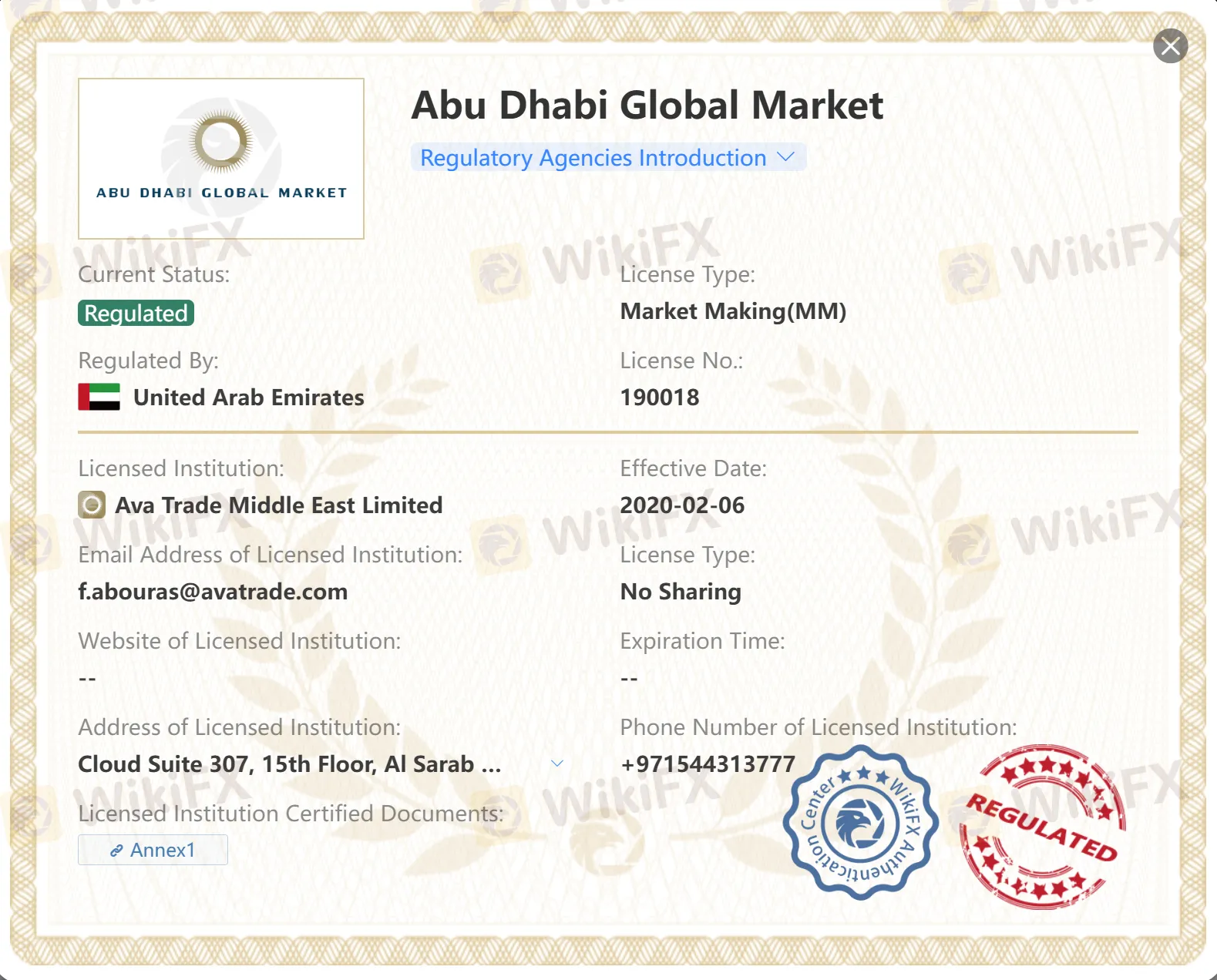

Avatrade is regulated by multiple financial regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Services Authority (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Market of the United Arab Emirates (ADGM), the Central Bank of Ireland (CBI), and the Financial Sector Conduct Authority of South Africa (FSCA). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

- Ava Capital Markets Australia Pty Ltd - authorized by ASIC (Australia) registration no. 406684

- Ava Trade Japan K.K. - authorized by FSA (Japan) registration no. 2010401081157 and FFAJ registration no. 1574

- Ava Trade Middle East Limited - authorized by ADGM (UAE) registration no.190018

- AVA Trade EU Ltd - authorized by CBI (Ireland) registration no. C53877

- Ava Capital Markets Pty Ltd - authorized by FSCA (South Africa) registration no. 45984

Market Instruments

Avatrade offers a wide range of trading instruments across various markets, including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options.

| Asset Class | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Crypto CFD | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| FX Options | ✔ |

Account Type

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, HFM and XM have a minimum deposit requirement of $0 and $5, respectively.

