No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between AvaTrade and INVAST ?

In the table below, you can compare the features of AvaTrade , INVAST side by side to determine the best fit for your needs.

EURUSD:-0.7

EURUSD:-2.8

EURUSD:7

XAUUSD:22.81

EURUSD: -2.53 ~ 0.34

XAUUSD: -5.82 ~ 1.95

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of ava-trade, invast lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| AvaTrade | Basic Information |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA, KNF |

| Tradable Assets | Forex, CFD, stock, commodities, indices, futures, cryptocurrencies, options |

| Demo Account | ✅ |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| EUR/USD Spread | 0.9 pips |

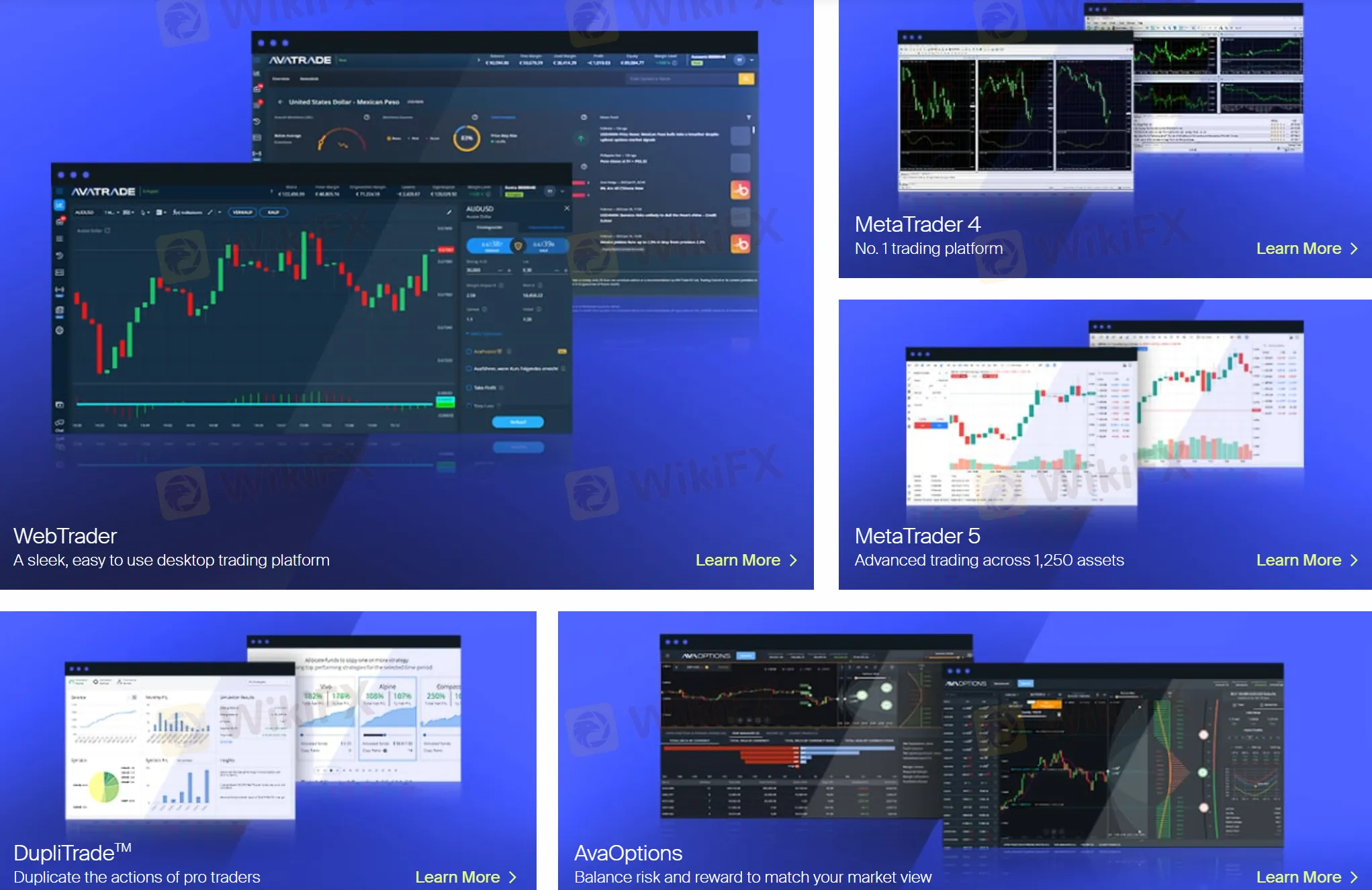

| Trading Platform | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Minimum Deposit | $100 |

| Payment Method | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Customer Support | 24/7 - live chat, contact form, WhatsApp: +447520644093, phone (vary by the region) |

| Educational Resources | Academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, trading webinars |

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, FSA, FFAJ, ADGM, CBI, FSCA, and KNF.

