WikiFX، كمنصة مستقلة لخدمة المعلومات تابعة لجهة خارجية، مخصصة لتزويد المستخدمين بخدمات معلومات تنظيمية شاملة وموضوعية عن الوسطاء. لا تشارك WikiFX بشكل مباشر في أي أنشطة تداول فوركس، ولا تقدم أي شكل من أشكال توصيات قنوات التداول أو المشورة الاستثمارية. تستند تصنيفات وتقييمات الوسطاء من قبل WikiFX إلى معلومات موضوعية متاحة للجمهور وتأخذ في الاعتبار الاختلافات في السياسة التنظيمية لمختلف البلدان والمناطق. تصنيفات وتقييمات الوسطاء هي المنتجات الأساسية لـ WikiFX، ونحن نعارض بشدة أي ممارسات تجارية قد تعرض موضوعيتهم ونزاهتهم للخطر. نرحب بالإشراف والاقتراحات من المستخدمين في جميع أنحاء العالم. الخط الساخن للشكاوى: report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

بحث الوسيط

العربية

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX1825331864

0123456789

0123456789

0123456789

0123456789

مستثمر

ID: 3712791129

هونغ كونغ

6-10 سنة

متابعة

FX1825331864

What is Forward Trading in Forex?

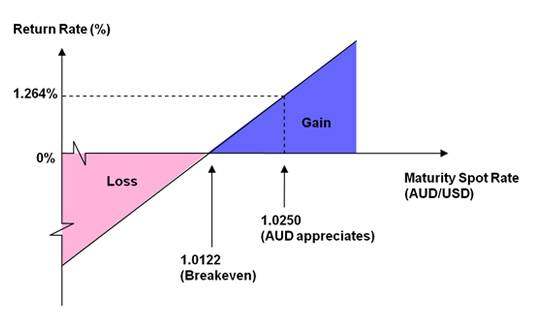

Forward trading in Forex involves buying or selling a currency pair at a fixed exchange rate for delivery on a specific date in the future, typically ranging from a few days to several years.

*How Forward Trading Works*

1. *Agreement*: Two parties agree to exchange a specific amount of currency at a fixed exchange rate on a future date.

2. *Fixing the Rate*: The exchange rate is fixed at the time of the agreement, regardless of future market fluctuations.

3. *Settlement*: On the agreed-upon date, the parties exchange the currencies at the fixed exchange rate.

*Types of Forward Contracts*

1. *Outright Forward*: A standard forward contract where two parties agree to exchange currencies at a fixed rate on a specific date.

2. *Forward Swap*: A combination of two outright forwards, one for a shorter period and another for a longer period.

3. *NDF (Non-Deliverable Forward)*: A forward contract where the parties agree to exchange the difference between the fixed rate and the spot rate on the settlement date, rather than exchanging the actual currencies.

*Benefits of Forward Trading*

1. *Hedging*: Forward trading allows companies and investors to hedge against potential losses due to exchange rate fluctuations.

2. *Speculation*: Traders can speculate on future exchange rate movements, potentially profiting from favorable rate changes.

3. *Risk Management*: Forward trading provides a way to manage risk by locking in exchange rates for future transactions.

*Risks and Challenges*

1. *Market Volatility*: Forward trading involves exposure to market volatility, which can result in significant losses if not managed properly.

2. *Counterparty Risk*: The risk that the counterparty may default on the forward contract.

3. *Liquidity Risk*: The risk that the forward contract may not be easily liquidated or closed before expiration.

2024-11-25 17:52

FX1825331864

Stock market realities in forex

Market Volatility

1. _Prices can fluctuate rapidly_: Forex prices can change quickly, resulting in significant gains or losses.

2. _Market sentiment can shift rapidly_: Changes in market sentiment, news, or economic data can cause sudden shifts in Forex prices.

_Market Participants_

1. _Institutional investors_: Banks, hedge funds, and other institutional investors play a significant role in Forex markets.

2. _Retail traders_: Individual traders, like you, also participate in Forex markets, often using online trading platforms.

3. _Market makers_: Some market participants, like banks and brokers, act as market makers, providing liquidity to Forex markets.

_Market Dynamics_

1. _Supply and demand_: Forex prices are determined by the interaction of supply and demand in the market.

2. _Order flow_: The flow of buy and sell orders can impact Forex prices and create trading opportunities.

3. _Market trends_: Forex markets can exhibit trends, which can be driven by factors like economic data, news, and market sentiment.