Demo Account

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

How to Open an Account?

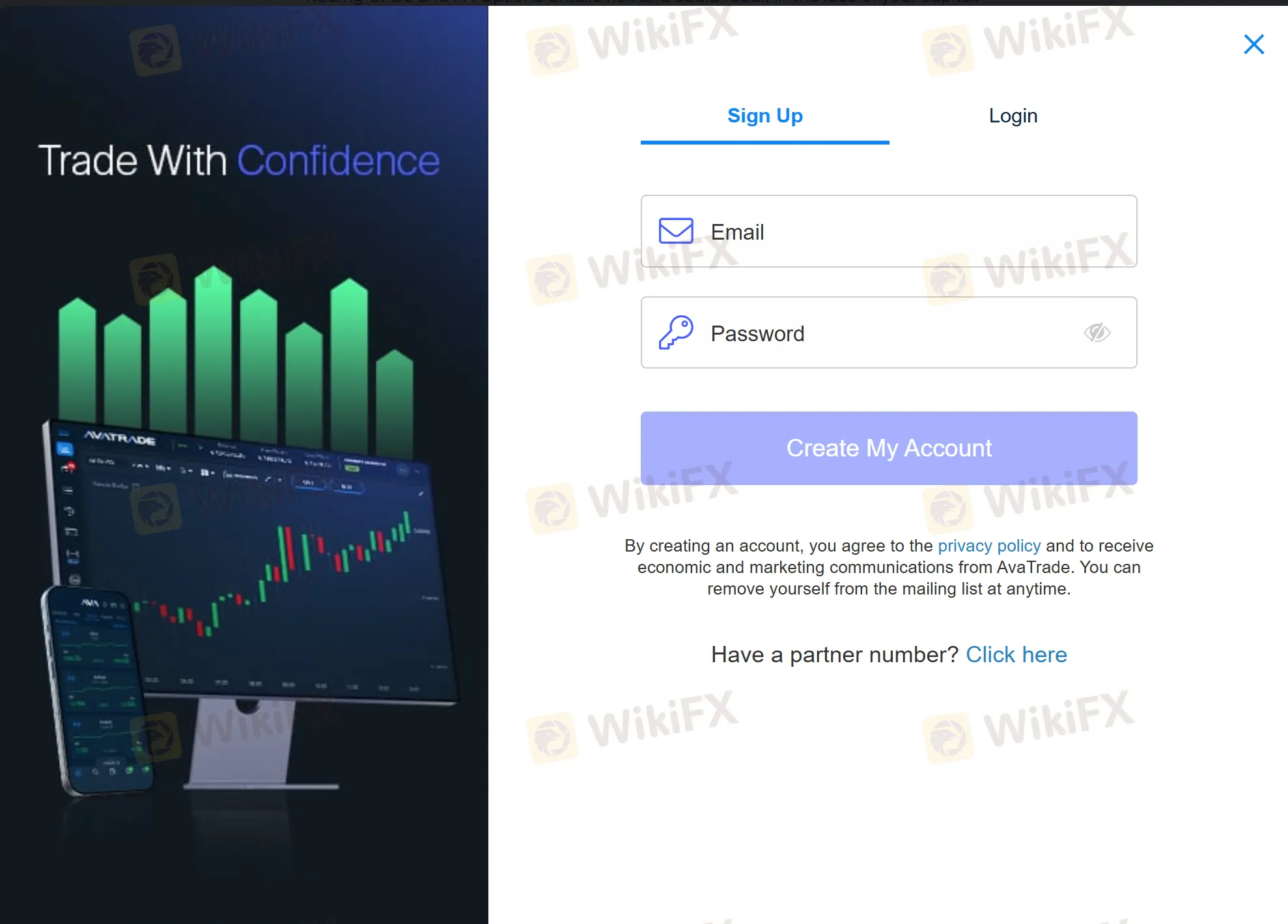

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

- First, you need to visit the Avatrade website and click on the “Register Now” button, which is prominently displayed on the homepage.

- Then, you will then be taken to a Sign Up Form where you will need to provide your email address. You will also need to create a password.

- After filling out the registration form, you will need to verify your identity by submitting a copy of your government-issued ID and a recent utility bill or bank statement. This is a standard requirement for all regulated brokers and is done to ensure the security and integrity of the trading platform.

- Once your account is verified, you can fund your account using one of the many payment options available, such as credit/debit card, bank transfer, or electronic wallets like Neteller or Skrill. After funding your account, you can download the Avatrade trading platform or use the web-based version to start trading.