As a market maker broker, Avatrade offers a range of tradable assets including forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options. The broker provides clients with access to multiple trading platforms, including AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, and DupliTrade.

Avatrade requires a minimum deposit of $100 to open an account, and clients can choose from a variety of payment methods including MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto.

Customer support is available via live chat, phone, email, and a knowledge base. The broker also provides a range of educational resources for traders, including academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, trading webinars.

Avatrade is regulated by multiple financial regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Services Authority (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Market of the United Arab Emirates (ADGM), the Central Bank of Ireland (CBI), the Financial Sector Conduct Authority of South Africa (FSCA), and the Polish Financial Supervision Authority of Poland (KNF). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

When it comes to choosing a broker, it's important to carefully consider the pros and cons to determine which one is right for you. Some potential advantages of a broker may include competitive spreads, user-friendly trading platforms, and rich educational resources. Additionally, a regulated broker can provide peace of mind knowing that your funds are protected.

| Pros | Cons |

| Regulated by reputable financial authorities | Single account option |

| Competitive spreads | |

| Multiple trading platforms | |

| Rich and Free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

Avatrade offers a wide range of trading instruments across various markets, including Forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options.

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

The standard account provides access to all of Avatrade's trading instruments, including forex, stocks, commodities, and cryptocurrencies. This means that traders can diversify their portfolio and take advantage of different market conditions, all within the same account.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, Pepperstone and XM have a minimum deposit requirement of $0 and $5, respectively.

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it's important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It's important to note that professional clients must meet certain criteria to qualify for higher leverage.

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it's important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading.

Non-trading fees are the fees that a broker charges for activities other than trading. These fees can significantly impact the profitability of a trader, and it's important to be aware of them when choosing a broker. Avatrade charges inactivity fee and administration fee. You can find detailed info in the table below:

| Fee Type | Amount | Detail |

| Inactivity Fee | $/€/£50 | Charged after 3 consecutive months of non-use (“Inactivity Period”) |

| Administration Fee | $/€/£100 | Charged fter 12 consecutive months of non -use (“Annual Inactivity Period”) |

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

Avatrade accepts MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, and Boleto. The minimum deposit requirement is 100 USD, EUR, GBP or AUD. Deposit and withdrawal processing time very by the method you choose. You can find more detailed info in the screenshot below or directly visit this link: https://www.avatrade.com/about-avatrade/avatrade-withdrawals-deposits.

Avatrade offers customer support 24/7 through multiple channels, including live chat, contact form, WhatsApp: +447520644093, phone (vary by the region), and email. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, etc. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management. Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter.

Avatrade is a well-established broker with a long history of providing trading services to traders worldwide. They offer a variety of trading instruments, including forex, CFD, stock, commodities, indices, futures, cryptocurrencies, and options, with competitive spreads and leverage options. Their trading platform is user-friendly and provides a range of advanced tools and features for traders of all skill levels. Additionally, they provide excellent customer support, educational resources, and a demo account for traders to practice their strategies. However, there are some downsides to consider, such as higher inactivity fees and limited account options.

Is Avatrade regulated?

Yes, Avatrade is regulated by multiple reputable authorities, including ASIC (Australia), FSA (Japan), FFAJ (Japan), ADGM (UAE), CBI (Ireland), FSCA (South Africa), and KNF (Poland).

Does Avatrade offer a demo account?

Yes, Avatrade offers a free demo account for traders to practice and test their strategies before trading with real money.

What is the minimum deposit requirement for Avatrade?

The minimum deposit requirement for Avatrade is $100.

What is the maximum leverage offered by Avatrade?

The maximum leverage offered by Avatrade is 1:400.

| INVAST Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Business Scopes | Online financial derivative trading services for margin FX and OTC CFDs (Contract for Difference) |

| Demo Account | Unavailable |

| Customer Support | Phone, email, Twitter, Facebook and YouTube |

Invast Securities Co., Ltd is a leading brokerage company based in Japan. Founded in 1960, it operates as a wholly-owned subsidiary of INVST Co., Ltd, a listed company. Invast Securities offers a wide range of online financial derivative trading services. Their expertise lies in margin FX and OTC CFDs (Contract for Difference), attracting a significant number of users in Japan and boasting a user base of over 400,000 individuals.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by FSA | • Complex funding |

| • Various business scopes | • No live chat support |

| • FAQ section available | |

| • Social media presence |

There are many alternative brokers to INVAST depending on the specific needs and preferences of the trader. Some popular options include:

Monex Securities - A renowned online brokerage firm offering a wide range of financial services and investment opportunities.

ACY Securities - A global financial services provider renowned for offering innovative trading solutions, including foreign exchange, contracts for difference (CFDs), and cryptocurrencies.

ALPHA INTERNATIONAL SECURITIES - A financial servicesthat focuses on internet securities business, investment banking services, including both the bond capital market (DCM) and equity capital market (ECM).