_Risk Management_

1. _Leverage_: Forex trading often involves leverage, which can amplify gains but also increases potential losses.

2. _Position sizing_: Managing position size is crucial to controlling risk and protecting trading capital.

3. _Stop-loss orders_: Using stop-loss orders can help limit potential losses if the market moves against your position.

_Trading Strategies_

1. _Technical analysis_: Many Forex traders use technical analysis, which involves studying charts and patterns to identify trading opportunities.

2. _Fundamental analysis_: Fundamental analysis involves studying economic data, news, and market sentiment to make informed trading decisions.

3. _Quantitative trading_: Some Forex traders use quantitative trading strategies, which involve using mathematical models to identify trading opportunities.

2024-11-25 17:46

FX1825331864

Following trading plan in forex

Why Follow a Trading Plan?

1. _Reduces Emotional Decision-Making_: A trading plan helps you make objective, data-driven decisions, rather than emotional ones.

2. _Improves Discipline_: Following a trading plan promotes discipline, ensuring you stick to your strategy and avoid impulsive decisions.

3. _Enhances Consistency_: A trading plan helps you develop a consistent trading approach, which is essential for achieving long-term success.

4. _Optimizes Performance_: By following a trading plan, you can optimize your trading performance, as you'll be making decisions based on a well-thought-out strategy.

_Key Components of a Trading Plan_

1. _Trading Objectives_: Clearly define your trading goals, risk tolerance, and profit targets.

2. _Market Analysis_: Outline your market analysis approach, including technical and fundamental analysis.

3. _Entry and Exit Rules_: Define specific rules for entering and exiting trades, including criteria for stop-loss orders and take-profit levels.

4. _Risk Management_: Outline your risk management strategy, including position sizing, leverage, and stop-loss orders.

5. _Trade Management_: Define how you'll manage trades, including adjustments to position size, stop-loss orders, and take-profit levels.

_Benefits of Following a Trading Plan_

1. _Improved Trading Performance_: A trading plan helps you make informed, data-driven decisions, leading to improved trading performance.

2. _Reduced Stress and Anxiety_: By following a trading plan, you'll feel more in control, reducing stress and anxiety.

3. _Increased Confidence_: A trading plan helps you develop confidence in your trading decisions, as you'll be following a well-thought-out strategy.

4. _Better Risk Management_: A trading plan ensures you're managing risk effectively, reducing the likelihood of significant losses.

_Common Mistakes to Avoid_

1. _Not Having a Trading Plan_: Failing to create a trading plan can lead to impulsive decisions and poor trading performance.

2. _Not Following the Plan_: Deviating from the trading plan can lead to emotional decision-making and poor trading performance.

3. _Not Reviewing and Adjusting the Plan_: Failing to review and adjust the trading plan can lead to stagnation and poor trading performance.

_Best Practices for Creating and Following a Trading Plan_

1. _Keep it Simple_: Avoid overly complex trading plans that are difficult to follow.

2. _Make it Flexible_: Allow for adjustments to the trading plan as market conditions change.

3. _Review and Adjust Regularly_: Regularly review and adjust the trading plan to ensure it remains effective.

4. _Stay Disciplined_: Stick to the trading plan, even during periods of market volatility or uncertainty.