Leverage

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it's important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It's important to note that professional clients must meet certain criteria to qualify for higher leverage.

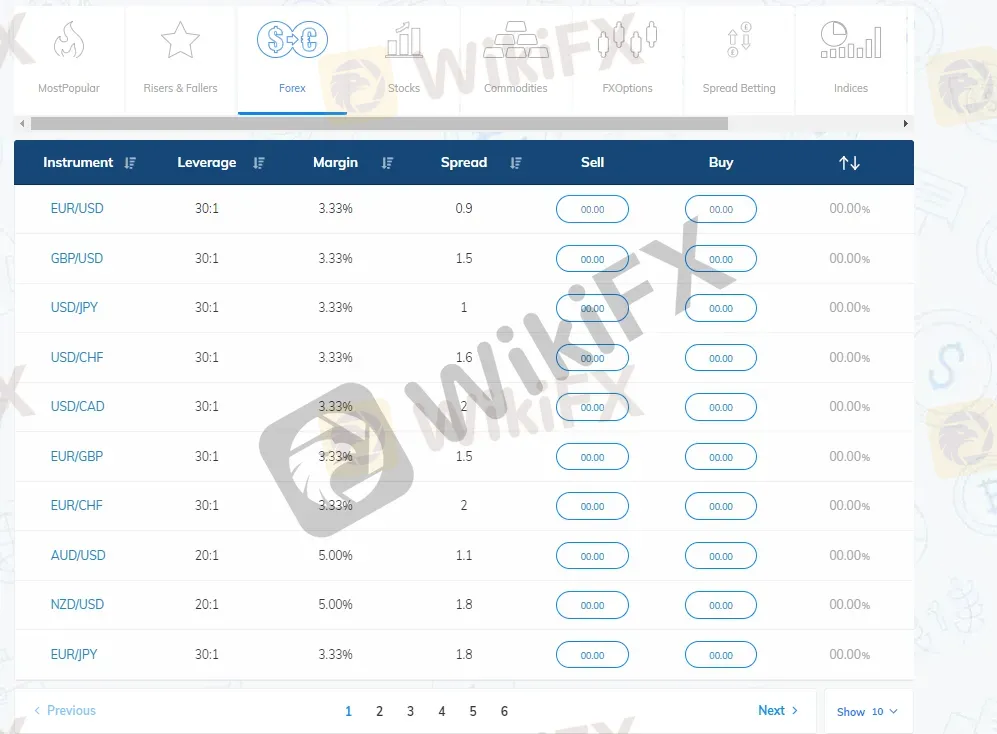

Spreads & Commissions (Trading Fees)

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it's important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading.

