简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AVIC FUTURES

الملخص:AVIC FUTURES, established in 2017 and regulated by the China Futures Association (CFFEX), offers a diverse range of futures contracts for traders. Operating within a secure regulatory framework, the company provides both Standard and VIP account types, requiring a minimum initial deposit of $100. With a generous leverage of up to 1:100, traders can amplify their positions. The trading platforms, including BOYIDASHI 5, KUAIQI V2, KUAIQI V3, WHYS (WH6), and YANGUANJIA APP, offer convenient access. Traders benefit from competitive spreads starting from 1 pip. AVIC FUTURES facilitates deposits and withdrawals through credit cards, debit cards, and wire transfers, contributing to a seamless trading experience. The company's commitment to comprehensive customer support ensures traders can access assistance promptly via multiple channels.

| Company name | AVIC FUTURES |

| Registered in | China |

| Regulated by | China Futures Association (CFFEX) |

| Years of establishment | 2017 |

| Trading instruments | Diverse range of futures contracts |

| Account types | Standard, VIP |

| Minimum Initial Deposit | $100 |

| Maximum leverage | 1:100 |

| Minimum spread | 1 pip |

| Trading platform | Multiple platforms: BOYIDASHI 5, KUAIQI V2, KUAIQI V3, WHYS (WH6), YANGUANJIA APP |

| Deposit and withdrawal methods | Credit card, debit card, wire transfer |

Overview of AVIC FUTURES

AVIC FUTURES, established in 2017 and regulated by the China Financial Futures Exchange(CFFEX), offers a diverse range of futures contracts for traders. Operating within a secure regulatory framework, the company provides both Standard and VIP account types, requiring a minimum initial deposit of $100. With a generous leverage of up to 1:100, traders can amplify their positions.

The trading platforms, including BOYIDASHI 5, KUAIQI V2, KUAIQI V3, WHYS (WH6), and YANGUANJIA APP, offer convenient access. Traders benefit from competitive spreads starting from 1 pip. AVIC FUTURES facilitates deposits and withdrawals through credit cards, debit cards, and wire transfers, contributing to a seamless trading experience. The company's commitment to comprehensive customer support ensures traders can access assistance promptly via multiple channels.

Is AVIC FUTURES legit or a scam?

AVIC FUTURES operates under the regulation of the China Financial Futures Exchange(CFFEX), a prominent regulatory authority overseeing the fairness and transparency of the futures industry in China. This recognition mandates AVIC FUTURES to hold a valid futures license, enabling the provision of futures trading services to Chinese residents.

This license signifies adherence to stringent criteria, including financial stability, qualified leadership, robust risk management, and full compliance with relevant regulations, ensuring a secure and regulated trading environment.

Pros and Cons

AVIC FUTURES offers a wide variety of futures contracts spanning different asset classes, accompanied by competitive spreads and a user-friendly trading platform. Traders benefit from the absence of commissions on futures contracts and can access educational resources to enhance their knowledge.

However, some users have reported potential delays in customer support response times, occasional trading platform glitches, and the platform's availability being limited to certain countries.

| Pros | Cons |

| Wide range of futures contracts | Customer support can be slow |

| Competitive spreads | Trading platform can be buggy at times |

| User-friendly trading platform | Not available in all countries |

| No commissions on futures contracts | |

| Educational resources |

Market Instruments

AVIC FUTURES provides a diverse range of futures contracts across various asset classes, offering traders ample opportunities to participate in global financial markets. Commodities such as crude oil, natural gas, gold, silver, copper, soybeans, corn, and wheat are available for trading, allowing investors to take advantage of price movements in these essential resources. Currencies like USD/JPY, EUR/USD, GBP/USD, and AUD/USD provide exposure to foreign exchange markets, where traders can speculate on the fluctuations in exchange rates between major currencies.

Additionally, AVIC FUTURES offers futures contracts on popular indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, enabling investors to gain exposure to the overall performance of various sectors in the economy.

With this wide array of futures contracts, traders can diversify their portfolios and manage risk effectively by taking positions in different asset classes, depending on their market outlook and investment objectives.

Account Types

AVIC FUTURES caters to the needs of different traders by offering two distinct account types. The Standard account is designed for beginners or those who prefer a more straightforward trading experience. It comes with no minimum deposit requirement, making it accessible to a broader audience. Traders using the Standard account still benefit from competitive spreads, ensuring they can execute trades with minimal transaction costs.

On the other hand, the VIP account is tailored for more experienced and high-volume traders. Requiring a minimum deposit of $10,000, this account type provides additional perks such as lower spreads, faster execution, and dedicated customer support. The reduced spreads can significantly impact profitability, especially for frequent traders who execute large volumes of trades.

