WikiFX는 독립적인 제3자 정보 서비스 플랫폼으로서 사용자에게 포괄적이고 객관적인 브로커 규제 정보 서비스를 제공하는 데 전념하고 있습니다. WikiFX는 외환 거래 활동에 직접적으로 참여하지 않으며, 어떤 형태의 거래 채널 추천이나 투자 조언도 제공하지 않습니다. WikiFX의 브로커 등급과 평점은 공개적으로 이용 가능한 객관적인 정보를 기반으로 하며 다양한 국가 및 지역의 규제 정책 차이를 고려합니다. 브로커 등급과 평점은 WikiFX의 핵심 제품이며, 당사는 그들의 객관성과 공정성을 손상시킬 수 있는 상업적 행위에 단호히 반대합니다. 당사는 전 세계 사용자의 감독과 제안을 환영합니다. 신고 핫라인: report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

브로커 검색

한국어

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX1799814375

0123456789

0123456789

0123456789

0123456789

투자자

ID: 1510085629

홍콩

6-10년

팔로우

FX1799814375

Euro Falters as German Industrial Data Decline

Weak industrial production data out of Germany contributed to euro weakness, especially as figures revealed a decline in year-over-year and month-over-month production rates. Economic concerns within the Eurozone are dampening investor confidence in the euro, pushing EUR/USD lower in early European trading.

2024-11-09 16:38

FX1799814375

Yen Appreciates as Market Sentiment Turns Cautious

The Japanese yen strengthened due to increased demand for safe-haven assets. The Fed’s mixed messaging on the timing of interest rate cuts in 2024 has prompted some investors to seek safety in the yen amid global economic uncertainties. The USD/JPY pair saw declines as the dollar weakened slightly against the yen, demonstrating how central bank policy shifts and global risk appetite are influencing this currency pair.

2024-11-09 06:11

FX1799814375

Brazil’s Higher-Than-Expected Inflation

Brazil’s inflation data showed an increase beyond what analysts had predicted, intensifying pressure on the real. While the inflation spike could prompt the Brazilian central bank to consider tighter monetary policies, some analysts are wary of the potential impact on economic growth. This situation leaves the Brazilian real vulnerable, as inflation concerns can detract from investor confidence in emerging market currencies.

2024-11-09 05:56

FX1799814375

Euro Faces Volatility Amid Mixed Economic Data

The euro saw fluctuations today, with economic data from the Eurozone offering mixed signals. Weak industrial production and retail sales figures from major economies, including Germany, have raised concerns about a possible recession, casting a shadow over the euro’s outlook. EUR/USD experienced downward pressure as traders consider the effects of the ongoing European Central Bank policies to address inflation while balancing economic growth. This mixed data has added complexity to the euro’s trading patterns against both the dollar and other major currencies.

2024-11-09 05:52

FX1799814375

Asia FX firms as dollar pares recent gains

Most Asian currencies firmed on Monday as the dollar fell sharply from recent highs after soft labor data, with focus turning squarely to the upcoming presidential election and a Federal Reserve meeting.

Focus this week is also on a Reserve Bank of Australia meeting, and a meeting of China’s National People’s Congress, with the latter set to provide more cues on fiscal stimulus.

Regional currencies benefited from weakness in the dollar, with the dollar index and dollar index futures both falling about 0.6% each in Asian trade. The greenback was dented by softer-than-expected nonfarm payrolls data on Friday, which showed the U.S. labor market was steadily cooling.

2024-11-08 07:35

FX1799814375

Go long the dollar, BCA says as geopolitical risks

BCA Research advises investors to take a tactical long position on the U.S. dollar, highlighting persistent geopolitical risks that position the greenback as a solid hedge.

In a recent report, the investment research firm foresees a hawkish shift in U.S. trade and foreign policy regardless of the election’s outcome, noting that “the global political system is destabilizing.”

2024-11-08 07:29

FX1799814375

Stocks hit record for second day

NEW YORK/LONDON (Reuters) -Shares on Wall Street scaled record highs on Thursday, lifting stock markets around the world, while U.S. Treasury yields retreated further after the Federal Reserve cut interest rates and as investors processed a second Donald Trump presidency.