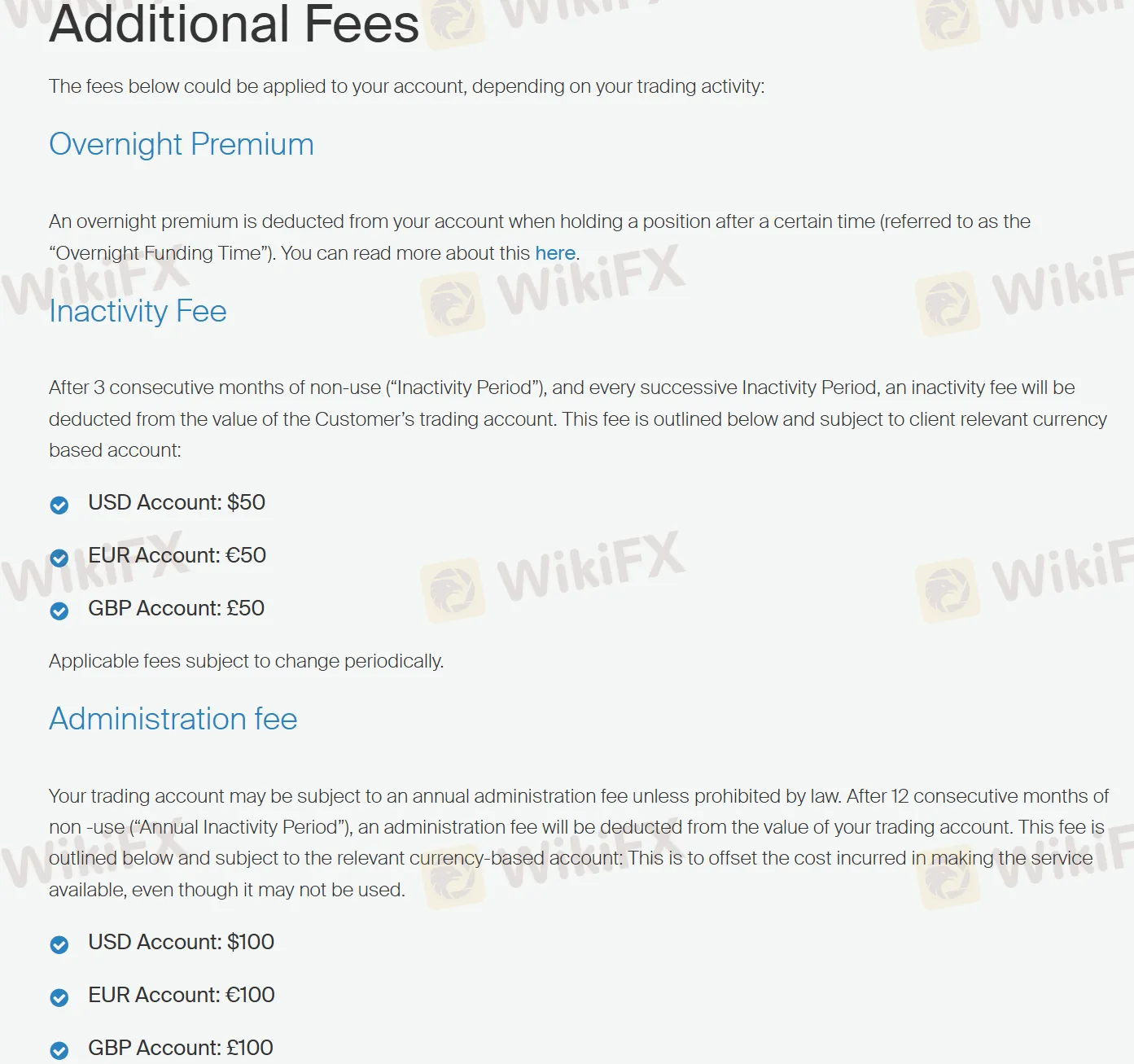

Non-Trading Fees

Non-trading fees are the fees that a broker charges for activities other than trading. These fees can significantly impact the profitability of a trader, and it's important to be aware of them when choosing a broker. Avatrade charges inactivity fee and administration fee. You can find detailed info in the table below:

| Fee Type | Amount | Detail |

| Inactivity Fee | $/€/£50 | Charged after 3 consecutive months of non-use (“Inactivity Period”) |

| Administration Fee | $/€/£100 | Charged fter 12 consecutive months of non -use (“Annual Inactivity Period”) |