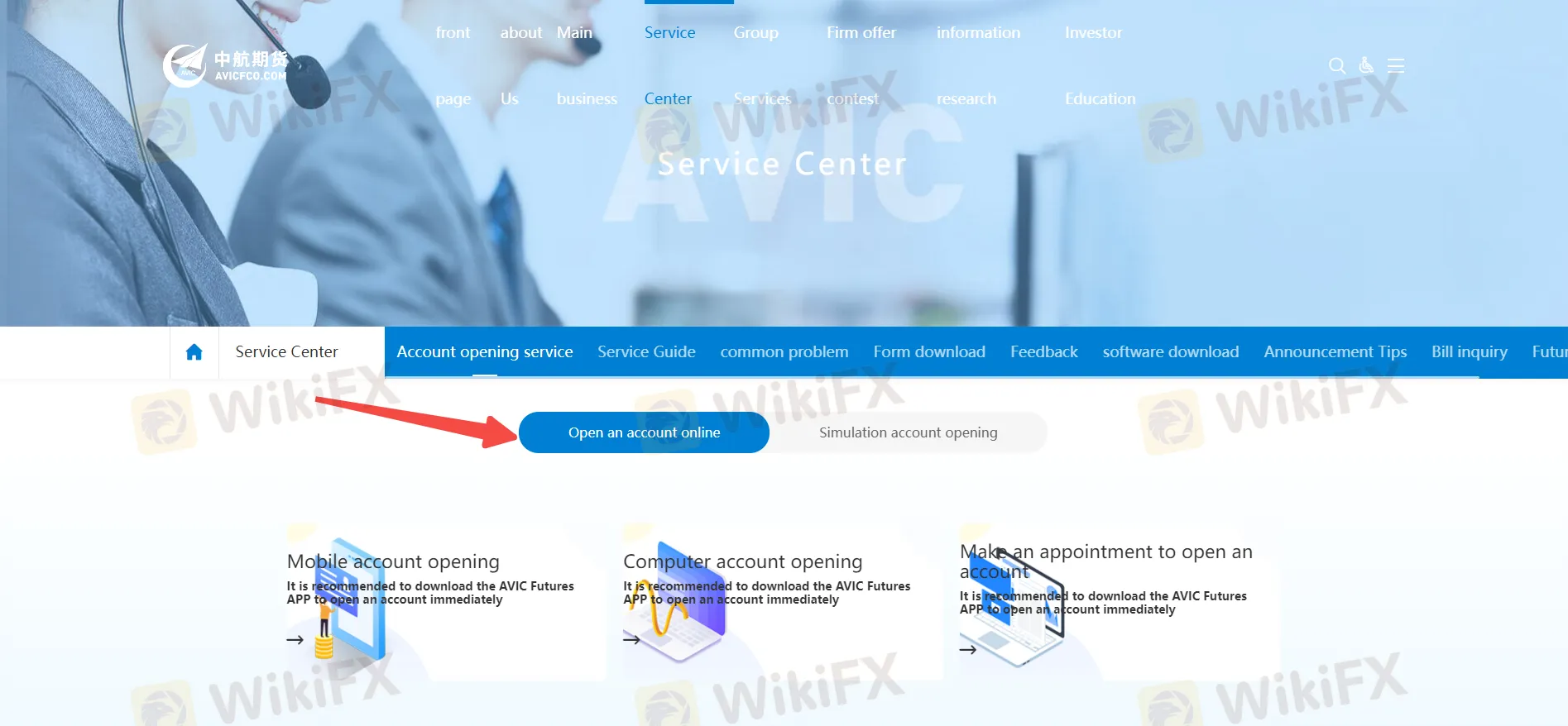

How to Open an Account?

To open an account with AVIC FUTURES, you can follow these five steps:

Step 1: Visit AVIC FUTURES Website

Go to the official AVIC FUTURES website at https://www.avicfco.com/.

Step 2: Click on “Open Account”

Look for the “Open Account” or “Sign Up” button on the website's homepage or in the navigation menu. Click on it to start the account opening process.

Step 3: Fill in Your Information

You will be directed to a registration form where you need to provide your personal details. This information typically includes your name, email address, phone number, country of residence, and date of birth. Ensure the information is accurate and up-to-date as it will be used for account verification.

Step 4: Submit Required Documents

To comply with regulatory requirements, AVIC FUTURES may request proof of identity and proof of address. Prepare scanned or photographed copies of a valid passport or driver's license as proof of identity, and a utility bill or bank statement as proof of address. Upload these documents through the platform's secure document upload feature.