2024-11-25 17:41

FX1825331864

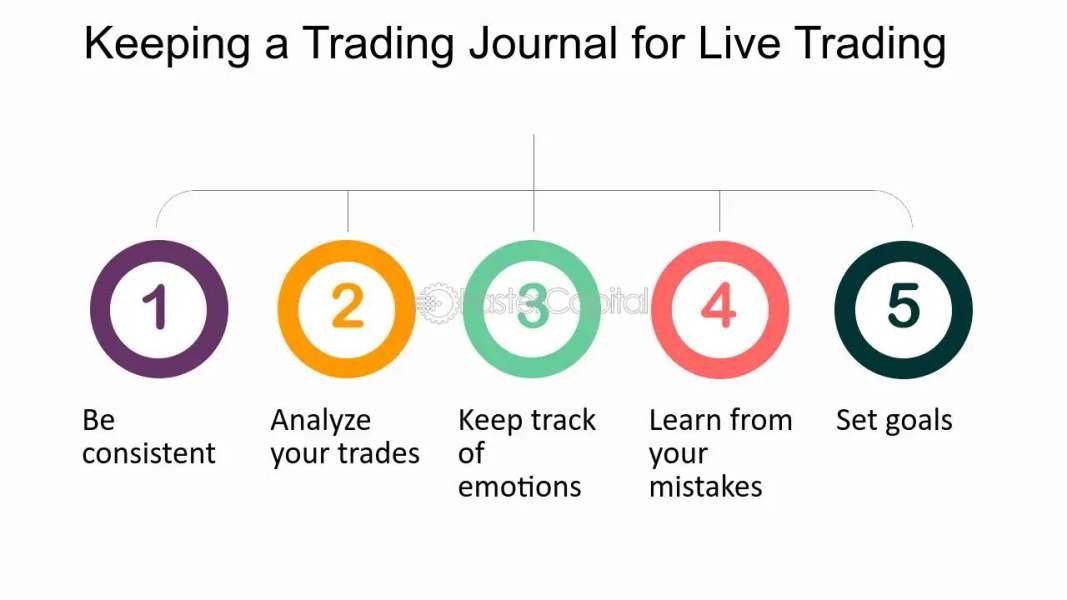

Maintaining a trading journal in forex

Benefits of Maintaining a Trading Journal

1. *Improved self-awareness*: A trading journal helps you understand your thought process, emotions, and behaviors during trading.

2. *Identifying patterns and mistakes*: By analyzing your trades, you can identify patterns, mistakes, and areas for improvement.

3. *Refining trading strategies*: A trading journal helps you evaluate the effectiveness of your trading strategies and make adjustments as needed.

4. *Enhanced discipline and accountability*: Maintaining a trading journal promotes discipline and accountability, helping you stick to your trading plan.

*What to Include in a Trading Journal*

1. *Trade details*: Record the date, time, currency pair, trade type (buy/sell), and position size.

2. *Market analysis*: Note your market analysis, including technical and fundamental factors that influenced your trading decision.

3. *Trade rationale*: Explain why you entered the trade, including your goals and expectations.

4. *Trade outcome*: Record the outcome of the trade, including the profit/loss and any notable events that occurred during the trade.

5. *Lessons learned*: Reflect on what you learned from the trade, including any mistakes or areas for improvement.

*Tips for Maintaining an Effective Trading Journal*

1. *Be consistent*: Regularly update your trading journal, ideally after each trade.

2. *Be honest*: Accurately record your trades, including mistakes and losses.

3. *Use a standardized format*: Develop a consistent format for recording trades to facilitate analysis and review.

4. *Review and analyze regularly*: Regularly review your trading journal to identify patterns, mistakes, and areas for improvement.

5. *Adjust your trading plan*: Based on your analysis, adjust your trading plan to optimize performance.

*Digital Trading Journal Tools*

1. *Excel or Google Sheets*: Create a spreadsheet to record and analyze trades.

2. *Trading journal software*: Utilize specialized software, such as Trader's Journal or Edgewonk, designed specifically for maintaining a trading journal.

3. *Mobile apps*: Leverage mobile apps, such as Trading Journal or Forex Trading Journal, to record and analyze trades on-the-go.

2024-11-25 17:38

FX1825331864

Consistency is crucial in Forex trading as it enables traders to develop and refine their trading strategies over time. Consistency involves:

1. _Following a trading plan_: Develop a comprehensive trading plan and stick to it.

2. _Using a consistent trading strategy_: Refine and stick to a single trading strategy to optimize results.

3. _Maintaining a trading journal_: Record and analyze trades to identify areas for improvement.

4. _Regularly reviewing and adjusting_: Periodically review and adjust the trading plan and strategy as needed.

