简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Nov 22, 2024

Zusammenfassung:Market OverviewGOLDGOLD has gained, albeit very conservatively, due to higher chances of the Federal Reserve delaying its easing cycle. The market has also been supported by increased risks in the Rus

Market Overview

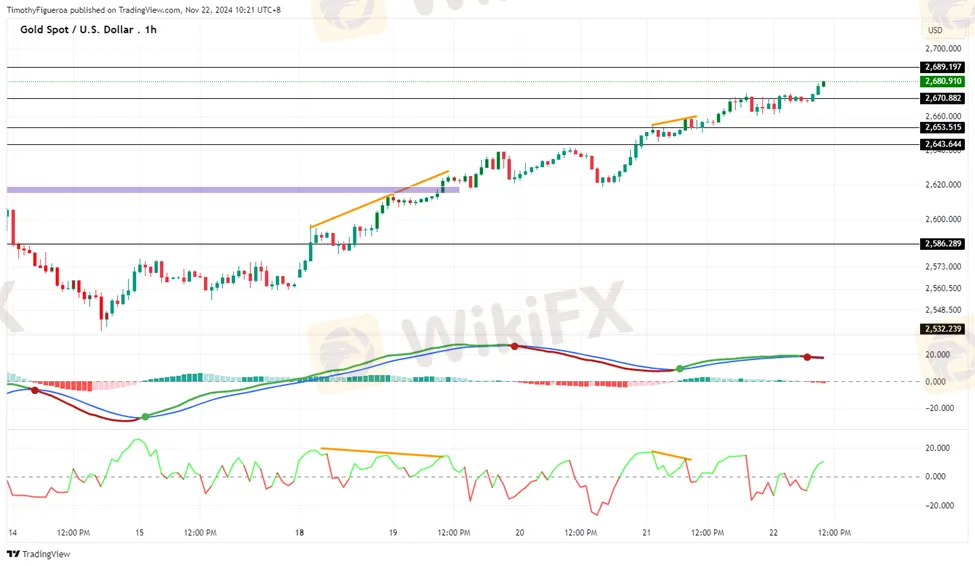

GOLDGOLD has gained, albeit very conservatively, due to higher chances of the Federal Reserve delaying its easing cycle. The market has also been supported by increased risks in the Russia-Ukraine conflict, which has entered a new phase after Russia deployed a new missile to attack Ukraine.

From a technical perspective, the MACD shows a crossover to the low, indicating slowing buying momentum. The RSI exhibits divergence, increasing the chances of a potential drop. However, current price action still indicates heightened chances of a bullish market movement, a sentiment reinforced by the RSI heading upward."

SILVER The technical analysis of SILVER reveals buying momentum after the price reached the previous swing high, indicating a shift in market dynamics. The RSI aligns with this trend. However, the MACD shows a bearish move, though it is printing lighter histograms, signaling weakening selling momentum. Support is seen at 30.668 and resistance at 31.472. Unless a significant structural level is broken, silver is expected to remain consolidated.

DXY "The Dollar has reached a high, gaining strength after unemployment data showed lower claims than expected. Current price action suggests increased chances for continuation on the buy side, supported by the MACD crossing upward and the RSI maintaining bullish momentum.

Recent comments from Federal Reserve officials, including Chair Jerome Powell, suggest a slower pace in the rate-cut path, reinforcing bullish sentiment for the dollar."

GBPUSD The Pound has experienced significant losses due to heightened risks in the Russia-Ukraine conflict. The MACD has crossed downward with strong momentum, and the RSI shows bearish movement, consistent with earlier expectations. A divergence in the RSI suggests a possible short-term pullback, but price action supports a bearish outlook, especially if the price drops below 1.25740.

AUDUSD Strength in the Aussie Dollar stems from delayed expectations of a rate cut by the Reserve Bank of Australia (RBA) until July next year, following better-than-expected data. However, the current market remains flat under 0.65250, with higher chances of a bearish move. While the MACD and RSI show increasing bullish momentum, price action suggests rejection from key levels, pointing toward continued downward movement. This sentiment will be amplified if U.S. dollar data indicates a stronger economy.

NZDUSD "The Kiwi has weakened following expectations that the Reserve Bank of New Zealand (RBNZ) will cut its cash rate to 4.25% on November 27, down from the current 4.75%. Twenty-seven out of thirty economists forecast this 50-basis-point cut.

From a technical standpoint, the drop was so abrupt that the MACD failed to reflect the actual movement. However, the RSI supports previous analysis, showing a continuation to the low. Price action also indicates a further decline, aligning with bearish projections."

EURUSD The Euro faces significant risks from the intensifying Russia-Ukraine conflict. A potential loss for Ukraine could undermine investor confidence in the European economy, increasing investment risks. The MACD and RSI both exhibit strong bearish momentum, while price action supports continued selling, especially after breaking below recent lows.

USDJPY "The Yen has found support in a supply-and-demand zone following a drop in the previous session. On Thursday, BOJ Governor Ueda described December's meeting as ""unpredictable,"" reopening the possibility of a rate increase. This has created volatility, as traders price in a 50/50 chance of both a BOJ rate hike and a Federal Reserve rate cut.

Technically, the MACD shows a strong bullish crossover from the previous day. However, recent trades indicate weakening volatility and volume. The RSI demonstrates a buy signal, supported by divergence, while price action suggests continued upward momentum. These factors collectively support a bullish bias for the Yen."

USDCHF The Franc is seeing increased buying momentum as expected in prior analysis, with prices failing to break below the previous swing low. The MACD and RSI both show increasing buying strength, which aligns with current price action. However, short-term sideways movement under 0.88886 is possible as the market awaits Federal Reserve rate decisions.

USDCAD The Canadian Dollar (CAD) has gained strength, reflecting continued bearish momentum in broader markets. The RSI shows divergence, and the MACD has crossed upward, although trading volume remains largely sideways since the previous session.

Investors now assign only a 10% chance of a half-point rate cut by the Bank of Canada (BoC) at its next meeting on December 11, down from 38% before Canadian inflation data exceeded expectations. This diminished likelihood of a rate cut has strengthened the CAD. However, if upcoming U.S. inflation data proves positive for the dollar, the CAD could face downward pressure.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Shiba Inu-Besitzer ziehen 1,67 Billionen SHIB-Token von der Börse ab

Solana-Kurs gibt nach: Widerstand bei $250 bremst die Rallye aus

Ethereum (ETH) mit Kursplus: Rally auf 3.350 USD – Der Weg zu 4.522 USD?

Trump-Team plant neue Position für Krypto-Politik im Weißen Haus

Grundsteuer-Schock 2023: Ein Viertel der Kommunen erhöht die Hebesätze – stärkster Anstieg seit Jahrzehnten

US-Zentralbank soll Goldbestände durch Bitcoin ersetzen, um den Dollar zu stärken, fordert Senatorin

Deutsche Wirtschaft vermeidet Rückfall in die Rezession mit 0,1 Prozent Wachstum im dritten Quartal

Ex-Trigema-Chef Wolfgang Grupp schießt gegen René Benko und fordert, dass er für die Signa-Pleite Verantwortung übernimmt

Erinnert ihr euch an Punica? So feiert das Kultgetränk sein Comeback

Ab Dezember Warnstreiks bei Volkswagen – Standorte und Termine noch nicht bekannt

Wechselkursberechnung