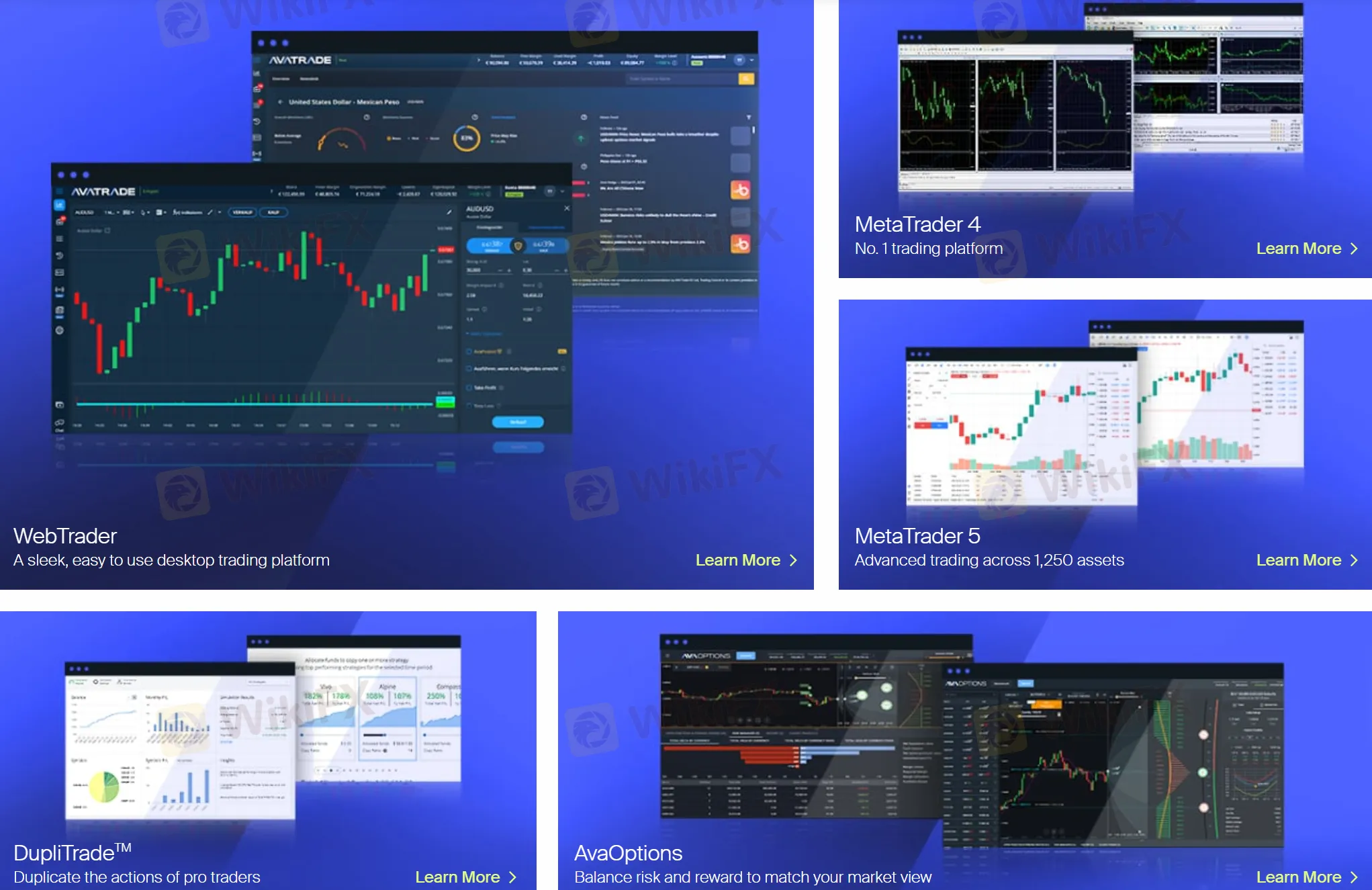

Trading Platform

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

- AvaTrade Mobile App: This is a mobile app that is available on both iOS and Android platforms. It allows traders to access their accounts and trade on the go.

- MT4: Avatrade offers the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its user-friendly interface, advanced charting tools, and a range of custom indicators and expert advisors.

- MT5: Avatrade also offers the MetaTrader 5 (MT5) platform, which is the successor to MT4. MT5 has several new features, including more advanced charting tools, a wider range of order types, and improved back-testing capabilities.

- WebTrader: Avatrade's WebTrader platform allows traders to access their accounts and trade directly from their web browser. The platform is easy to use and offers a range of trading tools and indicators.

- AvaOptions: This is Avatrade's platform for trading options. It offers a range of options trading tools, including risk management tools, and a range of customizable trading strategies.

Deposit & Withdrawal

Avatrade accepts MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, and Boleto. The minimum deposit requirement is 100 USD, EUR, GBP or AUD. Deposit and withdrawal processing time very by the method you choose. You can find more detailed info in the screenshot below or directly visit this link: https://www.avatrade.com/about-avatrade/avatrade-withdrawals-deposits