Step 5: Wait for Verification and Account Approval

After submitting your application and required documents, wait for the AVIC FUTURES team to verify your information and approve your account. This process may take a few business days. Once your account is approved, you will receive login credentials, and you can access the trading platform to fund your account and start trading.

Leverage

Leverage is a powerful tool offered by AVIC FUTURES that enables traders to control larger positions with a smaller initial capital outlay. With leverage up to 1:100, traders can amplify their trading potential, as they can control a position worth $100,000 with a mere $1,000 deposit. However, while leverage can magnify potential profits, it also increases the risk of significant losses. Traders must exercise caution and employ risk management strategies to protect their capital effectively.

Spreads & Commissions

AVIC FUTURES maintains a competitive edge by offering attractive spreads, ensuring traders can enter and exit positions with minimal costs. For instance, the typical spread on the USD/JPY contract is around 1 pip, making it appealing to traders seeking tight spreads on major currency pairs.

Moreover, the absence of commissions on futures contracts is another advantage, as it eliminates additional costs that might eat into potential profits. This fee structure makes AVIC FUTURES an attractive choice for both beginners and experienced traders looking to optimize their trading expenses.

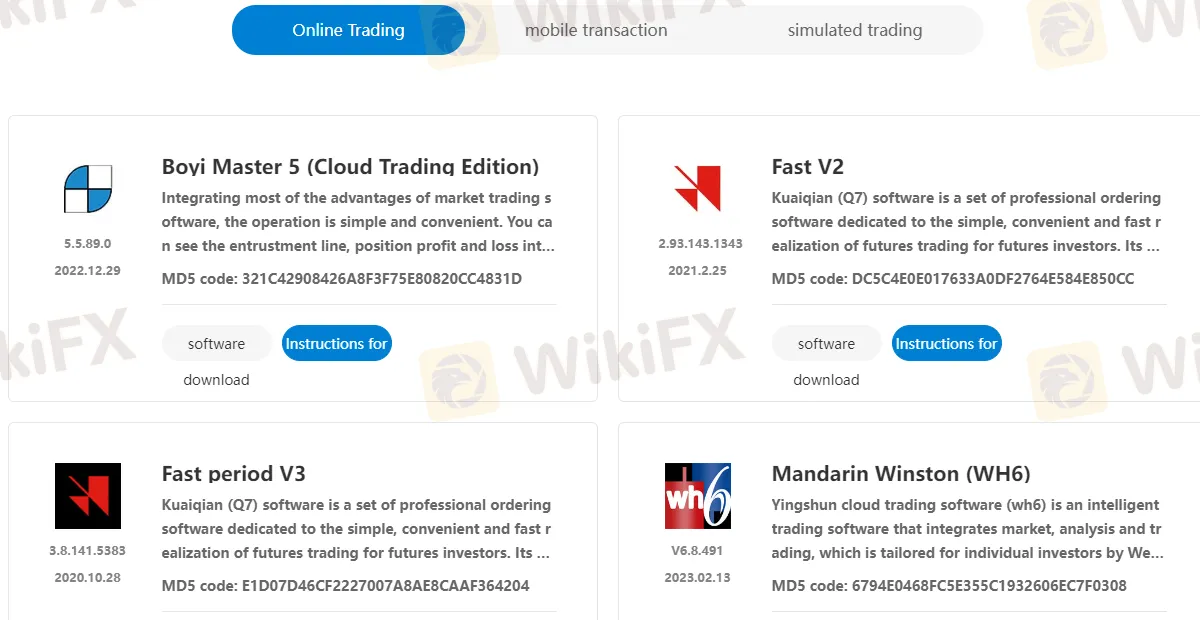

Trading Platform

AVIC FUTURES is a comprehensive financial platform that offers five different trading platforms to cater to the diverse needs of traders and investors. The first platform, “BOYIDASHI 5,” stands out for its user-friendly interface and a range of features, including intuitive visualization of order lines and position profits/losses on k-line and time-sharing charts. It also allows traders to lock trading varieties in multiple windows and supports night market trading.

The second platform, “KUAIQI V2,” emphasizes simplicity, convenience, and speed for futures trading. It offers multiple interface styles, easy-to-use operations, and an advanced technology architecture, ensuring a seamless trading experience. Like the first platform, it provides various features such as order line visualization, position profits/losses display, and the ability to lock trading varieties. It also supports night market trading and shows relevant information on government bond futures.

The third platform, “KUAIQI V3,” continues the commitment to simplicity and convenience for futures trading, providing traders with an unprecedented trading experience. It offers an array of features, including intuitive visualization of order lines and position profits/losses on k-line and time-sharing charts, multi-window locking of trading varieties, support for night market trading, and comprehensive displays of government bond futures-related information.

