简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WIKIFX REPORT: Russians lose millions as Finiko pyramid scheme collapses

Abstract:Many people link Russia's big financial pyramid schemes with the 1990s and the financial Wild West that followed the Soviet Union's demise. They are, nevertheless, still alive and well today. The Finiko pyramid fraud was busted recently, and its founder, Kirill Doronin, was arrested. The scandal, which began in 2018, defrauded Russians of over $100 million.

Many associate giant financial pyramid schemes in Russia with the 1990s and the financial Wild West that followed the end of the Soviet Union. But they are still alive and well today. The last few weeks saw the unraveling of the Finiko pyramid scheme and the arrest of founder Kirill Doronin. The scheme, which launched in 2018, swindled about $100 million from the Russians who took part.

How Finiko operated

On one of its sites, Finiko described itself as an “automated profit-generation system”. Investors had three options. In one, you invested a sum over $1,000 on the promise of up to 30 percent a month in profit (the initial investment threshold later increased sharply). In another, Finiko promised to pay off a debt, loan or mortgage within 10 months if you paid 35 percent of the value of the debt to Finiko. In a third option, Finiko offered to purchase a house or car for 35 percent of the total cost.

Money could be invested in Finiko using Bitcoin or by purchasing Tether — the companys in-house currency — which traded at a value determined by Finiko. As always with a pyramid scheme, some clients made money off the investments of later clients. But returns were increasingly delayed and all payments ceased in June.

Who was behind it?

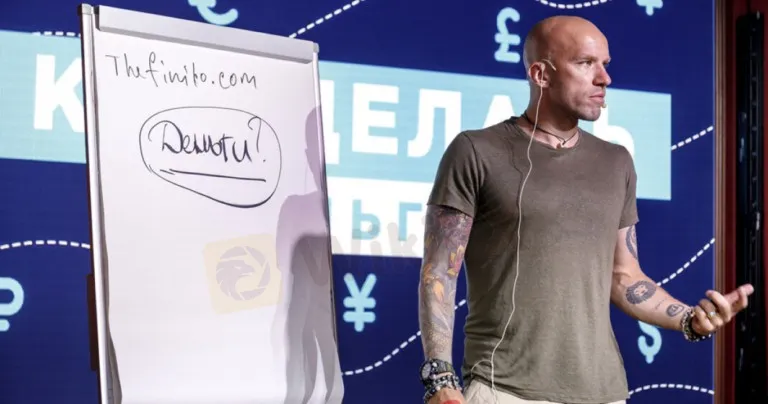

Dorinin was the face of Finiko and heavily promoted the company on his social media accounts. His charisma played a big role in the scheme‘s rapid expansion, according to a source at the Central Bank. “He looks trustworthy, he’s well-dressed, and he has an athletic physique,” the source said, adding that women were a particular target. A store owner from Krasnoyarsk told The Bell that even when it was clear the company was struggling, Doronins YouTube performances convinced her everything would be OK.

The other founder of Finico was Eduard Sabirov, an ex-business partner of former Communications Minister Nikolai Nikiforov (they worked together on the Innopolis project — a state-funded attempt to build a Russian Silicon Valley). Back then, Nikiforov said he had “no doubts about Sabirovs business reputation”. The third key figure in Finiko was the unusually named Zygmunt Zygmuntovich.

The three founders blame each other for the collapse of Finiko. Doronin has said his partners deceived him, while Sabirov claimed money disappeared in the accounts of brokers. Before his arrest last month, Doronin announced he was going to move to Turkey. The whereabouts of Sabirov and Zygmuntovich are unknown.

Who invested in Finiko?

A Finiko manager told a local newspaper late last year that there were more than 200,000 investors (but this figure is difficult to verify). By earlier this summer, popular Russian search engine Yandex was recording almost half a million monthly questions about Finiko. Thats significantly more than the Cashberry pyramid scheme, which fell apart a few years ago, resulting in $50 million of losses.

How it came to the attention of the authorities

Officials first began to take notice of Finiko in spring 2020, according to The Bells source at the Central Bank. By the summer, the regulator had passed details to law enforcement. A criminal case was eventually opened against the founders of Finico in December, although even this did not deter new investors.

Where did Finiko come from

Finiko was set-up in Tatarstan, an oil-rich, majority Muslim region in Central Russia. Pyramid schemes in Tatarstan are common because financial literacy is low, according to a source familiar with the Finiko investigation. Many locals do not trust banks, and are inclined to hand over their money to anyone who promises them mountains of gold.

Why the world should care: The background to Finico is a multi-year fall in real wages, poverty and a lack of options for savers. Just as the MMM pyramid scheme in the 1990s was a symbol of the post-Soviet period, so Finico tells us something about contemporary Russian politics and society.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator