简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Divergence of Britain and EU Is Weighing Down on Euro

요약:When it comes to the future of European capital market after Brexit, Britain and the European Union had not seen great disputes as they did over other issues. But the situation is changing now.

When it comes to the future of European capital market after Brexit, Britain and the European Union had not seen great disputes as they did over other issues. But the situation is changing now.

British Chancellor Sajid Javid and EUs chief negotiator Michel Barnier have engaged in a fierce debate, while people are expecting concrete progress of the negotiation by June this year, which is drawing near. The focus of this debate centers on the agreement known as “equivalence” that will allow British businesses to enjoy access to European single market even after Brexit, a policy that underpins the future relation between the two parties in the financial sector.

The Bank of England has also joined the debate in which Britain and EU have come to a deadlock.

Andrew Bailey, BoE‘s new governor implied on Wednesday that Britain may part ways with European Union in several key areas of regulation, while Barnier said there won’t be such an equivalence as sought by the British side. However the issue will be solved, a less efficient European capital market will hurt everyone.

Economy of the Eurozone is already fragile, with the official interest rate kept in negative rage. On the other hand, financial industry and the relevant services account for 8% of the countrys economy, and nearly 11 pounds out of every 100 pounds of revenue come from the financial sector.

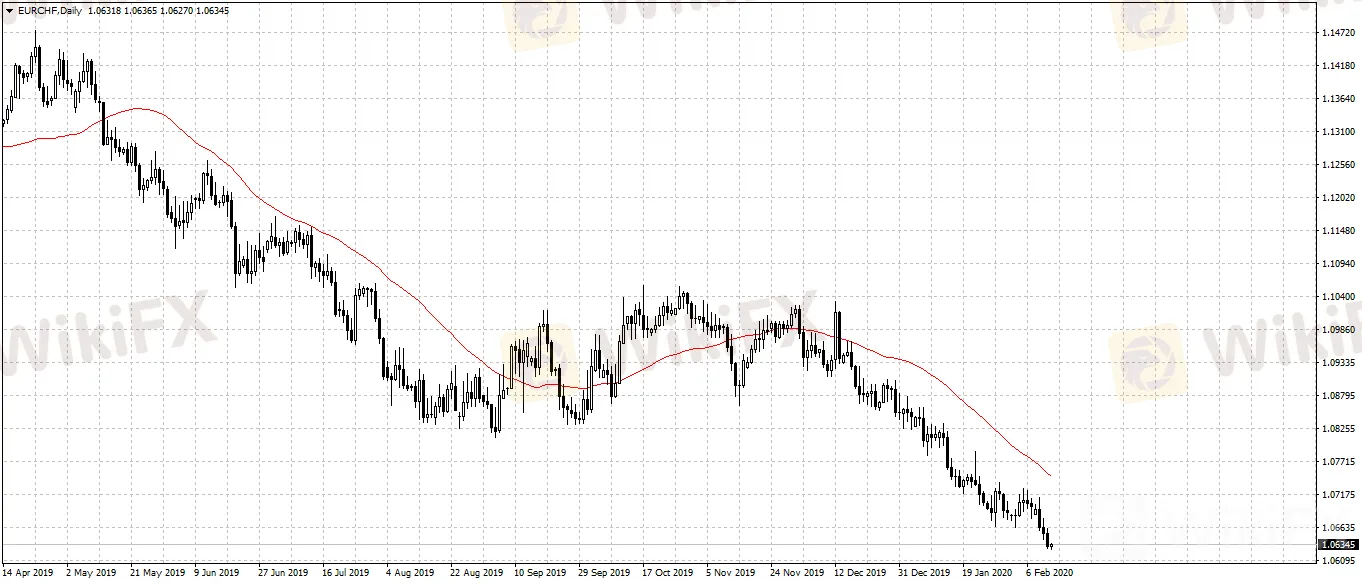

The series of events have affected the euro‘s trend on the forex market. Sellout and stop-loss in trend-following funds have driven euro’s rate against US dollar to the lowest since May, 2017, while euro against Swiss franc also dropped to the lowest since 2016.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기