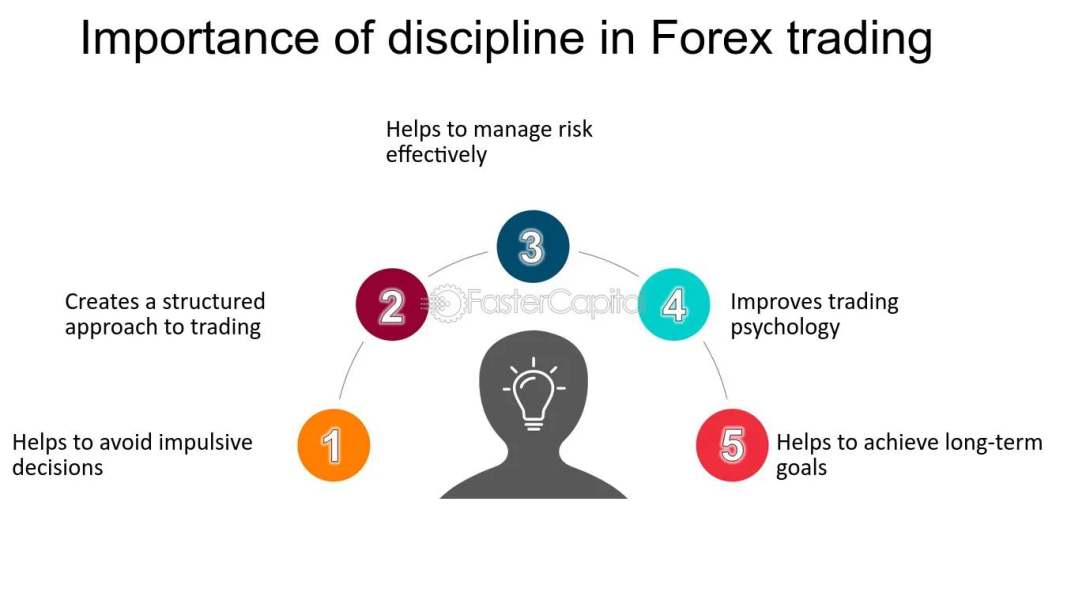

*Discipline in Forex*

Discipline is essential in Forex trading as it enables traders to stick to their trading plan and avoid impulsive decisions. Discipline involves:

1. _Sticking to the trading plan_: Avoid deviating from the trading plan, even in the face of losses or profits.

2. _Managing emotions_: Develop emotional control to avoid impulsive decisions based on fear, greed, or excitement.

3. _Avoiding over-trading_: Refrain from over-trading, which can lead to excessive losses and decreased profitability.

4. _Maintaining a healthy risk-reward ratio_: Ensure that the risk-reward ratio is reasonable and aligned with the trading plan.

*Benefits of Consistency and Discipline in Forex*

1. _Improved trading performance_: Consistency and discipline enable traders to refine their trading strategies and optimize results.

2. _Reduced emotional stress_: Discipline helps traders manage emotions, reducing stress and anxiety.

3. _Increased confidence_: Consistency and discipline foster confidence in trading decisions and strategies.

4. _Better risk management_: Discipline enables traders to maintain a healthy risk-reward ratio and avoid excessive risk-taking.

*Tips for Developing Consistency and Discipline in Forex*

1. _Start with a clear trading plan_: Develop a comprehensive trading plan and stick to it.

2. _Practice self-reflection and analysis_: Regularly review and analyze trades to identify areas for improvement.

3. _Set realistic goals and expectations_: Establish achievable goals and expectations to maintain motivation and discipline.

4. _Seek support and accountability_: Join a trading community or find a trading buddy to provide support and accountability.

2024-11-25 17:35

FX1825331864

Benefit of using a forex trading robot

Here are the benefits of using a Forex trading robot:

*Benefits of Using a Forex Trading Robot*

1. *Emotion-Free Trading*: Forex trading robots eliminate emotional decision-making, which can lead to impulsive and irrational trading choices.

2. *24/5 Market Monitoring*: Robots can monitor the markets continuously, identifying potential trading opportunities and executing trades without human intervention.

3. *Faster Trade Execution*: Forex trading robots can execute trades much faster than humans, which can be particularly beneficial in fast-paced markets.

4. *Consistency and Discipline*: Robots adhere to a predefined trading strategy, ensuring consistency and discipline in trading decisions.

5. *Risk Management*: Many Forex trading robots come equipped with built-in risk management features, such as stop-loss orders and position sizing.

6. *Backtesting and Optimization*: Robots can be backtested and optimized using historical data, allowing traders to refine their trading strategies and improve performance.

7. *Diversification*: Forex trading robots can trade multiple currency pairs and strategies simultaneously, providing diversification benefits and reducing dependence on a single market or strategy.

8. *Scalability*: Robots can handle large trading volumes and can be scaled up or down depending on market conditions and trading objectives.

9. *Reduced Trading Stress*: By automating trading decisions, Forex trading robots can significantly reduce trading stress and anxiety.

10. *Improved Trading Performance*: By combining technical and fundamental analysis with automated trading, Forex trading robots can potentially improve trading performance and increase profitability.