The fourth platform, “WHYS(WH6),” is an intelligent trading software tailored for individual investors. It combines market data, analysis, and trading capabilities, all designed with a focus on simplicity, advancement, and intelligence. The platform aims to offer traders a superior market and order placement experience. The fifth platform, “YANGUANJIA APP,” is a comprehensive financial platform that integrates account opening, trading, market data, financial information, products, and services. It caters to both iPhone and Android users, offering a convenient and feature-rich platform for financial market participants.

Deposit & Withdrawal

AVIC FUTURES facilitates easy and efficient funding of trading accounts through multiple currency options, including USD, EUR, and GBP. Traders can use various payment methods, such as credit cards, debit cards, or wire transfers, to deposit funds securely.

Additionally, quick withdrawal processing within 24 hours ensures that traders can access their profits promptly and with minimal delays. This seamless and hassle-free deposit and withdrawal process enhances the overall trading experience for AVIC FUTURES' clients.

Customer Support

AVIC FUTURES provides comprehensive customer support to assist its users with any inquiries, issues, or assistance they may require. The customer support team can be contacted through various channels:

Customer Support Hotline: Users can reach the customer support team by calling 400-700-8812 during business hours, which are from Monday to Friday, 9:00 AM to 4:30 PM.

Complaint Hotline: For any complaints or grievances, users can call the complaint hotline at 0755-83688372.

Complaint Email: Users can also send their complaints to the email address zhqh@avic.com.

Educational Resources

AVIC FUTURES recognizes the importance of education in empowering traders to make informed decisions. Therefore, the platform offers a range of educational resources to enrich traders' knowledge and skills.

These resources include comprehensive tutorials that cover the basics of futures trading, webinars conducted by experienced traders and analysts, and informative articles that delve into specific trading strategies and market analysis. By utilizing these educational materials, traders can enhance their understanding of the financial markets and refine their trading techniques, ultimately improving their trading performance.

Conclusion

AVIC FUTURES emerges as a reputable and reliable futures trading platform, offering a comprehensive suite of futures contracts across various asset classes. Its user-friendly trading platform, competitive spreads, leverage options, and accommodating customer support contribute to a positive trading experience for clients.

However, traders should be mindful of the inherent risks associated with futures trading, particularly when using leverage, and adopt prudent risk management practices. Overall, AVIC FUTURES provides a promising platform for traders seeking exposure to global futures markets. As with any financial endeavor, traders should conduct thorough research and due diligence before engaging in trading activities.

FAQs

Q: What is AVIC FUTURES?

A: A regulated trading platform offering diverse futures contracts since 2017.

Q: How is AVIC FUTURES regulated?

A: Regulated by China Futures Association (CFFEX) for secure trading.

Q: What is the minimum deposit for an account?

A: Minimum deposit is $100 for Standard and VIP accounts.

Q: What is the maximum leverage offered?

A: Maximum leverage provided is up to 1:100 for trading.

Q: Which trading platforms are available?

A: BOYIDASHI 5, KUAIQI V2, KUAIQI V3, WHYS (WH6), YANGUANJIA APP.

عدم اعطاء رأي:

الآراء الواردة في هذه المقالة تمثل فقط الآراء الشخصية للمؤلف ولا تشكل نصيحة استثمارية لهذه المنصة. لا تضمن هذه المنصة دقة معلومات المقالة واكتمالها وتوقيتها ، كما أنها ليست مسؤولة عن أي خسارة ناتجة عن استخدام معلومات المقالة أو الاعتماد عليها.

وسيط WikiFX

أحدث الأخبار

كابيتالكس Capitalix: مراجعة شاملة لعام 2024 – هل هي شركة موثوقة أم عملية احتيال؟

لماذا تُجرى الانتخابات الرئاسية الأمريكية في يوم الثلاثاء من شهر نوفمبر؟

مراجعة وتقييم شركة GFX Securities هل هي موثوقة أم محتالة ؟

احترس عند التعامل مع هذا الوسيط A Book Broker .

مراجعة وتقييم شركة NPBFX هل هي موثوقة أم محتالة ؟

احترس من التعامل مع هذا الوسيط FX Solutions

محظورات التداول خلال الانتخابات الأمريكية 2024

إكسنس تختار Centroid Bridge لتعزيز عروض السيولة

ترامب ضد هاريس: من هي السياسات الأفضل للمستثمرين في الأسهم الأمريكية؟

احترس من التعامل مع شركة الوساطة HEADWAY

حساب النسبة