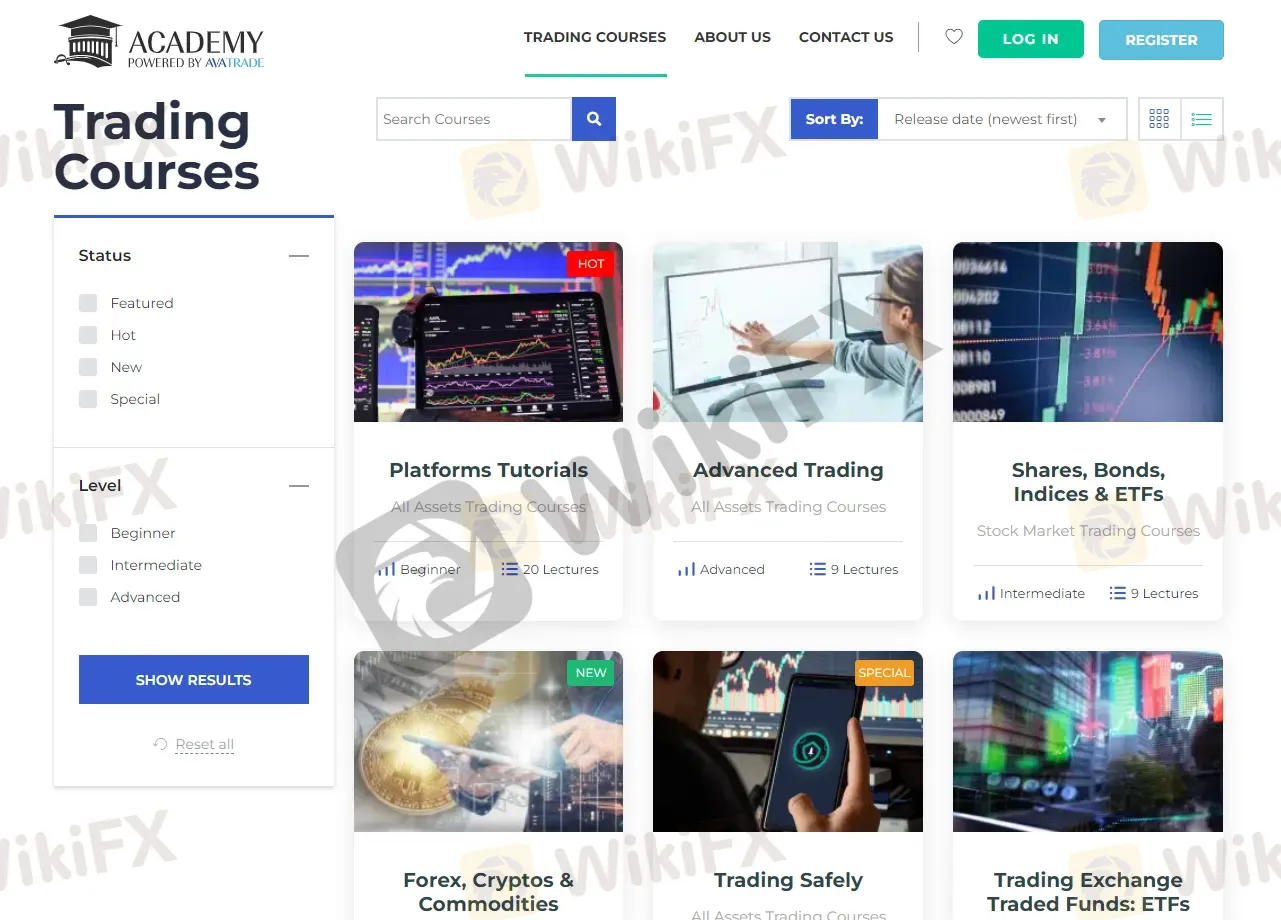

Educational Resources

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, etc. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management. Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter.

Customer Support

Avatrade offers customer supportthrough multiple channels, including live chat, contact form, WhatsApp: +447520644093, phone (vary by the region), and email. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.

Conclusion

Avatrade is a well-established broker with a long history of providing trading services to traders worldwide. They offer a variety of trading instruments, including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options, with competitive spreads and leverage options. Their trading platform is user-friendly and provides a range of advanced tools and features for traders of all skill levels. Additionally, they provide excellent customer support, educational resources, and demo accounts for traders to practice their strategies. However, there are some downsides to consider, such as higher inactivity fees and limited account options.

FAQs

Is Avatrade regulated?

Yes, Avatrade is regulated by multiple reputable authorities, including ASIC (Australia), FSA (Japan), FFAJ (Japan), ADGM (UAE), CBI (Ireland), and FSCA (South Africa).

Does Avatrade offer demo accounts?

Yes.

What is the minimum deposit requirement for Avatrade?

The minimum deposit requirement for Avatrade is $100.

Does Avatrade charge inactivity fee?

Yes. After 3 consecutive months of non-use (“Inactivity Period”), and every successive Inactivity Period, an inactivity fee will be deducted from the value of the Customers trading account. This fee is outlined below and subject to client relevant currency based account:

- USD Account: $50

- EUR Account: €50

- GBP Account: £50

sbi-fxtrade

| Information | Details |

| Company Name | SBI FXTRADE |

| Registered Country/Area | Japan |

| Regulation | Financial Services Agency, Japan |

| Minimum Deposit | 1,000 yen for Quick Deposits |

| Spreads | Narrow Spreads |

| Trading Platforms | Desktop and Mobile |

| Tradable Assets | Forex (34 currency pairs) |

| Demo Account | Available |

| Deposit & Withdrawal | Quick Deposits, Normal Deposits, Deposits to SBI Shinsei Bank |