*Important Considerations*

1. *Choose a Reliable Robot*: Select a reputable and well-tested Forex trading robot to minimize the risk of losses.

2. *Monitor and Adjust*: Continuously monitor the robot's performance and adjust its settings as needed to optimize results.

3. *Understand the Risks*: Forex trading carries inherent risks, and using a trading robot does not guarantee profits or eliminate risk.

4. *Use Proper Risk Management*: Implement proper risk management strategies, such as stop-loss orders and position sizing, to minimize potential losses.

2024-11-25 17:26

FX1825331864

Position trading in forex

Position trading is a long-term trading strategy in which a trader holds a position for an extended period, often weeks, months, or even years.

*Characteristics of Position Trading*

1. *Long-term focus*: Position traders focus on long-term trends and market movements.

2. *Infrequent trading*: Position traders typically trade less frequently than day traders or swing traders.

3. *Large position sizes*: Position traders often trade with larger position sizes to maximize profits.

4. *Risk management*: Position traders must have a solid risk management strategy to protect against potential losses.

*Benefits of Position Trading*

1. *Less time commitment*: Position trading requires less time commitment compared to day trading or swing trading.

2. *Reduced transaction costs*: Position traders incur lower transaction costs due to fewer trades.

3. *Increased profit potential*: Position traders can potentially earn larger profits due to the long-term nature of their trades.

4. *Improved market insight*: Position traders develop a deeper understanding of market trends and dynamics.

*Challenges of Position Trading*

1. *Market volatility*: Position traders must be prepared to withstand market volatility and potential losses.

2. *Trade management*: Position traders must have a solid trade management strategy to adjust to changing market conditions.

3. *Patience and discipline*: Position traders require patience and discipline to stick to their trading plan.

4. *Risk of significant losses*: Position traders are exposed to the risk of significant losses if their trades do not work out as planned.

*Steps to Become a Successful Position Trader*

1. *Develop a trading plan*: Create a comprehensive trading plan that outlines your trading strategy, risk management approach, and performance metrics.

2. *Choose the right markets*: Select markets that are suitable for position trading, such as major currency pairs or commodity markets.

3. *Use technical and fundamental analysis*: Combine technical and fundamental analysis to identify potential trading opportunities.

4. *Manage risk effectively*: Implement a solid risk management strategy to protect against potential losses.

5. *Monitor and adjust*: Continuously monitor your trades and adjust your strategy as needed to optimize performance.

2024-11-25 17:21

FX1825331864

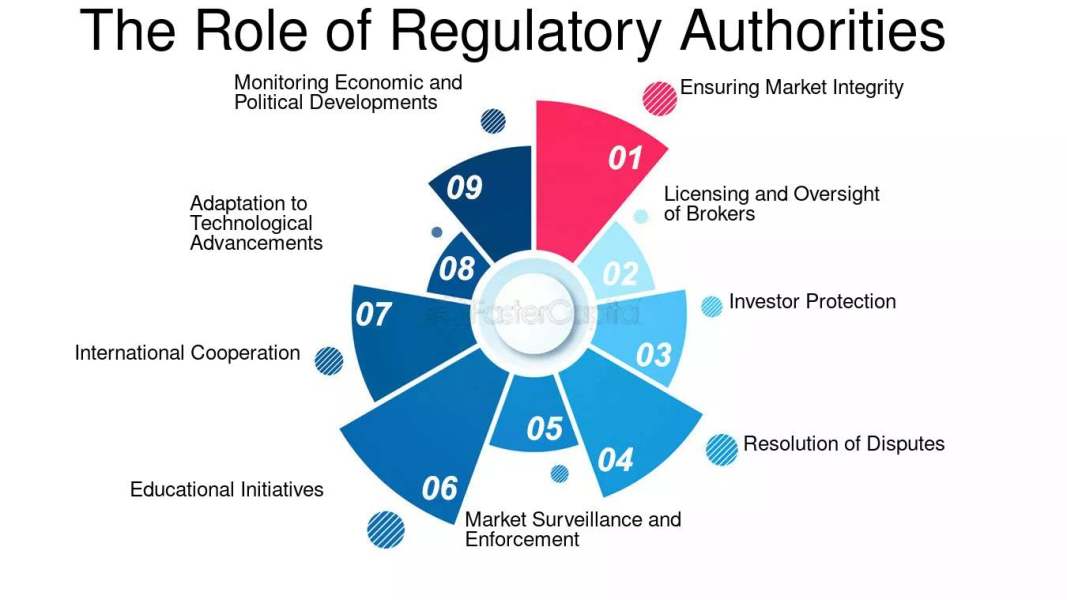

Regulatory system in forex

*Regulatory Bodies*

1. *National Futures Association (NFA)*: Regulates Forex brokers in the United States.

