简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Some Detailed Information about Vestle

Abstract:Vestle is a forex/CFD broker that was set up as iFOREX in Cyprus in 2011. Vestle operates out of Limassol, Cyprus where it has an office. Vestle (formerly known as iFOREX) is the trading name of iCFD Limited, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license 143/11.

General Information& Regulation

Vestle is a forex/CFD broker that was set up as iFOREX in Cyprus in 2011. Vestle operates out of Limassol, Cyprus where it has an office. Vestle (formerly known as iFOREX) is the trading name of iCFD Limited, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license 143/11.Vestle was set up to administer its services to clients in the European Economic Area (EEA). But they also accept clients from China, Malaysia, Mexico, United Arab Emirates and Indonesia as well as dependent territories of EEA members. However, the broker cannot provide services to some countries such as the USA.

Market Instruments

Traders have a wide choice when it comes to trading instruments on Vestle. There are more than 800 instruments available. These consist of 85 forex currency pairs, 15 cryptocurrencies, 20 commodities, 52 Exchange Traded Funds (ETFs), 34 indices and over 600 stocks.

Minimum Deposit

Standard account is the main live account available to all client. All the trading instruments available can be traded on this account. There is no minimum threshold to operate this account but an assessment of the traders trading abilities will determine the minimum deposit they can. Besides, the swap-free and Demo account are also offered.

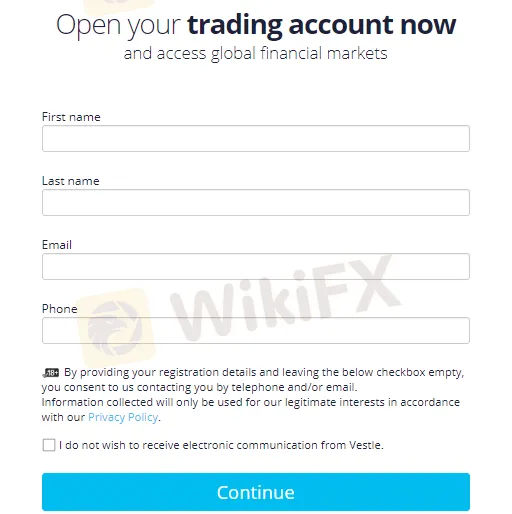

Account Opening

You can click on the 'Register' tab on the Vestle website to commence the account opening procedure. A short form will appear where you can fill your name, email and phone number then click 'continue'.

Leverage

A maximum leverage of 30:1 is available in Forex trading, in line with current regulations. Lower maximums apply to most of the non-Forex instruments which are offered.

Spreads & Commissions

The basic EURUSD spread with Vestle floats around 1.9 pips – 2 pips, which in our view is a bit higher than what traders usually expect to see with a standard account.

Trading Platform

Vestle has its proprietary trading platform known as FXnet. It is a web-based platform so there‘s no need to download any software as it runs directly in the web browser. The platform can be customized to suit each trader’s preference and has a built-in economic calendar for fundamental analysis. It supports 7 languages and is compatible with web browsers on Mac, Windows and Linux devices.

Deposit & Withdrawal

Funding can be done using a few different methods, including Visa MasterCard, Maestro and wire transfers. Withdrawals are generally made through the same channel that deposits have been made through.

Customer Support

Vestle customer support is multilingual with 8 major European languages supported. Customer inquiries, comments or requests to Vestle can be made between 4am – 8pm GMT on weekdays. Customer support representatives can be reached through phone, fax and email. In addition, there are numbers for specific European countries which clients resident in those countries can make use of. There is no online live chat support on the brokers website.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Philippine Banks Launch PHPX Stablecoin to Transform Payments

Broker Review: Is FOREX.com a solid Broker?

Tether to Discontinue EURt Stablecoin Amid Regulatory Shifts in Europe

Adani’s Bribery Scandal! SEC Charges, Major Fallout & Adani’s Stand

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

NAGA Adds UAE, Saudi Stocks to Platform with Zero Commissions

ED uncovered 106 Crore "Nagaland Crypto Scam"

Smart Prop Trader to Close Doors in December 2024

Meme Coins: Fleeting Fortune or Financial Folly?

Philippine Scam Ring Targets Aussie Men with Fake Crypto Offers

Currency Calculator