| Educational Resources | Official YouTube channel |

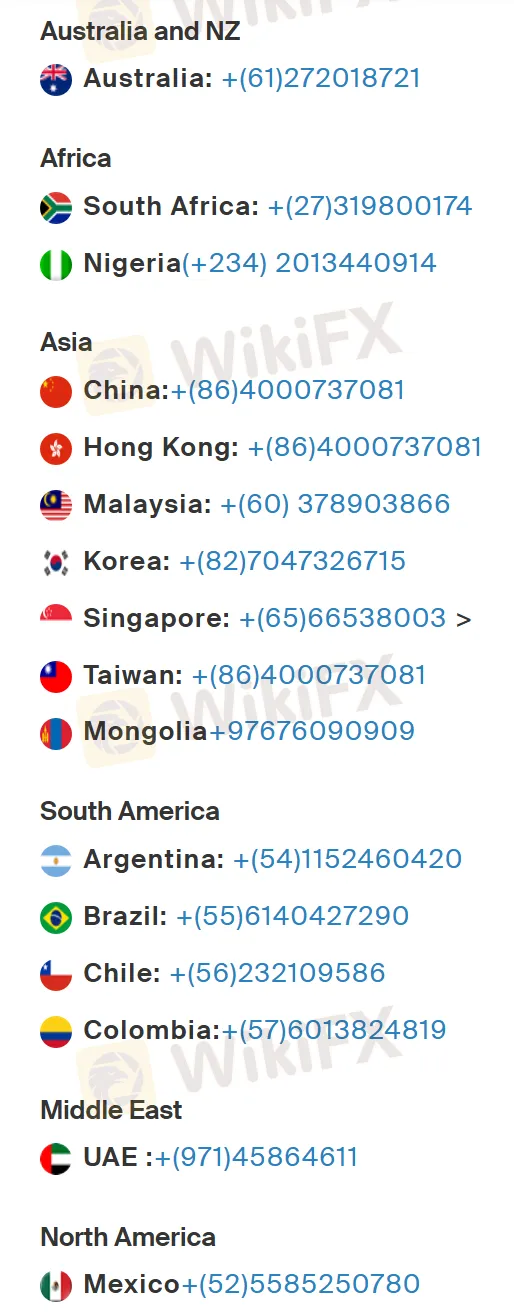

Overview of SBI FXTRADE

SBI FXTRADE is a Forex broker and a part of the SBI Group, a leading online financial services company in Japan. Its service allows users to engage in foreign exchange (FX) margin trading. The platform offers real-time market information and various analysis tools, which can assist both novices and experienced traders in their decision-making process.

The SBI FXTRADE platform boasts of features such as narrow spreads and 24-hour trading. It also offers a demo account option for practice. Additionally, there is a user-friendly interface which simplifies the process of FX trading and a mobile application for trading on the go. It is essential to remember that just like any other type of trading and investment, forex trading involves certain risks which should be thoroughly understood before participating.

Regulation

SBI FXTRADE is a regulated broker under the jurisdiction of Japan. The platform is licensed as a Retail Forex License holder and is overseen by the Financial Services Agency of Japan. The license number is 関東財務局長(金商)第2635号 and the official licensed institution is SBI FX トレード株式会社. The license was effectively granted on 13th April 2012. However, there is no shared email address of the licensed institution. It's crucial to trade with a regulated broker as it provides a certain level of security and oversight.

Pros and Cons

Pros:

1. Wide Range of Trading Instruments: SBI FXTRADE offers an extensive range of 34 currency pairs for trading, making it an attractive platform for those who wish to diversify their trading portfolio.

2. Quick Deposits: The platform provides a quick deposit feature that starts from 1,000 yen with no associated fees.

3. Regulation: SBI FXTRADE is regulated by the Financial Services Agency of Japan, adding a higher level of security and trustworthiness.

5. User-Friendly Interface: The platform has a user-friendly interface that simplifies the process of FX trading, making it easier for beginner traders to navigate.

6. Demo Account: SBI FXTRADE provides a demo account which allows users to practice trading strategies before investing real money.

7. 24-Hour Service: The platform facilitates 24-hour trading, enabling traders to take advantage of global forex market hours.

8. Mobile Trading: SBI FXTRADE offers mobile trading platforms for users to trade on the go.

Cons:

1. Deposit Fees: While quick deposits are free, other deposit methods such as the “normal deposit” method have associated transfer fees that will be borne by the customer.

2. Delay in Reflection of Deposits: Certain deposit methods may not immediately reflect the deposited amount in the trading account. If any error occurs, the reflection of deposit will have to wait till the confirmation of payment receipt.

3. Fees on Some Services: For certain services, such as normal deposits, transfer fees will be borne by the customer.

Market Instruments

SBI FXTRADE provides its users with the opportunity to trade in a total of 34 currency pairs. This offering is considered to be one of the highest in the industry, giving traders a wide range of options when it comes to choosing their trading instruments.

It signifies that traders have the opportunity to capitalize on the movements of various currencies ranging from major currency pairs to minor and exotic ones. However, it's always important for traders to understand the risks associated with each trading instrument before investing.

How to open an account?

- The first step would be to navigate to the “Complete application in” button at the top right side of the page.

- Please enter your email address using the submit button that is below the “apply for a personal account” sign. An account opening application URL will be sent to the email address you entered.