INVAST is regulated by the Financial Services Agency (FSA) oversees all financial services providers, including Forex brokers, in Japan. It is regulated by reputable authorities, has been in operation for several years, and has received positive reviews from many customers. Based on the information available, INVAST appears to be a reliable and trustworthy broker.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

The business scope of INVAST includes providing online financial derivative trading services for margin FX and OTC CFDs (Contract for Difference). They offer trading platforms for individuals and institutional clients to engage in speculative trading of various financial products, including foreign exchange (FX) and contracts for difference (CFDs).

INVAST facilitates buying and selling these financial instruments over electronic platforms, allowing traders to speculate on price movements without owning the underlying assets. They provide access to global markets, leverage trading options, risk management tools, and various trading strategies to meet the needs of their clients.

Invast Securities offers low spreads, USD/JPY 0.3 pips, GBP/JPY 0.1 pips, EURJPY 0.5 pips, AUDJPY 0.6 pips, and EURUSD 0.3 pips. (From 9:00 AM to 5:00 AM the next day Fixed in principle (with exceptions).

Click 365“ is a nickname for Forex Margin Trading (FX) handled by the Tokyo Financial Exchange. Exchange FX ”Click 365 is safe because all the deposited funds are deposited and segregated at the Tokyo Financial Exchange. In addition, Exchange FX trades at the rates offered by the exchange and swap points, so fair and favorable rates are delivered. Click 365 handles 25 currency pairs centered on popular currencies such as dollar / yen, euro / yen, and Australian dollar / yen.

Fees will decrease according to the number of transactions.

| 1 sheet (tax included) | Usually one-way fee | |

| Usually | JPY 330 | |

| Volume discounts (monthly transaction total) | 1,000 or more | JPY 88 |

| 3,000 or more | JPY 0 | |

For Deposit:

-Invast Securities provides “immediate deposit service”, and you can transfer (deposit) in near real time 24 hours a day, and you can deposit at night and on public holidays.

-The instant deposit service is a deposit via the Internet through “My Page” and “Tri-Auto ETF Trading Tool”. It cannot be done from the counter of a financial institution or ATM. Immediate deposits cannot be made from the companys website or the website of each financial institution. Immediate deposits with corporate accounts are available only at four financial institutions: Rakuten Bank, PayPay Bank, SBI Sumishin Net Bank, and Japan Post Bank.

For Withdrawal:

To withdraw funds from your INVAST Securities account, you can follow these steps:

1. Log in to your account through the “My page” or trading tool.

2. Navigate to “Deposits and withdrawals” and then select “Withdraw”.

3. Enter the details required, including your withdrawal source trading account, the amount you wish to withdraw, and your withdrawal password. Click “Confirm”.

4. You will receive a verification code to your registered primary email address. Enter this code.

(Note: If you don't have multi-factor authentication enabled, you won't need to enter an authentication code.)

5. Review the withdrawal details and click “Run” to complete the withdrawal process.

It's important to note that INVAST Securities covers the transfer fee for withdrawals. The timing of the transfer will depend on various factors and you can refer to their platform for more specific information.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +81 0120-659-274

Email: fx-info@invast.jp

fx24-info@invast.jp

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook and YouTube.

Twitter: https://twitter.com/invast

Facebook: https://www.facebook.com/invastsecurities/

YouTube: https://www.youtube.com/user/INVASTSecurities

Whats more, INVAST provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information. The FAQ section aims to address common queries and concerns that investors may have regarding the company's services, processes, and investment opportunities. By offering this resource, INVAST aims to provide transparency and clarity to their clients, helping them make informed decision.

INVASToffers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

In conclusion, INVAST Securities is a reputable brokerage company based in Japan. The company is authorized and regulated by FSA, a regulatory body in Japan. INVAST Securities specializes in providing online financial derivative trading services for margin FX and OTC CFDs (Contract for Difference).

Overall, INVAST Securities' regulatory framework, extensive experience, and dedication to providing trading services contribute to its status as a trusted brokerage company in Japan.

| Q 1: | Is INVAST regulated? |

| A 1: | Yes. It is regulated by FSA. |

| Q 2: | How can I contact the customer support team at INVAST? |

| A 2: | You can contact via telephone, +81 0120-659-274 and email, fx-info@invast.jp and fx24-info@invast.jp. |

| Q 3: | Does INVAST offer demo accounts? |

| A 3: | No. |

| Q 4: | Is INVAST a good broker for beginners? |

| A 4: | Yes. It is a good choice for beginners because it is regulated well and offers various services. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive ava-trade and invast are, we first considered common fees for standard accounts. On ava-trade, the average spread for the EUR/USD currency pair is -- pips, while on invast the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

ava-trade is regulated by ASIC,FSA,FFAJ,ADGM,CBI,FSCA,KNF. invast is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

ava-trade provides trading platform including -- and trading variety including --. invast provides trading platform including -- and trading variety including --.