2. *Commodity Futures Trading Commission (CFTC)*: Oversees Forex trading in the United States.

3. *Financial Conduct Authority (FCA)*: Regulates Forex brokers in the United Kingdom.

4. *Cyprus Securities and Exchange Commission (CySEC)*: Regulates Forex brokers in Cyprus.

5. *Australian Securities and Investments Commission (ASIC)*: Regulates Forex brokers in Australia.

*Regulatory Requirements*

1. *Licensing*: Forex brokers must obtain a license from a regulatory body to operate.

2. *Capital Requirements*: Forex brokers must maintain a minimum amount of capital to ensure financial stability.

3. *Segregation of Funds*: Forex brokers must segregate client funds from their own funds.

4. *Risk Disclosure*: Forex brokers must provide clear risk disclosure statements to clients.

5. *Reporting Requirements*: Forex brokers must submit regular reports to regulatory bodies.

*Regulatory Frameworks*

1. *MiFID II*: A European Union regulatory framework that governs Forex trading.

2. *Dodd-Frank Act*: A United States regulatory framework that governs Forex trading.

3. *ASIC's Regulatory Framework*: A regulatory framework that governs Forex trading in Australia.

*Benefits of Regulation*

1. *Protection of Client Funds*: Regulation ensures that client funds are protected and segregated from broker funds.

2. *Increased Transparency*: Regulation promotes transparency in Forex trading, reducing the risk of scams and fraud.

3. *Improved Risk Management*: Regulation ensures that Forex brokers implement effective risk management strategies.

4. *Enhanced Market Integrity*: Regulation promotes market integrity, reducing the risk of market manipulation and abuse.

*Red Flags of Unregulated Brokers*

1. *No Physical Address*: Unregulated brokers may not provide a physical address.

2. *No License or Registration*: Unregulated brokers may not be licensed or registered with a regulatory body.

3. *Unrealistic Promises*: Unregulated brokers may make unrealistic promises or guarantees.

4. *Poor Communication*: Unregulated brokers may have poor communication or unresponsive customer support.