- Enter your name, date of birth, and current address as in the identity verification document. The user is required to have a Japanese “MyNumber” identification in order to continue to after this step.

- After the information has been examined, SBI FXTRADE will determine if the account creation process will be completed.

Minimum Deposit

SBI FXTRADE offers two different methods of depositing funds: quick deposits and normal deposits.

Quick deposits start from 1,000 yen, with no associated fees. It's important to note that applications cannot be accepted during maintenance times performed by the broker or financial institutions.

Deposit & Withdrawal

SBI FXTRADE provides several methods for depositing and withdrawing funds.

For making deposits, there are three methods available:

- Quick deposits: This method allows clients to deposit funds starting from 1,000 yen with no associated fees. However, deposition isn't guaranteed to reflect immediately - errors might delay the reflection of the deposit.

- Normal deposits: This involves a money transfer to a created “Customer Dedicated Deposit Account”. Note that transfer fees are borne by the customer unless they are an SBI Shinsei Bank account holder depositing into the “SBI Shinsei Bank account exclusively for SBI FX Trade”.

- Deposit to SBI Shinsei Bank: This method involves a money transfer to the dedicated SBI Shinsei Bank account for SBI FX Trade. There are no transfer fees and the customer has to specify their login ID and first and last name in kana in the remittance name.

The following provides more details on deposit confirmation and conditions:

- Payments can be confirmed on the transaction screen.

- Payments may not reflect immediately as they need to be received and confirmed by the bank. This process can take some time during busy periods.

- Deposit processing is done three times a day at 9:00, 13:00, and 15:30.

- Shinsei Bank deposits will be reflected in the FX account and need to be transferred to the savings FX account or the crypto asset CFD account by the user.

Customer Support

SBI FXTRADE offers an array of contact channels enabling seamless and efficient communication:

- Direct Phone Line: Enabling immediate assistance, the firm can be directly contacted via their dedicated line at +81 0120-982-417.

- Official Web Portal: An exhaustive array of resources could be found on their official website, SBI FXTRADE.

- Social Media Presence: Connect with them on Twitter for real-time updates and interactions. They also maintain an active online presence on Facebook and exclusive content on their dedicated YouTube channel.

Educational Resources

SBI FXTRADE provides several educational resources for its traders:

- Official YouTube Channel: SBI FXTRADE maintains an official YouTube channel where they share informative video content. This includes market news, tutorials, trading strategies, and explanations on various aspects of Forex trading.

- Today's Exchange News: This is presumably a feature where recent news and events affecting the exchange market are discussed, providing insights to help traders make informed decisions.

- Crypto Asset Market Information: This channel is maintained by SBI VC Trade, which is also a part of the SBI Group. It provides information related to the crypto asset market.

Please note that Forex trading and trading in general can be risky, so it's essential to fully understand these risk factors and strategies before investing. Educational resources are a starting point, but should not be the only source of knowledge or strategy formulation. Real-time experience, trading practice, and individual research are also critical components of trading education.

Conclusion

SBI FXTRADE, a premium trading firm, offers multiple features tailored towards assisting traders succeed. Key offerings include diverse deposit methods (featuring Quick Deposits), a wide array of trading instruments, a user-friendly platform, and well-developed educational resources. However, potential users should be aware of potential deposit fees and delays, and inherent trading risks.

FAQs

Q: What are some educational resources that SBI FXTRADE provides for traders?

A: SBI FXTRADE offers a variety of educational resources, including a YouTube channel filled with market news, trading strategies, and other trading-related insights, a feature for recent market news, programs providing insights into alternative currencies to USD/JPY.

Q: How can users contact SBI FXTRADE?

A: SBI FXTRADE can be reached through their phone number (+81 0120-982-417), their official website, or their social media accounts on Twitter, Facebook, and YouTube.

Q: What are the unique features of SBI FXTRADE?

A: SBI FXTRADE offers quick deposits without any fees starting from 1,000 yen and is regulated by the Financial Services Agency of Japan for enhanced security.

Are the transaction costs and expenses of ava-trade, sbi-fxtrade lower?

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive ava-trade and sbi-fxtrade are, we first considered common fees for standard accounts. On ava-trade, the average spread for the EUR/USD currency pair is -- pips, while on sbi-fxtrade the spread is --.

Which broker between ava-trade, sbi-fxtrade is safer?

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

ava-trade is regulated by ASIC,FSA,CBI,ADGM,FSCA. sbi-fxtrade is regulated by FSA.

Which broker between ava-trade, sbi-fxtrade provides better trading platform?

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

ava-trade provides trading platform including -- and trading variety including --. sbi-fxtrade provides trading platform including -- and trading variety including --.