The Fed lowered rates by 25 basis points on Thursday, as expected, noting that the job market has generally eased while inflation is moving toward its 2% target - saying price pressures had "made progress," compared with prior language that it had "made further progress."

“The Fed didn’t rock the boat," said Ryan Detrick, chief market strategist at Carson Group in Omaha, Nebraska. "The big question now is will they cut again in December? Our best guess is they do, as inflation continues to improve.”

2024-11-08 06:58

FX1799814375

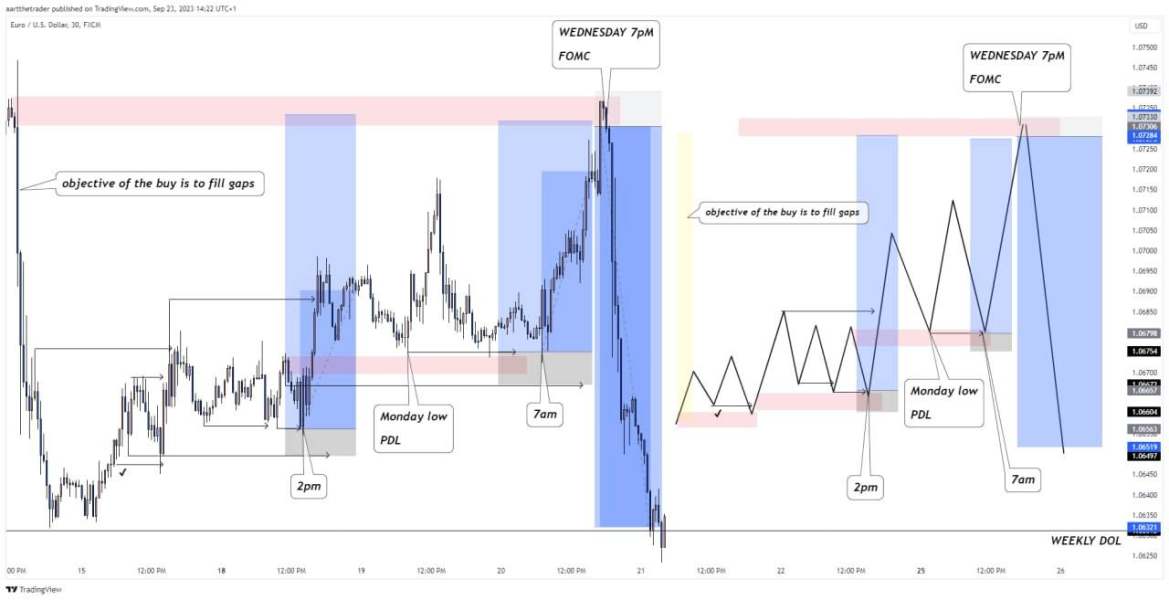

"One Strategy to Achieve Consistent Profits

I've traded for 6 years and this ONE strategy is all you need to become consistently profitable

I've been using it for 2+ years consistently because it keeps printing

Take 30 seconds to learn it for yourself:🧵

2024-11-06 21:37

FX1799814375

Essential Traits for Success in Forex Trading

Forex trading is design for large percentage of people to FAIL.

If you are not discipline Forex is not for you❌

If you are not consistent Forex is not for you❌

If you lack Patience Forex is not for you❌

If you can't adapt forex is not for you❌

If you are greedy Forex is not for you❌

You need to develop all these attribute to be a successful trader

You need to be

Satisfied

Patience

Discipline

Consistent

Learn to adapt as well ....

The good thing is that with time you can accually develop all these attribute and become a successful trader

Forex is for any serious determined person with the right information ✍️✍️✍️✍️

2024-11-06 21:09

FX1799814375

Why Experience Beats Knowledge in Forex Trading

Mastering every theory and strategy in the forex market doesn’t guarantee profitability. True growth and resilience come from years of real-world experience—learning through losses, adapting, and evolving. It's a journey where each setback is a stepping stone. Remember, #ImpossibleIsNothing!

2024-11-06 20:46

더 보기

관심이 있을 수 있는 사람들

바꾸기

FX1395681821

팔로우

FX1636731038

팔로우

FX1671607680

팔로우

FX3076589042

팔로우

사랑방

팔로우