2024-11-25 17:17

FX1825331864

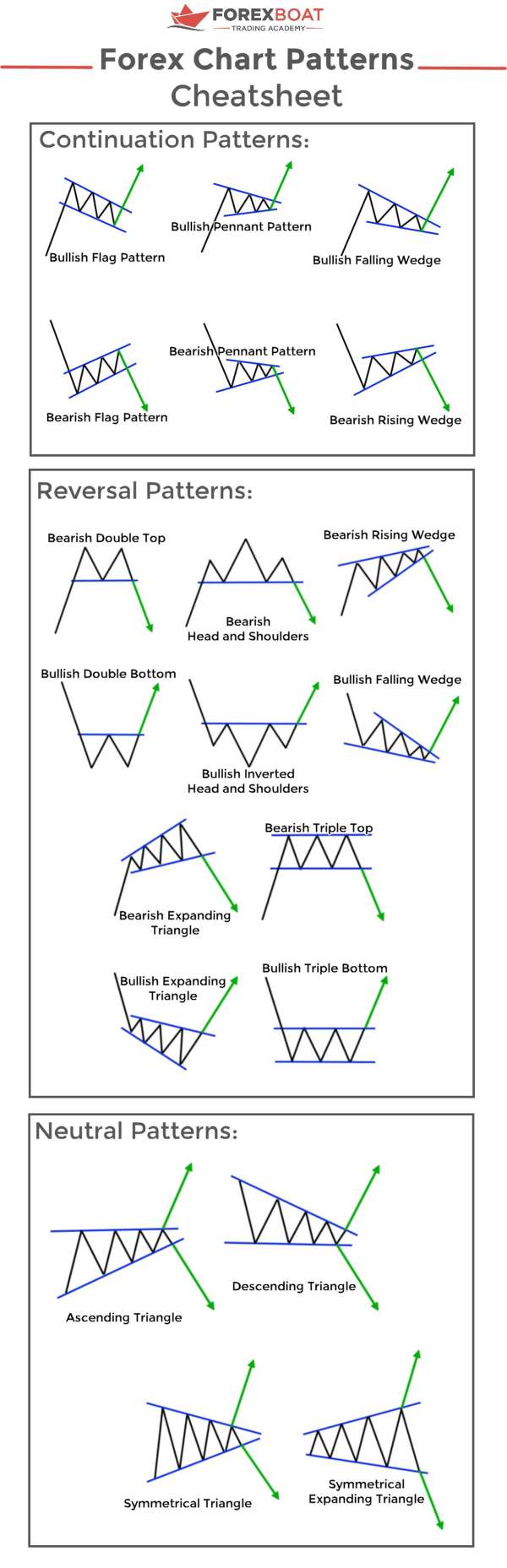

Chart and patterns in forex

Types of Charts in Forex

1. *Line Charts*: Display the closing price of a currency pair over time.

2. *Bar Charts*: Display the high, low, opening, and closing prices of a currency pair over time.

3. *Candlestick Charts*: Display the high, low, opening, and closing prices of a currency pair over time, with different colors indicating bullish or bearish movements.

*Types of Chart Patterns in Forex*

1. *Reversal Patterns*: Indicate a potential change in market direction.

- *Head and Shoulders*: A bearish reversal pattern.

- *Inverse Head and Shoulders*: A bullish reversal pattern.

- *Double Top*: A bearish reversal pattern.

- *Double Bottom*: A bullish reversal pattern.

2. *Continuation Patterns*: Indicate a potential continuation of the current market trend.

- *Triangles*: A continuation pattern that can be bullish or bearish.

- *Wedges*: A continuation pattern that can be bullish or bearish.

- *Flags*: A continuation pattern that can be bullish or bearish.

3. *Breakout Patterns*: Indicate a potential breakout from a established trading range.

- *Ascending Triangle*: A bullish breakout pattern.

- *Descending Triangle*: A bearish breakout pattern.

*How to Identify Chart Patterns in Forex*

1. *Look for Confluence*: Multiple indicators or patterns confirming the same trade idea.

2. *Use Technical Indicators*: Indicators like Moving Averages, RSI, and Bollinger Bands can help identify patterns.

3. *Analyze Chart Timeframes*: Look for patterns on multiple timeframes to confirm trade ideas.

4. *Practice and Experience*: The more you practice, the better you'll become at identifying chart patterns.

*Common Mistakes to Avoid When Using Chart Patterns in Forex*

1. *Over-Relying on Patterns*: Don't rely solely on chart patterns; use them in conjunction with other forms of analysis.

2. *Ignoring Market Context*: Consider the broader market context, including fundamental analysis and market news.

3. *Not Adjusting for Timeframe*: Adjust your pattern recognition for different timeframes.

4. *Not Managing Risk*: Always use proper risk management techniques, including stop-loss orders and position sizing.

2024-11-25 17:13

FX1825331864

Economic calendars in forex

Economic calendars are essential tools for Forex traders, providing valuable insights into upcoming economic events that can impact currency markets. These calendars list important events such as interest rate decisions, GDP releases, and employment reports, which can influence market sentiment and volatility.

A typical economic calendar will include the following information:

- *Event Name*: A description of the upcoming event, such as "Interest Rate Decision" or "GDP Release".

- *Date and Time*: The date and time of the event, usually listed in GMT or another major time zone.

- *Currency Affected*: The currency or currencies that are likely to be impacted by the event.

- *Impact Level*: An indication of the potential impact of the event on the market, often listed as "High", "Medium", or "Low".

- *Previous Value*: The previous value of the economic indicator being released, which can help traders gauge market expectations.

- *Forecast Value*: The forecast value of the economic indicator, based on surveys of economists or other market participants.

- *Actual Value*: The actual value of the economic indicator, released after the event.

To effectively use an economic calendar, traders should:

- *Filter for relevance*: Focus on events that are likely to impact the currencies they trade.

- *Set reminders*: Set reminders for important events to stay informed and adapt their trading strategies accordingly.

- *Analyze market expectations*: Compare the forecast value with the actual value to gauge market expectations and potential market reactions.

Some popular sources for economic calendars include FBS ¹ and IG ². These calendars can be customized to suit individual trading needs and preferences.

2024-11-25 17:10

تحميل المزيد

أشخاص قد تعجبك

تغيير

Abd Azeez

متابعة

عليباناحه

متابعة

Mohamed Talaat

متابعة

Hajji Forex

متابعة

نينو

متابعة